Blank Fha Loan Contingency Form 2008-2026

What is the Blank FHA Loan Contingency Form

The Blank FHA Loan Contingency Form is a crucial document used in real estate transactions involving Federal Housing Administration (FHA) loans. This form outlines the conditions under which a buyer can withdraw from a purchase agreement without penalty, specifically if the buyer fails to secure FHA financing. It serves as a protective measure for buyers, ensuring that they are not financially obligated to proceed with a purchase if they are unable to obtain the necessary loan approval.

How to Use the Blank FHA Loan Contingency Form

To effectively use the Blank FHA Loan Contingency Form, buyers should first review the terms of their purchase agreement. This form should be filled out and submitted alongside the purchase agreement to the seller. It is essential to clearly indicate the contingencies related to the FHA loan, including the timeline for obtaining financing and any specific conditions that must be met. Properly completing this form helps protect the buyer's interests and clarifies the expectations for both parties involved in the transaction.

Steps to Complete the Blank FHA Loan Contingency Form

Completing the Blank FHA Loan Contingency Form involves several key steps:

- Review the purchase agreement to understand the specific contingencies required.

- Fill in the buyer's information, including name and contact details.

- Specify the loan amount and type of FHA loan being sought.

- Outline the conditions under which the buyer can withdraw from the agreement.

- Sign and date the form, ensuring all parties receive a copy for their records.

Legal Use of the Blank FHA Loan Contingency Form

The Blank FHA Loan Contingency Form is legally binding once signed by both the buyer and seller. It is important that all terms outlined in the form comply with state and federal regulations regarding real estate transactions. Buyers should ensure they understand their rights and obligations as stipulated in the form. Consulting with a real estate attorney or agent can provide additional guidance to ensure legal compliance and protect the buyer's interests.

Key Elements of the Blank FHA Loan Contingency Form

Several key elements should be included in the Blank FHA Loan Contingency Form to ensure its effectiveness:

- Identification of the buyer and seller, including contact information.

- Details of the property being purchased.

- Specific loan amount and type of FHA loan.

- Conditions under which the buyer can cancel the agreement.

- Timeline for securing financing and any necessary documentation required.

State-Specific Rules for the Blank FHA Loan Contingency Form

Each state may have specific rules and regulations governing the use of the Blank FHA Loan Contingency Form. It is essential for buyers to familiarize themselves with their state's requirements to ensure compliance. This may include specific language that must be included in the form or additional disclosures that need to be made. Consulting local real estate laws or working with a knowledgeable real estate professional can help navigate these state-specific rules effectively.

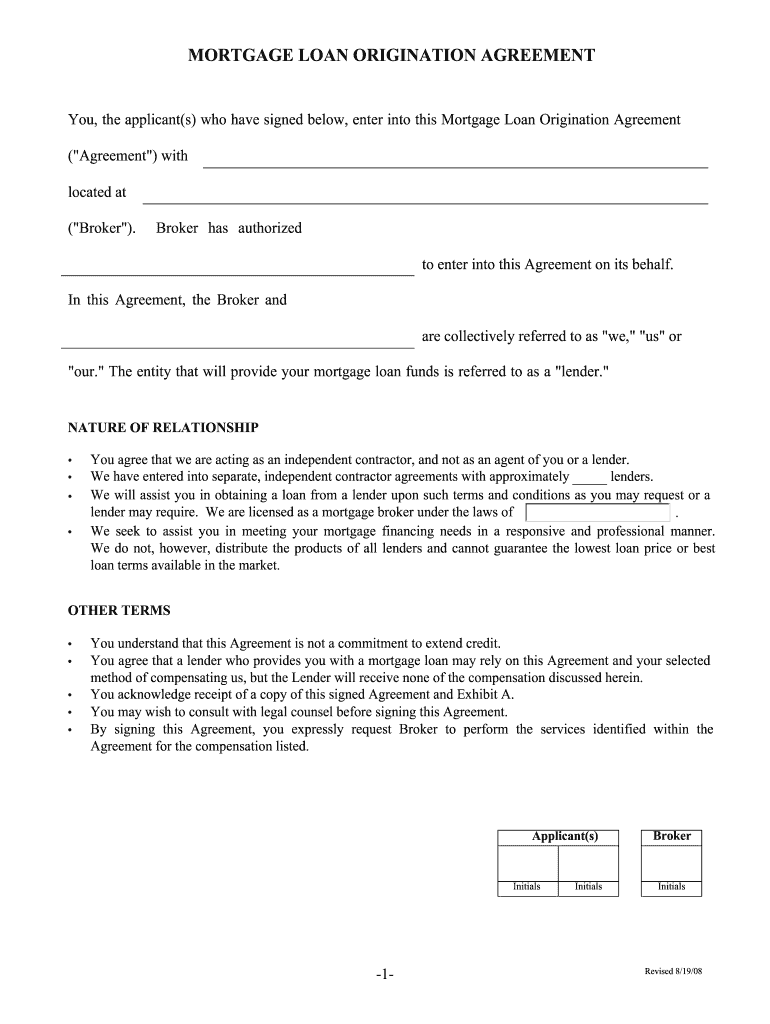

Quick guide on how to complete mortgage loan origination agreement form

The simplest method to obtain and endorse Blank Fha Loan Contingency Form

On the scale of an entire enterprise, ineffective workflows surrounding paper approvals can consume numerous working hours. Endorsing documents such as Blank Fha Loan Contingency Form is a customary aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle is critical to the organization’s overall productivity. With airSlate SignNow, endorsing your Blank Fha Loan Contingency Form can be as straightforward and rapid as possible. You’ll discover on this platform the latest version of nearly any document. Even better, you can endorse it instantly without the requirement of installing additional software on your computer or printing anything as physical copies.

How to acquire and endorse your Blank Fha Loan Contingency Form

- Explore our collection by category or use the search bar to locate the document you require.

- Examine the document preview by clicking Learn more to confirm it is the correct one.

- Hit Get form to begin editing immediately.

- Fill out your document and incorporate any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your Blank Fha Loan Contingency Form.

- Select the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to conclude editing and move on to document-sharing options if needed.

With airSlate SignNow, you possess everything required to handle your documentation efficiently. You can locate, fill out, modify, and even send your Blank Fha Loan Contingency Form within a single tab without any complications. Enhance your workflows with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do mortgage brokers explain origination fees, points, discount points and closing/loan costs to clients?

We at least I send my borrowers a loan estimate or closing cost worksheet. I follow the direction of my clients, I go to the section they'd like further information on. All fees and their amounts can be explained, I let the borrowers lead because they have their own level of experience. No need to over explain or say something that would warrant additional questions or cause concern or worry.I always encourage questions during the entire mortgage process, because there are so many things happening at once.Hope this helps. Let me know if I can assist further.

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan origination agreement form

How to generate an electronic signature for your Mortgage Loan Origination Agreement Form in the online mode

How to create an electronic signature for the Mortgage Loan Origination Agreement Form in Google Chrome

How to create an electronic signature for signing the Mortgage Loan Origination Agreement Form in Gmail

How to create an electronic signature for the Mortgage Loan Origination Agreement Form right from your smartphone

How to create an electronic signature for the Mortgage Loan Origination Agreement Form on iOS

How to create an electronic signature for the Mortgage Loan Origination Agreement Form on Android OS

People also ask

-

What is a Blank FHA Loan Contingency Form?

A Blank FHA Loan Contingency Form is a crucial document used in real estate transactions to outline the conditions under which a buyer can back out of a purchase agreement related to an FHA loan. It helps protect the buyer's interests by specifying contingencies such as financing approval and home inspections.

-

How can I obtain a Blank FHA Loan Contingency Form?

You can easily obtain a Blank FHA Loan Contingency Form by downloading it from our airSlate SignNow platform. Our service provides a user-friendly interface that allows you to access and customize this form according to your real estate transaction needs.

-

Is there a cost associated with using the Blank FHA Loan Contingency Form on airSlate SignNow?

Using the Blank FHA Loan Contingency Form on airSlate SignNow comes with a variety of pricing plans to fit different budgets. We offer a free trial to get you started, and our subscription plans are designed to be cost-effective for businesses of all sizes.

-

What features does airSlate SignNow offer for the Blank FHA Loan Contingency Form?

airSlate SignNow offers several features for the Blank FHA Loan Contingency Form, including eSigning capabilities, document templates, and real-time collaboration. These features ensure that your real estate transactions are streamlined and efficient.

-

How do I eSign a Blank FHA Loan Contingency Form?

To eSign a Blank FHA Loan Contingency Form, simply upload the document to airSlate SignNow, add the necessary fields for signatures, and send it to the relevant parties. Recipients can sign electronically from any device, ensuring a hassle-free process.

-

Can I integrate airSlate SignNow with other real estate software for the Blank FHA Loan Contingency Form?

Yes, airSlate SignNow offers seamless integrations with various real estate software solutions. This allows you to manage your Blank FHA Loan Contingency Form alongside other essential tools, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for the Blank FHA Loan Contingency Form?

Using airSlate SignNow for the Blank FHA Loan Contingency Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. Our platform simplifies the signing process, allowing for quicker transactions and improved client satisfaction.

Get more for Blank Fha Loan Contingency Form

Find out other Blank Fha Loan Contingency Form

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free