What is a Disbursement?Tax Adviser Form

What is the What Is A Disbursement?Tax Adviser

The What Is A Disbursement?Tax Adviser form is a crucial document used primarily in the context of tax reporting and financial transactions. It serves to clarify the nature of disbursements made by businesses or individuals, detailing the amounts and purposes of these payments. This form is particularly relevant for tax advisers who need to ensure that all disbursements are accurately reported to the IRS, thereby maintaining compliance with tax regulations.

How to use the What Is A Disbursement?Tax Adviser

Using the What Is A Disbursement?Tax Adviser form involves several key steps. First, gather all necessary financial records and documentation related to the disbursements in question. This may include invoices, receipts, and any relevant contracts. Next, complete the form by accurately filling in all required fields, ensuring that each disbursement is clearly described. Once completed, the form should be reviewed for accuracy before submission to the appropriate tax authority or financial institution.

Steps to complete the What Is A Disbursement?Tax Adviser

Completing the What Is A Disbursement?Tax Adviser form involves a systematic approach:

- Collect all relevant financial documents.

- Fill in the form with precise details of each disbursement, including amounts and purposes.

- Double-check for any errors or omissions.

- Sign and date the form, if required.

- Submit the form to the designated authority, either online or via mail.

Legal use of the What Is A Disbursement?Tax Adviser

The legal use of the What Is A Disbursement?Tax Adviser form is essential for ensuring compliance with federal and state tax laws. By accurately documenting disbursements, individuals and businesses can avoid potential legal issues related to tax evasion or misreporting. This form acts as a safeguard, providing a clear record of financial transactions that can be referenced in case of audits or inquiries from tax authorities.

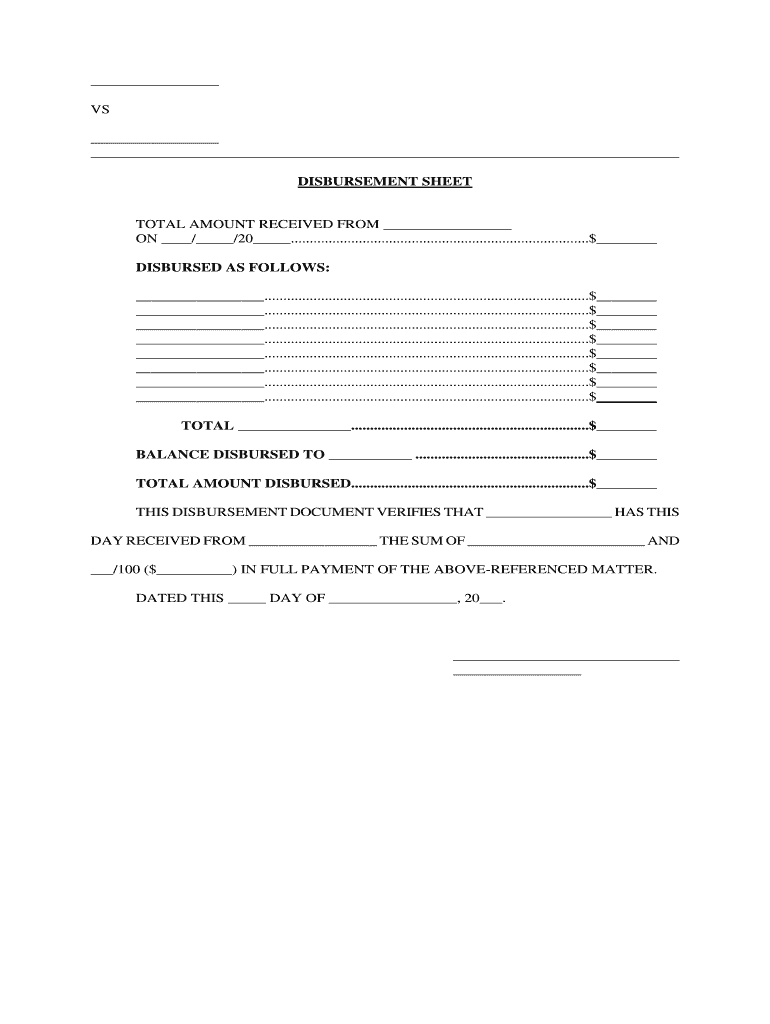

Key elements of the What Is A Disbursement?Tax Adviser

Key elements of the What Is A Disbursement?Tax Adviser form include:

- Disbursement Amount: The total amount being disbursed.

- Purpose of Disbursement: A clear description of why the funds are being disbursed.

- Date of Transaction: The date when the disbursement occurred.

- Recipient Information: Details about the individual or entity receiving the funds.

- Signature: Required for verification and authenticity.

Filing Deadlines / Important Dates

Filing deadlines for the What Is A Disbursement?Tax Adviser form can vary based on the type of disbursement and the tax year. It is important to be aware of these dates to ensure timely submission. Generally, forms related to tax reporting must be filed by April 15 of the following tax year, but specific deadlines may apply to different types of disbursements. Consulting the IRS guidelines or a tax professional can provide clarity on these important dates.

Quick guide on how to complete what is a disbursementtax adviser

Complete What Is A Disbursement?Tax Adviser effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage What Is A Disbursement?Tax Adviser on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign What Is A Disbursement?Tax Adviser effortlessly

- Find What Is A Disbursement?Tax Adviser and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about missing or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign What Is A Disbursement?Tax Adviser and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a disbursement in the context of a Tax Adviser?

A disbursement refers to the payment or distribution of funds to clients or vendors. For a Tax Adviser, understanding what a disbursement is essential for managing client accounts and processing tax-related transactions efficiently.

-

How does airSlate SignNow facilitate disbursement management?

airSlate SignNow simplifies disbursement management by allowing businesses to send and eSign documents securely, ensuring that all financial transactions are well-documented and traceable. This is crucial for Tax Advisers when managing client payments accurately.

-

What features make airSlate SignNow suitable for Tax Advisers?

airSlate SignNow offers features like customized templates, secure eSigning, and automated workflows that streamline the disbursement process. These tools help Tax Advisers operate more efficiently by reducing paperwork and enhancing client communication.

-

Is airSlate SignNow cost-effective for independent Tax Advisers?

Yes, airSlate SignNow provides an affordable solution for independent Tax Advisers looking to manage their disbursements without breaking the bank. The pricing plans are designed to meet varying needs, ensuring that even small businesses can benefit from its features.

-

Can airSlate SignNow integrate with accounting software used by Tax Advisers?

Absolutely! airSlate SignNow can integrate seamlessly with popular accounting software, which enhances the overall workflow for Tax Advisers. This integration helps in tracking disbursements and maintaining accurate financial records.

-

What benefits can Tax Advisers expect from using airSlate SignNow?

Tax Advisers can expect numerous benefits from using airSlate SignNow, including increased efficiency through automated processes, improved accuracy in document handling, and enhanced client satisfaction due to faster transactions and communications regarding disbursements.

-

How secure is airSlate SignNow for managing sensitive disbursement information?

airSlate SignNow prioritizes security by implementing strong encryption methods and compliance with industry standards. This ensures that sensitive disbursement information handled by Tax Advisers remains confidential and protected against unauthorized access.

Get more for What Is A Disbursement?Tax Adviser

- New mexico purchase agreement form

- California enterprise zone hiring tax credit voucher application form

- Driving record filler form

- Out service training request form 411 department of human

- Alabama aoc form

- 19949716 12d 16 002 florida administrative rules law form

- Florida annual resale certificate for sales tax form

- Tc 824 insufficient evidence of ownership bond surety bond forms ampamp publications

Find out other What Is A Disbursement?Tax Adviser

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free