Multistate Fixed Rate Note, Installment Payments UnSecured Form

What is the Multistate Fixed Rate Note, Installment Payments UnSecured

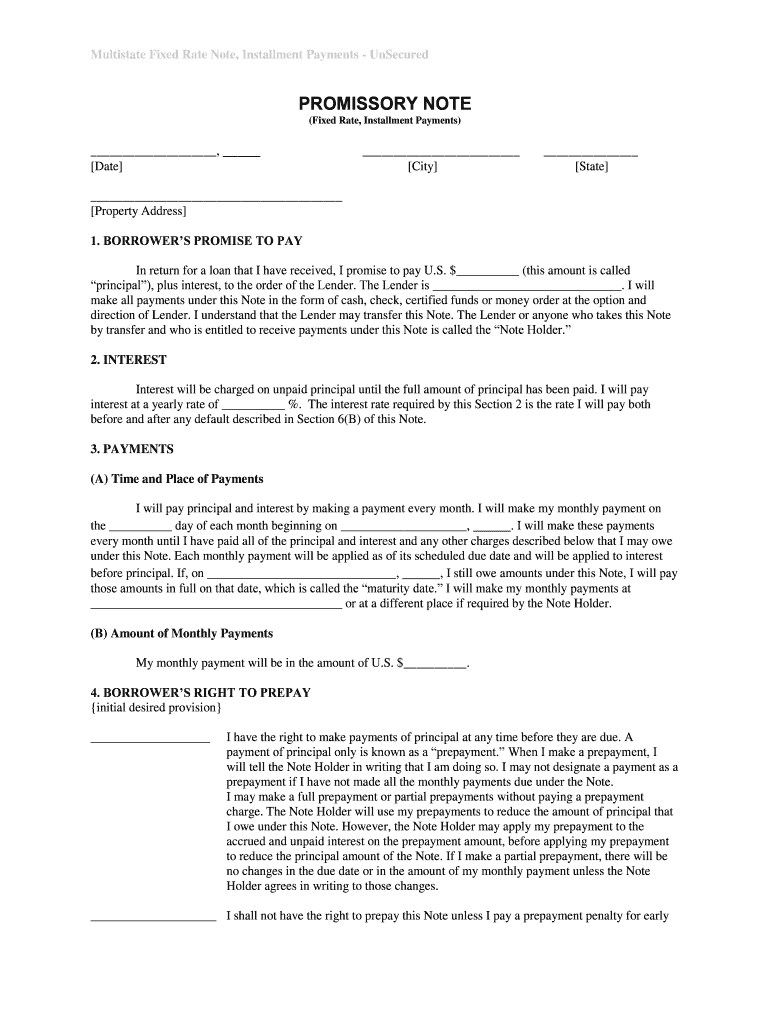

The Multistate Fixed Rate Note, Installment Payments UnSecured is a financial instrument used to formalize a loan agreement where the borrower agrees to repay the lender in fixed installments over a specified period. This note is particularly useful in situations where collateral is not provided, making it an unsecured form of borrowing. It outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments. Understanding the specifics of this note is crucial for both borrowers and lenders to ensure compliance with legal standards and to protect their interests.

Steps to complete the Multistate Fixed Rate Note, Installment Payments UnSecured

Completing the Multistate Fixed Rate Note requires careful attention to detail. Here are the essential steps:

- Gather necessary information: Collect details such as the borrower's name, address, and financial information, as well as the lender's information.

- Specify loan terms: Clearly outline the loan amount, interest rate, payment frequency, and total repayment duration.

- Define payment schedule: Create a detailed schedule that indicates when payments are due and the amount of each installment.

- Include legal clauses: Add any necessary legal provisions regarding default, prepayment, and dispute resolution.

- Sign and date the document: Both parties should sign and date the note to make it legally binding.

Legal use of the Multistate Fixed Rate Note, Installment Payments UnSecured

The legal use of the Multistate Fixed Rate Note is governed by state and federal laws that regulate lending practices. This document must comply with the Uniform Commercial Code (UCC) and any specific state laws relevant to unsecured loans. It is essential for both parties to understand their rights and obligations under this note. Failure to adhere to legal requirements can result in unenforceability of the note or potential legal disputes.

Key elements of the Multistate Fixed Rate Note, Installment Payments UnSecured

Several key elements must be included in the Multistate Fixed Rate Note to ensure its validity:

- Borrower and lender information: Names and addresses of both parties.

- Loan amount: The total amount being borrowed.

- Interest rate: The fixed rate applied to the loan.

- Payment terms: Details on installment amounts and due dates.

- Default provisions: Conditions under which the borrower may be considered in default.

How to use the Multistate Fixed Rate Note, Installment Payments UnSecured

Using the Multistate Fixed Rate Note involves several steps to ensure proper execution and compliance. Once the note is completed, it should be presented to the borrower for review. After both parties agree to the terms, they should sign the document in the presence of a witness or notary, if required by state law. The signed note should be stored securely by both parties, and a copy should be provided to the borrower for their records. This process ensures that both parties have a clear understanding of the loan agreement and their responsibilities.

State-specific rules for the Multistate Fixed Rate Note, Installment Payments UnSecured

Each state may have specific regulations that affect the use of the Multistate Fixed Rate Note. It is important to review state laws regarding unsecured lending, interest rate limits, and required disclosures. Some states may require additional documentation or impose restrictions on certain terms within the note. Consulting with a legal professional familiar with local laws can help ensure compliance and protect the interests of both the lender and borrower.

Quick guide on how to complete multistate fixed rate note installment payments unsecured

Complete Multistate Fixed Rate Note, Installment Payments UnSecured effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Multistate Fixed Rate Note, Installment Payments UnSecured on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and electronically sign Multistate Fixed Rate Note, Installment Payments UnSecured with ease

- Locate Multistate Fixed Rate Note, Installment Payments UnSecured and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Multistate Fixed Rate Note, Installment Payments UnSecured while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Multistate Fixed Rate Note, Installment Payments UnSecured?

A Multistate Fixed Rate Note, Installment Payments UnSecured is a financial instrument that allows borrowers to secure loans with fixed interest rates across multiple states. It provides flexibility in payment options, allowing for installment payments that can fit within your budget. This instrument is particularly beneficial for those looking for stable, predictable financing.

-

How does airSlate SignNow facilitate the signing of Multistate Fixed Rate Notes?

AirSlate SignNow offers a seamless eSigning solution that allows users to easily sign and manage Multistate Fixed Rate Notes, Installment Payments UnSecured. Our platform ensures compliance with legal standards, making the process quick and reliable. With just a few clicks, you can send and receive documents, thereby saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for Multistate Fixed Rate Notes?

Our pricing plans for airSlate SignNow are designed to be affordable and cater to various business needs. Whether you frequently handle Multistate Fixed Rate Notes, Installment Payments UnSecured or require occasional access, we offer flexible subscription plans. You can choose the package that best suits your volume of transactions and features needed.

-

What benefits do Multistate Fixed Rate Notes provide to borrowers?

Borrowers benefit from Multistate Fixed Rate Notes, Installment Payments UnSecured as they guarantee a fixed interest rate, which can make budgeting easier. These notes also allow for installment payments, providing financial flexibility and reducing the overall burden of large payments. This feature can be particularly advantageous for long-term investments.

-

Are there any integrations available for managing Multistate Fixed Rate Notes with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with a variety of business applications, making it easier to manage Multistate Fixed Rate Notes, Installment Payments UnSecured. Users can connect our platform with CRM systems, document management tools, and financial software to streamline workflows. This integration enhances productivity and ensures that all documents are managed in one central location.

-

How secure is the eSignature process for Multistate Fixed Rate Notes?

AirSlate SignNow prioritizes security in all its transactions, including for Multistate Fixed Rate Notes, Installment Payments UnSecured. Our platform uses advanced encryption and authentication protocols to protect sensitive information. This ensures that your eSigned documents are safe, compliant, and legally binding.

-

Can I customize a Multistate Fixed Rate Note using airSlate SignNow?

Absolutely! AirSlate SignNow allows users to customize their Multistate Fixed Rate Notes, Installment Payments UnSecured to meet specific requirements. You can modify templates, add necessary clauses, and ensure all relevant details are included before sending for signature, making the process tailored to your needs.

Get more for Multistate Fixed Rate Note, Installment Payments UnSecured

- Environmental clearance for undertakings within nmdot right of dot state nm form

- Prepopik instructions day before regimen form

- Arizona cc 218 order form to request des state legal forms

- A haccp flowchart for beef stew form

- Special warranty deed 4246114 form

- Answer to civil complaint form

- Plea form city of sweeny texas

- Yvonne m williams texas state directory online form

Find out other Multistate Fixed Rate Note, Installment Payments UnSecured

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation