MA DO 11 Form

What is the MA DO 11

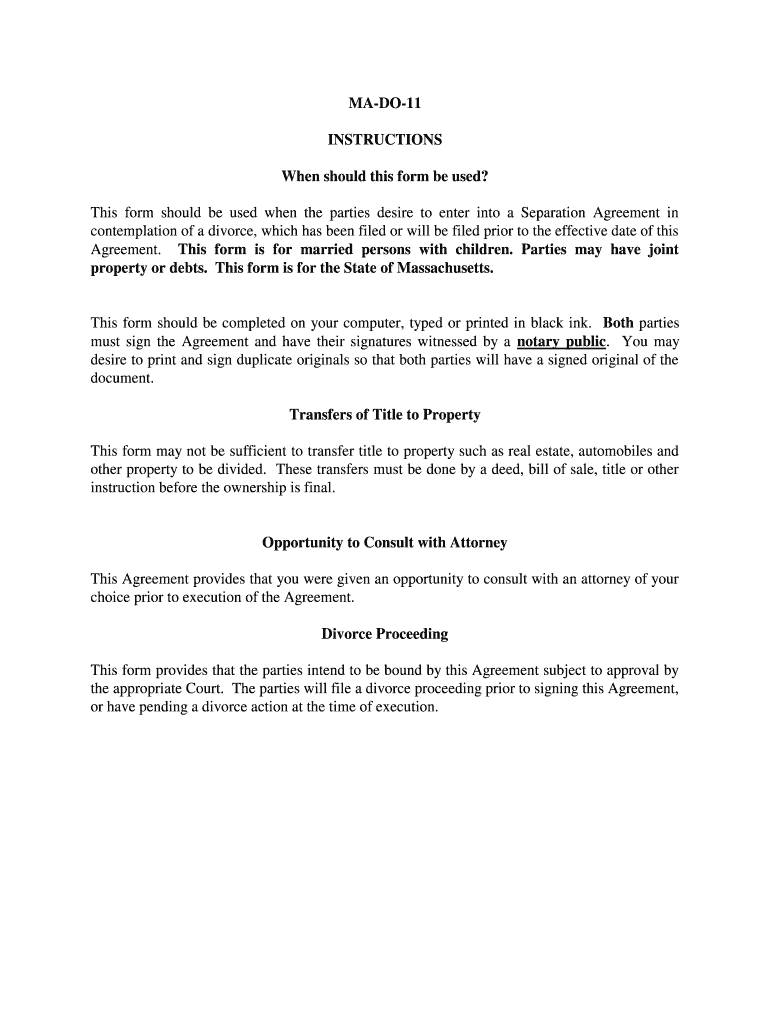

The MA DO 11 form is a crucial document used in the state of Massachusetts for various administrative purposes. This form is primarily associated with the Department of Revenue and is utilized for reporting specific financial information. It is important for individuals and businesses to understand the purpose and implications of this form, as it plays a significant role in tax compliance and record-keeping. The MA DO 11 ensures that the necessary information is accurately reported to the state, facilitating proper assessment and collection of taxes.

How to use the MA DO 11

Using the MA DO 11 form involves several key steps to ensure compliance and accuracy. First, gather all necessary financial documents and information relevant to the form. This may include income statements, tax identification numbers, and any previous filings. Next, fill out the form carefully, ensuring that all entries are accurate and complete. Once the form is filled out, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, which may include online submission, mailing, or in-person delivery to the appropriate agency.

Steps to complete the MA DO 11

Completing the MA DO 11 form requires attention to detail and adherence to specific guidelines. Follow these steps to ensure a smooth process:

- Gather all relevant financial documents.

- Access the MA DO 11 form from the official state resources.

- Fill in the required fields accurately, including personal and financial information.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the completed form through the designated method.

Legal use of the MA DO 11

The MA DO 11 form must be used in accordance with Massachusetts state laws and regulations. It is essential to ensure that the information provided is truthful and complies with all legal requirements. Misuse of the form or providing false information can lead to penalties, including fines or legal action. Understanding the legal implications of the MA DO 11 is crucial for both individuals and businesses to maintain compliance and avoid potential issues with state authorities.

Required Documents

To successfully complete the MA DO 11 form, certain documents are typically required. These may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, including a Social Security number or tax identification number.

- Any previous correspondence or filings related to the form.

Having these documents ready can streamline the process and help ensure that the form is filled out accurately.

Form Submission Methods

The MA DO 11 form can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online Submission: Many users opt to submit the form electronically through the Massachusetts Department of Revenue website.

- Mail: The completed form can be printed and mailed to the appropriate department.

- In-Person: Individuals may also choose to deliver the form in person at designated state offices.

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Quick guide on how to complete ma do 11

Accomplish MA DO 11 seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed files, enabling you to access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly and without complications. Manage MA DO 11 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign MA DO 11 effortlessly

- Obtain MA DO 11 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or shared link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign MA DO 11 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is MA DO 11 in airSlate SignNow?

MA DO 11 refers to a specific document management process within the airSlate SignNow platform designed to enhance efficiency. It allows users to streamline the eSignature process, ensuring quick and secure document handling. With MA DO 11, businesses can send, sign, and store documents all in one place.

-

How much does MA DO 11 cost?

The pricing for MA DO 11 within airSlate SignNow varies based on the chosen plan. airSlate SignNow offers affordable subscription options tailored to businesses of all sizes. You can explore different plans on our website to find the most cost-effective solution that meets your needs.

-

What features are included in MA DO 11?

MA DO 11 includes features like customizable templates, advanced security, and real-time tracking of document status. Users can also leverage integrations with various applications to enhance their workflow. This makes the eSigning experience efficient and user-friendly.

-

How does MA DO 11 benefit businesses?

The benefits of MA DO 11 include increased operational efficiency, reduced paper usage, and faster turnaround times for document approvals. By using MA DO 11, businesses can improve productivity while ensuring compliance and security in their document handling processes.

-

Can MA DO 11 integrate with other software?

Yes, MA DO 11 is designed to integrate seamlessly with multiple software platforms. This feature allows users to enhance their existing workflows with eSigning capabilities. Common integrations include CRM systems, cloud storage, and project management tools.

-

Is there a mobile version of MA DO 11?

Absolutely! MA DO 11 is accessible via mobile devices, enabling users to send and sign documents on-the-go. The mobile-friendly design ensures that your document management needs are met anytime, anywhere, making it a convenient choice for busy professionals.

-

What types of documents can I manage with MA DO 11?

With MA DO 11, you can manage a variety of document types, including contracts, agreements, and forms. The platform supports numerous file formats, allowing maximum flexibility for your business. This helps ensure you can handle all your essential documents efficiently.

Get more for MA DO 11

- Sample air waybill for jewelry shipment fedex form

- Vacancy profile form

- Post anesthesia care unit orders csjcsm dr carondelet form

- Qmb application maryland form

- Wildwood municipal court form

- L112 restated and amended certificate of formation llc

- Proposed regulationn j state board of marriage and form

- Township of piscataway open public records act request form piscatawaynj

Find out other MA DO 11

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF