Form M 792 Certificate Releasing Massachusetts Estate Tax

What is the Form M-792 Certificate Releasing Massachusetts Estate Tax

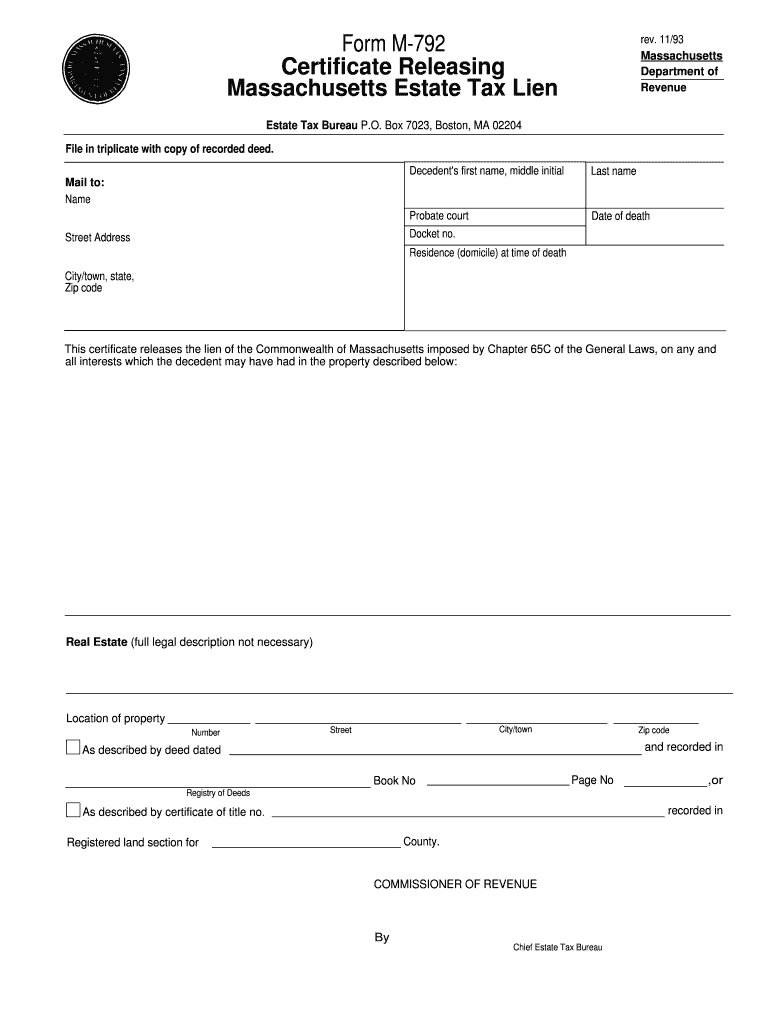

The Form M-792 is a crucial document in the Massachusetts estate tax process. It serves as a certificate that confirms the release of estate tax obligations for the estate of a deceased individual. This form is essential for beneficiaries and executors as it verifies that all estate taxes have been settled with the Massachusetts Department of Revenue. Without this certificate, the transfer of assets may be delayed, and legal complications could arise.

How to use the Form M-792 Certificate Releasing Massachusetts Estate Tax

Using the Form M-792 involves several key steps. First, ensure that all estate taxes have been paid in full. Next, the executor or administrator of the estate must complete the form accurately, providing necessary details such as the decedent's information and the tax identification number. Once filled out, the form must be submitted to the Massachusetts Department of Revenue for processing. Upon approval, the department will issue the certificate, allowing for the distribution of estate assets.

Steps to complete the Form M-792 Certificate Releasing Massachusetts Estate Tax

Completing the Form M-792 requires careful attention to detail. Follow these steps:

- Gather all relevant information about the decedent, including full name, date of death, and Social Security number.

- Ensure that all estate taxes have been paid and that you have documentation of these payments.

- Fill out the form with accurate details, ensuring that all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Massachusetts Department of Revenue, either online or by mail.

Legal use of the Form M-792 Certificate Releasing Massachusetts Estate Tax

The Form M-792 is legally binding once issued by the Massachusetts Department of Revenue. It is recognized as proof that all estate tax liabilities have been satisfied, which is essential for the lawful transfer of assets. Executors and beneficiaries should retain a copy of this certificate, as it may be required in various legal and financial transactions related to the estate.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form M-792 is vital to ensure compliance with Massachusetts estate tax laws. Generally, the estate tax return must be filed within nine months of the decedent's death. However, the Form M-792 should be submitted only after all tax liabilities are settled. It is advisable to keep track of any extensions or changes in deadlines announced by the Massachusetts Department of Revenue, as these can affect the timing of your submission.

Required Documents

When completing the Form M-792, several documents are necessary to support your submission. These include:

- The estate tax return (Form 706) that was filed with the Massachusetts Department of Revenue.

- Proof of payment for any estate taxes owed.

- Death certificate of the decedent.

- Any other relevant documentation that may be required by the Department of Revenue.

Quick guide on how to complete form m 792 certificate releasing massachusetts estate tax

Prepare Form M 792 Certificate Releasing Massachusetts Estate Tax effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Form M 792 Certificate Releasing Massachusetts Estate Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Form M 792 Certificate Releasing Massachusetts Estate Tax with ease

- Find Form M 792 Certificate Releasing Massachusetts Estate Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiring form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form M 792 Certificate Releasing Massachusetts Estate Tax and ensure effective communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Massachusetts estate tax?

The Massachusetts estate tax is a tax imposed on the transfer of the estate of a deceased person. It applies to estates valued above a certain threshold, currently set at $1 million. Understanding the Massachusetts estate tax is crucial for planning and ensuring compliance during the estate settlement process.

-

How does airSlate SignNow facilitate document signing for Massachusetts estate tax forms?

airSlate SignNow offers an intuitive platform for eSigning documents, including Massachusetts estate tax forms. With our easy-to-use software, you can securely sign and manage all required documents for estate tax compliance. This ensures that you meet deadlines and maintain organization during the process.

-

Are there any costs associated with using airSlate SignNow for Massachusetts estate tax documents?

Yes, airSlate SignNow provides a range of pricing plans depending on your needs, making it a cost-effective solution for managing your Massachusetts estate tax documents. Each plan is designed to fit various budgets while providing essential features for document preparation and eSigning. You can choose a plan that best fits your volume of estate tax needs.

-

What features does airSlate SignNow offer that are beneficial for Massachusetts estate tax management?

airSlate SignNow includes features like customizable templates, secure storage, and automated workflows, all of which are beneficial for managing Massachusetts estate tax documents. These tools simplify the process and help you ensure that all your documents are correctly formatted and compliant with state regulations. Additionally, notifications and reminders keep you on track with important deadlines.

-

Can I track the status of my Massachusetts estate tax documents using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities that allow you to monitor the status of your Massachusetts estate tax documents in real-time. This feature ensures you know when documents are viewed, signed, or require further action, promoting accountability and efficiency throughout the process.

-

Does airSlate SignNow integrate with other platforms for Massachusetts estate tax document management?

Yes, airSlate SignNow integrates seamlessly with various popular platforms, enhancing the management of Massachusetts estate tax documents. These integrations help streamline your workflow, allowing you to connect with tools you already use for accounting or legal documentation. This interoperability adds further value to our service.

-

How secure is my information when handling Massachusetts estate tax documents with airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling Massachusetts estate tax documents, your data is protected with industry-standard encryption and robust privacy measures. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form M 792 Certificate Releasing Massachusetts Estate Tax

- Parts return form

- Salary reduction letter form

- Authorization for cremation and disposition the neptune society of form

- Kentucky irp apportioned operational lease agreement form

- General internal medicine clinic referral form st michaelamp39s hospital

- Highmark therapy treatment plan form fillable

- El paso airport badging office form

- El tutorial form

Find out other Form M 792 Certificate Releasing Massachusetts Estate Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors