State Tax Form 214

What is the State Tax Form 214

The State Tax Form 214 is a specific tax form utilized by residents in certain states to report income and calculate state taxes owed. This form is essential for ensuring compliance with state tax laws and is typically required for individuals and businesses filing their annual tax returns. Understanding the purpose and requirements of Form 214 can help taxpayers navigate their state tax obligations effectively.

How to obtain the State Tax Form 214

Taxpayers can obtain the State Tax Form 214 through various channels. Most states provide access to their tax forms on official government websites. Additionally, individuals can visit local tax offices or libraries where printed forms may be available. It is important to ensure that you are using the correct version of the form for the applicable tax year to avoid any issues during the filing process.

Steps to complete the State Tax Form 214

Completing the State Tax Form 214 involves several key steps:

- Gather necessary documentation, including income statements, deductions, and credits.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income accurately on the form.

- Calculate deductions and credits applicable to your situation.

- Review all entries for accuracy before submission.

Following these steps carefully will help ensure that the form is completed correctly and submitted on time.

Legal use of the State Tax Form 214

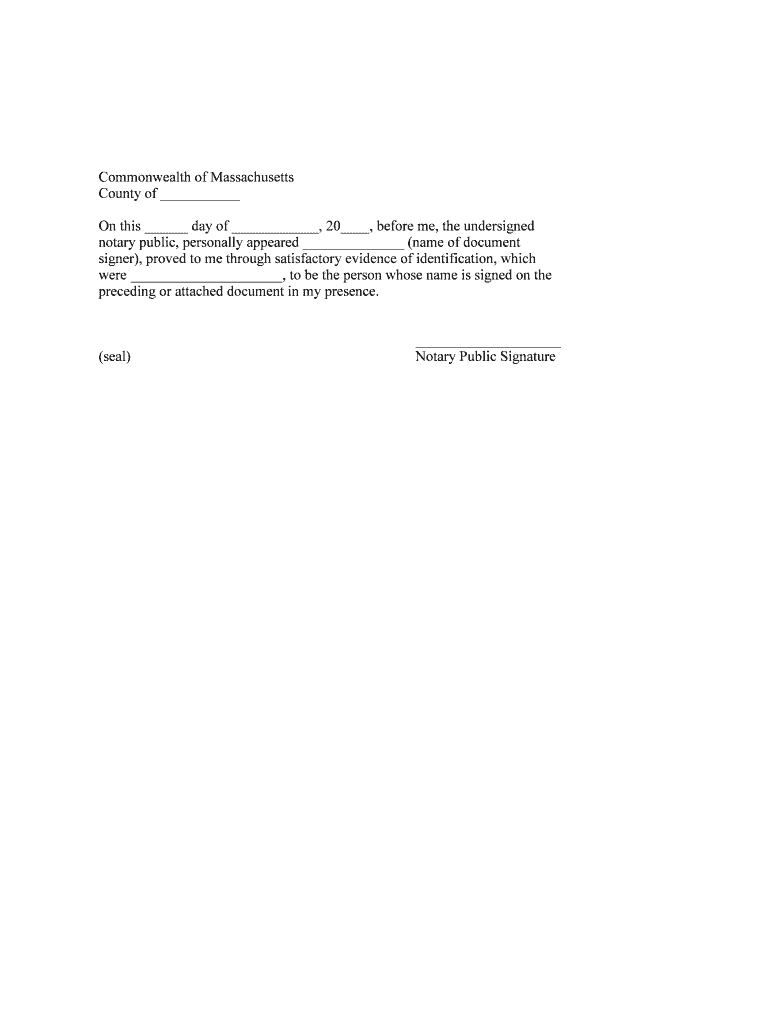

The State Tax Form 214 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must provide accurate information and comply with all filing requirements. Electronic signatures, when used, must meet the standards set forth by eSignature laws, ensuring that the form is recognized as a legitimate document by state authorities.

Form Submission Methods

Taxpayers have several options for submitting the State Tax Form 214. These methods typically include:

- Online submission through the state’s tax portal, which is often the fastest method.

- Mailing a printed version of the form to the appropriate state tax office.

- In-person submission at local tax offices, which can provide immediate confirmation of receipt.

Choosing the right submission method can help ensure timely processing of your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the State Tax Form 214 vary by state, but generally, they align with federal tax deadlines. Typically, taxpayers must file their state taxes by April 15 of each year. It is essential to check with your state’s tax authority for specific deadlines and any extensions that may apply. Staying aware of these dates can help avoid penalties and interest on late filings.

Quick guide on how to complete state tax form 214

Complete State Tax Form 214 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without any holdups. Manage State Tax Form 214 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign State Tax Form 214 with ease

- Obtain State Tax Form 214 and then click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign State Tax Form 214 and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is State Tax Form 214 and why is it important?

State Tax Form 214 is an essential document for individuals and businesses to report state income and deductions accurately. It ensures compliance with state tax regulations, helping to avoid potential penalties. Utilizing airSlate SignNow makes it easy to eSign and manage your State Tax Form 214 efficiently.

-

How can airSlate SignNow help with submitting State Tax Form 214?

airSlate SignNow simplifies the process of submitting State Tax Form 214 by allowing users to eSign documents securely and quickly. You can easily send your form to others for signatures without any hassle. With our platform, tracking the status of your submissions is straightforward and user-friendly.

-

Is there a cost associated with using airSlate SignNow for State Tax Form 214?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Our plans are cost-effective and provide great value, especially for managing documents like the State Tax Form 214. We also offer a free trial, allowing you to explore our features before committing.

-

What features does airSlate SignNow provide for State Tax Form 214 management?

airSlate SignNow offers a range of features for managing State Tax Form 214 efficiently, including customizable templates, document tracking, and secure eSignatures. The platform is designed for ease of use, ensuring that you can prepare and send your tax forms without complications. Automated reminders for signatures streamline the process further.

-

Can I integrate airSlate SignNow with other applications for managing State Tax Form 214?

Absolutely! airSlate SignNow integrates with various applications, including cloud storage services and accounting software, to enhance your workflow for managing State Tax Form 214. These integrations ensure that all your documents and signatures are organized and accessible from one place, improving efficiency.

-

What are the benefits of using airSlate SignNow for State Tax Form 214?

Using airSlate SignNow for State Tax Form 214 provides benefits such as reduced turnaround time for signatures, enhanced document security, and the ability to manage all forms from one platform. It streamlines the tax filing process, helping you focus on more critical tasks. Our intuitive interface makes it a go-to solution for tax professionals and businesses alike.

-

How secure is my data when using airSlate SignNow to handle State Tax Form 214?

Your data security is a top priority at airSlate SignNow. We employ advanced encryption protocols to protect sensitive information associated with your State Tax Form 214. Additionally, our compliance with industry standards ensures that your documents are stored securely, giving you peace of mind.

Get more for State Tax Form 214

- Barnetrygd form

- W 4p rol frs state fl us retirement ftp rol frs state fl form

- Printable caregiver forms

- Form ct 1 302413

- Graduate admissions virginia commonwealth university form

- Withdrawal forms from university of pikeville

- Volleyball questionnaire 230144130 form

- Observation form pdf child development labs

Find out other State Tax Form 214

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors