*Optional Notice Required Only If the Homeowner Has Borrowed or is Borrowing Money to Finance the Form

What is the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The

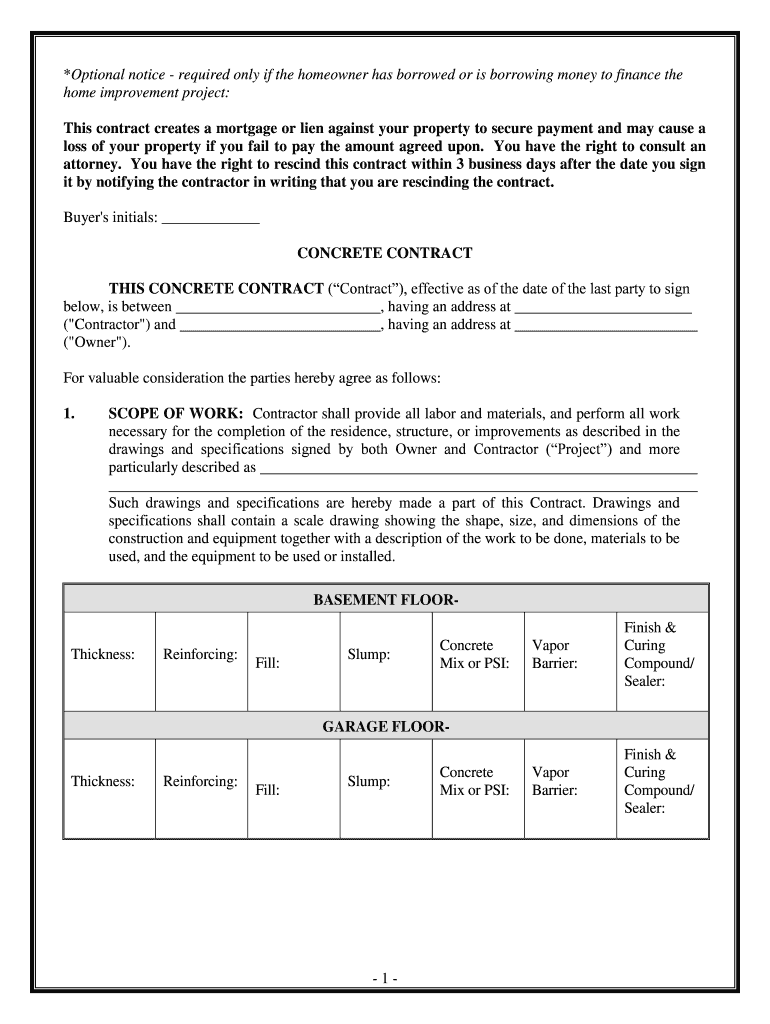

The Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The is a specific document that serves to inform relevant parties about the financial obligations related to a property. This notice is particularly important in real estate transactions where a homeowner has taken out a loan or is in the process of securing financing. It outlines the terms under which the homeowner is borrowing money and ensures that all parties are aware of the financial encumbrances associated with the property.

Steps to Complete the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The

Completing the Optional Notice involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the homeowner's loan, including the lender's details, loan amount, and terms. Next, fill out the notice form clearly, ensuring that all sections are completed. It is crucial to provide accurate information to avoid potential legal issues. Once the form is filled out, the homeowner should review it for any errors. Finally, the completed notice should be signed and dated, and copies should be distributed to all relevant parties, including the lender and any co-signers.

Legal Use of the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The

The legal use of the Optional Notice is to provide transparency in financial transactions involving real estate. It is often required by lenders and can serve as a protective measure for both the homeowner and the lender. By disclosing the financial obligations associated with the property, the notice helps prevent misunderstandings or disputes that may arise later. Additionally, having this notice on file can be beneficial in legal proceedings, as it demonstrates compliance with lending regulations and proper documentation practices.

Key Elements of the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The

Several key elements must be included in the Optional Notice to ensure its validity. These elements typically include:

- The homeowner's name and contact information

- The lender's name and contact information

- The loan amount and interest rate

- The terms of the loan, including payment schedule

- Any additional stipulations or conditions related to the financing

Including these details ensures that all parties have a clear understanding of the financial obligations and can refer back to the notice as needed.

How to Obtain the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The

Obtaining the Optional Notice can typically be done through your lender or financial institution. Many lenders provide a template or form that can be filled out. Alternatively, homeowners can access official templates online or consult with a legal professional to draft the notice. It is essential to ensure that the form complies with state regulations and includes all necessary information to avoid any legal complications.

State-Specific Rules for the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The

State-specific rules regarding the Optional Notice can vary significantly. Some states may have particular requirements for the content of the notice, while others may not require it at all. It is important for homeowners to familiarize themselves with their state's regulations regarding real estate financing and documentation. Consulting a local attorney or real estate professional can provide valuable insights into the specific requirements that must be met to ensure compliance.

Quick guide on how to complete optional notice required only if the homeowner has borrowed or is borrowing money to finance the

Finalize *Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The effortlessly on any device

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly without delays. Handle *Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The on any device using airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to edit and eSign *Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The with ease

- Obtain *Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark pertinent portions of the documents or conceal sensitive details with tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign *Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The?

The Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The is a document that provides essential information regarding financing agreements. It's crucial for homeowners to understand this notice as it outlines loan details and obligations. Using airSlate SignNow, you can easily create and manage these documents to ensure compliance.

-

How does airSlate SignNow help with the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The?

airSlate SignNow simplifies the process of generating the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The. With our intuitive interface, users can quickly fill out necessary fields and send documents for e-signature, ensuring fast and secure transactions. This helps businesses stay compliant with loan requirements effortlessly.

-

What are the pricing options for using airSlate SignNow for document management?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Pricing starts with a free trial, enabling users to explore features like e-signing and document templates, including those for the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The. Detailed pricing information can be requested through our website.

-

What features does airSlate SignNow provide that assist with real estate transactions?

airSlate SignNow includes features like customizable templates, in-app messaging, and integrations with popular CRMs to enhance real estate transactions. These features are especially useful for creating the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The, offering a streamlined solution for real estate professionals. This efficiency promotes quicker deal closures and customer satisfaction.

-

Is airSlate SignNow compliant with industry regulations for financing documents?

Yes, airSlate SignNow is designed to comply with regulatory standards for digital transactions, including documentation related to the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The. Our platform ensures that all signatures are legally binding and secure, giving users peace of mind while managing sensitive transactions.

-

Can I integrate airSlate SignNow with other software tools for better workflow?

Absolutely! airSlate SignNow offers seamless integrations with various software tools such as CRM systems, cloud storage, and project management tools. This enhances workflows and makes it easier to manage documents like the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The within your existing systems for a more cohesive experience.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing streamlines the entire signing process, saves time, and reduces paperwork. By incorporating features like the Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The into your document management, you enhance organization and efficiency within your operations. Additionally, e-signatures are legally binding, making them a secure option.

Get more for *Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The

- Ribbonx for dummies pdf worldtracker org form

- Otice and acknowledgement of reo purchasing screening form

- Chapter 7 itemized deductions discussion questions form

- Bobcat badge us scouting service project form

- Payg payment summary pdf form

- Mental health behavior contract template form

- Mental health contract template form

- Mentor mentee contract template form

Find out other *Optional Notice Required Only If The Homeowner Has Borrowed Or Is Borrowing Money To Finance The

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile