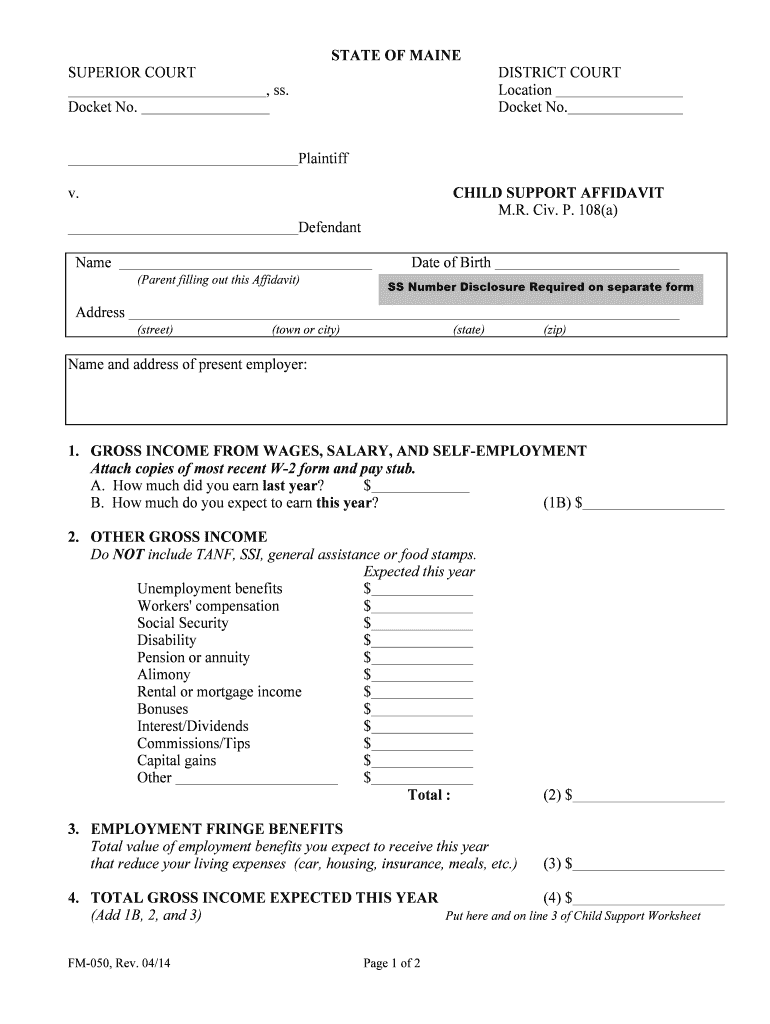

GROSS INCOME from WAGES, SALARY, and SELF EMPLOYMENT Form

What is the gross income from wages, salary, and self employment

The gross income from wages, salary, and self employment refers to the total earnings an individual receives before any deductions are made. This includes wages from employment, salaries, and income generated from self-employment activities. Understanding this concept is crucial for accurate tax reporting and financial planning. It encompasses all forms of compensation, including bonuses, overtime pay, commissions, and profits from business activities. Accurate reporting of gross income is essential for determining tax obligations and eligibility for various financial products.

How to use the gross income from wages, salary, and self employment

Using the gross income from wages, salary, and self employment involves accurately calculating and reporting your total income for tax purposes. Individuals should gather all relevant documentation, such as W-2 forms from employers and 1099 forms for self-employment income. It is important to ensure that all sources of income are included to avoid discrepancies. This information is typically reported on tax returns, which may influence eligibility for credits and deductions. Proper usage of this income figure is vital for effective financial management.

Steps to complete the gross income from wages, salary, and self employment

Completing the gross income from wages, salary, and self employment involves several key steps:

- Gather all income documentation, including W-2s and 1099s.

- Calculate total earnings from each source of income.

- Combine all income figures to determine your gross income.

- Ensure accuracy by cross-referencing with bank statements and other financial records.

- Report the total gross income on your tax return or relevant forms.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of gross income from wages, salary, and self employment. It is essential to adhere to these guidelines to ensure compliance with federal tax laws. The IRS requires that all income be reported accurately, regardless of the amount. Self-employed individuals must also pay self-employment tax on their earnings. Familiarity with IRS publications and resources can help individuals understand their obligations and avoid potential penalties.

Penalties for Non-Compliance

Failure to accurately report gross income from wages, salary, and self employment can result in significant penalties. The IRS may impose fines for underreporting income, which can lead to additional taxes owed. In severe cases, individuals may face criminal charges for tax evasion. It is crucial to maintain accurate records and report income truthfully to avoid these consequences. Understanding the importance of compliance can help individuals protect themselves from legal issues and financial penalties.

Required Documents

To accurately report gross income from wages, salary, and self employment, several documents are necessary. These include:

- W-2 forms from employers, detailing annual earnings and taxes withheld.

- 1099 forms for self-employed individuals, indicating income received.

- Bank statements that reflect income deposits.

- Records of business expenses for self-employed individuals, which may impact taxable income.

Quick guide on how to complete gross income from wages salary and self employment

Prepare GROSS INCOME FROM WAGES, SALARY, AND SELF EMPLOYMENT effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious substitute to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage GROSS INCOME FROM WAGES, SALARY, AND SELF EMPLOYMENT on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest method to modify and eSign GROSS INCOME FROM WAGES, SALARY, AND SELF EMPLOYMENT seamlessly

- Obtain GROSS INCOME FROM WAGES, SALARY, AND SELF EMPLOYMENT and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your delivery method for the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign GROSS INCOME FROM WAGES, SALARY, AND SELF EMPLOYMENT and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is gross income from wages, salary, and self employment?

Gross income from wages, salary, and self employment refers to the total earnings before any deductions such as taxes or retirement contributions. Understanding this concept is crucial for accurately tracking income, especially when using airSlate SignNow for document management. Our platform helps you organize and sign important income-related documentation swiftly.

-

How does airSlate SignNow help with managing income documents?

airSlate SignNow offers a reliable platform for electronically signing and sending documents related to gross income from wages, salary, and self employment. With easy-to-use features, users can streamline the creation and management of contracts, income statements, and other pertinent documents, ensuring accuracy and compliance.

-

Is airSlate SignNow affordable for small businesses handling gross income documentation?

Yes, airSlate SignNow provides cost-effective solutions ideal for small businesses dealing with gross income from wages, salary, and self employment. Our competitive pricing plans are designed to fit various budgets, allowing you to efficiently manage and sign your income documents without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow supports various integrations, making it easy to connect with your favorite accounting software. This seamless integration allows you to efficiently manage your gross income from wages, salary, and self employment documents while maintaining accurate financial records.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a suite of features designed for effective document management, including customizable templates, real-time collaboration, and secure cloud storage. These tools help users handle important documents related to gross income from wages, salary, and self employment effortlessly and securely.

-

How does eSigning with airSlate SignNow work?

eSigning with airSlate SignNow is simple and efficient. Users can upload their documents related to gross income from wages, salary, and self employment, add signature fields, and send them for signing to anyone, anywhere. This process speeds up transactions and ensures legal validity.

-

What benefits can I expect from using airSlate SignNow?

Using airSlate SignNow allows you to save time and resources when handling documents linked to gross income from wages, salary, and self employment. Our platform enhances productivity, offers superior document security, and ensures your agreements are legally binding, all while providing a user-friendly interface.

Get more for GROSS INCOME FROM WAGES, SALARY, AND SELF EMPLOYMENT

- 5909 84281 orlando health form

- Call girl dhanbad form

- For privacy act notice get form ftb 1131

- District of columbia notification of supervised practice of psychology form

- Mi bei test application state of michigan mich form

- Driver licence statement of circumstances form

- Bar staff contract template form

- Barber contract template form

Find out other GROSS INCOME FROM WAGES, SALARY, AND SELF EMPLOYMENT

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast