Sample Vat Invoice Ghana Form

What is the Sample Vat Invoice Ghana

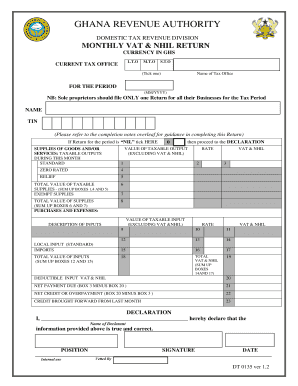

The Sample VAT Invoice Ghana is a standardized document used for recording transactions subject to Value Added Tax (VAT) in Ghana. This invoice serves as proof of purchase and includes essential details such as the seller's and buyer's information, a description of goods or services provided, the VAT amount charged, and the total cost. It is crucial for businesses to issue this invoice to comply with the Ghana Revenue Authority's regulations and to ensure that both parties have a clear record of the transaction for tax purposes.

Key elements of the Sample Vat Invoice Ghana

A well-structured Sample VAT Invoice Ghana contains several key elements that must be included for it to be valid. These elements include:

- Seller's Information: Name, address, and VAT registration number.

- Buyer's Information: Name and address, along with the VAT registration number if applicable.

- Description of Goods/Services: Clear details about what was sold.

- VAT Amount: The specific VAT charged on the transaction.

- Total Amount: The total cost including VAT.

- Invoice Number: A unique identifier for tracking purposes.

- Date of Issue: The date when the invoice is created.

Steps to complete the Sample Vat Invoice Ghana

Completing the Sample VAT Invoice Ghana involves several straightforward steps:

- Gather Information: Collect all necessary details about the transaction, including buyer and seller information.

- Fill in the Invoice: Input the details into the invoice template, ensuring all key elements are included.

- Calculate VAT: Determine the VAT amount based on the applicable rate and total cost of goods or services.

- Review the Invoice: Check for accuracy in all details to avoid any discrepancies.

- Issue the Invoice: Provide a copy to the buyer and retain a copy for your records.

Legal use of the Sample Vat Invoice Ghana

The Sample VAT Invoice Ghana is legally binding when it meets the requirements set forth by the Ghana Revenue Authority. To ensure its legal standing, the invoice must be accurately completed, containing all essential information. Additionally, both parties should retain copies for their records, as these documents may be required for tax audits or compliance checks. Failure to issue a proper VAT invoice can lead to penalties and complications with tax filings.

How to obtain the Sample Vat Invoice Ghana

Businesses can obtain the Sample VAT Invoice Ghana through various means. The Ghana Revenue Authority provides templates that can be downloaded from their official website. Alternatively, businesses may choose to create their own invoice templates using accounting software, ensuring that all necessary elements are included. It is essential to keep the invoice format compliant with the regulations set by the Ghana Revenue Authority to ensure its validity.

Digital vs. Paper Version

When it comes to the Sample VAT Invoice Ghana, businesses have the option to issue either a digital or paper version. Digital invoices are often more efficient, allowing for quicker delivery and easier record-keeping. They can be created and signed electronically, which streamlines the process. However, paper invoices may still be preferred by some businesses for traditional record-keeping or customer preferences. Regardless of the format, it is important that all legal requirements are met.

Quick guide on how to complete sample vat invoice ghana

Effortlessly prepare Sample Vat Invoice Ghana on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Sample Vat Invoice Ghana on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Sample Vat Invoice Ghana with ease

- Find Sample Vat Invoice Ghana and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or blackout sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sample Vat Invoice Ghana and guarantee efficient communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample vat invoice ghana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample VAT invoice Ghana?

A sample VAT invoice Ghana is a standard template that includes essential details such as the seller's and buyer's information, VAT registration numbers, and a breakdown of goods/services provided. This template helps businesses comply with Ghana's tax regulations effectively. Using a sample VAT invoice Ghana ensures accuracy and adherence to legal requirements.

-

How can airSlate SignNow help with creating a sample VAT invoice Ghana?

airSlate SignNow offers customizable templates that allow you to create a sample VAT invoice Ghana quickly and efficiently. With our easy-to-use interface, you can input and modify the required details to fit your business needs. This flexibility ensures that you can generate professional documents while remaining compliant with Ghanaian VAT laws.

-

Is there a cost associated with using airSlate SignNow for a sample VAT invoice Ghana?

Yes, using airSlate SignNow involves a subscription fee that varies depending on the features you select. However, our pricing plans are designed to be cost-effective for businesses of all sizes. The investment in our platform can signNowly streamline your invoicing process, ultimately saving you time and reducing errors.

-

What features are available for handling sample VAT invoices Ghana on airSlate SignNow?

airSlate SignNow provides numerous features that enhance the management of sample VAT invoices Ghana, including eSignature capabilities, document templates, and real-time collaboration. Users can easily track invoice status and send reminders for unpaid invoices. These features improve efficiency and ensure that all invoicing tasks are handled smoothly.

-

Can I integrate airSlate SignNow with other tools for invoicing?

Yes, airSlate SignNow can be integrated with various accounting and business management tools to facilitate the creation and sending of a sample VAT invoice Ghana. Integrations with software like QuickBooks and Zapier allow for seamless data transfer and automate your invoicing process. This connectivity enhances your overall business operations.

-

What are the benefits of using airSlate SignNow for my VAT invoicing in Ghana?

Using airSlate SignNow for your VAT invoicing provides numerous benefits, including efficiency, compliance, and ease of use. Our platform simplifies the process of generating a sample VAT invoice Ghana and ensures you remain compliant with local regulations. Additionally, the ability to track invoices electronically enhances your business's professionalism and reliability.

-

How secure is airSlate SignNow for electronic VAT invoicing?

AirSlate SignNow takes security seriously, employing robust encryption and authentication measures to protect your sensitive data, including sample VAT invoices Ghana. We comply with industry standards to ensure that both your documents and customer information remain safe from unauthorized access. You can confidently manage your invoicing processes with us.

Get more for Sample Vat Invoice Ghana

Find out other Sample Vat Invoice Ghana

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT