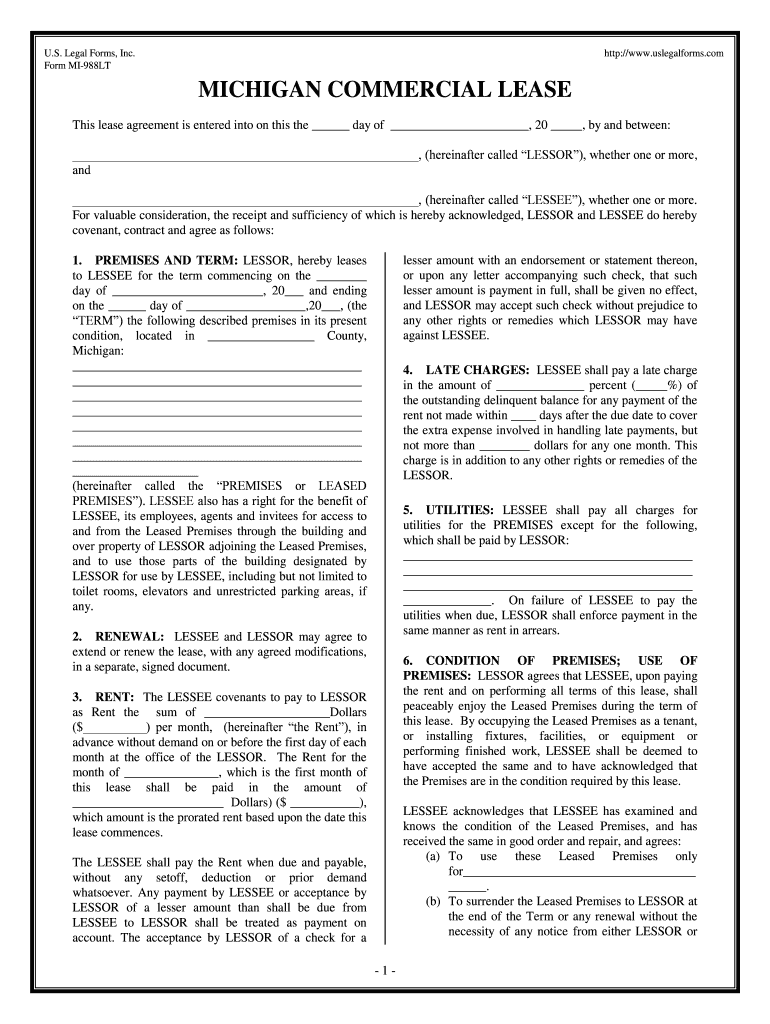

Form MI 988LT

What is the Form MI 988LT

The Form MI 988LT is a specific document used in the state of Michigan, primarily for tax-related purposes. It serves as a declaration for certain tax exemptions and is essential for individuals or businesses seeking to claim specific benefits under state law. Understanding the purpose and requirements of this form is crucial for compliance and to ensure that taxpayers can access the exemptions they are entitled to.

How to use the Form MI 988LT

Using the Form MI 988LT involves several key steps. First, ensure that you meet the eligibility criteria for the exemptions you wish to claim. Next, carefully fill out the form with accurate information, including your personal details and the specific exemptions you are applying for. Once completed, submit the form according to the instructions provided, either online or by mail, to the appropriate state tax authority.

Steps to complete the Form MI 988LT

Completing the Form MI 988LT requires attention to detail. Follow these steps:

- Gather necessary documentation, such as proof of eligibility for the exemptions.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Specify the exemption categories you are applying for, ensuring you meet all requirements.

- Review the form for accuracy and completeness.

- Submit the form as instructed, ensuring you keep a copy for your records.

Legal use of the Form MI 988LT

The legal use of the Form MI 988LT is governed by Michigan state tax laws. To ensure that your submission is legally valid, it is important to adhere to the guidelines set forth by the Michigan Department of Treasury. This includes providing truthful information and submitting the form within any specified deadlines. Failure to comply with these regulations may result in penalties or denial of the claimed exemptions.

Key elements of the Form MI 988LT

Key elements of the Form MI 988LT include:

- Personal Information: Required details about the taxpayer.

- Exemption Categories: Specific exemptions being claimed.

- Signature: A declaration that the information provided is accurate.

- Date of Submission: Important for tracking compliance with deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form MI 988LT can be submitted through various methods, depending on your preference and the guidelines provided by the Michigan Department of Treasury. Options typically include:

- Online Submission: Many taxpayers prefer to submit forms electronically for convenience.

- Mail: Completed forms can be sent to the designated tax office via postal service.

- In-Person: Some individuals may choose to deliver the form directly to a local tax office.

Quick guide on how to complete form mi 988lt

Complete Form MI 988LT effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form MI 988LT on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form MI 988LT without difficulty

- Locate Form MI 988LT and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Form MI 988LT and ensure outstanding communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form MI 988LT and why is it important?

Form MI 988LT is a critical document used in Michigan for various administrative processes. It is essential for compliance and ensures accurate submission of relevant information to state authorities. Understanding the significance of Form MI 988LT can help businesses streamline their operations and avoid potential legal issues.

-

How does airSlate SignNow simplify the process of using Form MI 988LT?

airSlate SignNow provides a user-friendly platform to complete, send, and eSign Form MI 988LT efficiently. The intuitive interface helps users navigate the form effortlessly, ensuring all necessary details are accurately filled out. This simplification saves time and reduces errors in document handling.

-

What are the pricing options for utilizing airSlate SignNow for Form MI 988LT?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes looking to manage Form MI 988LT. Users can choose from monthly or annual subscriptions, with options that suit varying needs and budgets. This affordability makes it a cost-effective solution for handling important documents.

-

Can I integrate airSlate SignNow with other applications while working on Form MI 988LT?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to work with Form MI 988LT alongside your favorite tools. These integrations enhance productivity by enabling document sharing and collaboration across platforms. This feature is particularly useful for businesses looking to streamline their workflows.

-

What benefits does airSlate SignNow provide for managing Form MI 988LT?

Using airSlate SignNow for Form MI 988LT offers numerous advantages, including increased efficiency and reduced paperwork. The electronic signature feature ensures faster processing and better tracking of documents. Additionally, it enhances security by providing a secure environment for sensitive information.

-

Is there a mobile app for managing Form MI 988LT with airSlate SignNow?

Yes, airSlate SignNow provides a mobile app that allows you to manage Form MI 988LT on the go. The app enables you to upload, fill out, and sign documents from your smartphone or tablet, ensuring flexibility and convenience. This functionality is ideal for busy professionals who need access to their documents anytime, anywhere.

-

How does airSlate SignNow ensure the security of Form MI 988LT?

airSlate SignNow prioritizes the security of Form MI 988LT by employing advanced encryption and secure access measures. Users' documents are protected during transmission and storage to prevent unauthorized access. This commitment to security helps businesses feel confident when handling sensitive information.

Get more for Form MI 988LT

- Navajo nation tax commission form

- D r l 111 111 a 112 115 form 1 c s c p a 17251 petition nycourts

- Consent to disclosure of tax return information

- Fillable online the sly owens state line ranch house fax form

- Police property evidence room form

- Residential building application form

- Civil appeal bond form nueces county co nueces tx

- State of michigan mechanical permit us legal forms

Find out other Form MI 988LT

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast