YOU ARE NOTIFIED that Default Has Occurred in the Conditions of the Following Described Mortgage Form

What is the YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage

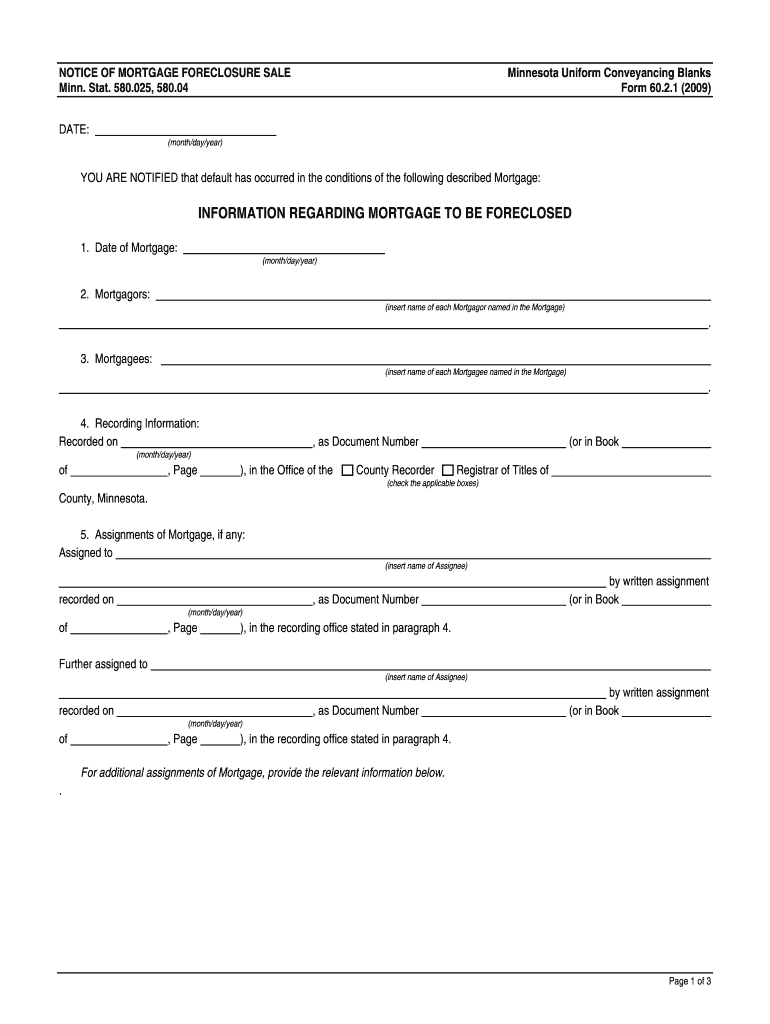

The form titled "YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage" serves as a formal notice to borrowers that they have defaulted on their mortgage obligations. This document outlines the specific conditions under which the default has occurred, providing clarity on the borrower's current standing regarding their mortgage. It is essential for both lenders and borrowers to understand the implications of this notice, as it can lead to significant consequences, including foreclosure proceedings if not addressed promptly.

How to use the YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage

Utilizing the "YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage" form involves several key steps. First, the lender must accurately fill out the form with details regarding the mortgage, including the borrower's name, property address, and the specific conditions of the default. Once completed, the form should be delivered to the borrower, ensuring that they receive it through a method that provides proof of delivery, such as certified mail or electronic delivery with a read receipt. This ensures the borrower is officially notified of the default status.

Steps to complete the YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage

Completing the "YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage" form requires careful attention to detail. The following steps outline the process:

- Gather all necessary information about the mortgage, including the loan number and property details.

- Clearly state the reasons for the default, referencing specific terms of the mortgage agreement.

- Include the date of the notice and any relevant deadlines for the borrower to respond or rectify the situation.

- Sign and date the document to validate its authenticity.

- Deliver the notice to the borrower using a reliable method that confirms receipt.

Legal use of the YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage

The legal use of the "YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage" form is crucial in the context of mortgage agreements. This notice serves as a legal document that formally informs the borrower of their default status, which is a prerequisite for any further legal action, such as foreclosure. It is essential for the lender to adhere to state-specific regulations regarding the delivery and content of this notice to ensure compliance with legal standards, thereby protecting their rights and interests in the mortgage agreement.

Key elements of the YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage

Several key elements must be included in the "YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage" form to ensure its effectiveness and legality. These elements include:

- The full name and address of the borrower.

- A detailed description of the mortgage, including the loan number and property address.

- A clear statement outlining the specific conditions that constitute the default.

- The date on which the notice is issued.

- Instructions for the borrower on how to address the default, including any deadlines for response.

State-specific rules for the YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage

State-specific rules play a vital role in the execution of the "YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage" form. Each state may have unique requirements regarding the content of the notice, the method of delivery, and the timeframes for notifying borrowers. It is important for lenders to familiarize themselves with these regulations to ensure compliance and avoid potential legal challenges. Consulting with a legal expert or reviewing state statutes can provide valuable guidance in this process.

Quick guide on how to complete you are notified that default has occurred in the conditions of the following described mortgage

Complete YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without interruptions. Manage YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage on any device using airSlate SignNow Android or iOS applications and streamline any document-based process today.

The easiest way to modify and eSign YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage effortlessly

- Obtain YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the exact same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean when you are notified that default has occurred in the conditions of the following described mortgage?

When you are notified that default has occurred in the conditions of the following described mortgage, it signifies that you have failed to meet the terms agreed upon in your mortgage contract. Such notifications can trigger potential foreclosure proceedings, making it critical to seek assistance immediately.

-

How can airSlate SignNow help with mortgage default notifications?

airSlate SignNow streamlines the process by allowing users to easily eSign and send necessary documents regarding your default notification. With our platform, you can quickly obtain agreements and responses, helping to address the situation more effectively.

-

What features does airSlate SignNow offer for managing mortgage-related documents?

airSlate SignNow offers features like document templates, in-app signing, and secure cloud storage, making it easier to handle your mortgage-related documents. This ensures that when you are notified that default has occurred in the conditions of the following described mortgage, you have the necessary tools at your disposal.

-

Is airSlate SignNow a cost-effective solution for handling mortgage defaults?

Yes, airSlate SignNow provides a cost-effective solution for managing documents related to mortgage defaults. Our pricing plans cater to businesses of all sizes, ensuring you can effectively respond to any notices of default without breaking the bank.

-

What are the benefits of using airSlate SignNow in financial transactions?

Using airSlate SignNow for financial transactions ensures speed, efficiency, and security. If you receive a notification indicating default on a mortgage, airSlate SignNow enables prompt action to mitigate risks, reinforcing the importance of stay on top of your obligations.

-

Can I integrate airSlate SignNow with other financial tools?

Yes, airSlate SignNow offers integrations with various financial tools and platforms. This enhances your capability to manage mortgage-related paperwork efficiently, particularly when you are notified that default has occurred in the conditions of the following described mortgage.

-

How can I ensure my documents are secure when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance protocols. This means that even when you need to respond swiftly to a notice indicating default in your mortgage, all your information remains protected.

Get more for YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage

- College scholarshipsknott scholarship funds form

- Background check texas form

- Presentation rubric form

- Time conflict permission form uwp

- Igetc requirements pierce college form

- Cedarcenter com premium domain names for sale namestore form

- Parent and sibling verification form of enrollment

- Edu jbkim uci edu fakhtar uci edu etr director r form

Find out other YOU ARE NOTIFIED That Default Has Occurred In The Conditions Of The Following Described Mortgage

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation