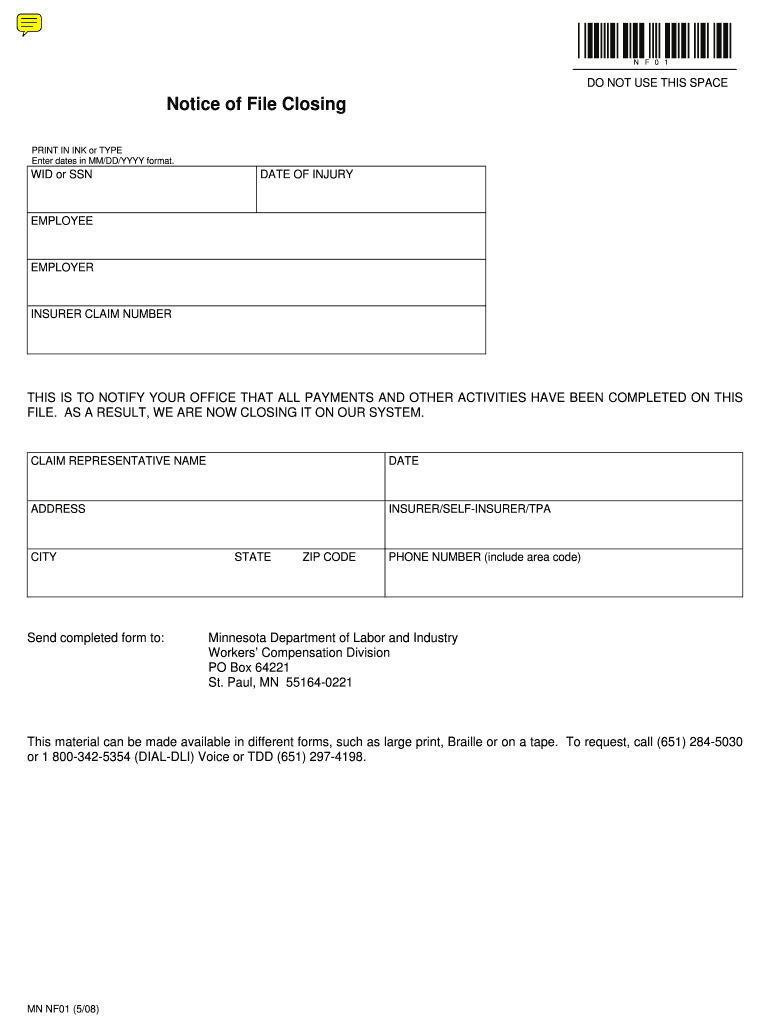

N F 0 1 Form

What is the N F 0 1

The N F 0 1 form is a specific document used primarily for tax purposes in the United States. It is essential for individuals and businesses to accurately report certain financial information to the Internal Revenue Service (IRS). This form serves as a declaration of income and other relevant financial details that may affect tax obligations. Understanding its purpose and requirements is crucial for compliance with federal tax laws.

How to use the N F 0 1

Using the N F 0 1 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, such as income statements and receipts. Next, complete the form by entering your personal information and financial details as prompted. It is important to double-check all entries for accuracy before submission. Finally, submit the form either electronically or via traditional mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the N F 0 1

Completing the N F 0 1 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, including W-2s, 1099s, and any other relevant financial records.

- Fill out your personal information, ensuring that your name and Social Security number are correct.

- Report your income accurately, including wages, dividends, and other earnings.

- Complete any additional sections related to deductions or credits that may apply to your situation.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the N F 0 1

The N F 0 1 form is legally binding when completed and submitted in accordance with IRS regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. The form must be signed and dated by the individual filing it, and electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the N F 0 1 form are critical to avoid penalties. Typically, individual taxpayers must submit their forms by April fifteenth of each year. However, specific deadlines may vary based on circumstances such as extensions or changes in tax law. It is advisable to stay informed about any updates from the IRS regarding filing dates to ensure compliance.

Who Issues the Form

The N F 0 1 form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. This form is part of the IRS's effort to streamline tax reporting and ensure that taxpayers provide accurate information regarding their financial activities. It is important to use the most current version of the form, as updates may occur annually.

Quick guide on how to complete n f 0 1

Effortlessly prepare N F 0 1 on any device

Digital document management has gained signNow traction among businesses and individuals. It offers a sustainable alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for creating, editing, and eSigning your documents swiftly without delays. Manage N F 0 1 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign N F 0 1 with ease

- Locate N F 0 1 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow provides for that specific purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign N F 0 1 and ensure excellent communication at every point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the N F 0 1 feature in airSlate SignNow?

The N F 0 1 feature in airSlate SignNow allows users to streamline their document signing process. It simplifies the way businesses can send and eSign documents, ensuring a quicker turnaround time and enhanced efficiency.

-

How does pricing work for the N F 0 1 solution?

airSlate SignNow offers flexible pricing plans for the N F 0 1 feature, catering to businesses of all sizes. You can choose from monthly or annual billing options, making it a cost-effective solution for your document signing needs.

-

What are the key benefits of using the N F 0 1 feature?

Using the N F 0 1 feature in airSlate SignNow provides numerous benefits, including increased productivity and enhanced security for your documents. It helps reduce paperwork and streamline workflows, allowing your team to focus on core tasks.

-

Can I integrate N F 0 1 with other software solutions?

Yes, airSlate SignNow's N F 0 1 feature integrates seamlessly with various software solutions such as CRM and document management systems. This integration enhances your existing workflows, making document signing easier and more efficient.

-

Is airSlate SignNow secure for eSigning documents with N F 0 1?

Absolutely! The N F 0 1 feature in airSlate SignNow ensures that all eSigned documents are encrypted and comply with industry standards. Your data safety and privacy are prioritized, making it a reliable choice for secure document signing.

-

What types of documents can I eSign using N F 0 1?

With the N F 0 1 feature in airSlate SignNow, you can eSign a wide variety of documents including contracts, agreements, and forms. This flexibility allows businesses to digitize their signing processes across various document types efficiently.

-

Is there a free trial available for N F 0 1 feature?

Yes, airSlate SignNow offers a free trial for the N F 0 1 feature, allowing you to explore its capabilities before committing to a subscription. This trial helps you understand how the solution can enhance your document signing processes.

Get more for N F 0 1

Find out other N F 0 1

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document