Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property Form

What is the Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property

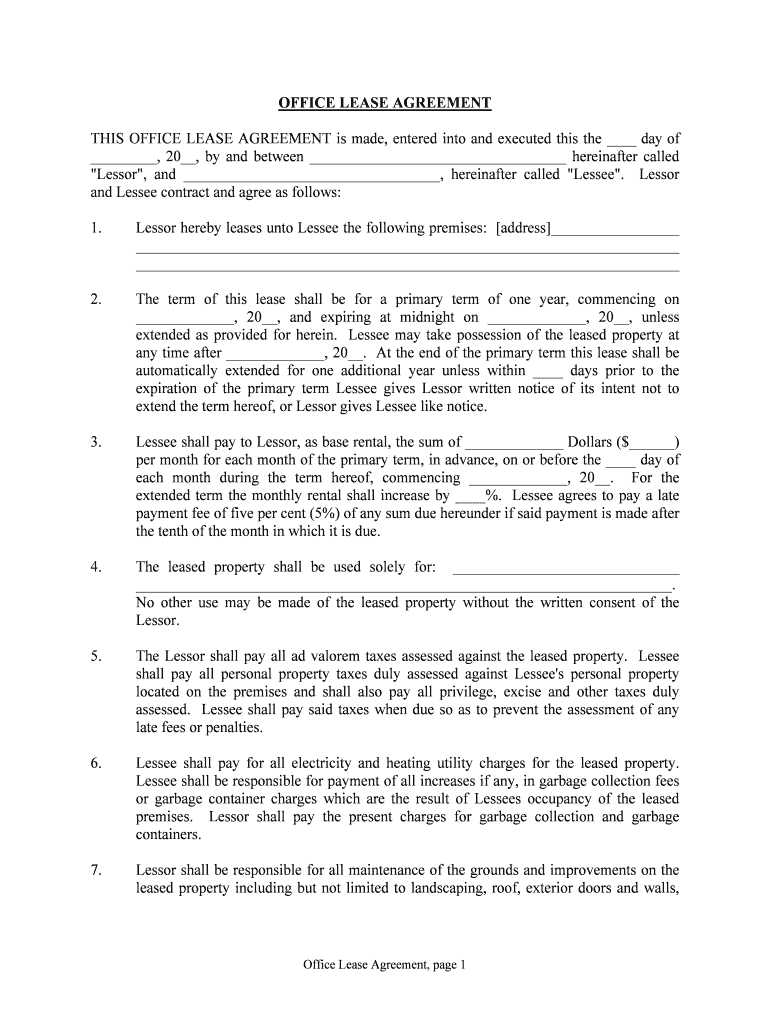

The form titled "Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property" is a legal document that outlines the obligations of a lessee regarding personal property taxes. This form specifies that the lessee is responsible for paying all taxes assessed against their personal property during the lease period. By signing this document, the lessee acknowledges their duty to fulfill these tax obligations, which may vary based on local laws and regulations.

How to use the Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property

Using the "Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property" form involves several steps. First, the lessee should carefully read the document to understand their responsibilities. Next, the lessee must fill out the required information accurately, ensuring that all details align with the lease agreement. Once completed, the lessee should sign the form electronically using a secure platform like signNow, which provides a legally binding eSignature. This process ensures that both parties are aware of the tax obligations and helps maintain compliance with local tax laws.

Key elements of the Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property

Several key elements are essential in the "Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property" form. These include:

- Identification of the parties: The form should clearly state the names and addresses of both the lessor and the lessee.

- Description of the property: A detailed description of the personal property subject to taxation must be included.

- Tax obligations: The specific responsibilities of the lessee regarding tax payments must be outlined, including any relevant deadlines.

- Signatures: Both parties must sign the document to validate the agreement.

Steps to complete the Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property

Completing the "Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property" form involves the following steps:

- Review the lease agreement to understand the tax obligations.

- Obtain the form from a reliable source or create it using a digital document platform.

- Fill in the required details, including names, addresses, and property descriptions.

- Review the completed form for accuracy.

- Sign the form electronically using a secure eSignature solution.

- Distribute copies to all relevant parties for their records.

Legal use of the Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property

The legal use of the "Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property" form is crucial for ensuring compliance with tax laws. This document serves as a binding agreement between the lessor and lessee, outlining the lessee's responsibility for tax payments. The form must be completed accurately and signed to be enforceable in a court of law. Utilizing a trusted eSignature platform like signNow can enhance the legal validity of the document, ensuring it meets all necessary electronic signature regulations.

Penalties for Non-Compliance

Failure to comply with the obligations outlined in the "Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property" form can result in significant penalties. These may include:

- Fines imposed by local tax authorities for late payments.

- Legal action taken by the lessor to recover unpaid taxes.

- Potential damage to the lessee's credit rating due to unresolved tax issues.

It is essential for lessees to understand these consequences and fulfill their tax obligations promptly to avoid complications.

Quick guide on how to complete shall pay all personal property taxes duly assessed against lessees personal property

Easily Prepare Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property on Any Device

Digital document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and efficiently. Manage Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The Simplest Way to Edit and Electronically Sign Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property

- Find Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow designed specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, and errors that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property' mean for my business?

This term indicates that as a lessee, you are responsible for paying any personal property taxes that have been legally assessed against your leased personal property. Understanding this obligation helps ensure compliance with local tax laws and avoids potential penalties. Using airSlate SignNow can streamline the document processes involved in fulfilling such financial responsibilities.

-

How does airSlate SignNow assist in managing personal property tax obligations?

airSlate SignNow simplifies the management of documents related to personal property taxes by providing a platform for easy eSigning and document management. This ensures that you can quickly sign and send necessary documents, maintaining compliance with the requirement to pay all assessed personal property taxes. Automating this process can save time and reduce the likelihood of missing important deadlines.

-

Is there a cost associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers various pricing plans designed to fit the needs of different businesses. The cost-effectiveness of the platform allows you to manage essential documents, including those related to personal property taxes, at a competitive price. By ensuring your team can efficiently handle these documents, you minimize costs associated with delays or errors.

-

What features does airSlate SignNow offer to streamline my tax document processes?

Key features include electronic signatures, customizable templates, and secure cloud storage. These features enable businesses to quickly manage and send documents related to 'Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property' and other financial obligations. With airSlate SignNow, you gain efficiency and better control over your document workflows.

-

Can airSlate SignNow integrate with other financial software for better tax management?

Absolutely! airSlate SignNow supports integrations with various financial and accounting software solutions. This capability allows you to seamlessly incorporate your document management processes with your existing workflows, enhancing your ability to comply with requirements to pay personal property taxes efficiently.

-

How secure is the information shared through airSlate SignNow when handling tax-related documents?

Security is a top priority for airSlate SignNow. All documents and sensitive information, such as those concerning 'Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property,' are encrypted and stored securely. This robust security helps protect your data from unauthorized access and ensures compliance with industry standards.

-

What industries can benefit from using airSlate SignNow for handling personal property taxes?

A wide range of industries can benefit from airSlate SignNow, including real estate, manufacturing, and retail, all of which may deal with personal property taxes. The platform's versatility makes it an ideal choice for any business needing to manage documents related to personal property tax assessments effectively. By streamlining this process, businesses can focus more on their core functions.

Get more for Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property

- Appeal form 1

- Privacy act of 1974 as amended public law 93 579 as form

- To be filled out by bir dan form

- Vehicle titles and registration division form

- Default divorce forms set c harris county law library

- Years 7 10 declaration of original work to b form

- Request for waiver executive order 12k procure ohio form

- Medication history form uw medicine

Find out other Shall Pay All Personal Property Taxes Duly Assessed Against Lessee's Personal Property

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple