Trust and the Other Documents and Instruments Evidencing or Securing the Loan Being Hereinafter Collectively Form

Understanding the Trust and Related Documents

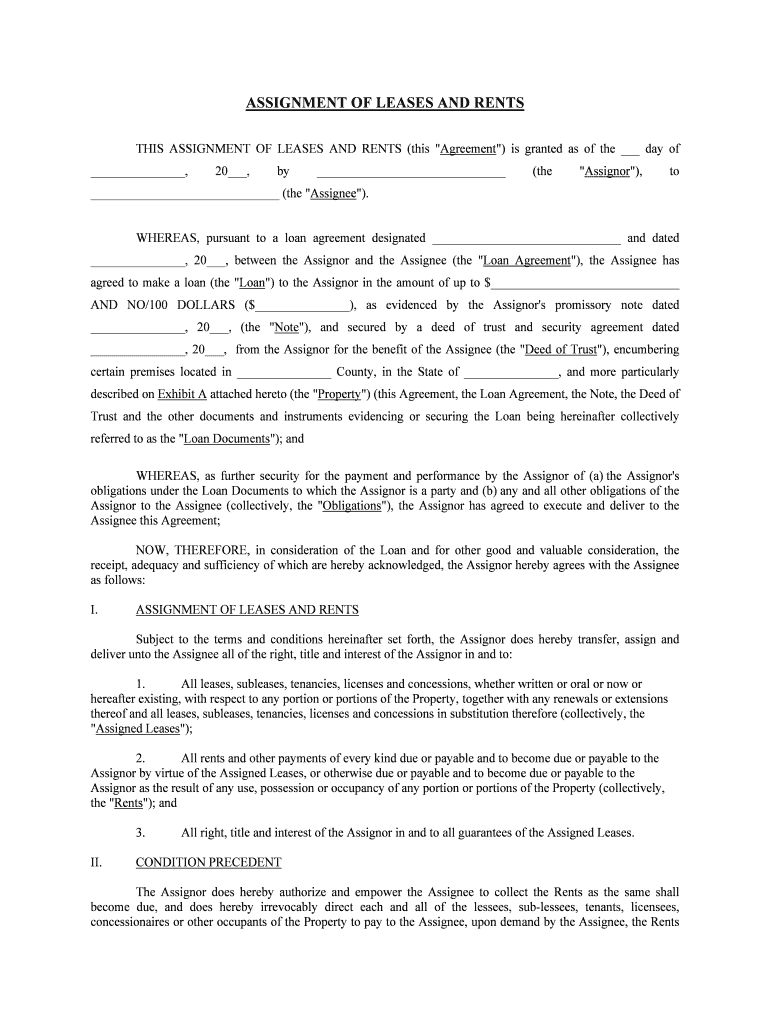

The Trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively referred to serve as crucial components in financial transactions. These documents establish the legal framework for the loan agreement and outline the rights and responsibilities of all parties involved. They typically include the trust agreement, promissory notes, security agreements, and any other relevant instruments that provide evidence of the loan's terms and conditions.

Steps to Complete the Trust and Related Documents

Completing the Trust and the other documents and instruments evidencing or securing the loan requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, including borrower and lender details, loan amount, and repayment terms.

- Review the trust agreement to ensure compliance with state laws and regulations.

- Fill out the promissory note, clearly stating the terms of the loan.

- Include any security agreements that specify collateral for the loan.

- Ensure all parties sign the documents, using a secure eSignature service to maintain legal validity.

Legal Use of the Trust and Related Documents

The legal use of the Trust and the other documents and instruments evidencing or securing the loan is governed by various laws and regulations. These documents must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) to be considered legally binding. Proper execution and adherence to these legal frameworks are essential for protecting the interests of all parties involved in the loan agreement.

Key Elements of the Trust and Related Documents

Several key elements must be included in the Trust and the other documents and instruments evidencing or securing the loan to ensure their effectiveness:

- Identification of Parties: Clearly identify the borrower, lender, and any other relevant parties.

- Loan Amount: Specify the total amount being borrowed.

- Interest Rate: Outline the interest rate applicable to the loan.

- Repayment Terms: Detail the schedule for repayments, including due dates and payment methods.

- Default Provisions: Include terms that outline what constitutes a default and the remedies available to the lender.

Obtaining the Trust and Related Documents

To obtain the Trust and the other documents and instruments evidencing or securing the loan, individuals can typically follow these steps:

- Consult with a legal professional to ensure compliance with state-specific regulations.

- Access templates or forms through trusted legal resources or financial institutions.

- Customize the documents to reflect the specific terms of the loan agreement.

- Utilize eSignature solutions to facilitate the signing process, ensuring all parties can sign securely and efficiently.

Examples of Using the Trust and Related Documents

Examples of situations where the Trust and the other documents and instruments evidencing or securing the loan are utilized include:

- Real estate transactions, where a trust may hold property as collateral for a mortgage loan.

- Business loans, where a trust secures financing for operational needs or expansion.

- Personal loans, where individuals may use a trust to manage assets and secure funds for personal projects.

Quick guide on how to complete trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively

Complete Trust And The Other Documents And Instruments Evidencing Or Securing The Loan Being Hereinafter Collectively effortlessly on any device

Digital document management has become more prevalent among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Trust And The Other Documents And Instruments Evidencing Or Securing The Loan Being Hereinafter Collectively on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Trust And The Other Documents And Instruments Evidencing Or Securing The Loan Being Hereinafter Collectively with ease

- Obtain Trust And The Other Documents And Instruments Evidencing Or Securing The Loan Being Hereinafter Collectively and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Trust And The Other Documents And Instruments Evidencing Or Securing The Loan Being Hereinafter Collectively and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of the Trust and the other documents and instruments evidencing or securing the loan?

The Trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively serve as essential legal frameworks that outline the terms of the loan agreement. They provide clarity on the responsibilities of both the borrower and the lender, ensuring that all parties understand their obligations. This documentation is key to protecting the interests of both sides involved in the transaction.

-

How does airSlate SignNow facilitate the signing of Trust and the other loan documents?

airSlate SignNow simplifies the eSigning process for Trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively by providing a user-friendly interface. Users can upload, edit, and send documents for electronic signatures with just a few clicks. This streamlining reduces the time spent on paperwork and enhances efficiency in the loan process.

-

What features does airSlate SignNow offer for managing loan documents?

airSlate SignNow includes a variety of features tailored for managing Trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively. Notable functionalities include document templates, customizable workflows, and real-time tracking of document status. These features improve organization and facilitate better communication between all parties involved in the loan.

-

Is airSlate SignNow cost-effective for small businesses dealing with loan documents?

Yes, airSlate SignNow provides a cost-effective solution for small businesses requiring the management of Trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively. The pricing plans are designed to fit varying budgets while offering robust features that can streamline document signing processes. This enables small businesses to manage their loan paperwork efficiently without incurring signNow costs.

-

What integrations does airSlate SignNow offer for loan document management?

airSlate SignNow seamlessly integrates with various platforms to enhance the management of Trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively. Popular integrations include Google Drive, Dropbox, and CRM systems. These integrations allow users to easily access and manage their documents from multiple platforms, making the process more efficient.

-

How does airSlate SignNow ensure the security of loan documents?

Security is a top priority for airSlate SignNow when handling Trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively. The platform employs advanced encryption protocols, ensuring that all eSigned documents remain confidential and secure. Regular security audits and compliance with industry standards further protect sensitive information.

-

Can airSlate SignNow help with compliance related to loan documents?

Absolutely, airSlate SignNow assists in ensuring compliance for Trust and the other documents and instruments evidencing or securing the loan being hereinafter collectively. The platform includes features that help users adhere to various legal and regulatory requirements. This capability is essential for organizations looking to maintain compliance throughout the loan process.

Get more for Trust And The Other Documents And Instruments Evidencing Or Securing The Loan Being Hereinafter Collectively

- Nyc gun permit application form fill online printable

- Est ado libra avocado de puerto ricotribunal gene form

- Declaracion del reclamante form

- Circuit court forms

- Special power of attorney us citizen doc special power form

- Jv 290 carefiver information form

- Any correction or alteration will void this form

- Pld 050 general denial form

Find out other Trust And The Other Documents And Instruments Evidencing Or Securing The Loan Being Hereinafter Collectively

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now