Uline Tax Exempt Form

What is the Uline Tax Exempt

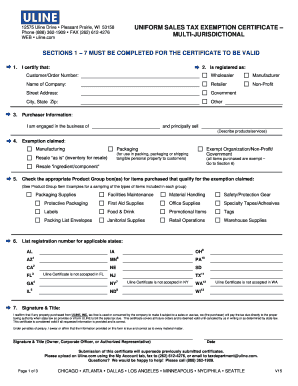

The Uline tax exempt form is a document that allows eligible businesses and organizations to purchase goods without paying sales tax. This exemption is typically granted to entities such as non-profits, government agencies, and certain educational institutions. By submitting the Uline tax exempt form, these organizations can save on costs associated with sales tax, which can be significant over time. Understanding the criteria and process for obtaining this exemption is crucial for eligible entities to take full advantage of the benefits.

How to Obtain the Uline Tax Exempt

To obtain the Uline tax exempt status, an organization must first determine its eligibility based on state-specific regulations. The process generally involves filling out the Uline tax exempt form, which may require information such as the organization's name, address, and tax identification number. Additionally, organizations may need to provide proof of their tax-exempt status, such as a letter from the IRS or state tax authority. Once the form is completed, it can be submitted to Uline for processing.

Steps to Complete the Uline Tax Exempt

Completing the Uline tax exempt form involves several key steps:

- Gather necessary documentation, including proof of tax-exempt status.

- Fill out the Uline tax exempt form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions to avoid delays in processing.

- Submit the completed form to Uline, either online or via mail, depending on the preferred submission method.

Following these steps carefully can help ensure that the application is processed smoothly and efficiently.

Legal Use of the Uline Tax Exempt

The legal use of the Uline tax exempt form is governed by both federal and state laws. Organizations must ensure they meet the eligibility criteria outlined by their respective state tax authorities. Misuse of the tax exempt status, such as using it for personal purchases or for items not intended for the organization's use, can lead to penalties and loss of tax-exempt status. It is essential for organizations to maintain accurate records and documentation to support their tax-exempt purchases.

Key Elements of the Uline Tax Exempt

Several key elements define the Uline tax exempt form:

- Eligibility Criteria: Organizations must qualify as tax-exempt under state laws.

- Required Information: The form requires detailed information about the organization and its tax status.

- Signature: An authorized representative must sign the form to validate the exemption.

- Submission Process: The form must be submitted to Uline for approval before tax-exempt purchases can be made.

Understanding these elements is crucial for organizations seeking to utilize their tax-exempt status effectively.

Quick guide on how to complete uline tax exempt

Complete Uline Tax Exempt effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Uline Tax Exempt on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Uline Tax Exempt with ease

- Find Uline Tax Exempt and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize pertinent paragraphs of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invite link, or download it onto your PC.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Uline Tax Exempt and ensure seamless communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uline tax exempt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the uline tax exempt process in airSlate SignNow?

The uline tax exempt process in airSlate SignNow allows businesses to streamline their tax exemption documentation through a digital platform. Users can easily upload and send their tax-exempt forms, ensuring compliance and reducing paperwork delays. This feature simplifies the signing process and enhances efficiency in managing tax-related documents.

-

How can airSlate SignNow help with uline tax exempt paperwork?

airSlate SignNow provides a user-friendly interface for handling uline tax exempt paperwork. It allows businesses to electronically sign and send documents, reducing the time taken to complete transactions. By eliminating the need for printing and scanning, it makes managing tax exempt forms both faster and easier.

-

Is there a cost associated with using airSlate SignNow for uline tax exempt transactions?

Using airSlate SignNow for uline tax exempt transactions is part of the overall pricing plans, which are designed to be cost-effective. The pricing is competitive and provides various features tailored to meet business needs. You can evaluate the plans and choose one that best fits your organization's requirements.

-

Can I integrate airSlate SignNow with other software for managing uline tax exempt documents?

Yes, airSlate SignNow offers integrations with several popular software applications, which can help manage uline tax exempt documents efficiently. These integrations allow for seamless data transfer and enhanced productivity. By connecting your current systems with airSlate SignNow, you can streamline your document management processes.

-

What security features does airSlate SignNow offer for uline tax exempt documents?

airSlate SignNow prioritizes the security of your uline tax exempt documents through advanced encryption measures and secure access controls. The platform is compliant with major industry standards, ensuring that sensitive data remains protected. You can trust airSlate SignNow to keep your tax exempt information secure.

-

How can I track the status of my uline tax exempt documents in airSlate SignNow?

With airSlate SignNow, tracking the status of your uline tax exempt documents is straightforward. The platform provides real-time updates on document statuses, allowing you to see when a document is sent, viewed, and signed. This feature enhances visibility and helps manage follow-ups effectively.

-

What are the benefits of using airSlate SignNow for uline tax exempt digital signatures?

Using airSlate SignNow for uline tax exempt digital signatures offers numerous benefits, including faster processing times and improved accuracy in document handling. Additionally, it reduces the risk of errors associated with manual processes. Businesses can enjoy a more efficient workflow while ensuring compliance with tax exemption regulations.

Get more for Uline Tax Exempt

- B r eckels bol 83728149 form

- 1 2b energy changes in materials worksheet form

- Homestead or property tax refund for homeowners forms and

- Profile form army

- Total real estate solutions form

- Cut out the parts of the skeleton form

- Non disclosure and non compete agreement template form

- Non disclosure for app development agreement template form

Find out other Uline Tax Exempt

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself