Certify and Understand that One of the Conditions of Our Loan, If Form

What is the Certify and Understand That One Of The Conditions Of Our Loan, If

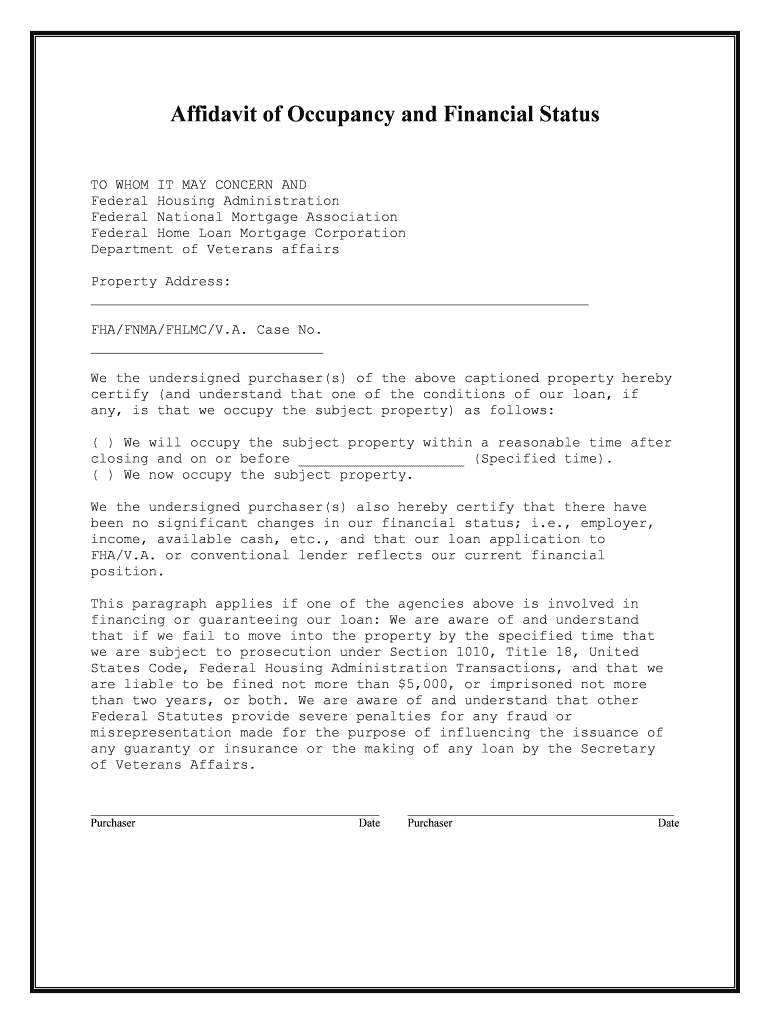

The Certify and Understand That One Of The Conditions Of Our Loan, If form is a crucial document used in the loan application process. It serves to confirm that the borrower acknowledges and agrees to specific conditions set forth by the lending institution. This form is designed to ensure that all parties are clear on the terms of the loan, which may include interest rates, repayment schedules, and any applicable fees. By signing this document, the borrower demonstrates their understanding of the obligations they are undertaking.

How to use the Certify and Understand That One Of The Conditions Of Our Loan, If

Using the Certify and Understand That One Of The Conditions Of Our Loan, If form involves a straightforward process. First, the borrower must carefully read the document to comprehend all conditions outlined. Next, they should fill in any required personal information, such as their name, address, and loan details. After completing the form, the borrower must sign it, either digitally or in print, to validate their acknowledgment of the loan conditions. Utilizing a reliable eSignature platform ensures that the form is securely signed and stored.

Steps to complete the Certify and Understand That One Of The Conditions Of Our Loan, If

Completing the Certify and Understand That One Of The Conditions Of Our Loan, If form involves several key steps:

- Read the document thoroughly to understand all terms.

- Fill in your personal details accurately.

- Review the conditions carefully to ensure clarity.

- Sign the document using a secure eSignature tool.

- Submit the completed form to the lending institution as instructed.

Key elements of the Certify and Understand That One Of The Conditions Of Our Loan, If

Several key elements are essential in the Certify and Understand That One Of The Conditions Of Our Loan, If form. These include:

- Borrower Information: Name, address, and contact details of the borrower.

- Loan Details: Amount, interest rate, and repayment terms.

- Conditions: Specific requirements that the borrower must adhere to.

- Signature: Acknowledgment of understanding and acceptance of the terms.

Legal use of the Certify and Understand That One Of The Conditions Of Our Loan, If

The legal use of the Certify and Understand That One Of The Conditions Of Our Loan, If form hinges on its compliance with federal and state regulations regarding loan agreements. This form must be executed in accordance with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic signatures are legally binding. Additionally, it should adhere to the Uniform Electronic Transactions Act (UETA) to guarantee its validity across different jurisdictions. Proper execution protects both the lender and borrower in case of disputes.

Examples of using the Certify and Understand That One Of The Conditions Of Our Loan, If

Examples of using the Certify and Understand That One Of The Conditions Of Our Loan, If form can be found in various loan scenarios:

- A first-time homebuyer signing a mortgage agreement.

- A small business owner applying for a commercial loan.

- A student securing a loan for educational expenses.

In each case, the form ensures that the borrower is aware of their responsibilities and the terms of the loan they are entering into.

Quick guide on how to complete certify and understand that one of the conditions of our loan if

Effortlessly Prepare Certify and Understand That One Of The Conditions Of Our Loan, If on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Certify and Understand That One Of The Conditions Of Our Loan, If on any device with the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to Edit and Electronically Sign Certify and Understand That One Of The Conditions Of Our Loan, If with Ease

- Find Certify and Understand That One Of The Conditions Of Our Loan, If and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your delivery method for the form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any chosen device. Edit and electronically sign Certify and Understand That One Of The Conditions Of Our Loan, If and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to signNow and Understand That One Of The Conditions Of Our Loan, If?

signNowing and understanding the conditions of your loan is crucial for compliance and ensuring that you fulfill all obligations. It involves acknowledging the terms set by the lender and ensuring you meet those criteria throughout the loan period.

-

How does airSlate SignNow help in the loan process?

airSlate SignNow simplifies the loan process by allowing users to seamlessly send, sign, and manage documents electronically. By using this platform, you can signNow and Understand That One Of The Conditions Of Our Loan, If, ensuring swift approval and secure documentation.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan is designed to provide the tools necessary to signNow and Understand That One Of The Conditions Of Our Loan, If, making it accessible for both small businesses and large enterprises.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include electronic signatures, document templates, and real-time collaboration tools. These features are essential for those who need to signNow and Understand That One Of The Conditions Of Our Loan, If, making the document process smooth and efficient.

-

Can airSlate SignNow be integrated with other applications?

Yes, airSlate SignNow offers numerous integrations with popular applications like Google Drive, Salesforce, and more. This flexibility allows you to easily signNow and Understand That One Of The Conditions Of Our Loan, If, by syncing your documents across platforms, improving workflow and accuracy.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security with industry-standard encryption and compliance to ensure your documents remain confidential. This is particularly important when you need to signNow and Understand That One Of The Conditions Of Our Loan, If, protecting your personal and financial information.

-

What benefits can I expect from using airSlate SignNow?

Using airSlate SignNow streamlines your document management process, saves time, and reduces costs associated with paper and printing. Moreover, you'll be better equipped to signNow and Understand That One Of The Conditions Of Our Loan, If, making your business processes more efficient and compliant.

Get more for Certify and Understand That One Of The Conditions Of Our Loan, If

- Donation request indiana form

- Kansas physical therapy jurisprudence exam answers form

- Weaver card apply online form

- Fillable online images for what is tireo initial and form

- North carolina state government social services form

- Gua de adopcin del estado de nueva york para padres de form

- Buy home contract template form

- Dss 5013 north carolina adoption assistance agreement form

Find out other Certify and Understand That One Of The Conditions Of Our Loan, If

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors