Missouri Fixed Rate Note, Installment Payments Secured Commercial Property Form

What is the Missouri Fixed Rate Note, Installment Payments Secured Commercial Property

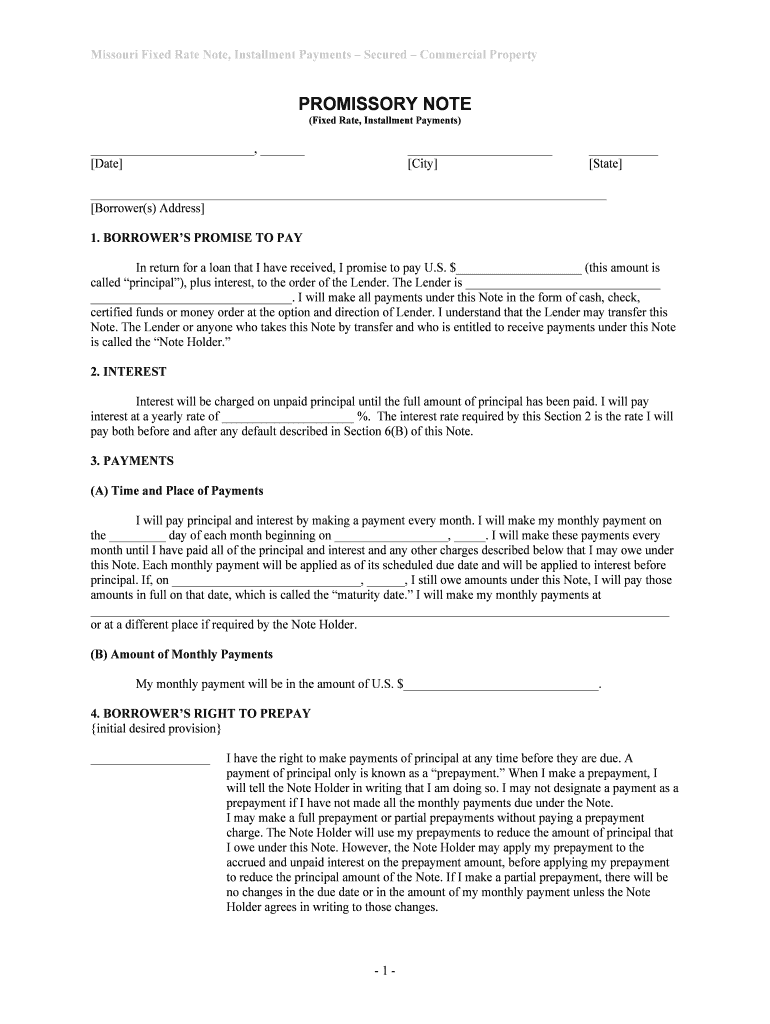

The Missouri Fixed Rate Note, Installment Payments Secured Commercial Property is a legal document that outlines the terms of a loan secured by commercial property. This note specifies the fixed interest rate, the payment schedule, and the responsibilities of both the borrower and lender. It serves as a binding agreement that ensures the lender can recover the loan amount through the property in case of default. Understanding this document is crucial for both parties involved in commercial real estate transactions.

Key elements of the Missouri Fixed Rate Note, Installment Payments Secured Commercial Property

Several key elements make up the Missouri Fixed Rate Note. These include:

- Principal Amount: The total amount borrowed by the borrower.

- Interest Rate: The fixed rate at which interest will accrue on the principal.

- Payment Schedule: The timeline for installment payments, including due dates.

- Collateral: The commercial property that secures the loan.

- Default Terms: Conditions under which the lender can take possession of the property if payments are not made.

Steps to complete the Missouri Fixed Rate Note, Installment Payments Secured Commercial Property

Completing the Missouri Fixed Rate Note involves several steps to ensure accuracy and legality:

- Gather necessary information, including details about the borrower, lender, and property.

- Clearly outline the loan terms, including the principal, interest rate, and payment schedule.

- Include any additional clauses that may be relevant, such as prepayment terms or penalties for late payments.

- Review the document for completeness and accuracy.

- Both parties should sign the document, ensuring that all signatures are witnessed or notarized if required.

Legal use of the Missouri Fixed Rate Note, Installment Payments Secured Commercial Property

This document is legally binding when executed according to Missouri law. It must meet specific requirements to be enforceable, such as having clear terms and signatures from both parties. Compliance with state and federal regulations regarding secured loans is essential. The use of digital signatures through platforms like signNow enhances the legal standing of the document, provided it adheres to the ESIGN and UETA laws.

How to use the Missouri Fixed Rate Note, Installment Payments Secured Commercial Property

Using the Missouri Fixed Rate Note involves understanding its purpose and application. Once the document is completed and signed, it serves as proof of the loan agreement. The borrower must adhere to the payment schedule outlined in the note. In case of default, the lender has the right to initiate foreclosure proceedings on the secured commercial property. It is advisable to keep a copy of the signed note for record-keeping and future reference.

State-specific rules for the Missouri Fixed Rate Note, Installment Payments Secured Commercial Property

Missouri has specific rules governing the execution and enforcement of fixed rate notes. These include requirements for notarization, the necessity of clear identification of parties, and adherence to state laws regarding secured transactions. Understanding these regulations is vital for ensuring the document's enforceability and protecting the interests of both the borrower and lender.

Quick guide on how to complete missouri fixed rate note installment payments secured commercial property

Complete Missouri Fixed Rate Note, Installment Payments Secured Commercial Property effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without complications. Manage Missouri Fixed Rate Note, Installment Payments Secured Commercial Property on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Missouri Fixed Rate Note, Installment Payments Secured Commercial Property without stress

- Locate Missouri Fixed Rate Note, Installment Payments Secured Commercial Property and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and then hit the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Missouri Fixed Rate Note, Installment Payments Secured Commercial Property and guarantee excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Missouri Fixed Rate Note?

A Missouri Fixed Rate Note is a financial instrument used in real estate transactions, providing a consistent payment schedule over time. It is designed for buyers or borrowers who want predictable payments, making it ideal for financing an Installment Payments Secured Commercial Property.

-

How do installment payments work for Missouri Fixed Rate Notes?

Installment payments for a Missouri Fixed Rate Note involve making regular payments over a specified period until the total borrowing amount is repaid. This structured approach allows borrowers to budget effectively while securing their commercial property.

-

What are the benefits of using a Missouri Fixed Rate Note for commercial properties?

Using a Missouri Fixed Rate Note for installment payments on secured commercial property offers benefits such as predictable monthly payments, stable interest rates, and improved cash flow management. This makes it easier to plan and manage finances over the long term.

-

Are there any fees associated with Missouri Fixed Rate Notes?

While the Missouri Fixed Rate Note may not have many hidden fees, it is essential to review the specific terms as some lenders may charge origination or service fees. It's advisable to consult with your financial advisor to understand all costs involved when securing an Installment Payments Secured Commercial Property.

-

Can I refinance my Missouri Fixed Rate Note?

Yes, you can refinance your Missouri Fixed Rate Note if you wish to adjust your payment terms, interest rate, or consolidate debt. This can be a strategic move for managing your finances associated with Installment Payments Secured Commercial Property.

-

What features should I look for in a Missouri Fixed Rate Note agreement?

Key features to look for in a Missouri Fixed Rate Note agreement include clarity on payment schedules, interest rates, prepayment penalties, and any clauses regarding defaults. Make sure the terms align with your financial goals for your Installment Payments Secured Commercial Property.

-

How can I integrate technology into managing my Missouri Fixed Rate Note?

Technology can streamline the management of your Missouri Fixed Rate Note through digital document signing and automated payment reminders. Utilizing platforms like airSlate SignNow can enhance efficiency for those dealing with Installment Payments Secured Commercial Property.

Get more for Missouri Fixed Rate Note, Installment Payments Secured Commercial Property

- Stan mucinic form

- Dual diagnosis workbook pdf form

- Cobra request for service form

- Aetna life insurance company designation of benefi form

- Tot reporting form sdttc comtot reporting form sdttc comtransient occupancy tax treasurer tax collectorsan diego county

- Letter to patient with positive screening result form

- Good neighbor u s department of housing omb approval no form

- Form 538 s claim for credit refund of sales tax 794951806

Find out other Missouri Fixed Rate Note, Installment Payments Secured Commercial Property

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement