Mississippi Notice of Intent to Increase Ad Valorem Tax Form

What is the Mississippi Notice Of Intent To Increase Ad Valorem Tax

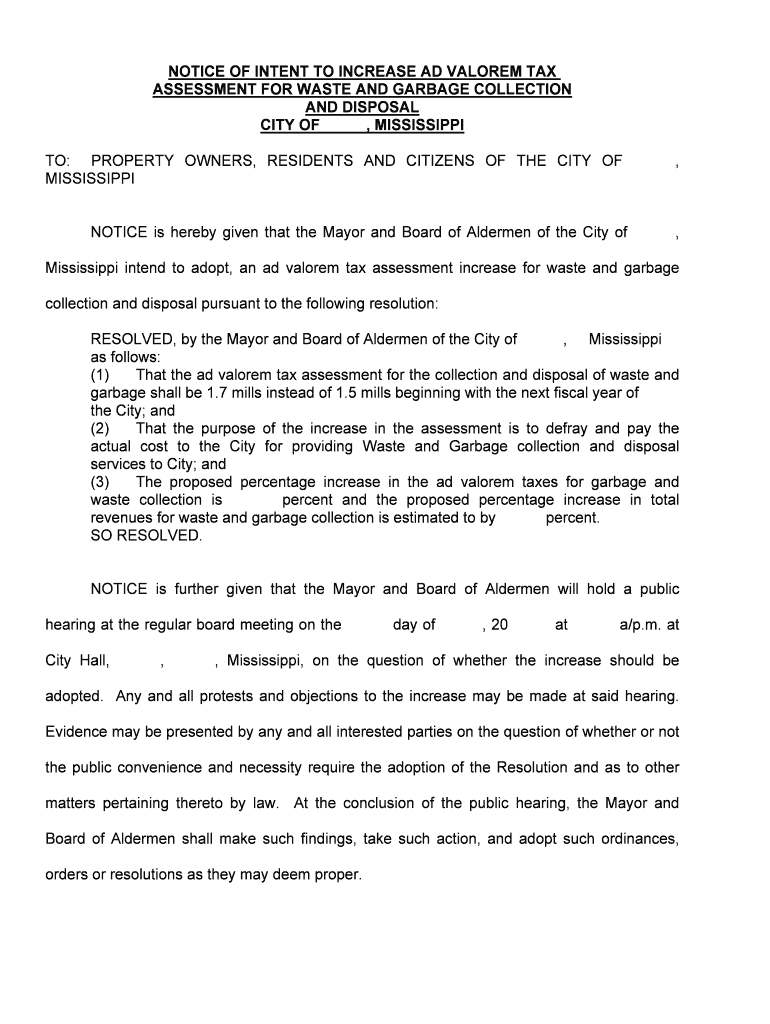

The Mississippi Notice Of Intent To Increase Ad Valorem Tax is a formal document that local governments use to notify property owners of a proposed increase in property taxes. This notice is essential for transparency and allows taxpayers to understand how changes in tax rates may affect their financial obligations. It typically includes details about the current tax rate, the proposed increase, and the rationale behind the adjustment. Understanding this notice is crucial for property owners who wish to stay informed about their tax responsibilities.

Steps to complete the Mississippi Notice Of Intent To Increase Ad Valorem Tax

Completing the Mississippi Notice Of Intent To Increase Ad Valorem Tax involves several key steps. First, local authorities must determine the need for a tax increase based on budgetary requirements. Next, they must accurately fill out the notice form, ensuring all relevant details are included, such as the current and proposed tax rates. After preparing the document, it should be reviewed for accuracy and compliance with state regulations. Finally, the notice must be distributed to all affected property owners, typically via mail or public posting, to ensure that the community is informed.

Legal use of the Mississippi Notice Of Intent To Increase Ad Valorem Tax

The legal use of the Mississippi Notice Of Intent To Increase Ad Valorem Tax is governed by state laws that mandate how and when such notices should be issued. Compliance with these regulations is essential to ensure that the notice is valid and enforceable. Failure to adhere to legal requirements can result in challenges from property owners and potential delays in tax collection. Local governments must ensure that they follow the prescribed procedures, including proper notification timelines and methods, to maintain the integrity of the tax increase process.

Key elements of the Mississippi Notice Of Intent To Increase Ad Valorem Tax

Several key elements must be included in the Mississippi Notice Of Intent To Increase Ad Valorem Tax to ensure its effectiveness and legality. These elements typically include:

- The current ad valorem tax rate.

- The proposed new tax rate.

- A detailed explanation of the reasons for the increase.

- Information on public hearings or meetings where property owners can voice their opinions.

- Contact information for local officials who can answer questions.

Inclusion of these elements helps ensure that property owners are fully informed and can engage in the public discourse surrounding tax increases.

Who Issues the Form

The Mississippi Notice Of Intent To Increase Ad Valorem Tax is typically issued by local government authorities, such as county or city tax assessors. These officials are responsible for determining property values and assessing tax rates based on local budgetary needs. It is important for property owners to know who is issuing the notice, as this can affect the legitimacy and authority of the information provided. Local governments are required to follow specific guidelines when issuing this notice to ensure compliance with state laws.

Filing Deadlines / Important Dates

Filing deadlines for the Mississippi Notice Of Intent To Increase Ad Valorem Tax are critical for ensuring that the notice is issued in a timely manner. Local governments must adhere to state-mandated timelines for notifying property owners, typically set before the beginning of the tax year. Important dates may include:

- The date by which the notice must be mailed to property owners.

- Any public hearing dates where property owners can discuss the proposed increase.

- The final date for the local government to finalize the new tax rate.

Staying aware of these deadlines helps local authorities manage the tax increase process effectively and ensures that property owners are informed in a timely manner.

Quick guide on how to complete mississippi notice of intent to increase ad valorem tax

Effortlessly Complete Mississippi Notice Of Intent To Increase Ad Valorem Tax on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitution for traditional printed and signed paperwork, allowing you to locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Mississippi Notice Of Intent To Increase Ad Valorem Tax on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

Effortlessly Modify and Electronically Sign Mississippi Notice Of Intent To Increase Ad Valorem Tax

- Obtain Mississippi Notice Of Intent To Increase Ad Valorem Tax and click on Get Form to initiate.

- Make use of our provided tools to complete your form.

- Mark essential parts of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to finalize your adjustments.

- Select your preferred method of delivering your form, whether via email, SMS, invitation link, or download it directly to your computer.

Leave behind the hassle of lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Mississippi Notice Of Intent To Increase Ad Valorem Tax to ensure excellent communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Mississippi Notice Of Intent To Increase Ad Valorem Tax?

The Mississippi Notice Of Intent To Increase Ad Valorem Tax is a formal document that notifies property owners of an impending increase in their property taxes. This notice must be prepared and filed before any tax increase can be enacted, ensuring transparency between the taxing authority and property owners.

-

How can airSlate SignNow assist in preparing the Mississippi Notice Of Intent To Increase Ad Valorem Tax?

AirSlate SignNow provides an intuitive platform for drafting and eSigning essential documents like the Mississippi Notice Of Intent To Increase Ad Valorem Tax. Our easy-to-use templates save time and ensure that all required information is included for compliance with local tax laws.

-

What are the benefits of using airSlate SignNow for the Mississippi Notice Of Intent To Increase Ad Valorem Tax?

Using airSlate SignNow allows for greater efficiency and accuracy when handling the Mississippi Notice Of Intent To Increase Ad Valorem Tax. The platform ensures documents are securely signed, tracked, and managed, reducing the risks associated with manual processing.

-

Are there any pricing options for using airSlate SignNow for the Mississippi Notice Of Intent To Increase Ad Valorem Tax?

Yes, airSlate SignNow offers various pricing plans suited for different business needs, including those who need to manage the Mississippi Notice Of Intent To Increase Ad Valorem Tax. Our cost-effective solutions ensure that you get the best value while efficiently managing your document requirements.

-

Can I integrate airSlate SignNow with other tools for processing the Mississippi Notice Of Intent To Increase Ad Valorem Tax?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, allowing for a streamlined process when dealing with the Mississippi Notice Of Intent To Increase Ad Valorem Tax. This interoperability enhances productivity by connecting with your existing systems.

-

What features does airSlate SignNow offer for handling the Mississippi Notice Of Intent To Increase Ad Valorem Tax?

AirSlate SignNow includes features such as custom templates, secure eSigning, automated workflows, and real-time tracking for the Mississippi Notice Of Intent To Increase Ad Valorem Tax. These features help simplify document management and ensure efficient and compliant handling of tax-related notices.

-

Is it easy to get started with airSlate SignNow for my Mississippi Notice Of Intent To Increase Ad Valorem Tax needs?

Yes, getting started with airSlate SignNow is quick and easy. With user-friendly navigation and comprehensive tutorials, you can efficiently create and manage your Mississippi Notice Of Intent To Increase Ad Valorem Tax within minutes.

Get more for Mississippi Notice Of Intent To Increase Ad Valorem Tax

- Form 5310 a rev november irs

- Instructions for form 8233 09internal revenue

- Limited permittee transaction report limited permittee transaction report form

- Answer form to landlords eviction petition

- Texas probable cause affidavit template form

- Yacht charter party agreement page 1 yacht braveheart form

- Leistungsauftrag barmenia krankenversicherung ag k4664 form

- Ein bestellformular herunterladen acrobat reader pdf rittech rittech

Find out other Mississippi Notice Of Intent To Increase Ad Valorem Tax

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple