Please Give the Name and Address of the Person Applying, under Section 6325 of the Form

What is the Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The

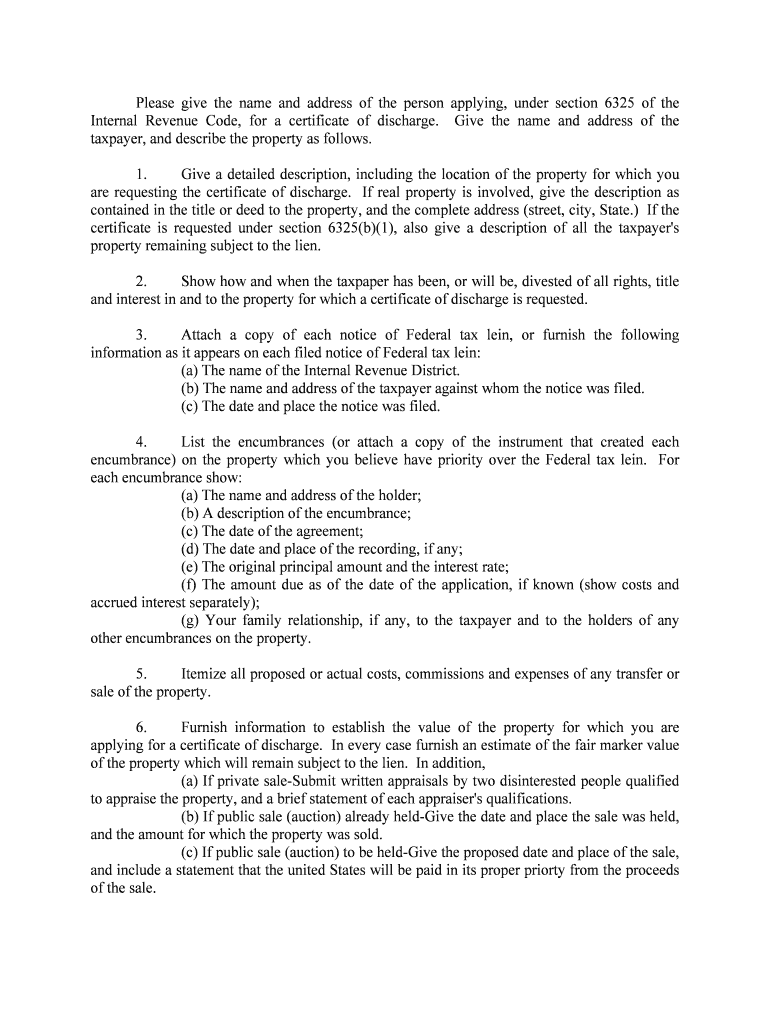

The form referred to as "Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The" is a legal document used primarily in various administrative and legal contexts. This form is essential for identifying the individual who is applying for a specific request or action under Section 6325. It typically requires the applicant to provide their full name, address, and possibly other identifying information to ensure accurate processing of their request. Understanding the purpose and requirements of this form is crucial for compliance with relevant regulations.

Steps to complete the Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The

Completing the form involves several important steps to ensure accuracy and compliance. First, gather all necessary personal information, including your full name and address. Next, carefully read the instructions associated with the form to understand any specific requirements. Fill out the form accurately, ensuring that all information is correct and complete. Once filled, review the form for any errors before submission. Finally, submit the form as directed, whether online or via mail, ensuring that you keep a copy for your records.

Legal use of the Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The

This form serves a legal purpose, as it is often required in various administrative procedures. It is important to understand that the information provided on this form must be accurate and truthful, as any discrepancies could lead to legal complications. The form is designed to comply with applicable laws and regulations, making it a critical component in processes that require formal identification of the applicant. Proper use of this form can help ensure that applications are processed smoothly and legally.

Required Documents

When completing the Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The form, certain documents may be required to support your application. These documents typically include proof of identity, such as a driver's license or passport, and any additional documentation that may be specified in the form instructions. It is advisable to review the requirements carefully to ensure that all necessary documents are included with your submission to avoid delays.

Form Submission Methods (Online / Mail / In-Person)

The submission of the Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The form can typically be done through various methods. Depending on the specific requirements, you may have the option to submit the form online through a designated portal, by mail to the appropriate address, or in person at a specified location. Each method may have its own processing times and requirements, so it is important to choose the method that best suits your needs and to follow the instructions provided for each submission option.

Eligibility Criteria

Eligibility to use the Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The form may vary based on the specific context in which it is being used. Generally, the applicant must be an individual who meets certain criteria outlined in the accompanying regulations. This may include age requirements, residency status, or specific qualifications related to the request being made. It is essential to review these criteria before completing the form to ensure that you qualify to apply.

Quick guide on how to complete please give the name and address of the person applying under section 6325 of the

Effortlessly Prepare Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and efficiently. Manage Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to Modify and Electronically Sign Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The with Ease

- Find Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The and click Get Form to commence.

- Make use of the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive data using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The and ensure seamless communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What information is required for the application under Section 6325?

To complete your application under Section 6325, you need to provide precise details. Please give the name and address of the person applying, under Section 6325 of the relevant guidelines. This ensures a smooth processing of your application.

-

How much does airSlate SignNow cost?

airSlate SignNow offers competitive pricing for its eSigning solutions. Plans cater to various business needs, and you can get started for a minimal monthly fee. Remember to evaluate what you need, especially if you require features related to providing names and addresses under Section 6325.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow supplies a suite of powerful features, including document templates, fields for signatures, and the ability to collect information securely. You can streamline your workflow by allowing users to easily enter information, like name and address, required under Section 6325.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow is designed to seamlessly integrate with various third-party applications and software. This connectivity enhances your ability to manage documents efficiently. It’s particularly useful for those who must submit applications requiring the name and address of the person applying under Section 6325.

-

How secure is my data with airSlate SignNow?

Security is a top priority at airSlate SignNow. Your data is protected using advanced encryption methods, ensuring that sensitive information, such as the name and address of the person applying, under Section 6325 of the regulations, is kept confidential and secure.

-

Is there a free trial available for airSlate SignNow?

Absolutely! airSlate SignNow offers a free trial period where you can test the features without commitment. This includes the utility of entering name and address fields, which is crucial if you are applying under Section 6325, ensuring it meets your requirements.

-

What types of documents can I send and sign with airSlate SignNow?

You can send and eSign various types of documents, from contracts to applications. Specifically, if you're working on forms that necessitate detailed entries, like the name and address of the person applying under Section 6325, airSlate SignNow makes it easy and efficient.

Get more for Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The

- I864p form

- Taxable distribution reports fuels tax state of oregon form

- Private paint party contract template form

- Private music teacher contract template form

- Private party auto loan contract template form

- Private party car sale with payments contract template form

- Private party contract template form

- Private party restaurant contract template form

Find out other Please Give The Name And Address Of The Person Applying, Under Section 6325 Of The

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien