FORM 4506

What is the FORM 4506

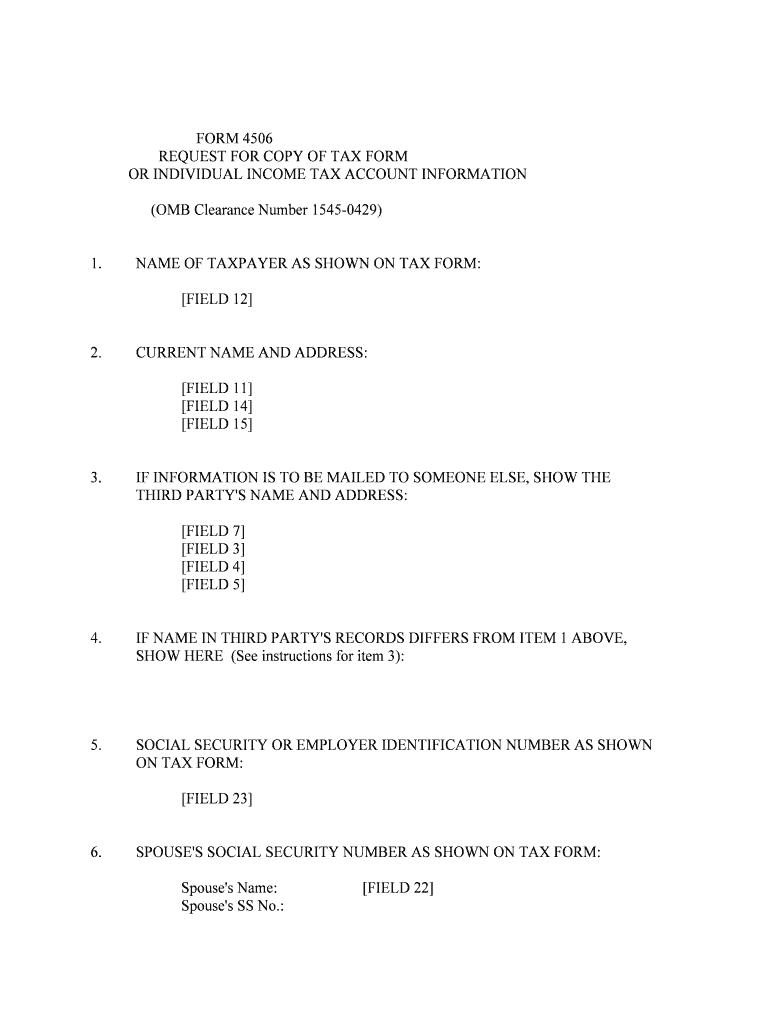

The FORM 4506 is a request form used by taxpayers in the United States to obtain a copy of their tax return from the Internal Revenue Service (IRS). This form is essential for individuals or businesses needing to verify their income, especially when applying for loans, mortgages, or other financial services. By submitting FORM 4506, taxpayers can access their previously filed tax returns, including any accompanying schedules and forms, which can be crucial for accurate financial reporting and compliance.

How to use the FORM 4506

Using the FORM 4506 involves a straightforward process. First, you need to fill out the form with your personal information, including your name, Social Security number, and the address used when filing your tax return. Next, specify the tax years for which you are requesting copies. After completing the form, you can submit it to the IRS either by mail or electronically, depending on the options available. The IRS typically processes these requests within a few weeks, providing you with the necessary tax documents.

Steps to complete the FORM 4506

Completing the FORM 4506 requires careful attention to detail. Follow these steps:

- Download the FORM 4506 from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the specific tax years for which you need copies of your returns.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the IRS via the designated method.

Legal use of the FORM 4506

The FORM 4506 is legally binding and must be filled out accurately to ensure compliance with IRS regulations. When you submit this form, you are certifying that the information provided is true and correct. Misrepresentation or false information can lead to penalties, including fines or legal repercussions. It is important to understand that the IRS may use the information provided in FORM 4506 for various purposes, including verifying income for loans or audits.

Required Documents

When submitting FORM 4506, you may need to include certain documents to support your request. These may include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Proof of address, if it differs from what is on your tax return.

- Any additional forms or documentation specified by the IRS for your particular request.

Form Submission Methods

FORM 4506 can be submitted to the IRS through various methods. The primary methods include:

- By Mail: Print and send the completed form to the address specified for your location on the IRS website.

- Electronically: If eligible, you can submit the form online using the IRS e-Services platform.

Choosing the right submission method can affect the processing time, so it's advisable to consider your urgency when deciding how to send your request.

Quick guide on how to complete form 4506

Manage FORM 4506 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents rapidly and without interruptions. Handle FORM 4506 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign FORM 4506 with ease

- Locate FORM 4506 and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Modify and electronically sign FORM 4506 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is FORM 4506, and why is it important?

FORM 4506 is a request for a copy of a tax return from the IRS. It's essential for individuals and businesses when applying for loans, verifying income, or resolving tax discrepancies. Understanding how to use FORM 4506 correctly ensures you receive accurate tax information promptly.

-

How can airSlate SignNow help with completing FORM 4506?

airSlate SignNow simplifies the process of filling out and signing FORM 4506. Our user-friendly platform allows you to complete the form digitally, ensuring accuracy and compliance. Additionally, you can sign and send it securely, making the workflow extremely efficient.

-

Is there a cost associated with using airSlate SignNow for FORM 4506?

Yes, there is a subscription fee for using airSlate SignNow, but it offers a cost-effective solution for businesses. Pricing plans are designed to suit different needs, providing great value for the features available, especially when handling documents like FORM 4506 efficiently.

-

What features does airSlate SignNow offer for managing FORM 4506?

airSlate SignNow provides essential features such as document editing, secure eSigning, and tracking capabilities for FORM 4506. These tools ensure that your forms are filled out correctly and can be easily monitored during the signing process. Our platform enhances workflow efficiency for all your documentation needs.

-

Can FORM 4506 be integrated with other applications through airSlate SignNow?

Yes, airSlate SignNow supports integrations with various applications that facilitate the handling of FORM 4506. You can easily connect to popular tools and platforms, streamlining your document management processes. This makes it easier to manage your tax documentation alongside your other business tools.

-

What are the benefits of using airSlate SignNow for FORM 4506?

Using airSlate SignNow for FORM 4506 provides numerous benefits, including improved efficiency and reduced paperwork. The digital signing process is fast and secure, which helps expedite the submission of your documents. Additionally, you can access your forms anywhere, making it convenient for busy professionals.

-

Is airSlate SignNow compliant with regulations when handling FORM 4506?

Absolutely, airSlate SignNow complies with all necessary regulations for handling sensitive documents like FORM 4506. We prioritize data security and user privacy, ensuring that your information remains confidential and protected throughout the signing process. Trust in our compliance to handle your important tax documents safely.

Get more for FORM 4506

Find out other FORM 4506

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple