Payroll Fnif 2016-2026

What is the Payroll Fnif

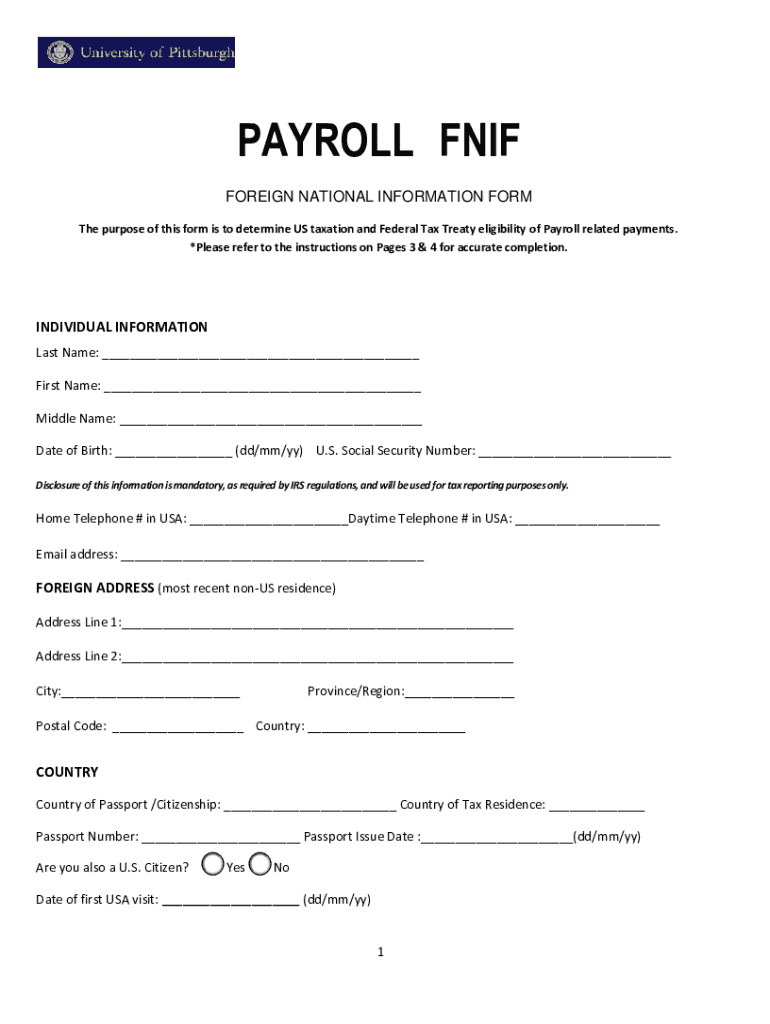

The Payroll Fnif is a crucial form used by employers in the United States to report payroll taxes and employee information to the Internal Revenue Service (IRS). This form helps ensure compliance with federal tax regulations and provides a clear record of payroll transactions. Understanding the Payroll Fnif is essential for businesses to maintain accurate financial records and fulfill their tax obligations.

How to use the Payroll Fnif

Using the Payroll Fnif involves several steps to ensure that all necessary information is accurately reported. Employers must gather employee details, including Social Security numbers, wages, and tax withholding information. Once the data is compiled, it can be entered into the Payroll Fnif form. After completing the form, employers should review it for accuracy before submission to the IRS. This process helps prevent errors that could lead to penalties or delays in tax processing.

Steps to complete the Payroll Fnif

Completing the Payroll Fnif involves a systematic approach to ensure all required information is included. Follow these steps:

- Gather employee information, including names, Social Security numbers, and wages.

- Determine the appropriate tax withholding amounts for each employee.

- Fill out the Payroll Fnif form with the collected data.

- Review the form for accuracy and completeness.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Payroll Fnif

The Payroll Fnif must be used in accordance with IRS regulations to ensure compliance with federal tax laws. Employers are legally required to report payroll information accurately and timely. Failure to do so can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of the Payroll Fnif is essential for businesses to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Payroll Fnif are critical for maintaining compliance with IRS requirements. Employers should be aware of the following important dates:

- Annual filing deadline: January 31 of the following year for most employers.

- Quarterly filing deadlines: April 30, July 31, October 31, and January 31 for the respective quarters.

Staying informed about these deadlines helps businesses avoid late fees and ensures timely reporting of payroll information.

Required Documents

To complete the Payroll Fnif, employers need to gather specific documents that support the information being reported. Essential documents include:

- Employee records, including W-2 forms and payroll summaries.

- Tax withholding certificates, such as W-4 forms.

- Previous payroll tax filings for reference.

Having these documents on hand streamlines the process of completing the Payroll Fnif and ensures accuracy in reporting.

Examples of using the Payroll Fnif

Employers can encounter various scenarios when using the Payroll Fnif. For instance, a business may need to report wages for new employees or adjust tax withholdings based on changes in employee status. Additionally, seasonal businesses might use the Payroll Fnif to report payroll for temporary workers. Each of these examples highlights the form's versatility and importance in maintaining accurate payroll records.

Create this form in 5 minutes or less

Find and fill out the correct payroll fnif

Create this form in 5 minutes!

How to create an eSignature for the payroll fnif

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Payroll Fnif and how does it work?

Payroll Fnif is a comprehensive solution designed to streamline payroll processes for businesses. It allows users to manage employee payments, tax calculations, and compliance with ease. By integrating with airSlate SignNow, Payroll Fnif ensures that all payroll-related documents are securely signed and stored.

-

How can Payroll Fnif benefit my business?

Using Payroll Fnif can signNowly reduce the time and effort spent on payroll management. It automates calculations and document handling, minimizing errors and ensuring compliance. This efficiency allows businesses to focus more on growth and less on administrative tasks.

-

What features does Payroll Fnif offer?

Payroll Fnif includes features such as automated payroll calculations, tax management, and customizable reporting. Additionally, it integrates seamlessly with airSlate SignNow for electronic signatures, making document handling straightforward. These features help businesses maintain accuracy and efficiency in their payroll processes.

-

Is Payroll Fnif suitable for small businesses?

Yes, Payroll Fnif is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective pricing make it an ideal choice for small businesses looking to simplify payroll management. With Payroll Fnif, small businesses can manage payroll without the need for extensive resources.

-

What are the pricing options for Payroll Fnif?

Payroll Fnif offers flexible pricing plans tailored to meet the needs of different businesses. Customers can choose from monthly or annual subscriptions based on their requirements. This ensures that businesses can find a plan that fits their budget while still benefiting from the features of Payroll Fnif.

-

Can Payroll Fnif integrate with other software?

Absolutely! Payroll Fnif is designed to integrate with various accounting and HR software, enhancing its functionality. This integration allows for seamless data transfer and improved workflow, making it easier for businesses to manage their payroll alongside other operations.

-

How secure is Payroll Fnif for handling sensitive payroll data?

Payroll Fnif prioritizes the security of sensitive payroll data by implementing robust encryption and compliance measures. All documents processed through airSlate SignNow are securely stored and accessible only to authorized users. This ensures that your payroll information remains confidential and protected.

Get more for Payroll Fnif

Find out other Payroll Fnif

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien