Located on the Premises and Shall Also Pay All Privilege, Excise and Other Taxes Duly Form

What is the Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly

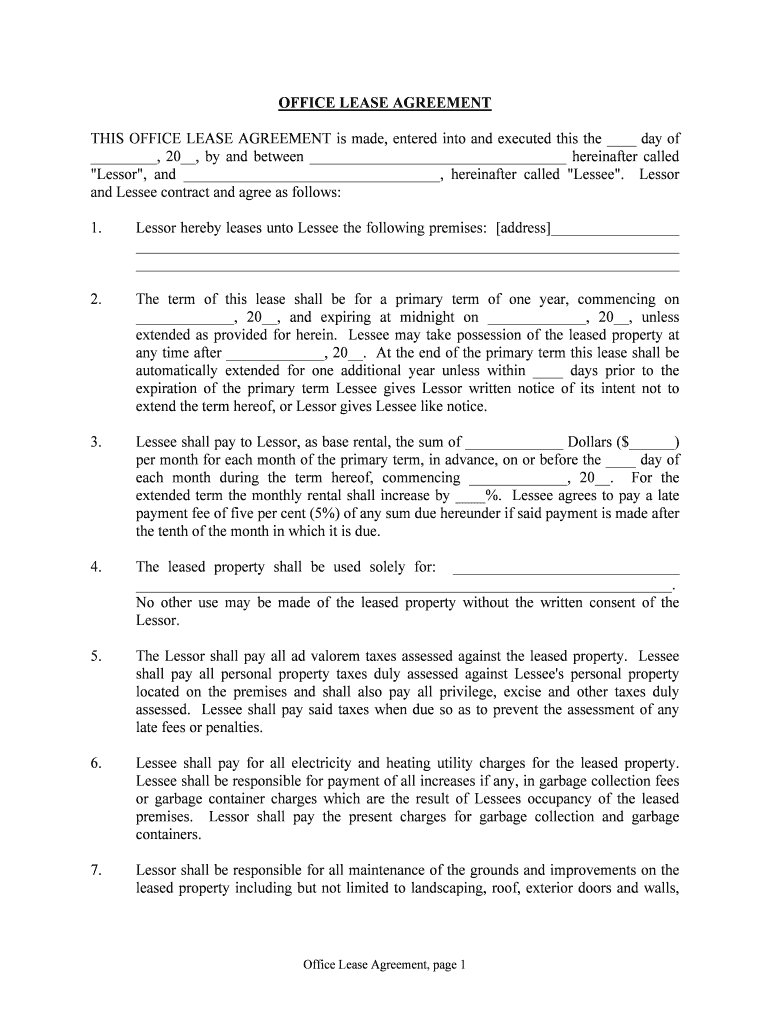

The "Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly" form is a legal document often required in various business contexts. This form is essential for businesses operating in specific jurisdictions, as it outlines the obligation to pay applicable taxes related to privileges and excises. Understanding this form is crucial for compliance with local and state tax regulations, ensuring that businesses remain in good standing with tax authorities.

How to use the Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly

Using the "Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly" form involves several key steps. First, gather all necessary information regarding your business operations and the specific taxes applicable to your location. Next, complete the form accurately, ensuring that all details reflect your current business status. Once filled out, the form can be submitted electronically through a reliable eSignature platform, which enhances the security and legality of the submission process.

Steps to complete the Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly

Completing the "Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly" form involves the following steps:

- Review the specific requirements for your jurisdiction regarding privilege and excise taxes.

- Collect relevant business information, including your business name, address, and tax identification number.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check the information for accuracy to avoid potential penalties.

- Submit the completed form electronically using a secure eSignature service.

Legal use of the Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly

The legal use of the "Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly" form is governed by state and local tax laws. This form serves as a formal declaration of a business's tax obligations and must be completed in compliance with these regulations. Utilizing an eSignature platform ensures that the form meets legal standards for electronic submissions, providing a timestamp and verification of identity, which are critical for legal validity.

Key elements of the Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly

Key elements of the "Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly" form include:

- Business Information: Name, address, and tax identification number.

- Tax Obligations: Detailed description of the privilege and excise taxes applicable.

- Signature Section: Area for authorized representatives to sign, confirming accuracy.

- Date of Submission: Timestamp indicating when the form was completed and submitted.

State-specific rules for the Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly

Each state has its own rules regarding the "Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly" form. It is important to be aware of these state-specific regulations, as they can vary significantly. Businesses should consult their state tax authority or a tax professional to ensure compliance with local requirements, including deadlines for submission and specific tax rates that may apply.

Quick guide on how to complete located on the premises and shall also pay all privilege excise and other taxes duly

Complete Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal sustainable substitute to traditional printed and signed documents, allowing you to acquire the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to adjust and eSign Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly seamlessly

- Locate Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly to ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What pricing options does airSlate SignNow offer?

airSlate SignNow provides various pricing plans tailored to meet different business needs. Each plan ensures that services are located on the premises and shall also pay all privilege, excise and other taxes duly. This way, you can choose a solution that best fits your budget while maximizing document management efficiency.

-

What features does airSlate SignNow include?

With airSlate SignNow, users benefit from features like eSignature functionality, document templates, and automated workflows. All these capabilities aim to streamline operations and ensure compliance with requirements such as those located on the premises and shall also pay all privilege, excise and other taxes duly.

-

How does airSlate SignNow improve business efficiency?

airSlate SignNow enhances business efficiency by simplifying document signing processes and promoting faster transaction times. This effectiveness is vital for companies that recognize the importance of being located on the premises and shall also pay all privilege, excise and other taxes duly for their operations.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various applications like CRM systems, cloud storage, and productivity tools. This flexibility allows businesses to maintain their processes located on the premises and shall also pay all privilege, excise and other taxes duly without disruption.

-

Is airSlate SignNow compliant with industry regulations?

airSlate SignNow is designed to comply with industry standards and regulations, ensuring secure and legally binding eSignatures. Businesses must ensure their operations, located on the premises and shall also pay all privilege, excise and other taxes duly, are up to date with compliance measures.

-

How does airSlate SignNow ensure document security?

Document security is a priority for airSlate SignNow, employing encryption and secure access protocols to protect sensitive information. Ensuring your documents are located on the premises and shall also pay all privilege, excise and other taxes duly promotes peace of mind while handling confidential materials.

-

What kind of customer support does airSlate SignNow provide?

airSlate SignNow offers robust customer support options, including live chat, email, and extensive knowledge bases. This assistance is crucial for users focused on maintaining systems located on the premises and shall also pay all privilege, excise and other taxes duly, ensuring they receive timely help whenever needed.

Get more for Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly

Find out other Located On The Premises And Shall Also Pay All Privilege, Excise And Other Taxes Duly

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document