Form W 532 Ldss 3707 2006-2026

What is the Form W-532?

The Form W-532, also known as the LDSS 3707, is a document utilized primarily in New York City for the purpose of verifying hardship when applying for various assistance programs. This form is essential for individuals seeking food stamps or other benefits, as it helps to substantiate claims of financial difficulty. Understanding the purpose of the W-532 is crucial for applicants to ensure they meet eligibility requirements and can effectively communicate their situation to the relevant authorities.

How to Use the Form W-532

Using the Form W-532 involves several key steps. First, applicants must accurately fill out the form, providing all necessary personal information and details regarding their financial circumstances. It is important to include any relevant documentation that supports claims of hardship, such as pay stubs, bank statements, or bills. Once completed, the form should be submitted to the appropriate agency, typically the local Department of Social Services. This submission can often be done in person, by mail, or online, depending on the specific instructions provided by the agency.

Steps to Complete the Form W-532

Completing the Form W-532 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents that demonstrate your financial situation.

- Fill out the form with accurate personal information, including your name, address, and contact details.

- Detail your income sources and expenses clearly to illustrate your hardship.

- Review the form for completeness and accuracy before submission.

- Submit the form to the local Department of Social Services through the designated method.

Legal Use of the Form W-532

The Form W-532 is legally binding when completed and submitted as part of an application for assistance programs. It is essential that all information provided is truthful and accurate, as providing false information can lead to penalties, including denial of benefits or legal repercussions. Understanding the legal implications of the form helps applicants navigate the application process responsibly.

Required Documents for the Form W-532

When submitting the Form W-532, applicants must provide specific documents to support their claims of hardship. Required documents may include:

- Proof of income, such as pay stubs or tax returns.

- Bank statements that reflect current financial status.

- Documentation of monthly expenses, including rent, utilities, and medical bills.

- Any other relevant paperwork that can substantiate claims of financial need.

Eligibility Criteria for the Form W-532

Eligibility for using the Form W-532 typically depends on an individual's financial situation and their need for assistance. Generally, applicants must demonstrate a significant financial hardship that affects their ability to meet basic living expenses. Specific eligibility criteria may vary by program, so it is advisable for applicants to review the requirements of the assistance program they are applying for to ensure compliance.

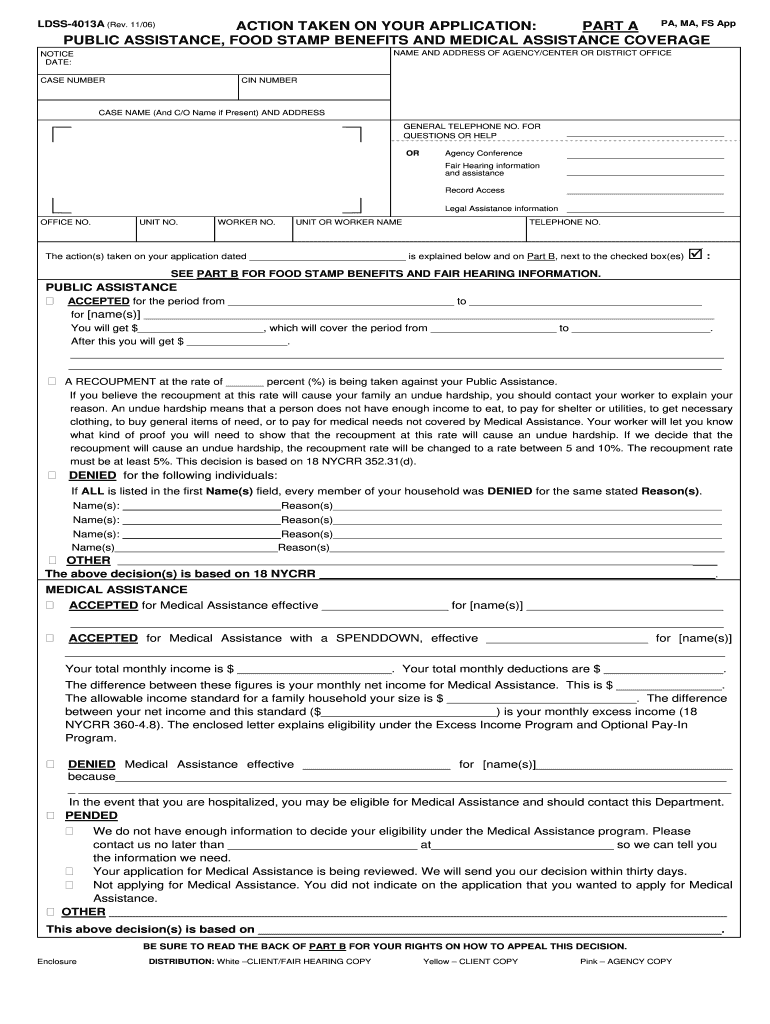

Quick guide on how to complete ldss 4013a new york state otda ny

Explore the simpler method to handle your Form W 532 Ldss 3707

The traditional approach to finishing and approving paperwork consumes an excessively long duration compared to contemporary document management tools. Previously, you would search for suitable forms, print them, fill in all the necessary information, and send them via mail. Now, you can locate, fill out, and sign your Form W 532 Ldss 3707 in just one browser tab using airSlate SignNow. Completing your Form W 532 Ldss 3707 has never been simpler.

Steps to finalize your Form W 532 Ldss 3707 with airSlate SignNow

- Access the category page you need and locate your state-specific Form W 532 Ldss 3707. Alternatively, utilize the search box.

- Verify that the version of the form is accurate by previewing it.

- Click Get form to enter editing mode.

- Fill in your document with the necessary information using the editing features.

- Examine the entered details and click the Sign tool to endorse your form.

- Select the most suitable method to create your signature: create it, sketch your signature, or upload an image of it.

- Click DONE to finalize your changes.

- Save the document to your device or move to Sharing settings to send it electronically.

Robust online tools like airSlate SignNow simplify the process of completing and submitting your forms. Use it to discover how long document management and approval procedures are genuinely meant to take. You will save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

Which forms do I need to fill in order to file New York state taxes?

You must determine your New York State residency status. You need to answer these questions:Did you live in an on-campus apartment or an apartment or house off-campus in New York State in 2012?Did you maintain, or rent, the on-campus apartment or off-campus residence for at least 11 months in 2012?Were you physically present in New York State for at least 183 days in 2012?If the answers to all three questions are "Yes", and you were not a full-time undergraduate student (which as an F-1 OPT I assume you were not), you are a New York State resident for tax purposes. Otherwise you are a nonresident.You file Form IT-201, http://www.tax.ny.gov/pdf/curren..., if you are a resident of New York State, Form IT-203, http://www.tax.ny.gov/pdf/curren..., if you are not.

-

Is it possible to run a NY LLC out of the New York State and even out of the US?

Sure, it is possible.Registering Business in New YorkIf you decided to open a new business that will be based in New York you can choose from several options:Sole OwnersSole Proprietorship: Sole owners of New York-based businesses could opt for sole proprietorship as the easiest form of business organization. Not the most recommended, given the liability a sole proprietor assumes as a result of owning a business. No registration with New York State Department of State is necessary, but it is recommended to obtain a Business Certificate (DBA), and if you plan to hire employees then also obtain an EIN.Single Member LLC: Limited liability company, as the name suggests, is an entity that allows its owners to limit the liability of the business to the entity itself, shielding the owners' personal assets. This type of entity is recommended for most small businesses. By default your LLC will be taxed as "disregarded entity", meaning you will file your LLC tax return as part of your personal tax return. Keep in mind though - LLC is a flexible entity, which means you have the option of electing it to be taxed as S-Corp (assuming you are a U.S. person) or C-Corp. Learn more about LLC here, and about the details of forming LLC in New York here.Corporation: You can also form a corporation and be a sole shareholder with 100% of all shares. Corporations have more formalities than LLCs (for example in New York you are required to have bylaws and maintain minutes of meetings in corporate records), but provide similar limited liability protection. That's one of the reasons this entity type is often more suitable for bigger companies, or those who seek major investment. Corporations can be taxed as S-Corp or C-Corp, with each form of taxation having its pros and cons. Keep in mind, you can elect your corporation to be S-Corp only if you, as the sole shareholder, are a U.S. person. Learn more about corporations here, and about the details of incorporating in New York here.PartnersGeneral Partnership: Like sole proprietorship, this entity type does not require registration with the New York State Department of State, but it also does not protect the owners from business liability, and therefore is usually not recommended. A General Partnership needs to obtain a Business Certificate (DBA), and obtain an EIN.Multiple Member LLC: like Single Member LLC for sole owner, Multiple Member LLC is often the entity of choice for small and new businesses with more than one partner.Corporation: Since corporation can have many shareholders, and transfering ownership is relatively easy (though share transfer) corporation might be a good choice of entity for business with partners. Keep in mind though - S Corporations are limited to 100 shareholders who must be physical U.S. persons. That means corporations owned (partially or fully) by non-U.S. persons or legal entities, cannot be elected as S-Corp, and therefore subject to double taxation of an C-Corp. In cases like that it would be recommended to consider choosing LLC instead.Limited Partnerships: Limited partnerships come in different forms, depending on the state (LP, LLP, LLLP). Though Limited Partnerships have their own purpose and place, for most cases we believe an LLC would serve its owners well enough, therefore at this point we do not cover Limited Partnerships.Existing Out-of-State CompaniesAn existing company registered in another state or country (called "foreign corporation", "foreign LLC", etc) looking to conduct business in New York might be required to foreign qualify in New York. This rule typically applies to companies looking to open a physical branch in New York, lease an office or warehouse, hire employees, etc."Foreign" businesses that do not create "strong nexus" by moving physically to New York might still be required to obtain Certificate of Authority to Collect Sales Tax from New York Department of Taxation and Finance if selling taxable products or services using local dropshippers.

-

How do I report Form 1042 S for New York State Tax on their website https://tax.ny.gov/?

Just give a call to the Personal Income Tax Information Center at 518-457-5181.They will ask you to report it as W-2 and attach scanned copy of your 1042-S. They will also make a note about that is how they asked you to report it.So, dont just report 1042-S as W-2. Give them a call first.

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Should a resident of New York register their business in Delaware? The business will operate in NY before rolling out to other states.

Delaware native here!“Register” is a misleading term. Do you mean form your business in Delaware? That is usually when Delaware comes up — forming an entity (whether an LLC, a partnership, or a C Corporation) is fast and cheap in Delaware, especially compared to New York.It doesn’t really matter where you do business or when you’re rolling out to other states. The two most important things to consider in formation:The difficulty and expense of formation (annual taxes and filings due), andThe laws of the state that will govern your entity.Your business only becomes “a company” or “a corporation” because it is duly recognized as such under the laws of a state. Those laws (and the mechanism for disputes that occur under those laws) are different in every state.I have never heard a single argument for why New York is preferable to Delaware in either of those cases, and when I lived in New York, I filed for our company’s formation in Delaware. I’m in Texas today but happily pay Delaware’s annual franchise tax of $300.This is different than “registering,” which you may need to do as a foreign entity doing business or employing people in one or more stats. This definition (usually tied to a term like “nexus”) varies by state and it depends on the activity you’re engaged in. You may have to collect sales tax. You may have to provide worker’s comp. You may have to withhold employee taxes. The key distinction here is that you register when you have to do so because some activity you’re engaged in triggers the requirement. But you choose where you form your entity and it really doesn’t have a lot to do with your location.

Create this form in 5 minutes!

How to create an eSignature for the ldss 4013a new york state otda ny

How to create an eSignature for your Ldss 4013a New York State Otda Ny online

How to create an eSignature for the Ldss 4013a New York State Otda Ny in Google Chrome

How to make an eSignature for putting it on the Ldss 4013a New York State Otda Ny in Gmail

How to generate an electronic signature for the Ldss 4013a New York State Otda Ny straight from your smartphone

How to create an electronic signature for the Ldss 4013a New York State Otda Ny on iOS

How to make an electronic signature for the Ldss 4013a New York State Otda Ny on Android

People also ask

-

What is Form W 532 Ldss 3707 and how is it used?

Form W 532 Ldss 3707 is a document used for specific applications related to welfare benefits in New York. This form is essential for individuals applying for assistance, ensuring that all required information is accurately submitted. By using airSlate SignNow, you can easily fill out and eSign Form W 532 Ldss 3707, streamlining your application process.

-

How can airSlate SignNow help me fill out Form W 532 Ldss 3707?

airSlate SignNow provides a user-friendly platform that simplifies the process of completing Form W 532 Ldss 3707. With our intuitive interface, you can easily input your information, save your progress, and eSign the document securely. This helps eliminate any errors and ensures that your form is ready for submission.

-

Is there a cost associated with using airSlate SignNow for Form W 532 Ldss 3707?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our plans are designed to be cost-effective, ensuring that you can manage and eSign documents like Form W 532 Ldss 3707 without breaking the bank. You can choose a plan that best suits your volume of usage and specific requirements.

-

What features does airSlate SignNow offer for managing Form W 532 Ldss 3707?

airSlate SignNow includes several powerful features for managing Form W 532 Ldss 3707, such as customizable templates, secure eSigning, and automated workflows. These features enhance efficiency and help you track the status of your document, ensuring that you can manage your applications smoothly and effectively.

-

Can I integrate airSlate SignNow with other applications for Form W 532 Ldss 3707?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow when handling Form W 532 Ldss 3707. Whether you use CRM systems, document management tools, or cloud storage services, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for Form W 532 Ldss 3707?

Using airSlate SignNow for Form W 532 Ldss 3707 offers numerous benefits, including improved accuracy, faster processing times, and enhanced security. Our digital solution eliminates the hassle of paper forms, allowing you to complete and submit your application efficiently. Plus, eSigning is legally binding, giving you peace of mind.

-

Is it easy to share Form W 532 Ldss 3707 with others using airSlate SignNow?

Yes, sharing Form W 532 Ldss 3707 is straightforward with airSlate SignNow. You can easily send the document to multiple recipients for eSigning or review, ensuring that everyone involved can access the form quickly. This feature is particularly useful for collaborative applications or when multiple signatures are required.

Get more for Form W 532 Ldss 3707

- Citizen complaint report city of pinole form

- Claim form city of pomona ci pomona ca

- Amplified sound permit for redondo beach form

- Town of ross business license form

- Miramar landfill clean fill dirt program application part 1 sandiego form

- City of san diego slbe application form 2012

- Ds313 form

- Sunnyvale permits form

Find out other Form W 532 Ldss 3707

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking