Referred to as the "Loan Documents"; and Form

What is the referred to as the "loan documents"?

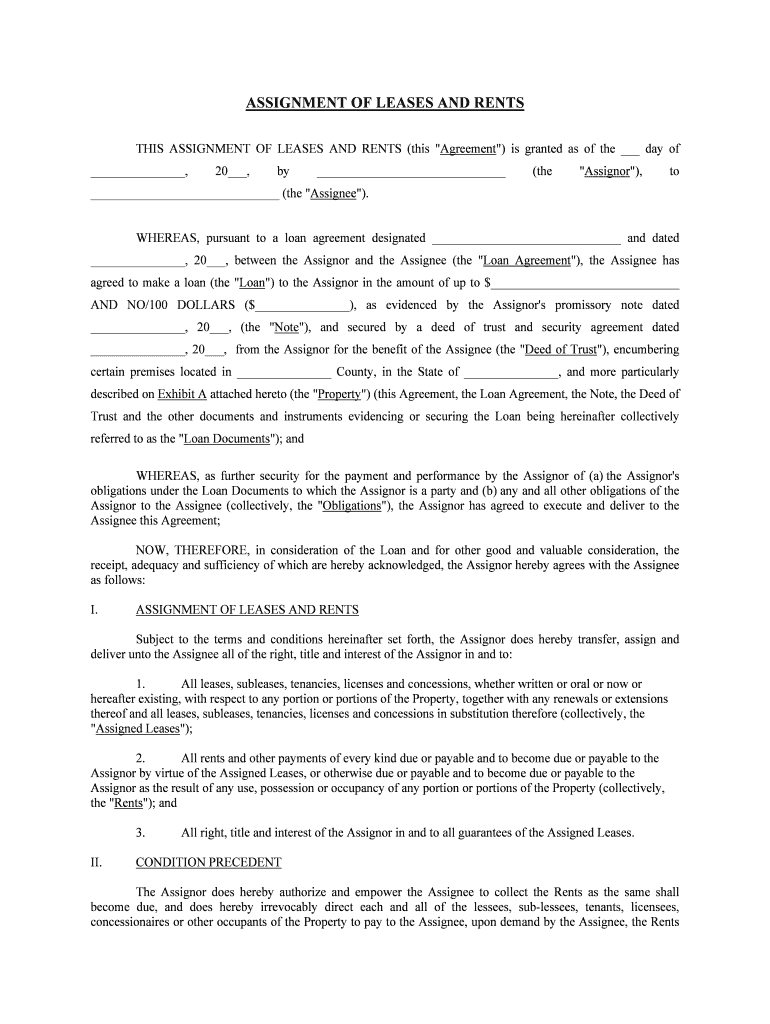

The referred to as the "loan documents" typically includes a collection of essential forms and agreements necessary for securing a loan. These documents serve as the foundation of the lending process, outlining the terms and conditions under which the loan is granted. They may include the loan application, promissory note, security agreement, and disclosures required by law. Understanding these documents is crucial for both borrowers and lenders to ensure clarity and compliance throughout the loan process.

Key elements of the referred to as the "loan documents"

Several key elements are vital in the referred to as the "loan documents." These include:

- Loan amount: The total sum of money being borrowed.

- Interest rate: The cost of borrowing expressed as a percentage of the loan amount.

- Repayment terms: The schedule and conditions under which the borrower must repay the loan.

- Fees and charges: Any additional costs associated with the loan, such as origination fees or late payment penalties.

- Borrower and lender information: Identification details of both parties involved in the loan agreement.

These elements ensure that both parties have a clear understanding of their rights and obligations, helping to prevent disputes in the future.

Steps to complete the referred to as the "loan documents"

Completing the referred to as the "loan documents" involves several important steps:

- Gather necessary information: Collect all required personal and financial information, including income, employment history, and credit history.

- Fill out the loan application: Complete the application form accurately, ensuring that all information is current and truthful.

- Review terms and conditions: Carefully read through the loan terms, including interest rates and repayment schedules, to ensure understanding.

- Sign the documents: Provide signatures where required, which may include electronic signatures for online submissions.

- Submit the documents: Send the completed loan documents to the lender through the specified method, whether online or via mail.

Following these steps helps streamline the loan process and ensures that all necessary information is provided to the lender.

Legal use of the referred to as the "loan documents"

The referred to as the "loan documents" must comply with various legal standards to be considered valid. In the United States, these documents are governed by federal and state laws that regulate lending practices. Key legal considerations include:

- Compliance with the Truth in Lending Act (TILA): This law requires lenders to disclose key terms and costs associated with the loan.

- Adherence to state-specific lending regulations: Each state may have unique laws governing loan agreements, including maximum interest rates and disclosure requirements.

- Proper execution of documents: Signatures must be obtained from all parties involved, and in some cases, notarization may be required.

Understanding these legal aspects helps ensure that the loan documents are enforceable and protect the rights of both borrowers and lenders.

How to obtain the referred to as the "loan documents"

Obtaining the referred to as the "loan documents" can be done through a few straightforward methods:

- Contacting the lender: Reach out to your lender directly to request the necessary documents, either through their website or customer service.

- Online resources: Many lenders provide downloadable versions of their loan documents on their websites for easy access.

- Consulting a financial advisor: A financial advisor can guide you in obtaining and understanding the required documents for your specific loan situation.

Ensuring you have the correct documents is essential for a smooth loan application process.

Examples of using the referred to as the "loan documents"

The referred to as the "loan documents" can be utilized in various scenarios, including:

- Home loans: When purchasing a home, buyers must complete loan documents to secure financing from a mortgage lender.

- Auto loans: Individuals seeking to finance a vehicle will need to fill out loan documents that outline the terms of the auto loan.

- Personal loans: For personal expenses, borrowers may apply for unsecured loans and must complete the corresponding documents.

These examples illustrate the diverse applications of loan documents across different types of financing needs.

Quick guide on how to complete referred to as the quotloan documentsquot and

Effortlessly Prepare Referred To As The "Loan Documents"; And on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Referred To As The "Loan Documents"; And on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and Electronically Sign Referred To As The "Loan Documents"; And with Ease

- Find Referred To As The "Loan Documents"; And and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Referred To As The "Loan Documents"; And to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the main features offered by airSlate SignNow for loan documents?

airSlate SignNow provides a range of features specifically designed for managing documents referred to as the 'Loan Documents'; And. Users can easily create, send, and eSign these documents, ensuring a seamless process. Additionally, the platform offers templates and customization options to suit various lending needs.

-

How does airSlate SignNow enhance the efficiency of handling loan documents?

With airSlate SignNow, businesses experience improved efficiency when dealing with documents referred to as the 'Loan Documents'; And. The platform streamlines workflows, reduces turnaround time, and eliminates paperwork delays, enabling faster processing of loans. This efficiency directly contributes to better customer satisfaction.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers several pricing plans that cater to different business needs regarding documents referred to as the 'Loan Documents'; And. All plans include essential features along with free trials, allowing prospective customers to assess the solution's fit for their requirements before committing. Pricing is transparent, ensuring no hidden costs.

-

Can airSlate SignNow integrate with other software for document management?

Yes, airSlate SignNow seamlessly integrates with various software platforms to enhance document management of items referred to as the 'Loan Documents'; And. Integration with existing CRM systems and cloud storage services makes it easier for businesses to manage their documents. This capability streamlines processes and retains data within familiar ecosystems.

-

What benefits do eSigning loan documents offer to businesses?

ESigning loan documents using airSlate SignNow provides multiple benefits, including increased security and compliance for documents referred to as the 'Loan Documents'; And. The electronic process also accelerates signing times, minimizes errors, and supports environmentally friendly practices by reducing paper usage. Ultimately, it empowers businesses to operate more efficiently.

-

Is airSlate SignNow suitable for small businesses managing loan documents?

Absolutely, airSlate SignNow is tailored to support small businesses dealing with documents referred to as the 'Loan Documents'; And. Its user-friendly interface requires minimal training, and its cost-effective pricing ensures that even smaller operations can benefit from robust eSigning capabilities. Small businesses can efficiently manage their loan processes without large expenditures.

-

What security measures does airSlate SignNow implement for loan documents?

Security is paramount when handling documents referred to as the 'Loan Documents'; And. airSlate SignNow employs advanced encryption methods and complies with necessary regulations to safeguard sensitive information. Users can trust that their loan documents are protected against unauthorized access and bsignNowes.

Get more for Referred To As The "Loan Documents"; And

Find out other Referred To As The "Loan Documents"; And

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template