Sd Tax Exempt Form

What is the South Dakota Sales Tax Exemption Form?

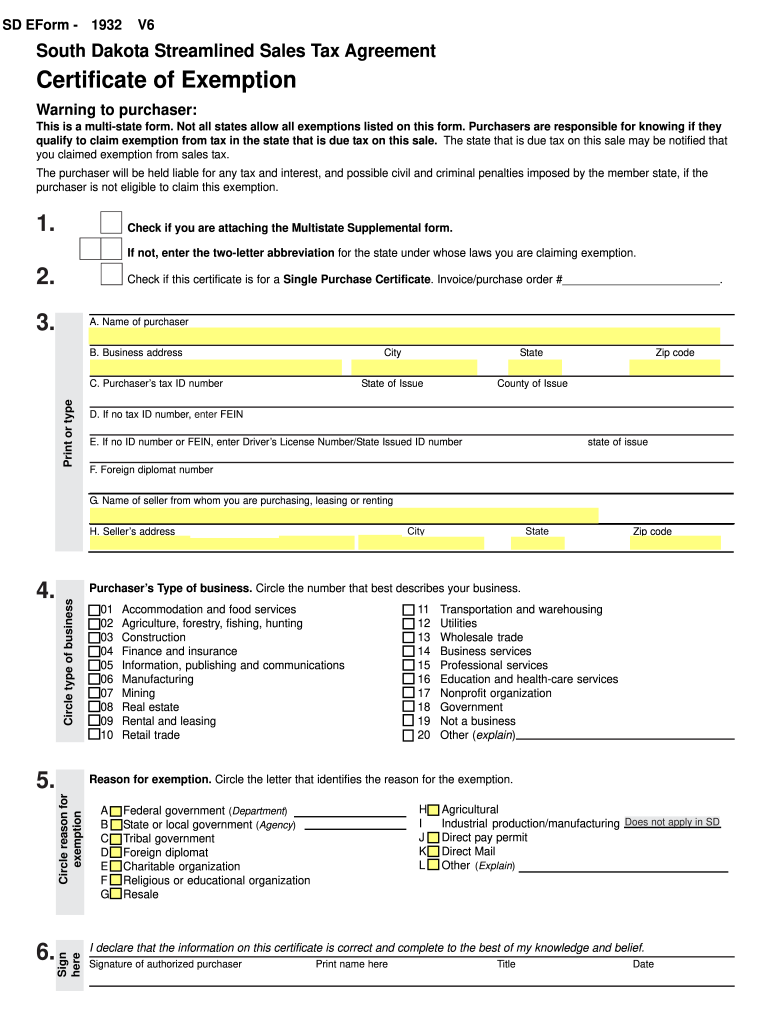

The South Dakota sales tax exemption form is a legal document that allows certain entities to purchase goods or services without paying sales tax. This form is primarily used by tax-exempt organizations, such as non-profits, government entities, and certain educational institutions. By completing this form, eligible entities can demonstrate their exempt status to vendors, ensuring that they do not incur unnecessary tax charges on purchases made for exempt purposes.

How to Use the South Dakota Sales Tax Exemption Form

Using the South Dakota sales tax exemption form involves a straightforward process. First, ensure that your organization qualifies for tax exemption under South Dakota law. Next, download the form, fill it out accurately, and provide the necessary details, such as your organization's name, address, and tax identification number. Once completed, present the form to vendors at the time of purchase to avoid sales tax charges. It is important to retain copies of the form for your records and to ensure compliance with state regulations.

Steps to Complete the South Dakota Sales Tax Exemption Form

Completing the South Dakota sales tax exemption form requires attention to detail. Follow these steps for accurate submission:

- Download the form from an official source.

- Fill in your organization’s name and address accurately.

- Provide your federal employer identification number (EIN) or social security number (SSN) if applicable.

- Indicate the reason for the exemption, selecting the appropriate category.

- Sign and date the form to certify its accuracy.

After completing the form, present it to suppliers to validate your tax-exempt status.

Legal Use of the South Dakota Sales Tax Exemption Form

The South Dakota sales tax exemption form is legally binding when used correctly. To ensure its validity, the form must be completed in full and signed by an authorized representative of the exempt organization. Misuse of the form, such as using it for personal purchases or by ineligible entities, can result in penalties. It is crucial to understand the legal implications and ensure compliance with state tax laws to maintain the integrity of the exemption.

Eligibility Criteria for the South Dakota Sales Tax Exemption Form

Eligibility for the South Dakota sales tax exemption form is typically limited to specific types of organizations. These include:

- Non-profit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Government entities at the federal, state, or local level.

- Educational institutions that meet state criteria for tax exemption.

Organizations must provide documentation proving their exempt status when applying for the exemption. It is advisable to review state guidelines to confirm eligibility before submitting the form.

Form Submission Methods

The South Dakota sales tax exemption form can be submitted in various ways, depending on the vendor's policies. Common submission methods include:

- Presenting the completed form in person at the time of purchase.

- Sending a scanned copy via email if the vendor accepts electronic submissions.

- Mailing a physical copy to the vendor if required.

Always check with the vendor for their preferred submission method to ensure acceptance of the form.

Quick guide on how to complete sd tax exempt form

Complete Sd Tax Exempt Form effortlessly on any device

Online document management has become highly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without delays. Manage Sd Tax Exempt Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Sd Tax Exempt Form with ease

- Find Sd Tax Exempt Form and click on Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Sd Tax Exempt Form and assure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sd tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the south dakota sales tax exemption form?

The South Dakota sales tax exemption form is a document that allows eligible purchasers to avoid paying sales tax on certain transactions. This form is essential for businesses and organizations that qualify for tax-exempt status in South Dakota. By using this form, you can streamline your purchasing process and ensure compliance with state tax regulations.

-

How can I obtain the south dakota sales tax exemption form?

You can download the south dakota sales tax exemption form directly from the South Dakota Department of Revenue's website. Additionally, airSlate SignNow offers easy access to this form, allowing you to complete and sign it electronically. This saves you time and ensures that your documentation is always up-to-date.

-

What are the benefits of using airSlate SignNow for the south dakota sales tax exemption form?

Using airSlate SignNow to manage your south dakota sales tax exemption form offers several benefits, including a user-friendly interface and the ability to eSign documents quickly. It eliminates the hassle of printing, scanning, and mailing, which saves time and resources. Plus, our secure platform ensures the safety of your sensitive information.

-

Is there a cost associated with using the south dakota sales tax exemption form through airSlate SignNow?

There are various pricing plans available for airSlate SignNow that cater to different business needs. While you can access the south dakota sales tax exemption form for free, utilizing the full capabilities of our platform may involve a subscription fee. We provide tiered pricing to ensure that you find a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software for better management of the south dakota sales tax exemption form?

Yes, airSlate SignNow offers seamless integration with various software platforms, enhancing your workflow for managing the south dakota sales tax exemption form. This allows you to connect with CRMs, cloud storage, and project management tools. Our integrations maximize efficiency and help you manage your documents without switching between multiple applications.

-

How does airSlate SignNow ensure the security of the south dakota sales tax exemption form?

Security is a top priority at airSlate SignNow. We implement robust encryption protocols to protect your south dakota sales tax exemption form and all other documents. Additionally, our application complies with industry standards and offers advanced authentication features to keep your information safe from unauthorized access.

-

What is the process to submit the south dakota sales tax exemption form after using airSlate SignNow?

After completing the south dakota sales tax exemption form on airSlate SignNow, you can submit it directly to the relevant authorities or stakeholders via email or by downloading a securely signed copy. The platform simplifies this process, ensuring that your submissions are timely and well-documented. Always check the specific submission guidelines provided by the South Dakota Department of Revenue.

Get more for Sd Tax Exempt Form

Find out other Sd Tax Exempt Form

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer