Loan Application Form 2010-2026

What is the Loan Application Form

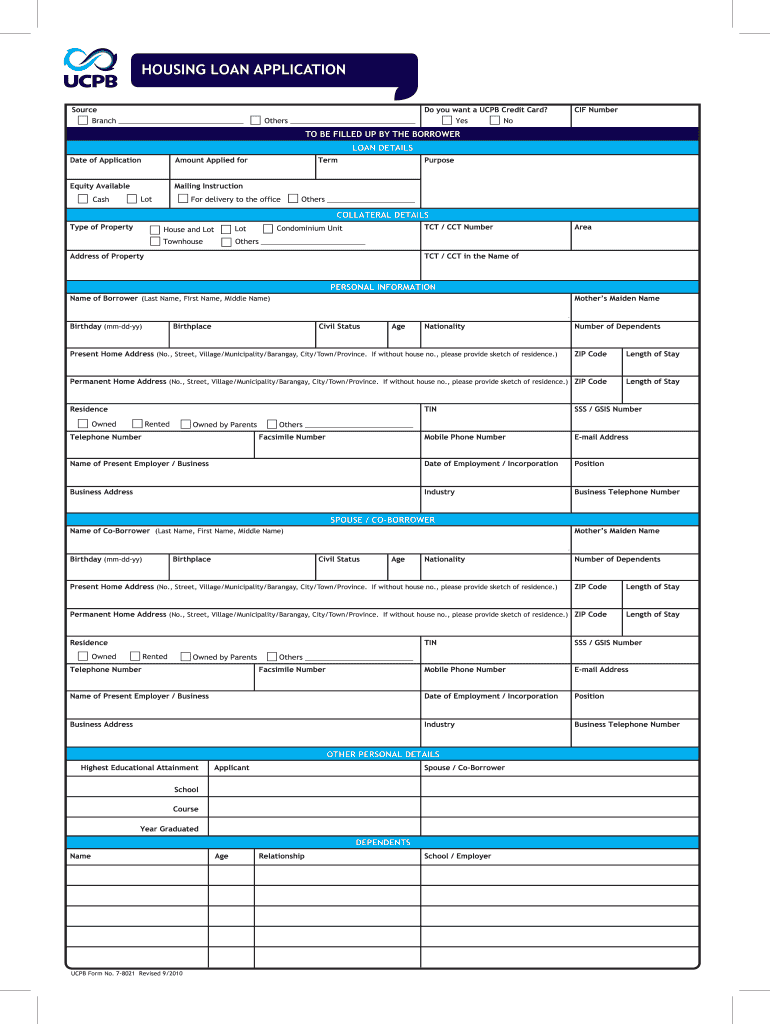

The loan application form is a crucial document that individuals or businesses complete when seeking financial assistance from lenders. This form collects essential information about the applicant, including personal details, financial status, and the purpose of the loan. By filling out this form, applicants provide lenders with the necessary data to assess their creditworthiness and determine loan eligibility.

Typically, the loan application form includes sections for the applicant's name, address, social security number, employment information, income details, and any existing debts. This comprehensive approach helps lenders evaluate the risk associated with granting the loan and decide on favorable terms for both parties.

Steps to Complete the Loan Application Form

Completing a loan application form involves several key steps to ensure accuracy and completeness. Begin by gathering all necessary documentation, such as proof of income, identification, and credit history. This preparation helps streamline the process and reduces the likelihood of delays.

Next, carefully fill out the form, ensuring that all information is accurate and up to date. Pay particular attention to financial details, as discrepancies can lead to complications in the approval process. After completing the form, review it thoroughly to confirm that no sections are left blank and that all required fields are filled correctly.

Finally, submit the completed form to the lender through the preferred method, whether online, by mail, or in person. Keep a copy of the application for your records, as it may be useful for future reference.

Key Elements of the Loan Application Form

Understanding the key elements of a loan application form is essential for a successful submission. The primary components typically include:

- Personal Information: This section requires details such as name, address, and social security number.

- Employment Information: Applicants must provide their current employment status, including job title and income.

- Financial Information: This includes assets, liabilities, and any existing loans or credit accounts.

- Loan Details: Applicants should specify the amount of money requested and the intended use of the funds.

Each of these elements plays a vital role in the lender's assessment process, influencing the decision on loan approval and terms.

Legal Use of the Loan Application Form

Using a loan application form legally involves adhering to specific regulations and guidelines set forth by federal and state laws. In the United States, lenders must comply with the Equal Credit Opportunity Act (ECOA), which prohibits discrimination based on race, gender, or other protected characteristics during the loan application process.

Additionally, applicants should ensure that the information provided on the form is truthful and accurate. Misrepresentation or fraudulent information can lead to severe penalties, including denial of the loan or legal repercussions. Understanding these legal aspects is crucial for both lenders and applicants to maintain compliance and protect their rights.

Required Documents

When applying for a loan, several documents are typically required to support the application. These documents help lenders verify the applicant's identity, financial stability, and creditworthiness. Commonly required documents include:

- Proof of Identity: A government-issued ID, such as a driver's license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements that demonstrate financial capability.

- Credit History: A report from a credit bureau to assess creditworthiness.

- Employment Verification: A letter from the employer confirming employment status and income.

Having these documents ready can expedite the loan application process and improve the chances of approval.

Application Process & Approval Time

The loan application process typically follows a structured path, starting with the submission of the completed application form and required documents. Once submitted, lenders review the application, assess the applicant's financial situation, and perform a credit check.

The approval time can vary based on the lender and the complexity of the application. Generally, applicants can expect a response within a few days to a couple of weeks. Factors influencing the timeline include the lender's workload, the completeness of the application, and the need for additional documentation. Understanding this process can help applicants manage their expectations and plan accordingly.

Quick guide on how to complete online loan application form

The simplest method to locate and endorse Loan Application Form

Across the breadth of your organization, ineffective processes tied to paper approvals can eat up signNow work hours. Endorsing documents such as Loan Application Form is an integral aspect of operations within any enterprise, which is why the efficiency of each agreement’s progression has a substantial impact on the overall performance of the company. With airSlate SignNow, endorsing your Loan Application Form is as straightforward and rapid as it can be. This platform provides you with the latest version of nearly any document. Even better, you can endorse it instantly without the necessity of installing external applications on your computer or printing any physical copies.

Steps to obtain and endorse your Loan Application Form

- Browse our catalog by category or use the search bar to find the document you require.

- Inspect the document preview by clicking Learn more to confirm it is the correct one.

- Press Get form to begin editing immediately.

- Fill out your document and include any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Loan Application Form.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documentation efficiently. You can search for, complete, modify, and even send your Loan Application Form in one tab with ease. Optimize your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How do I apply online for an instant personal loan?

Faced with an unexpected financial requirement? One of the quickest and smoothest solutions that you can get via a formal channel would be to avail of a personal loan. Like other loan products, banks and financial institutions (including NBFCs) offer a personal loan by applying in person, but with advanced technology a loan can be made available to you literally at the click of a button.Most of the larger banks in India offer a personal loan online, simplifying the process such that not only is it hassle-free, but the loan is sanctioned within a few hours, cutting down on processing time signNowly. Let’s take a quick look at the process, should you want to apply online.Step 1: Log on to the lender’s website.Step 2: Fill in a simple, easy-to-use online application form. Depending on whether you are salaried or self-employed, the information will differ.Step 3: Check your eligibility online.Step 4: Once your application is approved, the money will be credited to your account via an online transfer. Some lending institutions disburse loans within 72 hours, following a small 5-minute approval process. Hence before you apply for a loan, compare loan offerings across lenders before you make the decision to proceed.What you should know:Most lenders offer online loans of up to Rs. 25.0 lacs, with loan repayment tenures ranging from between 24 months to 60 months.Make use of online personal loan EMI calculators, that help you approximately gauge the amount you would need to repay month on month towards your loan.Once you have availed of a loan, lenders provide you online access to help you track your loan – right from personal details to complete loan information including g the repayment schedule, interest certificate and other relevant details.Check for any offers or promotions that the lender may have going at the time you apply, to ensure you get yourself the best deal out there. For example: discounted interest rates or lower processing fees for a certain promotional period, or as an ongoing offer for employees of category A companies (as defined by the lender).And finally…Do keep in mind that any loan you avail of needs to be repaid in a timely manner, to ensure that your credit score is not impacted negatively. With this information at hand, go ahead and live your dream!

-

What is the best thing you've looked forward to in your life?

Getting my medical license.The process is so painful that sometimes I feel like stabbing myself in the heart and gouging my eye out, and jumping off a bridge at the same time. And the most frustrating part of it is that there’s not a single thing I can do to speed things up.The website isn’t very user friendly.They request way too many documents. Like, you need to submit 6 different things to prove your citizenship. Can’t it be assumed that if the Federal Government gave me a passport, they know that it’s because I’m a citizen? Can’t it also safely be assumed that if I graduated from a residency program, I must have graduated from a medical school at some point?The website doesn’t tell you everything you need to send. After you’ve filled out the application online, there is a PDF you’re supposed to find somewhere. The PDF was the old application form. You’d fill it out by hand or by editing the PDF. If you did that, you’d see an number of appendices that told you what other documentation you were supposed to supply. But if you apply online, there’s nothing to let you know what you’re missing. So, you have to call them. When you do, they tell you that you need a bunch of stuff you’d never have guessed: a background check, forms you’re supposed to submit to your residency programs, etc. Why not put that in the online application?Then, after you do all that, you might wonder if your file is complete. So, you call. They’ll tell you that your application hasn’t been processed yet. How long till it gets processed? 3 to 4 weeks! So, they won’t even look at your file for 3 to 4 weeks. And, 3 to 4, of course, means 4. Then, when they look at your file, it might even be week 5 by the time they respond to you. At that point, they’ll tell your that your file is missing some stuff.You ask for clarification about the missing stuff, because you’re pretty sure you’ve already sent it. You hear nothing back for a week. You call them, only to hear that they thought they’d emailed you what you were supposed to fill out… You submit what they’re asking for, having wasted another week waiting. Then, they tell you that your file has been submitted for final approval. YAY!Then you’re told that, since you used to be a nurse, you should also submit a nursing license verification. Okay, no biggie, you think. You did a similar thing for Iowa a few years back. You’ll just go online and have the state of Michigan send the state of Tennessee some information about the nursing license that expired 6 years ago.You get on the Michigan website, and things are so disorganized that you can’t for the life of you figure out how to submit the verification request. Oh, and the process has changed. In 2015, you could use the Nursys verification site. But Michigan has pulled out of this process, because… just because. Now, you have to call during business hours, realize that you’re supposed to download and fill out a form, attach a money order (you can’t pay online anymore), and mail it to a P.O. Box.You do that, sending it by express mail. You call the next day to see if it’s been received. Now you’re told that if you want to send things by express mail, there’s another address you should have sent it to, an address that was never communicated to you when you talked to the Michigan people on the phone. You learn that sending mail to the P.O. Box means that it will sit there for a week, after which it will be processed by the Cashier’s office/Finance office/Treasury office, then slowly make its way to the Bureau of Licensing… this process might take 2 weeks. At this point, you’ve sent your initial application 8 weeks before. You wonder why it is that the process couldn’t be more streamlined. Why couldn’t they be a uniform process for all states? Why couldn’t they at least be a central database where healthcare providers could send their documentation, so that whenever they apply for licensing in a new state, that state can immediately receive all the relevant documentation. You’re powerless. You try to think of other things you might do.You remember that Iowa must have a copy of your nursing verification license. You wonder if you could talk to them and see if they’d share it with you. You’re told that they will emphatically not release the document to you. Why? Who knows. Anyway, they might consider releasing it to the Tennessee people if they are contacted directly by their Medical Board. You sheepishly ask the people in Tennessee if they’d be willing to contact Iowa, giving them a phone number, email, and fax number, knowing full well that it will be to no avail.You decide that maybe, if you were to track down the cashier’s office in Michigan, you could fly there and make the payment in person, in a bid to speed up the processing of your license verification request. It’s after hours now, so you can’t be sure. There’s a plane early in the morning. You could fly to Detroit, rent a car, drive to Lansing, and give it a shot. But… what if it doesn’t work? You decide to wait until the morning and call the office to see if getting there in person would make a difference. You are told that it is impossible to make a payment in person, because… rules. There’s literally not a damn thing you can do.And that, my friends, is the story of my life right now. The most frustrating part of this saga is that not only can I not work, but I’m sort of homeless right now. Let me explain. A while back, I bid on a house. I used what is called a physician loan. What my lender did not tell me is that you need an active medical license. So, we were a week from the closing date before I learned this. At this point, I had three options:Walk away from the home purchase and rent. This wouldn’t have been a terrible idea.Prolong my temporary lease at the place I was renting. I would not do this because I hated, hated, hated them with their nickle-and-diming tactics.Wait for my license.I opted for number 3, because I thought it couldn’t take much longer until I’d get my license. My belongings are currently in storage. I’m staying with my sister in Florida. It’s not the worst thing that’s ever happened to anyone in human life, but it’s still really frustrating. The only bright spot is that I get to spend time with my family. I have a nephew and two nieces here that I hadn’t seen in 9 months. They’re growing so very fast. I am constantly peppering them with mental math questions, but they seem to love me for some reason. So, all in all, things could be worse.

-

Can you tell me how to apply for a home loan in India?

Before you start the home loan process, determine your total eligibility, which will mainly depend on your repaying capacity. Your repayment capacity is based on your monthly disposable/surplus income, which, in turn, is based on factors such as total monthly income/surplus less monthly expenses, and other factors like spouse’s income, assets, liabilities, stability of income, etc.The bank has to make sure that you’re able to repay the loan on time. The higher the monthly disposable income, the higher will be the loan amount you will be eligible for. Typically, a bank assumes that about 50% of your monthly disposable/surplus income is available for repayment. The tenure and interest rate will also determine the loan amount. Further, the banks generally fix an upper age limit for home loan applicants, which could impact one’s eligibility.For Home Loans your CIBIL Score should be above 750 and also ensure the following documents are available for the process of your Home Loan application.List of papers/ documents applicable to all applicants:Loan Application: Completed loan application form duly filled in and affixed with 3 Passport size photographsProof of Identity (Any one): PAN/ Passport/ Driver’s License/ Voter ID cardProof of Residence/ Address (Any one): Recent copy of Telephone Bill/ Electricity Bill/Water Bill/ Piped Gas Bill or copy of Passport/ Driving License/ Aadhar CardProperty Papers:Permission for construction (where applicable)Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for SaleOccupancy Certificate (in case of ready to move property)Share Certificate (only for Maharashtra), Maintenance Bill, Electricity Bill, property tax receiptApproved Plan copy (Xerox Blueprint) & Registered Development agreement of the builder, Conveyance Deed (For New Property)Payment Receipts or bank A/C statement showing all the payments made to Builder/SellerAccount Statement:Bank A/c. Statement (Individual) for last six monthsIf any previous loan from other Banks/Lenders, then Loan A/C statement for last 1 yearIncome Proof for Salaried Applicant/ Co-applicant/ Guarantor:Last 3 months Salary Slip.Copy of Form 16 for last 2 years or copy of IT Returns for last 2 financial years, acknowledged by IT Dept.Income Proof for Non-Salaried Co-applicant/ Guarantor:Business Registration Proof.Balance Sheet & Profit & loss A/c for last 3 yearsBusiness License Details(or equivalent)TDS Certificate (Form 16A, if applicable)Certificate of qualification (for C.A./ Doctor and other professionals)IT returns for last 3 yearsYou can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

-

How did bank managers and staff in India treat you whenever you approach them for some loans?

When I was making plans to go to the USA to attend graduate school, my father and I went to different banks asking for education loan.At that time, my father made just enough to support our family and all he has is a small house. No Savings or any other property.The home value is more than the loan amount we requested for. Most of the banks turned us down and I almost gave up on my dream to go to Grad school.I went to Andhra bank near my area. This was a new branch and I just went to try my luck. The bank manager is a soft-spoken person. He asked me for my details and other stuff. He told me that he can’t guarantee a loan until the appraisal is done.Two days later, he called me telling that the appraiser is in town and they want to see my home to estimate it’s value. I called my dad and they got the appraisal done. The manager looked into my study certificates and told me that he will do his best to get the loan approved.He went above and beyond his duty and got the loan approved. I got my loan papers and the next day, he got transferred to a different branch.I finished my Master’s degree and now, I am having a good job. I called the manager to convey my thanks for his help. He told me that he is really happy for me and that I was the first one who got an education loan from the new branch.Thank you, Sir!!!!

-

How much time will it take for my personal loan to get approved?

(1) Check the loan eligibility criteria before applyingIt’s essential to check whether you are able to meet the personal loan eligibility criteria of the lender you wish to borrow from. Most of the lenders require applicants to be in a particular age group, preferably between 21 and 65 years. Moreover, you must annually earn a minimum amount that is specified by the lender. Also, you should not have any outstanding defaults on loans or on any of your credit cards.(2) Check your credit scoreIf you are not attentive of your credit score while applying for a personal loan, your loan application might get rejected. Obtain your credit report, so as to identify your credit score and rectify errors, if any. A decent credit score not only increases your chances of loan approval but also helps you grab an attractive interest rate.(3) Avoid multiple applicationsApplying for a loan at numerous places is not a good idea. The probability of getting your loan application approved is less in such cases. Also, rejection of multiple loan applications will influence your credit score.(4) Provide truthful informationLoan providers verify the information provided by you through supporting documents. They may possibly give you a call to verify your information personally. Therefore, you must provide factual information about your residential details, annual income, past loan repayments etc.(5) Aim for a realistic loan amountOften, many borrowers apply for an extremely huge amount and get rejected by the lender. It is crucial to recognize how much you need to borrow. Apply for a loan amount based on your capability to repay the amount. Most lenders conduct a check of your income and repayment ability before approving your loan. Thus, aim for a reasonable amount in order to avoid loan rejection.Now, you can conveniently assess your personal loan eligibility or EMI using utility tools like personal loan eligibility calculator& personal loan EMI calculator at Compare and Apply For Loans in India, Best Car Loan, Home Loan in Delhi/NCR Noida Jan 2018. The calculator will help you to determine your factual loan amount, EMI outflow every month including the interest rate you need to pay. Using the calculator at afinoz.com is free, easy and simple.(6) Maintain work stabilityLending institutions require loan applicants to have a stable job history. Many lenders require the borrower to have at least two years of work experience in a particular job. Thus, avoid switching jobs frequently if you are planning to apply for a personal loan. Constancy in the job helps in assuring that you have a steady source of income.

-

How do I apply for a loan from a company?

Ask your friends or family about who they might recommend. Call a few lenders and talk with them. You will know the right one when you hear them. Competence, empathy, enthusiasm, creativity, and a clear communication style that works for you.I believe in Mortgage Bankers as I personally feel they have more choices but that is a personal view. You may find a different answer that works for you.Most importantly, if you are told you do not qualify talk with at least two other lenders if the first one doesn't help you set yourself up for a home in the coming months. The percentage of our business that is made up of people we have helped after they were told they didn't qualify at another lender would shock you. I personally have worked with people for as much as 22 months to position them for their home purchase. It is a lot of work but they should be more concerned about you. If they aren't, move on to someone else.,

Create this form in 5 minutes!

How to create an eSignature for the online loan application form

How to make an eSignature for the Online Loan Application Form in the online mode

How to make an eSignature for your Online Loan Application Form in Chrome

How to make an eSignature for signing the Online Loan Application Form in Gmail

How to generate an eSignature for the Online Loan Application Form straight from your smart phone

How to generate an eSignature for the Online Loan Application Form on iOS devices

How to generate an electronic signature for the Online Loan Application Form on Android

People also ask

-

What is a Loan Application Form in airSlate SignNow?

The Loan Application Form in airSlate SignNow is a customizable digital document that allows borrowers to apply for loans online. This form streamlines the application process, enabling users to gather essential information from applicants efficiently. With eSignature capabilities, you can easily sign and send the Loan Application Form, making it a cost-effective solution for businesses.

-

How can airSlate SignNow improve my loan application process?

By using airSlate SignNow's Loan Application Form, you can enhance the efficiency of your loan application process. The platform allows for quick creation and sharing of forms, reducing paperwork and speeding up the approval time. Moreover, integrated eSignature features ensure that your applicants can sign documents securely and conveniently.

-

Is there a cost associated with using the Loan Application Form?

Yes, airSlate SignNow offers various pricing plans to access features, including the Loan Application Form. These plans are designed to be affordable, catering to businesses of all sizes. By investing in this solution, you can save time and resources in managing loan applications.

-

Can I customize the Loan Application Form to fit my business needs?

Absolutely! The Loan Application Form in airSlate SignNow is fully customizable, allowing you to add or modify fields according to your specific requirements. This flexibility ensures that you can collect all necessary information from applicants, tailored to your lending processes.

-

What integrations does airSlate SignNow offer for the Loan Application Form?

airSlate SignNow integrates seamlessly with various platforms, enhancing the functionality of your Loan Application Form. You can connect with popular CRMs, document management systems, and payment processors, streamlining your workflow and improving efficiency in managing loan applications.

-

How secure is my data when using the Loan Application Form?

Security is a top priority for airSlate SignNow. When using the Loan Application Form, your data is protected with advanced encryption technologies and compliance with industry standards. This ensures that sensitive information collected through your loan applications remains safe and confidential.

-

Can I track the status of my Loan Application Form submissions?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of all Loan Application Form submissions. You can see when forms are sent, viewed, and signed, giving you complete visibility over the application process. This helps you manage follow-ups and improve communication with applicants.

Get more for Loan Application Form

Find out other Loan Application Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement