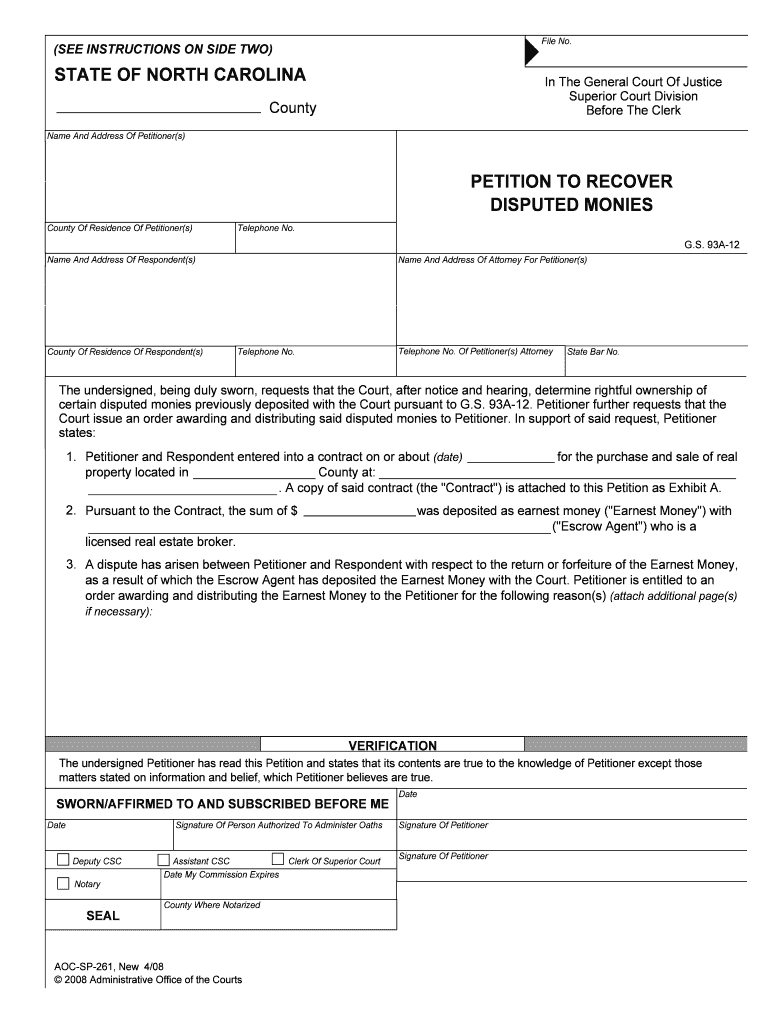

SEE INSTRUCTIONS on SIDE TWO Form

What is the SEE INSTRUCTIONS ON SIDE TWO

The SEE INSTRUCTIONS ON SIDE TWO form is a document that provides essential guidelines for completing various forms accurately. This form is often used in contexts where detailed instructions are necessary to ensure compliance with specific regulations or requirements. It serves as a reference point for individuals or businesses to understand the necessary steps and information needed to complete their submissions effectively.

How to use the SEE INSTRUCTIONS ON SIDE TWO

To use the SEE INSTRUCTIONS ON SIDE TWO form, begin by carefully reviewing the instructions provided on the reverse side. Each section will outline specific requirements and necessary information. It is important to follow these guidelines closely to avoid errors that could lead to delays or rejections. Take your time to gather all required documents and ensure that you understand each step before proceeding with your submission.

Steps to complete the SEE INSTRUCTIONS ON SIDE TWO

Completing the SEE INSTRUCTIONS ON SIDE TWO involves several key steps:

- Read through the instructions thoroughly to understand the requirements.

- Gather all necessary documents and information as outlined in the instructions.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Review your completed form for any errors or omissions.

- Submit the form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the SEE INSTRUCTIONS ON SIDE TWO

The legal use of the SEE INSTRUCTIONS ON SIDE TWO form is crucial for ensuring that all submissions comply with relevant laws and regulations. This form is designed to help users understand the legal implications of their submissions, including any requirements for signatures or additional documentation. By following the instructions carefully, users can ensure their submissions are valid and legally binding.

Required Documents

When completing the SEE INSTRUCTIONS ON SIDE TWO form, it is essential to have all required documents ready. These may include identification, proof of residency, or other supporting materials specific to the form's purpose. Ensuring that you have the correct documents will streamline the process and help avoid any complications during submission.

Penalties for Non-Compliance

Failure to comply with the instructions outlined in the SEE INSTRUCTIONS ON SIDE TWO form can result in various penalties. These may include fines, delays in processing, or rejection of the submission altogether. It is important to adhere to the guidelines to avoid these potential consequences and ensure a smooth submission process.

Quick guide on how to complete see instructions on side two

Finish SEE INSTRUCTIONS ON SIDE TWO effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without hold-ups. Manage SEE INSTRUCTIONS ON SIDE TWO on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign SEE INSTRUCTIONS ON SIDE TWO effortlessly

- Locate SEE INSTRUCTIONS ON SIDE TWO and click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and bears the same legal validity as a standard wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, laborious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign SEE INSTRUCTIONS ON SIDE TWO to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does the instruction 'SEE INSTRUCTIONS ON SIDE TWO' mean in the context of airSlate SignNow?

The instruction 'SEE INSTRUCTIONS ON SIDE TWO' is a reminder for users to refer to additional information provided on the back side of the document. This ensures that all necessary details are reviewed before completing the eSignature process. airSlate SignNow emphasizes clarity to help users navigate signing with confidence.

-

How does airSlate SignNow simplify the eSigning process?

airSlate SignNow simplifies the eSigning process by providing an intuitive interface that allows users to sign documents easily. By following prompts like 'SEE INSTRUCTIONS ON SIDE TWO,' users are guided through each step to ensure a seamless experience. This reduces the chances of errors and enhances efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to meet various business needs. Each plan provides comprehensive features, and users can start with a free trial to explore the benefits. For detailed cost information, it’s important to 'SEE INSTRUCTIONS ON SIDE TWO' on our pricing page.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides a robust set of features including customizable templates, document tracking, and collaboration tools. Users can access all necessary information by carefully reading sections labelled 'SEE INSTRUCTIONS ON SIDE TWO' for better document management. These features help streamline workflows and enhance productivity.

-

How can airSlate SignNow help my business improve productivity?

By using airSlate SignNow, businesses can signNowly improve productivity through faster document turnaround times and reduced manual tasks. Teams can quickly send, receive, and sign documents following instructions like 'SEE INSTRUCTIONS ON SIDE TWO' to ensure no steps are missed. This leads to faster decision-making and overall efficiency.

-

Does airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow offers seamless integrations with a variety of popular business applications. This allows users to connect their existing tools to streamline processes and maximize efficiency. For detailed integration options, please 'SEE INSTRUCTIONS ON SIDE TWO' for a complete list of compatible platforms.

-

What are the benefits of using airSlate SignNow for eSigning?

The benefits of using airSlate SignNow include enhanced security, easy accessibility, and improved compliance. By adhering to guidelines such as 'SEE INSTRUCTIONS ON SIDE TWO,' users can ensure proper handling of sensitive documents. This makes it an ideal solution for businesses looking to modernize their signing procedures.

Get more for SEE INSTRUCTIONS ON SIDE TWO

Find out other SEE INSTRUCTIONS ON SIDE TWO

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation