Additions to the Property above the Cost of $ Shall Be Made Only with the Prior Form

What is the Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior

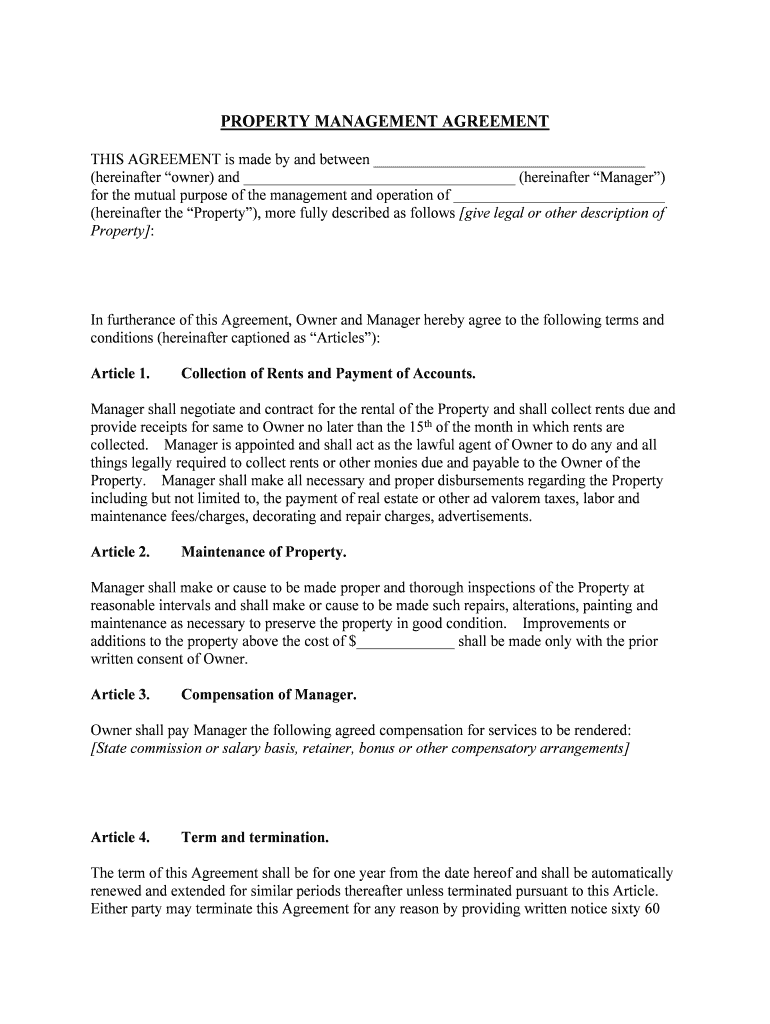

The form titled "Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior" serves as a legal document that outlines the conditions under which modifications or enhancements to a property can be made. This form is crucial for ensuring that any additions exceeding a specified cost are approved before work begins, protecting both the property owner and any contractors involved. It establishes clear guidelines and expectations, ensuring compliance with local regulations and agreements between parties.

Steps to complete the Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior

Completing the "Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior" form involves several key steps:

- Gather necessary information about the property, including its current condition and any proposed changes.

- Clearly outline the estimated costs associated with the additions.

- Ensure all parties involved review the form for accuracy and completeness.

- Obtain signatures from all relevant parties, indicating their agreement to the terms outlined in the document.

- Submit the completed form to the appropriate authority or retain it for personal records.

Legal use of the Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior

This form is legally binding when completed correctly, as it adheres to the requirements set forth by relevant laws governing property modifications. To ensure its legal standing, it is essential that all parties involved provide their signatures and that the document is executed in accordance with state regulations. Failure to comply with these legal stipulations may result in disputes or penalties.

Key elements of the Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior

Several key elements must be included in the "Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior" form:

- A detailed description of the proposed additions.

- The estimated costs associated with these additions.

- Signatures of all involved parties, confirming their agreement.

- The date of submission and any relevant deadlines.

- Any specific conditions or stipulations that must be met prior to commencement.

How to use the Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior

Using the "Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior" form effectively requires understanding its purpose and how to fill it out accurately. Start by clearly defining the scope of the project and the associated costs. Ensure all necessary parties are involved in the discussion to prevent misunderstandings. Once the form is filled out, review it thoroughly before obtaining signatures, ensuring that all information is correct and complete.

Examples of using the Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior

There are various scenarios where the "Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior" form is applicable. For instance, a homeowner planning to build an extension or install a new roof may need to use this form to ensure that the costs exceed a specified amount and receive prior approval. Similarly, property managers overseeing renovations in rental properties can utilize this form to maintain compliance with lease agreements and local building codes.

Quick guide on how to complete additions to the property above the cost of shall be made only with the prior

Complete Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly without interruptions. Handle Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior on any platform with airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to modify and eSign Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior effortlessly

- Find Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information using features that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select your preferred method to send your form, whether via email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior' mean?

The phrase 'Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior' refers to requirements for any enhancements to a property that exceed a specified cost threshold. Before undertaking these expansions, it is essential to secure prior approval to ensure compliance and avoid potential disputes. This policy promotes responsible budgeting and project management.

-

How does airSlate SignNow facilitate document signing related to property additions?

airSlate SignNow streamlines the document signing process needed for 'Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior' approvals. With our platform, you can easily prepare, send, and securely eSign necessary contracts and approvals, ensuring a seamless experience. This saves time and maintains legal compliance in property management.

-

What features does airSlate SignNow offer for property management documents?

With airSlate SignNow, users benefit from features such as customizable templates, automated workflows, and an intuitive dashboard tailored for property management needs. These features simplify the entire process of handling documents related to 'Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior.' You can ensure timely approvals and maintain thorough documentation.

-

What is the pricing structure for airSlate SignNow's services?

airSlate SignNow offers a range of pricing plans designed to fit different business needs and budgets. The pricing is competitive, especially considering the efficiency gained in managing documents related to important processes like 'Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior.' Sign up for a free trial to explore our features before committing.

-

Can airSlate SignNow integrate with other property management tools?

Yes, airSlate SignNow easily integrates with a variety of property management software and tools, enhancing your overall operational efficiency. These integrations provide a seamless experience when handling documents tied to 'Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior.' This ensures that you can manage all aspects of your property with minimal interruption.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including enhanced security, improved tracking of documents, and a faster signing process. Specifically for documents pertaining to 'Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior,' our platform ensures compliance and provides an easy method for obtaining necessary approvals. This reliability boosts confidence in your project management.

-

Is airSlate SignNow compliant with legal standards for electronic signatures?

Absolutely, airSlate SignNow is fully compliant with international eSignature laws, including the ESIGN Act and UETA. This compliance guarantees that documents signed electronically, particularly those concerning 'Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior,' are legally binding. You can have peace of mind knowing your agreements are valid and enforceable.

Get more for Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior

Find out other Additions To The Property Above The Cost Of $ Shall Be Made Only With The Prior

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors