Digital Signature Certificate Subscription Form

What is the Digital Signature Certificate Subscription Form

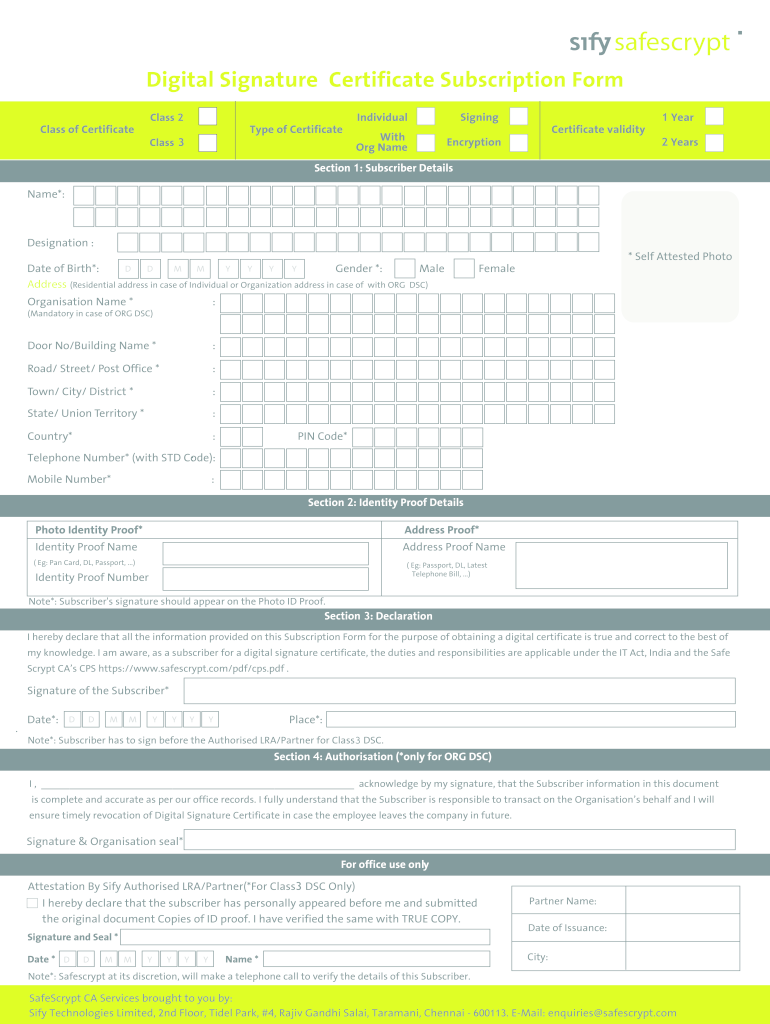

The Digital Signature Certificate Subscription Form is a document that allows individuals and businesses to apply for a digital signature certificate. This certificate serves as a secure and legally recognized way to sign documents electronically. It is essential for various transactions, including filing taxes, signing contracts, and submitting official documents. By obtaining this certificate, users can ensure the authenticity and integrity of their digital signatures, which are crucial in today's digital landscape.

Steps to complete the Digital Signature Certificate Subscription Form

Filling out the Digital Signature Certificate Subscription Form requires careful attention to detail. Here are the key steps to ensure a smooth process:

- Gather necessary information: Before starting, collect all required personal and business details, including identification documents and contact information.

- Access the form: Obtain the subscription form from a trusted source, ensuring it is the most current version.

- Fill in personal details: Complete sections that require your name, address, and other identifying information accurately.

- Provide identification: Attach copies of necessary identification documents, such as a government-issued ID or business registration documents.

- Review the form: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the form: Follow the specified submission method, whether online, by mail, or in person, to ensure your application is received.

Legal use of the Digital Signature Certificate Subscription Form

The Digital Signature Certificate Subscription Form is legally recognized under various laws, including the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures, when supported by a valid digital signature certificate, hold the same legal weight as traditional handwritten signatures. This legal recognition is essential for conducting business transactions, signing contracts, and filing government documents electronically.

Required Documents

When completing the Digital Signature Certificate Subscription Form, certain documents are typically required to verify your identity and eligibility. These may include:

- Government-issued identification (e.g., driver's license, passport)

- Proof of address (e.g., utility bill, bank statement)

- Business registration documents (if applicable)

- Any additional documents specified by the issuing authority

Having these documents ready will facilitate a smoother application process and ensure compliance with legal requirements.

Form Submission Methods

Submitting the Digital Signature Certificate Subscription Form can be done through various methods, depending on the issuing authority's guidelines. Common submission methods include:

- Online submission: Many authorities allow you to fill out and submit the form electronically through their secure portals.

- Mail: You can print the completed form and send it via postal service to the designated office.

- In-person: Some applicants may prefer to submit the form directly at a local office, where they can receive immediate assistance.

Choosing the right submission method can help expedite the processing of your application.

Eligibility Criteria

To successfully apply for a digital signature certificate, applicants must meet specific eligibility criteria. Generally, these include:

- Being a legal adult (usually eighteen years or older)

- Having valid identification and proof of address

- For businesses, being a registered entity with appropriate documentation

Understanding these criteria is essential to ensure your application is accepted and processed without issues.

Quick guide on how to complete digital signature certificate filled form

A concise guide on how to create your Digital Signature Certificate Subscription Form

Locating the appropriate template can turn into a difficulty when you need to supply official international documentation. Even if you have the necessary form, it might be tedious to swiftly fill it out according to all the specifications if you rely on printed copies instead of handling everything digitally. airSlate SignNow is the online eSignature platform that assists you in addressing all of that. It allows you to obtain your Digital Signature Certificate Subscription Form and effortlessly complete and sign it on the spot without having to reprint documents whenever you make an error.

Here are the procedures you must follow to develop your Digital Signature Certificate Subscription Form with airSlate SignNow:

- Click the Get Form button to instantly add your document to our editor.

- Begin with the first blank section, enter the information, and proceed with the Next function.

- Complete the empty fields using the Cross and Check tools from the top panel.

- Select the Highlight or Line options to emphasize the most signNow details.

- Click on Image and upload one if your Digital Signature Certificate Subscription Form requires it.

- Utilize the right-side panel to add more sections for you or others to fill out if needed.

- Review your responses and verify the template by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it with a camera or QR code.

- Complete the editing process by clicking the Done button and selecting your file-sharing preferences.

Once your Digital Signature Certificate Subscription Form is prepared, you can distribute it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your liking. Don’t spend time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How do I company registration online?

A business organization that makes, buys, or sells goods or services in exchange for money is known as a Company.In simple words, company is a mode of doing business.Your business setup need to be well thought of and the most important is to decide which form of business structure or vehicle to adopt. Choice of vehicle will help you to achieve most of your entrepreneurial dreams.Mostly, it depends on what is your expansion plans, future team size, funding requirements and business vision.Company registration means legally getting the right to do business in India, registration of company is also known as formation of business or incorporation of company.6 Reasons Why you must Register your Company?It protects you from personal liability for business risks and lossesMakes you look serious and attracts more customersCreates better image and credibility in the marketEasier to get bank credit and investment from investorsCreates faith in employees and easy to attract talented manpowerIt is very convenient to exit or sell the business, due to less documentation and costRead more about Company Registration – The Ultimate Step by Step Guide For IndiaHope this was helpful! :)

-

How should I register a company?

Registering a startup or a new business in India first and foremost one has to go by, there are some official procedures a startup or a company has to follow in order to register them in Indian official records, MCA (ministry of Corporate Affairs) has to made registration process online few years back, please find below on how to go about these process when you want to register your company.One don’t need to visit corporate office, you can apply for registration just sitting at home. We will help you to get a legal license for your business. The registration includes some must follow rules and some registration like Digital Signature Certificate(DSC), Director Identity Number(DIN) and filing for an eform.AdvertisementThese are four major steps:Acquiring Digital Signature Certificate(DSC)Acquiring Director Identification Number(DIN)Filing an eForm or New user registrationIncorporate the companyIt’s necessary to get registered yourself to run your business without any legal problem. India is a land of opportunity, no matter in which field your business is operating the chances of getting success is very high, so it just needs a start. starting an entrepreneurship in India would fetch you great success. fallow this post sincerely till you incorporate your final claim for your company. We assure one will end up in getting their business registered after following this procedure.Know the basics first: What is mean by company, the private company and public company?In India, there are about 7 lacks registered companies and every month thousands of firms apply for registration. company is a legal entity; According to Section 3 of companies act company means a legal entity formed and registered under Companies Act 1956. Under the ministry of corporate affairs, every company is to be registered by the registrar of companies for the state. This act maintains two types of companies called private and public companies. The ‘Limited’ is the most commonly used corporate form at the end of the company name. First you need to know what are these public and private companies and decide how you want your company to get registered.When it comes to company registration, Every firm will have following two options:Private company:Public company:The main differences between Private and Public companies are:Minimum number of Board members required for a private company is two and for a public company is seven.Private company can have maximum of only 50 members, but a public company can have any number of members.A private company can start its business as soon as it is incorporated but the public company shouldn’t start its business until it receives business commencement certificate.Private company shouldn’t sell it’s shares to anyone or shouldn’t make any invitation to people regarding a company shares, but a public company can invite people to buy it’s shares by issuing a prospectus.Private company may have two directors, but a public company must have at least three directors.Lets start the registration procedure: 4 StepsStep 1: Acquire Director Identification Number(DIN)This is the first process in registration that each director of the company should obtain their identification number. As per the amendment act 2006, acquiring a DIN is compulsory for every director i.e. as such every existing and intending directors have to obtain their DIN. To get DIN one need to file a eForm DIN-1. The DIN-1 form is available on Official site of the ministry of corporate affairs the link is DIN-1 Form.Register yourself on MCA website first and have a login id. After filling DIN-1 Form, one should upload the filled form by clicking to eForm upload button on MCA website and should pay applicable fees.After getting generated DIN one should intimate their company about DIN. The director can intimate their company about DIN by using DIN-2 Form.Then company should intimate the Registrar of Corporates(ROC) about all director’s DIN through DIN-3 Form.If there is any change in DIN or need for any updation like change of address, personal details etc, then director should intimate this change by submitting the eForm DIN-4 Form.Step 2: Acquire Digital Signature Certificate(DSC):In order to ensure the security or authenticity of documents filed electronically the information act 200o demands a valid digital signature on the documents submitted electronically. This is the only and safest way that one can submit their documents electronically. The digital signature certificate should be acquired by only those agencies which are appointed by the controller of certification agencies (CCA). One should not use DSC given by any other agency which is not approved and it’s illegal to use others DSC as yours or the false one.If you already have a digital signature then you can use the same, no need to apply for another. But do check for your digital signature validity, agencies issue DSC’s with one or two year validity after expiry you have to renew it.One can acquire his/her Digital Signature certificates from these government listed agencies like TCS, IDBRT, MTNL, SAFESCRYPT, NIC, nCODE Solutions etc. to check out their price details of these Govt approved agencies.Step 3: Create a account on MCA Portal – New user registrationThis is about having a registered user account on MCA Portal for filing a eForm, for online fee payment, for different transactions as registered and business user. Creating an account is totally free of cost. To register yourself on the MCA portal, click on the register link.Step 4: Apply for the company to be registered.This is the final major step in a registration of your company which includes incorporating company name, Registering the office address or notice of situation of office and notice for appointment of company directors, manager and secretary. And also regarding the take and pay for their qualification shares.Form-1:Form-1A: Application form for availability or change of a company name. Once you apply for new company name, the MCA will suggest four different form of your company name; you have to choose one among them. To do the same you have you have to fill Form-1A and submit.Form-1: This is for application or declaration for incorporation of a company, in this form you have to fill the same name which you have chosen during application of form-1A.Form-18:This form is for notice of the situation of a new company office or change of situation of previously registered office.For a new company you have to fill the form with genuine office address and submit.Form-32:For a new company, this form is for notice for appointment of new Directors, Managers and Secretary.For an existing company, this form is for a change of directors, Manger, Secretary or company head.After submitting these forms, once the application has been approved by MCA, you will receive a confirmation email regarding the application for incorporation of a new company, and the status of the form will get changed to Approved.Detailed procedure for approval of the proposed company name:For obtaining name for your new company, An application in Form-1A needs to be filed with the Registrar of Companies (ROC) of the state in which the Registered Office of the proposed Company is to be situated to ascertain the availability of a name along with an official service fee of Rs.500/-.You have to provide four alternative names for the proposed company. Your company name shall not resemble the name of any other company already registered or violate the provisions according to Act, 1950.In this form you have to fill name and addresses of directors (minimum 2 for a private company and 7 for a public company). You have to mention main objects of the company and authorized capital.In about 10 days, the ROC will inform you about approval or objections. If there are any objections then ROC will suggest you with some available names and let you choose among them. If your company name is approved then you will receive a formal letter regarding the confirmation of the same. Keep the same which will be required during registration process of the proposed company.If you find any difficulty or encounter any problem while obtaining the company name then do contact us, We will help you to sort out your problem.Check these documents before submission of a company:DIN of all those directors of a proposed company.DSC – Digital Signature CertificateOriginal copy the of formal letter issued by ROC regarding availability of Company name.Form-1 for incorporation of a company.Form-18 for situation or address of the proposed company.Form-32 for particulars of proposed directors, managers and secretary.Formalities to be followed while incorporation of a company:Obtain a TAN cardObtain a Permanent account number (PAN) from income tax dept. IndiaIf required: Documents obeying shop and establishment acts.If required: For foreign trade, Registration documents of import export code from Director General of foreign trade.If required: Registration documents of Software technologies Parks of India (STPI).If required: RBI approval for foreign companies investing in India and FIPB approval.Both Indian and foreign directors need to have valid Digital Signature Certificates from authorized agencies.

-

What is the legal procedure required for starting-up in India?

A guide on how to register Startup or new business in India with documents needed, fees breakdown and time to complete company registration.A startup is an energy booster for the Indian economy. Whether your startup is a sole proprietorship or a partnership business, it’s better to give your business a legal existence. The reason being, a registered company, can be closed down only by legal authorities in case of any unforeseen issues. Here we look at the steps to register a start-up or a new business in India.The Ministry of Corporate Affairs has made it convenient for the new startups by introducing the online registration. In May 2015, Ministry of Corporate Affairs introduced a five-in-one form to make the process of registration easier. The new form known as Integrated Incorporation Form INC-29 will require you to fill only one form instead of the tedious process of filling out eight forms. An advantage of the new form is that it reduces the interaction with the authorities at the various levels.Now you can register your new business from the comfort of your home. There are four steps that you need to do follow.Apply for Director Identification Number(DIN)The first and foremost process is to the registration of the company directors. You should create a login id in the LegalRaasta website.A nominal amount of Rs 500 for DIN will be charged and normally it takes a day to get this number.Acquire Digital Signature Certificate (DSC)This is important to ensure the authenticity of the documents that you file electronically. Also, understand that the digital signature certificate should be authenticated by the agencies appointed by the controller of certificate agencies.You would have to pay a nominal amount Rs 1299/-. It will get at least four days to get the certificate.Approval of the company name and certificate of IncorporationThe company name will be approved by Registrar of Company (ROC). Once the name is approved by ROC apply for the Certificate of Incorporation. This is done by filling out Form 1, Form 18 and Form 32.You would have to pay Rs 1000/- for the approval of the name and the Certificate of Incorporation, the amount can be anywhere between Rs 1000 to 4000.The name approval will take at least two days while the certificate of incorporation will take a week.The following documents that have to be attached to Form 1 while applying for the certificate of Incorporation.Signed copy of the Memorandum of Association (MOA).Signed copies of Articles of Association (AOA).The power of Attorney from the various subscribers on judicial stamp paper worth Rs 100 and finally, the identification of the subscribers.Apply for Permanent Account Number and Tax Account Number for the registered companyThe PAN card can be obtained from Income Tax Department, India by paying a nominal amount of INR 94. You can apply for the TAN card by visiting the website TIN. You will be charged INR 62.The total time span to obtain these is seven days.The other formalities that you can go about during this period include getting a rubber stamp of the company, registering for VAT and professional tax, employees provident fund and health insurance and so on.Hence, the entire process of registering a company in India takes about 10–15 days with cost of around INR 13,499/-For more information you can visit : Private Limited Company RegistrationYou can apply online : LegalRaasta.com

-

How do I register my company and logo in India?

Ministry of Corporate AffairsTo register a company, you need to first apply for a Director Identification Number (DIN) which can be done by filing eForm for acquiring the DIN. You would then need to acquire your Digital Certificate and register the same on the portal. Thereafter, you need to get the company name approved by the Ministry. Once the company name is approved , you can register the company by filing the incorporation form depending on the type of company (Use quick links available on left panel in case steps are known)Step 1 : Application For DIN The concept of a Director Identification Number (DIN) has been introduced for the first time with the insertion of Sections 266A to 266G of Companies (Amendment) Act, 2006. As such, all the existing and intending Directors have to obtain DIN within the prescribed time-frame as notified. You need to file eForm DIN-1 in order to obtain DIN. To get more information about the same click Director Identification Number Step 2 : Acquire/ Register DSCThe Information Technology Act, 2000 provides for use of Digital Signatures on the documents submitted in electronic form in order to ensure the security and authenticity of the documents filed electronically. This is the only secure and authentic way that a document can be submitted electronically. As such, all filings done by the companies under MCA21 e-Governance programme are required to be filed with the use of Digital Signatures by the person authorised to sign the documents. Acquire DSC -A licensed signNowing Authority (CA) issues the digital signature. signNowing Authority (CA) means a person who has been granted a license to issue a digital signature certificate under Section 24 of the Indian IT-Act 2000.Register DSC -Role check for Indian companies is to be implemented in the MCA application. Role check can be performed only after the signatories have registered their Digital signature certificates (DSC) with MCA. To know about it click Register a DSCStep 3 : New User RegistrationTo file an eForm or to avail any paid service on MCA portal, you are first required to register yourself as a user in the relevant user category, such as registered and business user. To register now click New User RegistrationStep 4 : Incorporate a CompanyApply for the name of the company to be registered by filing Form1A for the same. After that depending upon the proposed company type file required incorporation forms listed below.Form 1 : Application or declaration for incorporation of a companyForm 18 : Notice of situation or change of situation of registered officeForm 32 : Particulars of appointment of managing director, directors, manager and secretary and the changes among them or consent of candidate to act as a managing director or director or manager or secretary of a company and/ or undertaking to take and pay for qualification sharesOnce the form has been approved by the concerned official of the Ministry, you will receive an email regarding the same and the status of the form will get changed to Approved. To know more about eFiling process click "All About eFiling"

-

If I want to start a new company in India what are all of the legal procedures required?

These are four major steps:Acquiring Digital Signature Certificate(DSC)Acquiring Director Identification Number(DIN)Filing an eForm or New user registrationIncorporate the companyWhen it comes to company registration, Every firm will have following two options:Private company:Public company:The main differences between Private and Public companies are:Minimum number of Board members required for a private company is two and for a public company is seven.Private company can have maximum of only 50 members, but a public company can have any number of members.A private company can start its business as soon as it is incorporated but the public company shouldn’t start its business until it receives business commencement certificate.Private company shouldn’t sell it’s shares to anyone or shouldn’t make any invitation to people regarding a company shares, but a public company can invite people to buy it’s shares by issuing a prospectus.Private company may have two directors, but a public company must have at least three directors.Lets start the registration procedure: 4 StepsStep 1: Acquire Director Identification Number(DIN)This is the first process in registration that each director of the company should obtain their identification number. As per the amendment act 2006, acquiring a DIN is compulsory for every director i.e. as such every existing and intending directors have to obtain their DIN. To get DIN one need to file a eForm DIN-1. The DIN-1 form is available on Official site of the ministry of corporate affairs the link is DIN-1 Form.Register yourself on MCA Website first and have a login id. After filling DIN-1 Form, one should upload the filled form by clicking to eForm upload button on MCA website and should pay applicable fees.After getting generated DIN one should intimate their company about DIN. The director can intimate their company about DIN by using DIN-2 Form.Then company should intimate the Registrar of Corporates(ROC) about all director’s DIN through DIN-3 Form.If there is any change in DIN or need for any updation like change of address, personal details etc, then director should intimate this change by submitting the eForm DIN-4 Form.Step 2: Acquire Digital Signature Certificate(DSC):In order to ensure the security or authenticity of documents filed electronically the information act 200o demands a valid digital signature on the documents submitted electronically. This is the only and safest way that one can submit their documents electronically. The digital signature certificate should be acquired by only those agencies which are appointed by the controller of certification agencies (CCA). One should not use DSC given by any other agency which is not approved and it’s illegal to use others DSC as yours or the false one.If you already have a digital signature then you can use the same, no need to apply for another. But do check for your digital signature validity, agencies issue DSC’s with one or two year validity after expiry you have to renew it.One can acquire his/her Digital Signature certificates from these government listed agencies like TCS, IDBRT, MTNL, SAFESCRYPT, NIC, nCODE Solutions etc. to check out their price details of these Govt approved agencies, Go to this link.Step 3: Create a account on MCA Portal – New user registrationThis is about having a registered user account on MCA Portal for filing a eForm, for online fee payment, for different transactions as registered and business user. Creating an account is totally free of cost. To register yourself on the MCA portal, click on the register link.Step 4: Apply for the company to be registered.This is the final major step in a registration of your company which includes incorporating company name, Registering the office address or notice of situation of office and notice for appointment of company directors, manager and secretary. And also regarding the take and pay for their qualification shares.Form-1:Form-1A: Application form for availability or change of a company name. Once you apply for new company name, the MCA will suggest four different form of your company name; you have to choose one among them. To do the same you have you have to fill Form-1A and submit.Form-1: This is for application or declaration for incorporation of a company, in this form you have to fill the same name which you have chosen during application of form-1A.Form-18:This form is for notice of the situation of a new company office or change of situation of previously registered office.For a new company you have to fill the form with genuine office address and submit.Form-32:For a new company, this form is for notice for appointment of new Directors, Managers and Secretary.For an existing company, this form is for a change of directors, Manger, Secretary or company head.After submitting these forms, once the application has been approved by MCA, you will receive a confirmation email regarding the application for incorporation of a new company, and the status of the form will get changed to Approved.Detailed procedure for approval of the proposed company name:For obtaining name for your new company, An application in Form-1A needs to be filed with the Registrar of Companies (ROC) of the state in which the Registered Office of the proposed Company is to be situated to ascertain the availability of a name along with an official service fee of Rs.500/-.You have to provide four alternative names for the proposed company. Your company name shall not resemble the name of any other company already registered or violate the provisions according to Act, 1950.In this form you have to fill name and addresses of directors (minimum 2 for a private company and 7 for a public company). You have to mention main objects of the company and authorized capital.In about 10 days, the ROC will inform you about approval or objections. If there are any objections then ROC will suggest you with some available names and let you choose among them. If your company name is approved then you will receive a formal letter regarding the confirmation of the same. Keep the same which will be required during registration process of the proposed company.If you find any difficulty or encounter any problem while obtaining the company name then do contact us, We will help you to sort out your problem.Check these documents before submission of a company:DIN of all those directors of a proposed company.DSC – Digital Signature CertificateOriginal copy the of formal letter issued by ROC regarding availability of Company name.Form-1 for incorporation of a company.Form-18 for situation or address of the proposed company.Form-32 for particulars of proposed directors, managers and secretary.Formalities to be followed while incorporation of a company:Obtain a TAN cardObtain a Permanent account number (PAN) from income tax dept. IndiaIf required: Documents obeying shop and establishment acts.If required: For foreign trade, Registration documents of import export code from Director General of foreign trade.If required: Registration documents of Software technologies Parks of India (STPI).If required: RBI approval for foreign companies investing in India and FIPB approval.Both Indian and foreign directors need to have valid Digital Signature Certificates from authorized agencies.For query and help you can contact expert on below given linkCompany/ Startup Registration Query(Reference Indianweb2.com )

-

How do I make a PVT Ltd company in India?

How to register a company (Pvt. Ltd.)Pre-requisites1. Have paid-up capital of INR 1,00,0002. Have minimum of 2 directors/board members and two shareholders3. Have maximum of 50 members only4.Cannot publicly sell shares. Can only invite people to buy shares by issuing aprospectusStep1: Acquire DIN (Director Identification Number)DIN is a unique identification number for an existing director or a person intending tobecome a director of a company. As per a recent amendment to the Companies Act 1956, DIN has become mandatory for all the directors. DIN is unique and specific to an individual, therefore only one DIN is allotted per individual even if the individual serves as director at multiple companies. No fee is charged for issuing DIN. This process takes approximately 3 to 5 working days.Supporting documents required (soft-copies):1.Photograph2.Proof of identity3.Proof of residenceRegister on MCA website for login ID and password(create an account)I.File eForm DIN-11.Download eForm DIN-12.Fill the form3.Attach necessary documents4.Sign using digital signature5.“Check Form”6.Upload eForm7.Pay fees by credit card, debitcard, internet banking or cash/cheque at designated banks (State Bank of India, Punjab National Bank, Indian Bank, ICICI Bank, HDFC Bank) using the pre-filed challan that will be generated8.Note the Service Request Number (SRN) for later enquiries9.Check acknowledgement by email or through MCA portalII.Intimate approved DIN To your Company (within 30 days from date of approval)a.Download Form DIN-2 and printStep 2: Acquire Digital Signature Certificate(DSC):At least one of the directors should have a valid Digital Signature Certificate issued by the signNowing Authorities (CA) and approved by the Ministry of Corporate Affairs. The Information Technology Act,2000 provides for use of Digital Signatures on the documents submitted in electronic forms, in order to ensure the security and authenticity of the documents filed electronically. Every document prescribed under the Companies Act, 1956, is required to be filed with the digital signature of the managing director or director or manager or secretary of the company. Therefore at least one of directors must have a digital signature. Any person may make an application to the signNowing Authority for the issue ofa Digital Signature in such form as may be prescribed by the Central Government. Digital Signatures are typically issued with one year validity and two year validity. The issuance cost varies depending on the CA. Digital Signatures can be obtained within an hour.One can acquire his/her Digital Signature certificates from these government listed agencies like TCS, IDBRT, MTNL, SAFESCRYPT, NIC, nCODE Solutions etc.Step 3: Apply for the company to be registeredThis is the final major step in a registration of your company which includes incorporating company name, Registering the office address or notice of situation of office and notice for appointment of company directors, manager and secretary. And also regarding the take and pay for their qualification shares.Prerequisite for Virtual eFiling1.Install the following prerequisite software:Windows 2000 / Windows XP / Windows Vista / Windows 7 –Operating SystemInternet Explorere v6.0 and above, Google Chrome, Mozilla FirefoxsignNow from version 7.5 to version 10.1.4Java Runtime Environment (JRE –latest version freely downloadable fromwww.sun.com)2.Get yourself registered at the portal (www.mca.gov.in)3.Obtains a Director Identification Number (DIN).4.Obtain a Digital Signature Certificate (DSC).5.Broadband Internet connectivity or higher.6.A scanner (above 200 DPI) for converting the attachments in the PDF format.Steps:I.Fill Form-1A for obtaining the name for the company-onlineFor obtaining name for your new company, An application in Form-1A needs to be filed with the Registrar of Companies (ROC) of the state in which the Registered Office of the proposed Company is to be situated to ascertain the availability of a name along with an official service fee of Rs.500. You also have to provide the following information in the form.• Name of the proposed company (Minimum 4 alternative names, maximum 6).Indicate the order of preference. Ensure that the company name is in accordance to the guidelines of the MCA, and also ensure the name is unique and does not resemble the name of any existing company in India. The company name must end with the words ‘Private Limited’ or ‘PVT Ltd’. In order to have specific key words in the name such as corporation, International, Hindustan, Industries, India etc., the proposed company should satisfy a minimum authorized capital criteria.• Location of registered office of the proposed company• Main Objectives of the business of the company• Names and addresses of the directors• Proposed Authorized Share Capital of the Company• DIN & DSCSubmit duly filled form to the Registrar along with fee of Rs. 500.The Registrar shall intimate, within two to three days, whether the proposed name is available or not. If the preferred name is not available apply for a fresh name on the same application. The name made available by the Registrar shall be valid for a period of six months. In case, if the company is not incorporated within this validity period, an application may be made for renewal of name by paying additional fees. Otherwise the name approval process has to be repeated by submitting new application after payment of requisite fees.In about 10 days, the ROC will inform you about approval or objections. If there are any objections then ROC will suggest you with some available names and let you choose among them. If your company name is approved then you will receive a formal letter regarding the confirmation of the same. Keep the same which will be required during registration process of the proposed company.II.Prepare documentsAfter obtaining name approval from the ROC the following documents must beprepared to incorporate the company• Memorandum of Association (MOA) The Memorandum of Association is a document that sets out the constitution of the company. It contains, among-st others, the objectives and the scope of activity of the company and also describes the relationship of the company with the outside world.• Articles of Association (AOA) The Articles of Association contains the rules and regulations of the company for the management of its internal affairs. While the Memorandum specifies the objectives and purposes for which the Company has been formed, the Articles lay down the rules and regulations for achieving those objectives and purposes. It also states the authorized share capital of the proposed company and the names of its first / permanent directors. Professional help is to be sought in the drafting of the MOA and AOA, as it contains the governing policies, rules and by-laws of the proposed venture. The draft must be carefully vetted by the promoters before printing and stamping.The MOA and AOA must be signed by at least two subscribers in his own hand, along with father’s name, occupation, address and the number of shares subscribed for and witnessed by at least one person. Then the MOA and AOA are required to be stamped & filed with the ROC. A stamp duty is required to be paid on the MOA and on the AOA. The stamp duty depends on the authorized share capital and varies between states. Details of applicable stamp duty can be obtained from here. eStamping facility is now available via MCA’s portal. The document preparation process may take five to seven days.• Form 1 –providing details of promoters of the company• Form 18 –providing details of address of the registered office of the company• Form 32 –providing details of Directors, managers and secretaries of the companyIII.Submission of DocumentsSubmit the following documents to the ROC with the filing fee and the registration fee:• The stamped and signed Memorandum and Articles of Association (3 copies).• Form-1, 18 & 32 in duplicate.• Any agreement referred to in the Memorandum & Articles.• Any agreement proposed to be entered into withany individual for appointment as Managing or whole time Director.• Declaration of Compliance by an advocate or company secretary or chartered accountant or director, manager or secretary of the company• Name availability letter issued by the ROC.• Power of Attorney authorizing a person, on behalf of subscribers, any documents and papers filed for registration. The power of attorney should be given on Non-Judicial stamp paper of appropriate value and shall be submitted to the Registrar.After submitting these forms, once the application has been approved by MCA, you will receive a confirmation email regarding the application for incorporation of a new company, and the status of the form will get changed to Approved.IV.Payment of Registration FeesThe fees payable to the Registrar at the time of registration of a new company varies according to the authorized capital of a company proposed to be registered. Payment for the Registration and Filing Fee must be made by Demand Draft/Banker’s Cheque if it exceeds Rs.1000/.V.Obtaining Certificate of IncorporationThe ROC will issue a Certificate of Incorporation after careful review of documents submitted. Section 34(1) cast an obligation on the Registrar to issue a Certificate of Incorporation, normally within 7 days of the receipt of documents.A Private Limited Company can start its business immediately on receiving the Certificate of Incorporation.Check these documents before submission of a company:1.DIN of all those directors of a proposed company.2.DSC –Digital Signature Certificate3.Original copy of the formal letter issued by ROC regarding availability of Company name.4.Form-1 for incorporation of a company.5.Form-18 for situation or address of the proposed company.6.Form-32 for particulars of proposed directors, managers and secretary.Formalities to be followed while incorporation of a company:1.Obtain a TAN card2.Obtain a Permanent account number (PAN) from income tax dept. India3.If required: Documents obeying shop and establishment acts.4.If required: For foreign trade, Registration documents of import export code from Director General of foreign trade.5.If required: Registration documents of Software technologies Parks of India (STPI).6.If required: RBI approval for foreign companies investing in India and FIPB approval.7.Both Indian and foreign directors need to have valid Digital Signature Certificates from authorized agencies.For any further clarifications, please visithttp://www.mca.gov.in/MCA21/Regi...Thanks & Regards,Stay4u.

-

What are the ways to get a start-up registered into PVT LTD company within India?

How to register Private Limited companyEnsure flawless start of business without hassle on legal part by company incorporation online in following 4 steps only.Step 1: Procure Digital Signature Certificate:The first and foremost step is to procure the DSCs of the Personnel involved in Private Company Incorporation in India. The requirement of DSSCs arises for filling of e-forms on online portal of MCA as the Ministry has prescribed provided for online registration procedure for company incorporation and other applications. Digital Signature Certificate, commonly known as DSC are issued by the signNowing Authority in token form and is valid for 1 or 2 years.The personnel involved in company formation in India are Subscribers and Directors for proposed company. The Subscriber is a person who is the promoter of the company and proposed shareholders. The said shareholders are required to file e-MOA and e-AOA by affixing DSCs whereas proposed directors shall obtain DIN by making an online application in next step.List of Documents for Digital Signature Certificate:·Passport size photograph of applicant;·Self-attested Address proof of applicant; and·Self-attested PAN card of applicant.Step 2: Obtain Director Identification NumberDirector Identification Number (DIN) is a unique number assigned by Ministry of Corporate Affairs to the individual making an application for allotment of DIN. The number is allotted for lifetime by the Ministry unless it is surrendered or withdrawn.The directors of the company shall obtain and intimate the DIN while Private Ltd company incorporation. Hence, obtaining DIN is mandatory to be appointed as Director in any Company. The Director Identification Number obtained can also be used for appointment for any other company and appointment as Designated Partner in the LLP.What are the documents required for application of DIN?·Passport size photograph of applicant;·Self-attested Address proof of applicant; and·Self-attested PAN card of applicant.Step 3: Reservation of NameBefore making an application to incorporate and register Pvt Ltd Company in India, the name for the proposed company shall be reserved. An Application for Reservation of Name of Private Limited Company shall be made in e-Form INC – 1 by making payment of requisite fees. In one application you may provide maximum 6 names in preferential order along with the significance for application for proposed name(s). The appointed professional shall make a search for availability of name before filling the application so that the applicant can make application of the names accordingly. The Registrar enjoys 100% discretion for approval of name application.The person shall make an application for name approval considering the provisions laid down by the Act. Further, following general practise are adhered to choose and apply the name:·The name should be easy to spell and remember;·The name shall be able to provide a distinct identity to the company;·It should be short & simple;·The name should not contain any word as opposed to public policy or prohibited;·It should not infringe any Trademark registered nor shall be similar or identical to any company/ LLP registered.As stated above, the application for name reservation can be made with maximum 6 names, out of which the registrar may approve any one name or may ask to provide additional names with remarks.click aboveOnce the application made is approved, the registrar shall reserve the same name for a period of 60 days. The promoters in guidance with the Professional shall make the application for incorporation of company within prescribed period of 60 days, failing to which the name reserved shall lapse and therefore fresh application shall be made for reservation of name for further period of 60 days.Step 4: Certificate of IncorporationAfter reservation of the name for proposed company by submitting form INC – 1, the application for issuance of Certificate of Incorporation shall be made. The application for online registration for company is also required to be made by online submission of Simplified Proforma for Incorporating Company Electronically i.e. SPICe forms.Drafting MoA & AoABoth, MoA and AoA are charter document for a Private Limited Company. MoA stands for Memorandum of Association of company and AoA is abbreviated form of Articles of Association.Memorandum of Association of Company prescribes the scope of operations of company by enumerating the main object and activities of the company. Whereas the Articles of Association provides in what manner the operations and administration shall be carried on. Both documents having vital importance shall be drafted very carefully after consultation of Professional.The memorandum and Articles of the company shall also be filed in SPICe forms along with application for company formation and registration in India. The subscription to MoA and AoA shall be made by affixing DSCs of subscribers in electronic form.Documents to accompany the Application·Utility Bill and NOC from the owner for the Registered Office address of the Company;·Rental Agreement with the owner of registered office & Rent receipts, if premises is rented;·Consent to act as a Director of the company in form DIR – 2;·Affidavit and declaration by first subscriber(s) and director(s) in form INC – 9 (duly franked and signNowd);·Certified True copy of the self-attested Identity proof of the first subscriber(s) and director(s).The application is submitted by paying the requisite Government Fess and Stamp Duty as applicable in case of concerned state on the portal. The application and allotment of PAN and TAN are also processed with the same application.On review and verification of the application made for certificate of incorporation in SPICe forms, the Registrar on his satisfaction may issue the Certificate of Incorporation under his seal and signature in electronic form. The Certificate of Incorporation (CoI) issued will include the date of incorporation as well as the Permanent Account Number (PAN) of the company

-

What is the procedure to register a startup company in India and how much will it cost?

HiRegistering a start up company is fairly easy now a days.You may follow these steps;Decide the structure of the company ( Partnership, LLP, Pvt Ltd etc.)Decide on the nameGet the digital signature of all the stakehldersDownload the relevant forms from MCA site (www.mca.gov.in)Fill in all the details and sign the form digitally.Get the form signed by a CA, CS or an AdvocateUpload the filesAnd you have your company registered.

-

What is the procedure To Register Online Startup Company In India?

Why do we need register Our Online store?Government of India has officially Defines a startup company based on their business Legal entity like A company That does not exceed 25 crores in the last five financial year, a company is dated below fives from the date of incorporation and its working towards innovation, development, deployment and commercialization of new products, process, or services driven by technology or intellectual property.Registering your company will provide a secure identity for the business. In the field of ecommerce, Business organizations likely to do day to day sales that keep their identity in business sector. Registering or trade marking your business will act as a remainder of your business name. This is either shown as ™ or ® character value.How to register your Business online?Government of India has made registration process more effortlessly. You don’t need to visit any corporation office. You can apply for registration by sitting at home. Here we will guide the steps and general rules that you must follow like Digital Signature Certificate(DCS) Director Identity Number(DIN) and filling for an Eform.Let’s Begin our registration processStep 1: Acquiring Direct Identification number (DIN)The first and viatal part in the registration process is that each Owner/director of the company should obtain their Identification Number. A per corporation Law on amendment act 2006 acquiring a DIN is compulsory for Every Owner/Director. To get a valid DIN, one should fill a eform DIN1. You can find DIN-form on the official site of the ministry of corporate affairs. Download DIN-1 FormRegister Yourself on MCA Website (Ministry of Corporate Affairs) and Have a Login ID. After Filling DIN-1 Form, You can upload the filled form by clicking to eForm Upload button on the on MCA Website and you have to pay the applicable fees.Post getting the generated DIN, You should intimate company about DIN. The Director / Owners can intimate their company about DIN by using DIN-2 Form.Then the company should Intimate the Registrar of Corporates (ROC) about all director’s DIN Through DIN-3 Form.If you need to make change in DIN or any future updation like change of address, personal information and many things, The director or owner should intimate this change by submitting the eForm DIN-4 Form.Step 2: Acquire Digital Signature Certificate (DSC)To ensure the security or Authenticity of documents that filed electronically the information act 200 demands a valid signature on the documents submitted electronically. This is most safest way where you can submit your document electronically. The digital Signature certificate should be acquired by only those agencies which are appointed by the controller of certification agency(CCA) You should not use DSC Given by any other agency which is unapproved and it’s illegal to use others DSC Other than your own DSC.If you already got a digital signature you can continue using the same certificate and you don’t have to apply for new one. But make sure and check out about your digital signature validity. Agencies issues DSC’s with one or two year Validity and after its expiry, you have to renew it.You can acuire a DSC (Digital Signature Certificate) from these govermant Listed agencies like TCS, IDBRT,SAFECRYPT, NIC And manymore. You can check out their prices on this link.Step 3: Create a new account on MCA PortalHaving a registered account is useful for filling a Eform, for online fee payment, and for different transactions as registered and business users. Creating an account in MCA is totally free of cost. To register yourself on the this MCA Profile, Click register link on their websiteStep 4: Apply for the company to be registeredThis is final and most important step in a registration of your company which provide trademark for your company and its name. Registering the address of office or notice the exact situation of office and notice for the appointment of company directors/owners, Accountant and secretary. Also refer regarding salary for their qualification.Form-1A:Form-1A: This application form is check availability of the name or to change it to some other. After you applied for the new company name, the MCA will suggest upto four different names and you can choose one among them. All you have to do is fill up the Form-1A and submit it.Form-1:This is for application or declaration for incorporating your company. All you have fill the same name you have selected during application of form-1A.Form-18:This form is for notice of the current location of a new company or change of location of previously registered office.For a new company you have to fill the form with genuine office address location and submit it.Form-32:For a new yet to register company this for acts as a notice for appointment of new Directors/owners, accountants and secretary.For an existing company this form is for a change of directors, accountants and secretary or company head.After submitting these forms, they have to be approved by MCA, You will receive a confirmation mail regarding the application of registration of a new company, and the status of the form will get switched to approve.Detailed Procedure for approval of the proposed Company NameTo obtain a name for your new company, form-1A application needs to be filled with the Registrar of Company (ROC) of the state in which the Registered office of the company that was proposed located to make sure that availability of a name along with an official service fee of INR 500/-.While registering the name you have to provide four alternative names. You must make sure that your company name should not resemble the name of any company already registered. In that form you have to fill name and address information of directors/owners. For private companies you should provide at least 2 directors/owners and 7 directors for public Company.In about 7 to 10 days, the ROC will inform you about Approval or objection if they have any. If there are any objections for your name, ROC will suggest you with Some available names so that you can choose among them. If your name is approved you will be notified and will receive a formal letter regarding the confirmation.Some Common tips to be followed while Registering Your CompanyHave a PAN (Permanent Account Number) Card for Income Tax Purpose.Get Documents of Obeying shops and establishment Acts.Get registered documents of Import Export code from D.G of Foreign Trade.Have a registration documents of software Technologies park of India(SPTI)An approval from FIPB and RBI about foreign companies investing in IndiaThings you should do after incorporation of a private limited companyFile E-Form INC22For Situtaion of registered officeSituation of Registered office has to be intimated within 30 days from the date of incorporation to the registart of company. As per Section 12 of companies act 2013 a company shall, on and form the 15thday of its incorporation and all times thereafter shall have a registered office.Display companies identity and other DetailsAfter Incorporation of your company it’s the duty of the company to display following things Outside the company’s Registred office. These details are also required to be printed in all business letters, bill-heads and in all other official publications.In FinalRegistering your Brand will provide a Trustworthiness view towards your company. Incorporating your company will establish your brand and Ensures that you have a unique New business. If you need help regarding registering your ecommerce online store, don’t Hesitate to contact us.

Create this form in 5 minutes!

How to create an eSignature for the digital signature certificate filled form

How to make an eSignature for your Digital Signature Certificate Filled Form in the online mode

How to generate an eSignature for the Digital Signature Certificate Filled Form in Chrome

How to make an eSignature for signing the Digital Signature Certificate Filled Form in Gmail

How to create an eSignature for the Digital Signature Certificate Filled Form from your smartphone

How to create an eSignature for the Digital Signature Certificate Filled Form on iOS devices

How to create an electronic signature for the Digital Signature Certificate Filled Form on Android OS

People also ask

-

What is the sify digital signature certificate subscription form?

The sify digital signature certificate subscription form is a simple and secure way to apply for a digital signature certificate through Sify Technologies. This form enables you to obtain a legally compliant digital signature that is essential for signing documents electronically. This process streamlines the way businesses manage documentation, ensuring efficiency and security.

-

How much does the sify digital signature certificate subscription form cost?

Pricing for the sify digital signature certificate subscription form varies based on the type and duration of the digital signature you select. Typically, you can expect competitive rates that cater to businesses of all sizes. Additionally, the cost includes ongoing support and assurance of compliance with digital signature regulations.

-

What are the main features of the digital signature certificate obtained through the sify subscription form?

The sify digital signature certificate subscription form provides features such as secure encryption, identity verification, and legal recognition of electronically signed documents. Users also benefit from quick access to documents, reducing turnaround time for approvals and signatures. It ensures compliance with the IT Act and supports multiple document formats.

-

How does the sify digital signature certificate enhance security?

The sify digital signature certificate enhances security by using advanced encryption techniques that safeguard against tampering and unauthorized access. Each signature is linked to the signer’s identity, providing non-repudiation and authenticity. This makes digital transactions safer for both businesses and clients.

-

Can the sify digital signature certificate be integrated with other software?

Yes, the sify digital signature certificate can be easily integrated with various document management and e-signing software, including airSlate SignNow. This integration simplifies the signing process and helps streamline workflows. It allows users to manage documents seamlessly while ensuring compliance with digital signature standards.

-

What benefits does the sify digital signature certificate offer to businesses?

The sify digital signature certificate offers numerous benefits, including reduced paperwork, faster transaction times, and improved security. By using this certificate, businesses can enhance client trust and ensure compliance with legal requirements. This effectively increases productivity and allows for more efficient operations.

-

Is there customer support available for the sify digital signature certificate subscription form?

Absolutely! Customers can access comprehensive support for the sify digital signature certificate subscription form through various channels, including phone, email, and live chat. The support team is dedicated to helping users navigate the subscription process and troubleshoot any issues that arise. This ensures that businesses can focus on their core operations without interruptions.

Get more for Digital Signature Certificate Subscription Form

- Multi purpose change form

- Dd form 3012 tunnel reconnaissance report february 2016

- 866 463 7272 form

- Form hud 92006

- Gtaw wps form

- Southern cross claim form 431082870

- For canadians 16 years of age or over applying outside of canada and from the usa form

- This form is to be used for burnaby students whose parentslegal guardians maintain primary residence within the city of

Find out other Digital Signature Certificate Subscription Form

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter