Pursuant to the Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, the Form

What is the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

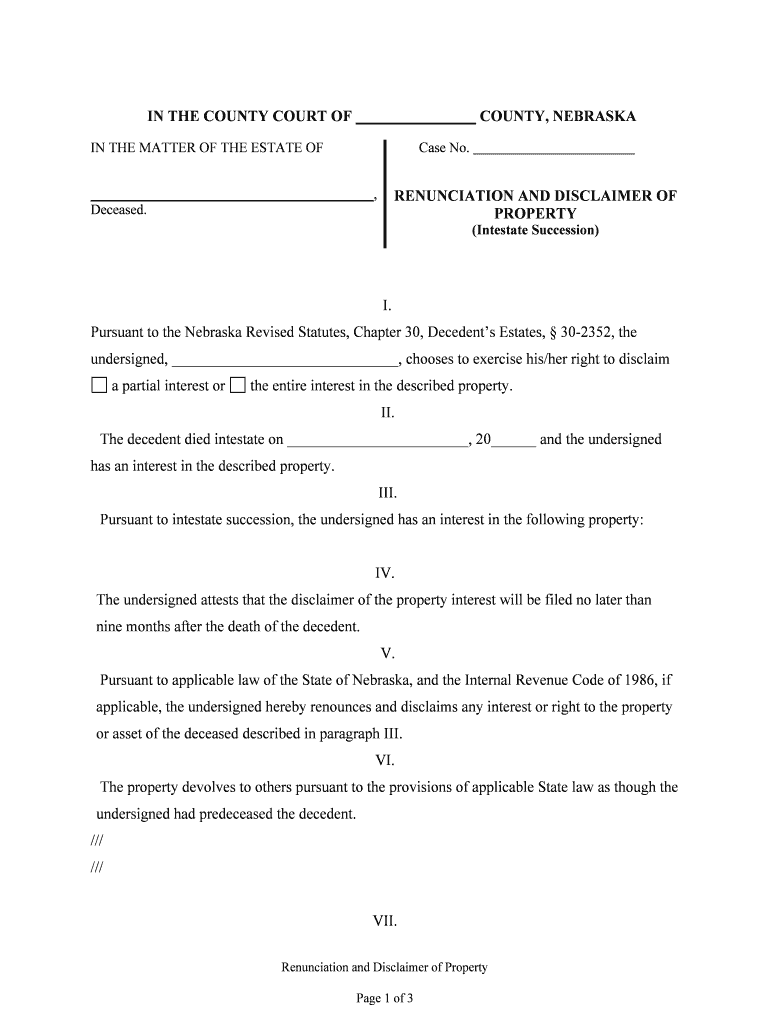

The Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The form is a legal document that addresses the distribution of a deceased person's estate in accordance with Nebraska law. This statute outlines the procedures for handling the affairs of decedents, ensuring that assets are allocated according to the deceased's wishes or state law when no will exists. Understanding this form is crucial for executors, administrators, and beneficiaries involved in estate matters.

How to use the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

Using the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The form involves several steps that ensure compliance with legal requirements. First, gather all necessary information regarding the decedent's estate, including asset details and beneficiary information. Next, fill out the form accurately, ensuring that all required fields are completed. Finally, submit the form to the appropriate court or authority, following any specific filing instructions provided by Nebraska law.

Steps to complete the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

Completing the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The form requires careful attention to detail. Here are the essential steps:

- Collect necessary documentation, including the decedent's will, if available, and financial records.

- Fill out the form with accurate information about the decedent and their estate.

- Ensure all signatures are obtained from relevant parties, such as executors or administrators.

- Review the completed form for accuracy and completeness.

- File the form with the appropriate court, adhering to any submission guidelines.

Legal use of the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

The legal use of the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The form is governed by Nebraska law, which stipulates the conditions under which the document must be executed. This includes ensuring that the form is signed by the appropriate parties and submitted within the designated timeframes. Compliance with these legal requirements is essential for the form to be considered valid in the eyes of the law.

Key elements of the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

Several key elements are crucial for the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The form to be effective:

- Identification of the decedent and their estate, including all relevant details.

- Clear instructions regarding the distribution of assets.

- Signatures from authorized individuals, such as executors or beneficiaries.

- Compliance with Nebraska's legal requirements for estate administration.

State-specific rules for the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

State-specific rules play a vital role in the execution of the Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The form. Nebraska law outlines specific procedures for filing, including deadlines and required documentation. Understanding these rules is essential for ensuring that the form is processed efficiently and legally, preventing potential disputes or delays in the estate administration process.

Quick guide on how to complete pursuant to the nebraska revised statutes chapter 30 decedents estates 30 2352 the

Easily Prepare Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools needed to create, edit, and eSign your documents swiftly without any delays. Manage Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

Effortlessly Edit and eSign Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

- Obtain Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The and click Get Form to start.

- Use the tools available to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget the hassle of lost or misplaced documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Edit and eSign Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The' mean for document signing?

Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The outlines specific requirements for signing documents related to estates in Nebraska. airSlate SignNow adheres to these legal standards, making it simpler for users to execute estate-related documents digitally. This compliance ensures that your eSignatures are legally binding and recognized under Nebraska law.

-

How can airSlate SignNow simplify the estate management process?

airSlate SignNow streamlines the estate management process by allowing users to eSign critical documents easily and securely. Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The emphasizes the importance of proper document handling, and our platform ensures compliance and efficiency. This saves users time and minimizes the risk of errors.

-

Is there a cost associated with using airSlate SignNow for estate documents?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling estate documents. Users can take advantage of our extensive features at competitive rates, ensuring that they can comply with legal statutes, including Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The, without breaking the bank.

-

What features does airSlate SignNow offer for estate document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage to manage estate documents effectively. By adhering to legal frameworks, including Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The, our platform enhances the integrity and efficiency of estate management tasks.

-

Can airSlate SignNow integrate with other software used in estate management?

Absolutely! airSlate SignNow supports integrations with several popular business applications, allowing for seamless workflow in estate management. This interoperability ensures that operations remain compliant with regulations, such as Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The, while optimizing efficiency across systems.

-

How does eSigning with airSlate SignNow enhance security for estate documents?

Security is a top priority for airSlate SignNow, especially when managing sensitive estate documents. Our platform employs bank-level encryption and complies with legal requirements, such as Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The, to protect your information. Users can confidently eSign knowing their documents are safeguarded against unauthorized access.

-

What benefits can businesses expect from using airSlate SignNow for estate documents?

Businesses utilizing airSlate SignNow for estate documents can expect reduced turnaround times, increased efficiency, and 100% compliance with regulations like Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The. Our user-friendly platform ensures that teams can execute critical documents quickly and with accuracy, ultimately enhancing overall productivity.

Get more for Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

Find out other Pursuant To The Nebraska Revised Statutes, Chapter 30, Decedents Estates, 30 2352, The

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form