Trainer Shall Be Responsible for the Payment of Any and All Gross Receipts Taxes, Income Form

What is the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income

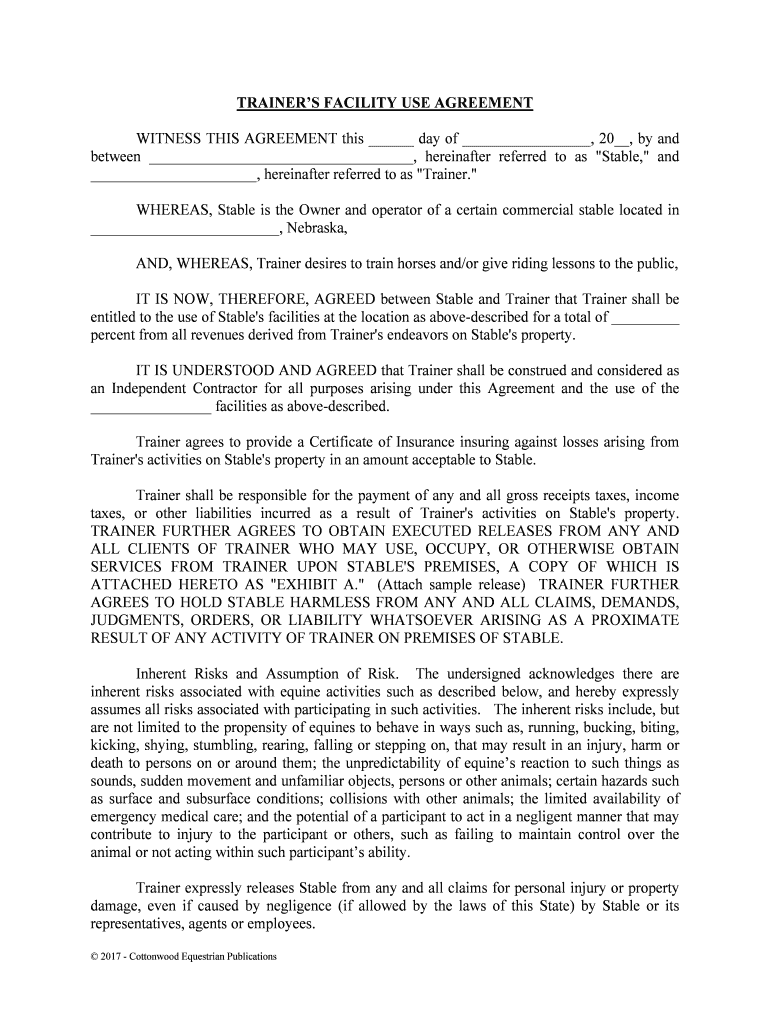

The form titled "Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income" outlines the financial responsibilities of a trainer regarding taxes. This form is crucial for ensuring that trainers acknowledge their obligation to pay any gross receipts taxes and income taxes associated with their earnings. It serves as a legal document that holds the trainer accountable for these financial responsibilities, which may vary based on state regulations and individual circumstances.

Steps to complete the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income

Completing the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income form involves several key steps:

- Gather necessary information, including your full name, business details, and income sources.

- Review state-specific tax obligations to ensure compliance.

- Fill out the form accurately, ensuring all financial details are correct.

- Sign the document electronically using a secure eSignature platform, which provides a legally binding signature.

- Submit the completed form as required, either online or via mail, depending on your state’s regulations.

Legal use of the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income

The legal use of this form is essential for compliance with tax regulations. It ensures that trainers are aware of their tax obligations and provides a framework for accountability. By signing this document, trainers agree to adhere to applicable laws regarding gross receipts and income taxes, which can help prevent legal issues and penalties in the future. It is important to keep a copy of the signed form for your records as proof of compliance.

Key elements of the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income

Several key elements are vital for the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income form:

- Trainer Information: Full name and contact details of the trainer.

- Income Sources: Detailed description of income-generating activities.

- Tax Obligations: A clear statement outlining the trainer's responsibility for taxes.

- Signature: An electronic signature that validates the form.

- Date of Signing: The date when the form is completed and signed.

State-specific rules for the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income

Each state may have specific rules and regulations regarding gross receipts taxes and income taxes that trainers must follow. These rules can affect how the form is completed and submitted. It is important for trainers to research their state’s requirements to ensure compliance. This may include understanding tax rates, filing deadlines, and any additional documentation that may be required.

Penalties for Non-Compliance

Failing to comply with the obligations outlined in the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding these consequences emphasizes the importance of accurately completing and submitting the form to avoid complications with tax authorities.

Quick guide on how to complete trainer shall be responsible for the payment of any and all gross receipts taxes income

Effortlessly Prepare Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as a superb eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and eSign Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income with Ease

- Locate Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all details and then click the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that necessitate reprinting new copies of documents. airSlate SignNow meets all your document management requirements with just a few clicks from your preferred device. Edit and eSign Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean that the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income?

This means that the trainer is accountable for covering all applicable taxes on gross receipts and income. Understanding this responsibility helps trainers manage their financial obligations effectively when using our services.

-

How does airSlate SignNow handle pricing for trainers?

Our pricing model ensures that trainers can use our platform without fearing unexpected fees. However, the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income, which is vital for financial planning.

-

What features does airSlate SignNow offer to support trainers?

airSlate SignNow provides features like document templates, eSignature capabilities, and custom workflows that streamline the paperwork process. This empowers trainers to focus on their core activities while ensuring the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow seamlessly integrates with various business tools and platforms, allowing for improved efficiency. It is crucial for trainers to keep in mind that the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income when using integrated services.

-

What benefits do trainers gain from using airSlate SignNow?

Trainers benefit from an efficient document management system, enhanced workflow automation, and reduced administrative burdens. This allows them to concentrate on training while ensuring the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income is managed appropriately.

-

Can airSlate SignNow help in automating invoicing for trainers?

Absolutely! airSlate SignNow can automate invoicing processes, saving trainers time and effort. Just remember that the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income when managing your invoices.

-

How secure is airSlate SignNow for sensitive trainer information?

Security is a priority at airSlate SignNow, with robust encryption and data protection measures in place. Trainers can securely manage their documents while understanding that the Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income to ensure compliance.

Get more for Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income

- Vehicle inspection sheet form

- Md review form

- Form 1323 application for service or disability retirement sra state md

- Maryland workers comp commission about issues filed on my claim form

- Masshousing payoff request form

- Massport badge security questions form

- Vbill access agreement form committee for public counsel services publiccounsel

- Appointments questionnaire michigan senate republicans state senate michigan form

Find out other Trainer Shall Be Responsible For The Payment Of Any And All Gross Receipts Taxes, Income

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile