Form NE 988LT

What is the Form NE 988LT

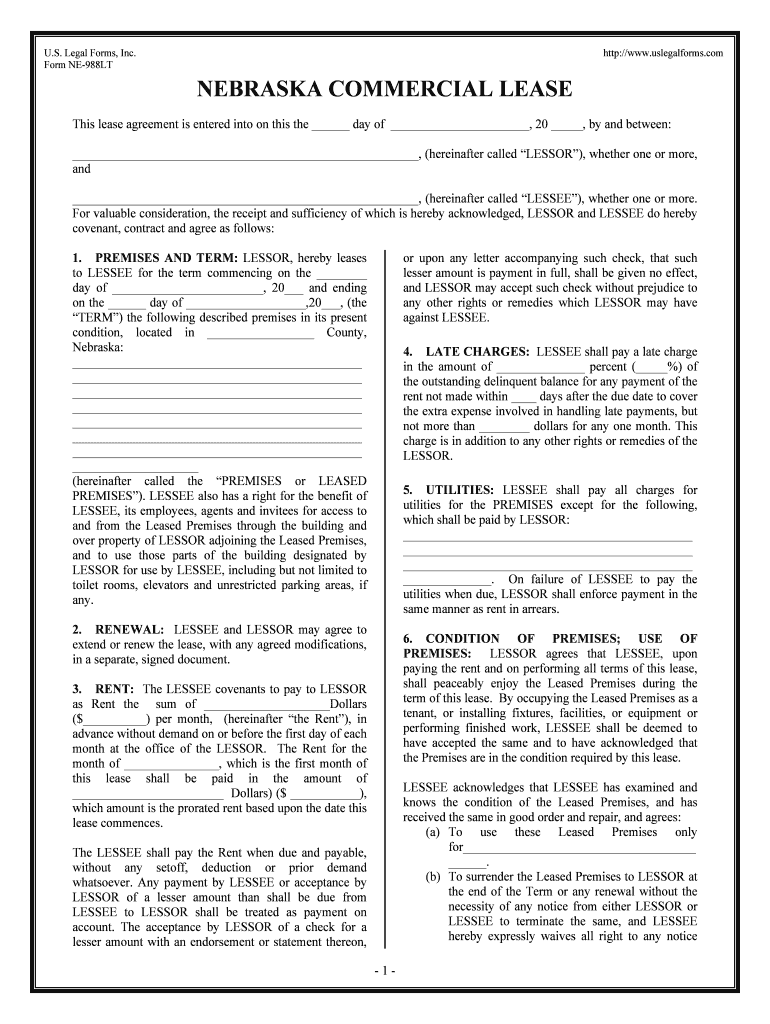

The Form NE 988LT is a specific document used in the state of Nebraska, primarily for tax purposes. This form is designed to facilitate the reporting of certain tax-related information to the Nebraska Department of Revenue. It is essential for individuals and businesses to understand the purpose of this form to ensure compliance with state tax regulations.

How to use the Form NE 988LT

Using the Form NE 988LT involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your personal details and any relevant financial data. Next, carefully fill out the form, making sure to follow the instructions provided. Once completed, review the form for any errors before submitting it to the appropriate state agency. It is crucial to keep a copy for your records.

Steps to complete the Form NE 988LT

Completing the Form NE 988LT requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the Nebraska Department of Revenue website.

- Fill in your name, address, and taxpayer identification number accurately.

- Provide the required financial information as specified in the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the guidelines provided, either online or by mail.

Legal use of the Form NE 988LT

The Form NE 988LT is legally binding when completed and submitted according to Nebraska state laws. It must be filled out truthfully and accurately to avoid potential legal repercussions. The information provided on this form is used by the state to assess tax liabilities and ensure compliance with tax obligations.

Who Issues the Form

The Form NE 988LT is issued by the Nebraska Department of Revenue. This state agency is responsible for administering tax laws and ensuring that taxpayers comply with state regulations. It is essential to obtain the form directly from the official state source to ensure that you are using the most current version.

Filing Deadlines / Important Dates

Filing deadlines for the Form NE 988LT can vary depending on the specific tax year and the type of taxpayer. Generally, it is advisable to submit the form by the specified due date to avoid penalties. Taxpayers should check the Nebraska Department of Revenue website for the most accurate and up-to-date information regarding filing deadlines and any important dates related to tax submissions.

Quick guide on how to complete form ne 988lt

Effortlessly Prepare Form NE 988LT on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the essential tools to create, edit, and electronically sign your documents swiftly and without issues. Manage Form NE 988LT on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Form NE 988LT with Ease

- Locate Form NE 988LT and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form NE 988LT to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form NE 988LT and how can airSlate SignNow help with it?

Form NE 988LT is a specific form used for tax purposes in Nebraska, and airSlate SignNow provides an efficient platform for sending and eSigning this form. With our user-friendly interface, you can complete and submit Form NE 988LT quickly, ensuring compliance and saving time.

-

Is there a cost associated with using airSlate SignNow for Form NE 988LT?

Yes, airSlate SignNow operates on a subscription-based model, but it offers competitive pricing that aligns with your business needs. For those needing to eSign Form NE 988LT frequently, investing in our solution can signNowly reduce the time spent on document management.

-

What features does airSlate SignNow offer for managing Form NE 988LT?

airSlate SignNow offers a range of features to streamline the process of managing Form NE 988LT, including template creation, automated workflows, and mobile access. These features enhance efficiency, allowing you to focus on your core business operations.

-

How can airSlate SignNow improve the signing process for Form NE 988LT?

With airSlate SignNow, you can enhance the signing process for Form NE 988LT by leveraging templates and reminders. This ensures that all parties are notified promptly and can eSign the document with ease, signNowly speeding up approvals.

-

Can I integrate airSlate SignNow with other tools for Form NE 988LT processing?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and document management systems, allowing you to handle Form NE 988LT alongside your existing tools. This integration capability helps create a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for Form NE 988LT as opposed to traditional methods?

Using airSlate SignNow for Form NE 988LT provides numerous benefits, including increased efficiency, reduced paper usage, and improved tracking of submissions. Transitioning to an electronic solution minimizes the risk of errors and enhances overall productivity.

-

Is airSlate SignNow secure for handling sensitive information on Form NE 988LT?

Yes, airSlate SignNow prioritizes the security of your documents, including Form NE 988LT. Our platform utilizes industry-standard encryption and compliance with data protection regulations to ensure that all sensitive information remains safe and secure.

Get more for Form NE 988LT

Find out other Form NE 988LT

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free