Installment Loan Act Chapter 45, Article 10 Nebraska Form

What is the Installment Loan Act Chapter 45, Article 10 Nebraska

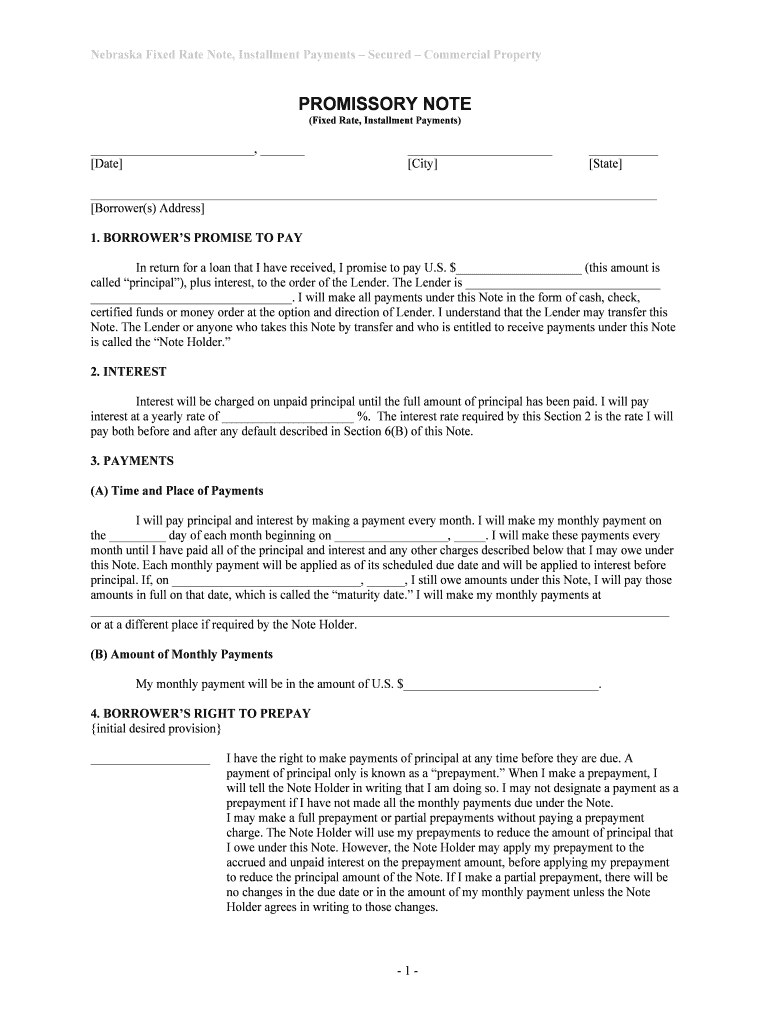

The Installment Loan Act Chapter 45, Article 10 in Nebraska regulates the terms and conditions under which installment loans can be issued. This legislation aims to protect consumers by establishing guidelines for lenders, ensuring transparency in loan agreements, and setting limits on interest rates and fees. It covers various aspects of installment loans, including the maximum loan amounts, repayment schedules, and borrower rights. Understanding this act is crucial for both lenders and borrowers to ensure compliance and informed decision-making.

Key elements of the Installment Loan Act Chapter 45, Article 10 Nebraska

Several key elements define the framework of the Installment Loan Act Chapter 45, Article 10. These include:

- Loan Limits: The act specifies the maximum amount that can be borrowed under an installment loan.

- Interest Rates: It establishes the maximum allowable interest rates that lenders can charge, protecting borrowers from excessive fees.

- Repayment Terms: The act outlines the repayment schedule, including the duration and frequency of payments.

- Borrower Rights: It ensures that borrowers are informed of their rights, including the right to receive clear and concise loan terms.

Steps to complete the Installment Loan Act Chapter 45, Article 10 Nebraska

Completing the requirements of the Installment Loan Act Chapter 45, Article 10 involves several steps. Borrowers should first assess their financial needs and determine the amount they wish to borrow. Next, they should research potential lenders and compare their terms, including interest rates and fees. After selecting a lender, borrowers will need to fill out an application form, providing necessary documentation such as proof of income and identification. Once the application is submitted, the lender will review it and communicate any further requirements or the approval status.

Legal use of the Installment Loan Act Chapter 45, Article 10 Nebraska

The legal use of the Installment Loan Act Chapter 45, Article 10 is essential for ensuring that both lenders and borrowers adhere to the established regulations. Lenders must comply with the act's stipulations regarding interest rates, loan limits, and borrower disclosures. Failure to comply can result in penalties or legal action. Borrowers, on the other hand, should familiarize themselves with their rights under the act to ensure they are treated fairly throughout the loan process.

Eligibility Criteria

Eligibility for obtaining an installment loan under the Installment Loan Act Chapter 45, Article 10 typically includes several criteria. Borrowers must be at least eighteen years old and possess a valid form of identification. Additionally, proof of income or employment is often required to demonstrate the ability to repay the loan. Lenders may also assess credit history, although the act encourages responsible lending practices that do not disproportionately disadvantage borrowers with lower credit scores.

Application Process & Approval Time

The application process for an installment loan under the Installment Loan Act Chapter 45, Article 10 generally involves submitting a completed application form along with supporting documentation. Once submitted, lenders will review the application, which may take anywhere from a few hours to several days, depending on the lender's policies and the completeness of the application. Communication regarding the approval status is typically provided promptly, allowing borrowers to plan accordingly.

Quick guide on how to complete installment loan act chapter 45 article 10 nebraska

Easily Prepare Installment Loan Act Chapter 45, Article 10 Nebraska on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents efficiently and without hassle. Manage Installment Loan Act Chapter 45, Article 10 Nebraska on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Installment Loan Act Chapter 45, Article 10 Nebraska Effortlessly

- Find Installment Loan Act Chapter 45, Article 10 Nebraska and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with specialized tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and eSign Installment Loan Act Chapter 45, Article 10 Nebraska to guarantee outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Installment Loan Act Chapter 45, Article 10 Nebraska?

The Installment Loan Act Chapter 45, Article 10 Nebraska regulates the terms and conditions under which installment loans can be issued in Nebraska. This act ensures that lending practices are fair and transparent, protecting consumers while providing lenders with a framework to operate within.

-

How does airSlate SignNow help with compliance to the Installment Loan Act Chapter 45, Article 10 Nebraska?

airSlate SignNow offers a user-friendly platform that helps businesses create and manage documents in compliance with the Installment Loan Act Chapter 45, Article 10 Nebraska. By streamlining document workflows, businesses can ensure that they meet all regulatory requirements efficiently and effectively.

-

What are the key features of airSlate SignNow relevant to the Installment Loan Act Chapter 45, Article 10 Nebraska?

Key features of airSlate SignNow include easy eSigning, template management, and secure document storage. These features help businesses comply with the Installment Loan Act Chapter 45, Article 10 Nebraska by facilitating quick processing and maintaining accurate records.

-

Is airSlate SignNow a cost-effective solution for managing loans under the Installment Loan Act Chapter 45, Article 10 Nebraska?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage documents related to the Installment Loan Act Chapter 45, Article 10 Nebraska. By reducing manual paperwork and speeding up the signing process, businesses can cut costs and improve their overall efficiency.

-

How can I integrate airSlate SignNow with other platforms to comply with the Installment Loan Act Chapter 45, Article 10 Nebraska?

airSlate SignNow allows for seamless integrations with major tools and platforms, making it easy to incorporate it into your existing workflow. This flexibility is crucial for businesses handling loans under the Installment Loan Act Chapter 45, Article 10 Nebraska, as it ensures all systems are aligned and compliant.

-

What benefits does airSlate SignNow provide specifically for businesses dealing with the Installment Loan Act Chapter 45, Article 10 Nebraska?

airSlate SignNow empowers businesses by digitizing the signing process, which is particularly beneficial for those dealing with the Installment Loan Act Chapter 45, Article 10 Nebraska. By providing quicker turnaround times and reducing the chance of paperwork errors, businesses can enhance their service delivery.

-

Can airSlate SignNow help in educating clients about the Installment Loan Act Chapter 45, Article 10 Nebraska?

Yes, airSlate SignNow can be utilized to create informative documents and guides that educate clients about the Installment Loan Act Chapter 45, Article 10 Nebraska. By having access to these resources, clients can better understand their rights and responsibilities under the law.

Get more for Installment Loan Act Chapter 45, Article 10 Nebraska

- Employment application st johns county clerk of courts form

- St johns county case search form

- Occupational license application process st john the baptist parish form

- Tarrant county probation department form

- Tarrant county criminal form

- Tarrant county divorce downloadable forms

- Ares application forms 2004

- Esc application trumbull county storm water district form

Find out other Installment Loan Act Chapter 45, Article 10 Nebraska

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure