Pa 1000 Rc Form 2004

What is the Pa 1000 Rc Form

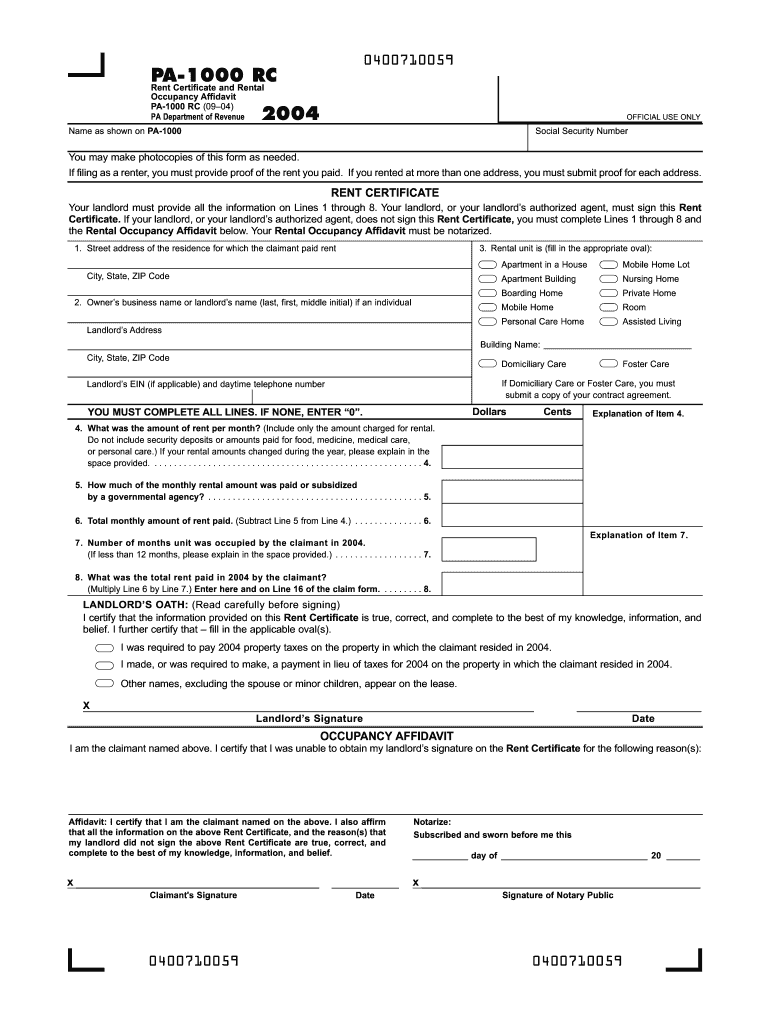

The Pa 1000 Rc Form is a specific tax form used in Pennsylvania for reporting income tax. This form is essential for individuals and businesses to accurately report their income and calculate their tax liabilities. It is designed to ensure compliance with state tax regulations and is a vital component of the overall tax filing process in Pennsylvania. Understanding the purpose and requirements of the Pa 1000 Rc Form is crucial for taxpayers to avoid penalties and ensure timely submissions.

Steps to complete the Pa 1000 Rc Form

Completing the Pa 1000 Rc Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, providing accurate information in each section, such as your personal details, income sources, and deductions. It is important to double-check all entries for accuracy before signing the form. Finally, submit the completed form either electronically or via mail, ensuring that it is sent to the correct address as specified by the Pennsylvania Department of Revenue.

How to obtain the Pa 1000 Rc Form

The Pa 1000 Rc Form can be obtained through the Pennsylvania Department of Revenue's official website. Taxpayers can download a printable version of the form directly from the site. Additionally, physical copies may be available at local tax offices or libraries. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Legal use of the Pa 1000 Rc Form

The legal use of the Pa 1000 Rc Form is governed by Pennsylvania tax law. This form must be completed accurately and submitted by the designated filing deadlines to avoid penalties. Taxpayers are required to provide truthful information, as any discrepancies or fraudulent claims can lead to severe legal consequences, including fines or criminal charges. Understanding the legal implications of the Pa 1000 Rc Form is essential for maintaining compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Pa 1000 Rc Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online through the Pennsylvania Department of Revenue’s e-filing system, which provides a quick and secure way to submit tax information. Alternatively, individuals can mail the completed form to the appropriate tax office, ensuring that it is postmarked by the filing deadline. In-person submissions may also be possible at designated tax offices, allowing for direct interaction with tax officials if needed.

Filing Deadlines / Important Dates

Filing deadlines for the Pa 1000 Rc Form are crucial for taxpayers to observe. Typically, the form must be submitted by April 15 of each year, aligning with the federal tax filing deadline. However, it is important to check for any changes or extensions that may be announced by the Pennsylvania Department of Revenue. Missing the deadline can result in penalties and interest on unpaid taxes, making it essential to stay informed about important dates related to tax filing.

Quick guide on how to complete pa 1000 rc 2015 2004 form

Your assistance manual on how to prepare your Pa 1000 Rc Form

If you’re wondering how to generate and submit your Pa 1000 Rc Form, here are a few brief instructions to simplify tax processing.

To begin, you merely need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to modify, create, and finalize your tax forms with simplicity. Utilizing its editor, you can alternate between text, check boxes, and electronic signatures and revisit to amend responses as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the instructions below to complete your Pa 1000 Rc Form in minutes:

- Establish your account and start working on PDFs within moments.

- Employ our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Pa 1000 Rc Form in our editor.

- Populate the mandatory fillable fields with your details (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-binding electronic signature (if necessary).

- Review your document and rectify any mistakes.

- Save alterations, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper may increase return errors and postpone refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct pa 1000 rc 2015 2004 form

FAQs

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

I cannot fill up the ITR form on my own. If I go to any professional, they will charge me Rs. 1000, which I cannot pay. What can be my way out?

I can fill it for you…

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the pa 1000 rc 2015 2004 form

How to make an electronic signature for your Pa 1000 Rc 2015 2004 Form in the online mode

How to generate an eSignature for the Pa 1000 Rc 2015 2004 Form in Chrome

How to create an electronic signature for putting it on the Pa 1000 Rc 2015 2004 Form in Gmail

How to make an electronic signature for the Pa 1000 Rc 2015 2004 Form right from your smartphone

How to create an electronic signature for the Pa 1000 Rc 2015 2004 Form on iOS

How to create an electronic signature for the Pa 1000 Rc 2015 2004 Form on Android

People also ask

-

What is the Pa 1000 Rc Form?

The Pa 1000 Rc Form is a state-specific form used by Pennsylvania businesses for various tax-related purposes. It is essential for ensuring compliance and accurate reporting of income or corporate taxes. Utilizing a reliable eSigning solution like airSlate SignNow can streamline the completion and submission of the Pa 1000 Rc Form.

-

How does airSlate SignNow simplify the Pa 1000 Rc Form process?

airSlate SignNow simplifies the Pa 1000 Rc Form process by allowing users to electronically sign and send documents seamlessly. With user-friendly features and templates, businesses can easily fill out the Pa 1000 Rc Form and send it to relevant parties without any hassle. This saves time and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for the Pa 1000 Rc Form?

Using airSlate SignNow for the Pa 1000 Rc Form offers several benefits including increased efficiency, reduced printing costs, and secure eSignature capabilities. It enhances collaboration by allowing multiple signees to review and sign the form quickly. Businesses can also track the status of the document in real-time for better management.

-

Is there a pricing structure for using airSlate SignNow to manage the Pa 1000 Rc Form?

Yes, airSlate SignNow offers flexible pricing plans to cater to different business needs when managing the Pa 1000 Rc Form. Pricing is based on features and the number of users, allowing businesses to choose the plan that fits their requirements. They also provide a free trial so users can explore the platform before committing.

-

Can I integrate airSlate SignNow with other software for processing the Pa 1000 Rc Form?

Absolutely! airSlate SignNow integrates with a variety of software solutions, enabling users to process the Pa 1000 Rc Form within their existing workflows. Popular integrations include CRMs, project management tools, and cloud storage platforms. This ensures that document management is streamlined and efficient.

-

How secure is the process of signing the Pa 1000 Rc Form on airSlate SignNow?

The security of your documents, including the Pa 1000 Rc Form, is a top priority at airSlate SignNow. The platform employs bank-level encryption and complies with industry standards for data protection. Users can rest assured that their sensitive information remains confidential and secure throughout the signing process.

-

What features does airSlate SignNow provide for managing the Pa 1000 Rc Form?

airSlate SignNow offers a variety of features for managing the Pa 1000 Rc Form, including customizable templates, automated reminders, and real-time tracking of document status. These features facilitate a smooth signing process and enhance the overall user experience. Users can easily navigate and complete the form without complications.

Get more for Pa 1000 Rc Form

Find out other Pa 1000 Rc Form

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed