Nys 45 Form 2005-2026

What is the NYS 45 Form

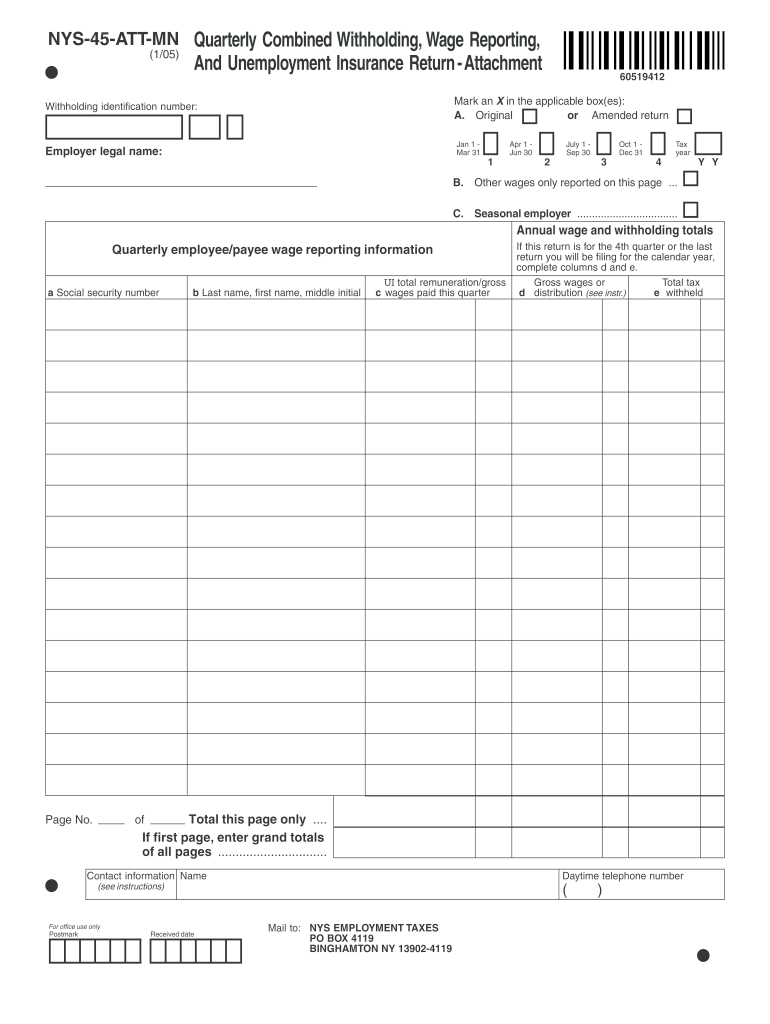

The NYS 45 form, also known as the New York State Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, is a tax document used by employers in New York. It is essential for reporting employee wages and the taxes withheld from those wages, as well as for unemployment insurance contributions. This form helps ensure compliance with state tax laws and provides necessary information to the New York State Department of Taxation and Finance.

Steps to Complete the NYS 45 Form

Completing the NYS 45 form involves several key steps. First, gather all relevant payroll information for the reporting period, including employee wages and tax withholdings. Next, accurately fill out the required sections of the form, ensuring that all figures are correct. It's important to review the instructions for the form to ensure compliance with any specific requirements. After completing the form, sign and date it before submission. Finally, choose your preferred submission method, whether online, by mail, or in person.

How to Obtain the NYS 45 Form

The NYS 45 form can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing employers to print and complete it manually. Additionally, employers can access the form through various payroll software programs that offer integrated solutions for tax reporting. Make sure to select the correct version of the form based on the reporting period you are addressing.

Legal Use of the NYS 45 Form

The NYS 45 form is legally required for employers in New York to report wages and taxes. Proper completion and timely submission of this form are crucial for compliance with state laws. Failure to file the form can result in penalties and interest charges. Employers must ensure that the information provided is accurate and complete to avoid any legal repercussions. Utilizing electronic filing options can enhance accuracy and facilitate timely submissions.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the NYS 45 form. The form is typically due on the last day of the month following the end of each calendar quarter. For example, the deadlines are January 31 for the fourth quarter, April 30 for the first quarter, July 31 for the second quarter, and October 31 for the third quarter. Staying informed about these deadlines is essential to avoid late fees and penalties.

Form Submission Methods

The NYS 45 form can be submitted through various methods. Employers have the option to file online through the New York State Department of Taxation and Finance website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed to the appropriate address provided in the instructions or submitted in person at designated offices. Each method has its benefits, and employers should choose the one that best fits their needs.

Penalties for Non-Compliance

Non-compliance with the NYS 45 filing requirements can lead to significant penalties. Employers who fail to file the form on time may incur late fees, which can accumulate over time. Additionally, inaccuracies in the reported information can result in further penalties and interest charges. It is crucial for employers to understand these risks and ensure that they meet all filing requirements to avoid unnecessary financial burdens.

Quick guide on how to complete nys 45 att mn fill in form

Your assistance manual on how to prepare your Nys 45 Form

If you wish to learn how to finalize and submit your Nys 45 Form, below are some concise guidelines on how to simplify tax filing signNowly.

To begin, you simply need to register for your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and complete your tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and return to amend answers when necessary. Simplify your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Nys 45 Form in just a few minutes:

- Establish your account and start working on PDFs within a few moments.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Retrieve form to access your Nys 45 Form in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to include your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please remember that paper filing can lead to return mistakes and postpone refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Is it necessary to fill in previous attempts while filling out the IBPS PO form?

It will be considered in future. Whenever IBPS Will put an constraint on number of attempts a candidate has given.Like say, SBI allows a UR candidate to appear in at most 4 attempts.These attempts are calculated by the recruiting agency in future through their database details.If you don’t fill it accurately, or fill wrong detail, your application may be rejected.How to fill IBPS PO Form Without Getting Rejected

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

How can I fill out a form to become a pilot in Nepal?

Obtain the forms. Read the forms. Add correct information.

-

How do I fill out the ITR II form in case my MNC gave an awarded share in a foreign German account?

This is better answered by a CA. I can give my experience.There are two factors here. 1. Perquisite - This is the difference between the price of the share at the time of vesting (also called Fair Market Value) and the cost you paid for it (which is mostly zero). This would be taxed as part of the salary in the year of vesting 2. Capital gains - When you sell the shares, capital gains would be calculated on the difference between the selling price and FMV Since no STT would have been paid on the transaction, the stock would be treated as ‘non-equity’ and corresponding treatment would apply. Currently the tax is your marginal tax rate for holding period < 3 years, and 20% with indexation for period > 3 years.Also ensure that you list the foreign account in Schedule FA.

Create this form in 5 minutes!

How to create an eSignature for the nys 45 att mn fill in form

How to create an electronic signature for your Nys 45 Att Mn Fill In Form online

How to generate an eSignature for your Nys 45 Att Mn Fill In Form in Google Chrome

How to make an eSignature for putting it on the Nys 45 Att Mn Fill In Form in Gmail

How to make an electronic signature for the Nys 45 Att Mn Fill In Form right from your smart phone

How to create an eSignature for the Nys 45 Att Mn Fill In Form on iOS

How to make an eSignature for the Nys 45 Att Mn Fill In Form on Android

People also ask

-

What is the NYS 45 amended form, and why is it important?

The NYS 45 amended form is a critical document used in New York State for reporting employee wages and taxes. Filing this form accurately is essential for compliance with state regulations, ensuring that businesses meet their tax obligations effectively.

-

How does airSlate SignNow simplify the process of submitting the NYS 45 amended form?

airSlate SignNow streamlines the submission of the NYS 45 amended form by providing an intuitive eSigning platform. You can easily fill out, sign, and submit your forms electronically, reducing the risk of errors and ensuring timely submissions.

-

What pricing options does airSlate SignNow offer for businesses needing to file the NYS 45 amended?

airSlate SignNow offers flexible pricing plans designed to fit the needs of businesses of all sizes. Whether you're a small business or a large organization, you can select a plan that provides access to essential features for processing the NYS 45 amended form efficiently.

-

Can airSlate SignNow integrate with other accounting software to help with the NYS 45 amended filing?

Yes, airSlate SignNow integrates with various accounting and payroll software tools, making it easier to manage your NYS 45 amended filings. This integration allows for seamless data transfer and enhances the overall workflow, ensuring accuracy and compliance.

-

What features does airSlate SignNow provide that benefit businesses in filing the NYS 45 amended?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage. These tools simplify the process of managing the NYS 45 amended form, helping businesses to stay organized and compliant with state laws.

-

How can I ensure the security of my NYS 45 amended forms when using airSlate SignNow?

airSlate SignNow prioritizes security by utilizing advanced encryption and authentication measures. When you file your NYS 45 amended forms through our platform, you can trust that your sensitive data is protected from unauthorized access.

-

What benefits can I expect from using airSlate SignNow for my NYS 45 amended filings?

Using airSlate SignNow for your NYS 45 amended filings can save you time and reduce the complexity of the filing process. Our platform not only ensures compliance but also allows for efficient document management and collaboration among team members.

Get more for Nys 45 Form

- Informed consent for non contrast the most trusted name

- Letter of authorization form 475025746

- Baco 90 form

- Assistant angling guide consent form frontcounter bc

- Read before you begin this form

- Medical records request athens orthopedic clinic form

- Direct admission reservation form reservation form

- Sheridan wyoming elks lodge 520 form

Find out other Nys 45 Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document