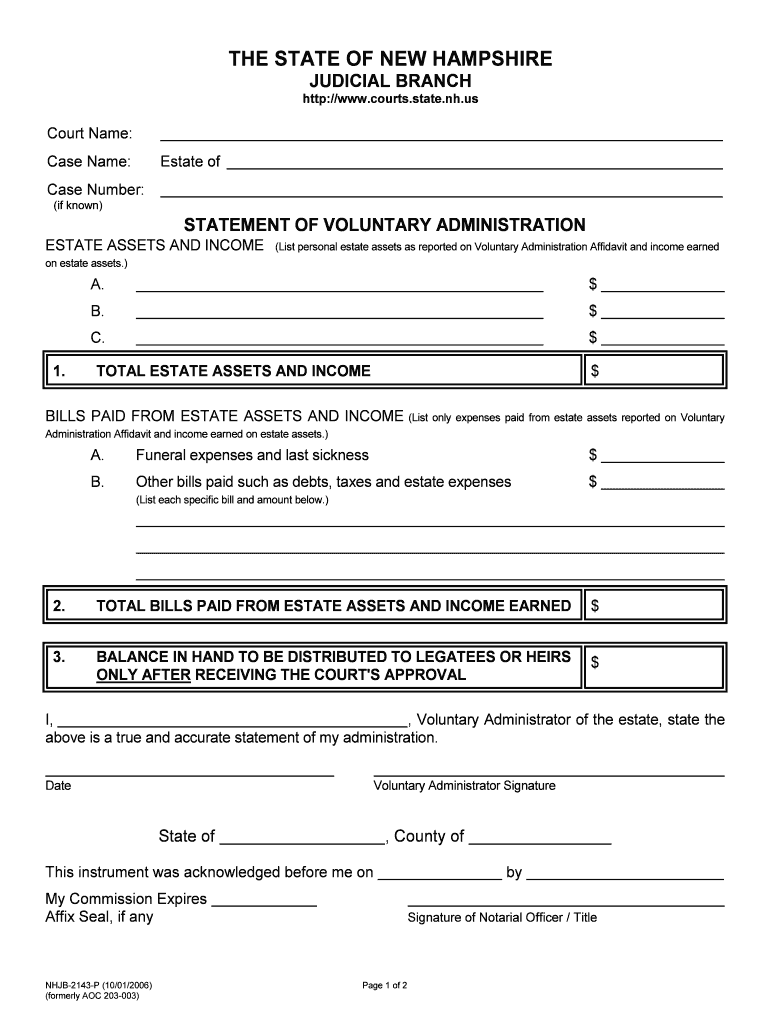

ESTATE ASSETS and INCOME Form

What is the estate assets and income form?

The estate assets and income form is a crucial document used to report the financial status of an estate. It details the assets owned by the deceased, including real estate, bank accounts, investments, and personal property. Additionally, it outlines any income generated by these assets during the estate administration process. This form is essential for ensuring accurate tax reporting and compliance with state and federal regulations.

Steps to complete the estate assets and income form

Completing the estate assets and income form involves several key steps:

- Gather all necessary documentation, including property deeds, bank statements, and investment records.

- List all assets owned by the deceased, providing detailed descriptions and valuations.

- Document any income generated from these assets, such as rental income or dividends.

- Ensure that all information is accurate and complete to avoid potential legal issues.

- Review the form for any errors before submission.

Legal use of the estate assets and income form

The estate assets and income form serves a legal purpose in estate administration. It is used to provide transparency to beneficiaries and the court regarding the financial standing of the estate. Proper completion of this form is necessary to comply with legal requirements, ensuring that the estate is managed according to the wishes of the deceased and applicable laws. Failure to accurately report estate assets and income can lead to legal penalties and complications in the distribution of assets.

Required documents for the estate assets and income form

To complete the estate assets and income form, several documents are typically required:

- Death certificate of the deceased

- Property deeds and titles

- Bank statements for all accounts

- Investment account statements

- Records of personal property and valuables

- Any existing wills or trusts

IRS guidelines for the estate assets and income form

The Internal Revenue Service (IRS) provides specific guidelines regarding the reporting of estate assets and income. These guidelines outline how to value assets, report income, and the tax implications for estates. It is important for executors and administrators to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. The IRS also specifies filing deadlines and necessary forms that may need to accompany the estate assets and income form.

Examples of using the estate assets and income form

Common scenarios for using the estate assets and income form include:

- Settling an estate after the death of an individual, ensuring all assets are accounted for and reported.

- Preparing for tax filings related to the estate, including income generated from assets.

- Providing beneficiaries with a clear understanding of the estate's financial situation.

Penalties for non-compliance with the estate assets and income form

Failure to comply with the requirements of the estate assets and income form can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action against the executor or administrator of the estate. It is crucial to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete estate assets and income

Effortlessly Prepare ESTATE ASSETS AND INCOME on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle ESTATE ASSETS AND INCOME on any device with the airSlate SignNow apps for Android or iOS and simplify any document-centered process today.

How to Modify and eSign ESTATE ASSETS AND INCOME with Ease

- Locate ESTATE ASSETS AND INCOME and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign ESTATE ASSETS AND INCOME and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are estate assets and income, and why are they important?

Estate assets and income refer to the total value and revenue generated from a person's estate after passing. Understanding these components is crucial for accurate estate planning and tax management, ensuring that all assets are appropriately accounted for during the estate settlement process.

-

How can airSlate SignNow help manage estate assets and income documentation?

airSlate SignNow provides a streamlined platform for managing all documentation related to estate assets and income. With eSignature capabilities and automated workflows, users can easily send, sign, and store essential documents securely, removing the hassle from manual processes.

-

What features does airSlate SignNow offer for estate planning?

airSlate SignNow includes features such as customizable templates, secure document storage, and real-time collaboration tools that enhance the management of estate assets and income. These tools ensure that all parties involved in the estate planning process can communicate effectively and make informed decisions.

-

Is airSlate SignNow cost-effective for managing estate assets and income?

Yes, airSlate SignNow offers competitive pricing plans tailored to suit various needs, making it a cost-effective solution for managing estate assets and income. The platform eliminates traditional paper-based processes, saving both time and money for users handling estate documentation.

-

Can airSlate SignNow integrate with other tools for estate planning?

Absolutely, airSlate SignNow supports integration with a range of popular applications, enhancing its functionality for managing estate assets and income. This allows users to connect their preferred tools for accounting, legal services, and project management, providing a comprehensive approach to estate planning.

-

What benefits does eSigning provide for estate documents?

eSigning with airSlate SignNow accelerates the process of finalizing estate documents by allowing instant signatures, which is critical for estate assets and income management. It also adds a layer of security and compliance, ensuring that all signed documents are binding and verifiable.

-

How secure is the data on airSlate SignNow when dealing with estate assets and income?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance with data protection regulations to safeguard sensitive information regarding estate assets and income, ensuring that all documents are stored securely and accessed only by authorized individuals.

Get more for ESTATE ASSETS AND INCOME

Find out other ESTATE ASSETS AND INCOME

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo