Sstgb Form F0003 Fillable

What is the Sstgb Form F0003 Fillable

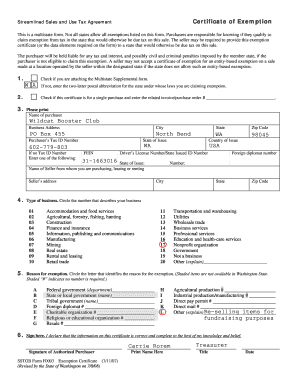

The fillable F0003 form, also known as the SSTGB Form F0003, is a streamlined sales and use tax form used in the United States, specifically for West Virginia. This form is essential for businesses and individuals who need to report and remit sales tax or claim exemption from sales tax on purchases. The fillable version allows users to complete the form digitally, ensuring accuracy and ease of submission.

How to Use the Sstgb Form F0003 Fillable

To effectively use the fillable F0003 form, start by downloading it from a reliable source. Once you have the form, open it in a PDF reader that supports fillable forms. Carefully enter the required information, including your business details, tax identification number, and any applicable exemption claims. Review the completed form to ensure all information is accurate before submission.

Steps to Complete the Sstgb Form F0003 Fillable

Completing the fillable F0003 form involves several straightforward steps:

- Download the fillable F0003 form from a trusted source.

- Open the form in a compatible PDF reader.

- Fill in your business name and address in the designated fields.

- Provide your tax identification number.

- Indicate the type of exemption you are claiming, if applicable.

- Review all entries for accuracy.

- Save the completed form for your records.

Legal Use of the Sstgb Form F0003 Fillable

The fillable F0003 form is legally recognized when completed accurately and submitted according to state regulations. It serves as an official document for reporting sales tax or claiming exemptions, and it must comply with the legal frameworks governing sales tax in West Virginia. Ensuring that the form is filled out correctly is crucial for its acceptance by tax authorities.

Key Elements of the Sstgb Form F0003 Fillable

Key elements of the fillable F0003 form include:

- Business Information: Name, address, and tax identification number.

- Exemption Details: Specific reasons for claiming an exemption.

- Signature: Required to validate the information provided.

- Date of Submission: Important for tracking and compliance purposes.

Form Submission Methods (Online / Mail / In-Person)

The fillable F0003 form can be submitted through various methods. Users may choose to submit the form online via the state’s tax portal, which often ensures quicker processing. Alternatively, the completed form can be mailed to the appropriate tax authority or delivered in person at designated offices. Each method has its own processing times and requirements, so it is advisable to check the latest guidelines from the West Virginia tax authority.

Quick guide on how to complete sstgb form f0003 fillable

Effortlessly Prepare Sstgb Form F0003 Fillable on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly option to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly and without delays. Manage Sstgb Form F0003 Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Alter and Electronically Sign Sstgb Form F0003 Fillable with Ease

- Find Sstgb Form F0003 Fillable and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Sstgb Form F0003 Fillable to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sstgb form f0003 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fillabe f0003?

The fillabe f0003 is a customizable form template designed for efficient data collection and document management. With airSlate SignNow, users can easily fill, sign, and send this template, streamlining their workflow and ensuring accurate submissions.

-

How does the fillabe f0003 integrate with other tools?

The fillabe f0003 seamlessly integrates with various tools and applications, enhancing its usability. By connecting with platforms like Google Drive, Dropbox, and popular CRM systems, airSlate SignNow helps you incorporate the fillabe f0003 into your existing processes effortlessly.

-

Is the fillabe f0003 easy to use for new users?

Yes, the fillabe f0003 is designed with user-friendliness in mind. Anyone can quickly learn to use it with airSlate SignNow's intuitive interface, enabling users to create, fill, and sign documents without prior experience.

-

What are the pricing options for using fillabe f0003?

airSlate SignNow offers flexible pricing plans to access the fillabe f0003, catering to businesses of all sizes. You can choose from monthly or annual subscriptions that provide features tailored to your needs while remaining cost-effective.

-

What features are included with the fillabe f0003?

The fillabe f0003 comes with a rich set of features, including eSignature capabilities, document tracking, and customizable fields. With airSlate SignNow, users can modify the template to fit their specific requirements, improving their document workflows.

-

Can I use the fillabe f0003 for legal documents?

Absolutely! The fillabe f0003 is suitable for various legal documents such as contracts and agreements. airSlate SignNow ensures compliance with legal standards, offering a secure way to fill, sign, and store important documents.

-

How can fillabe f0003 enhance team collaboration?

The fillabe f0003 enhances team collaboration by allowing multiple users to fill and sign documents in real time. With airSlate SignNow's shared access features, your team can work together efficiently, ensuring everyone is on the same page.

Get more for Sstgb Form F0003 Fillable

- Apartment lease rental application questionnaire california form

- Ca lease form

- Salary verification form for potential lease california

- Ca landlord tenant 497298585 form

- California notice default form

- Co signer agreement form

- California application form online

- Inventory and condition of leased premises for pre lease and post lease california form

Find out other Sstgb Form F0003 Fillable

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile