How to Form an LLC in New HampshireNolo

What is the How To Form An LLC In New HampshireNolo

The How To Form An LLC In New HampshireNolo is a legal document designed to guide individuals through the process of establishing a Limited Liability Company (LLC) in New Hampshire. This form outlines the necessary steps, requirements, and compliance measures needed to create an LLC, ensuring that the entity is recognized by the state. It serves as a comprehensive resource for business owners looking to protect their personal assets while enjoying the benefits of a formal business structure.

Steps to complete the How To Form An LLC In New HampshireNolo

Completing the How To Form An LLC In New HampshireNolo involves several important steps:

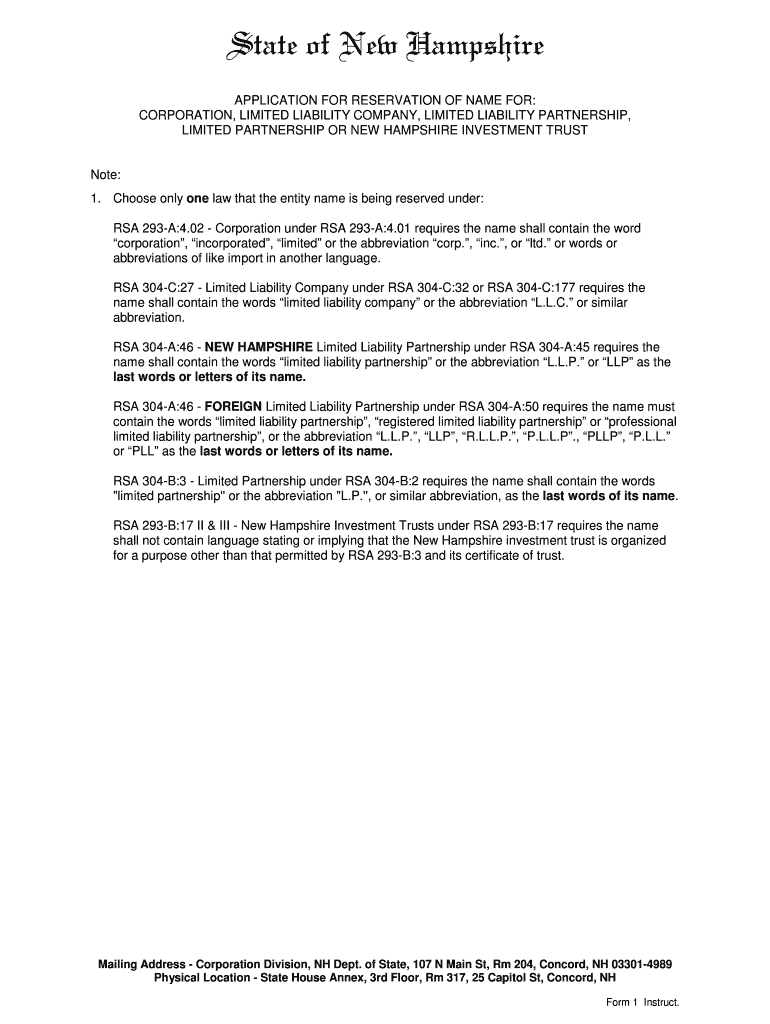

- Choose a unique name for your LLC that complies with New Hampshire naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Certificate of Formation with the New Hampshire Secretary of State, including necessary details about the LLC.

- Pay the required filing fee to process your application.

- Draft an Operating Agreement to outline the management structure and operating procedures of the LLC.

- Obtain any necessary licenses or permits required for your specific business activities.

Legal use of the How To Form An LLC In New HampshireNolo

The How To Form An LLC In New HampshireNolo is legally binding when completed correctly and submitted to the appropriate state authorities. It must meet the requirements set forth by New Hampshire law, including proper signatures and notarization if required. Utilizing this form ensures that your LLC is recognized as a separate legal entity, providing liability protection and compliance with state regulations.

Required Documents

To successfully complete the How To Form An LLC In New HampshireNolo, you will need several key documents:

- Certificate of Formation form.

- Operating Agreement (though not required, it is highly recommended).

- Identification documents for the members of the LLC.

- Any applicable business licenses or permits.

State-specific rules for the How To Form An LLC In New HampshireNolo

New Hampshire has specific rules that govern the formation of LLCs. These include:

- The name of the LLC must include "Limited Liability Company" or an abbreviation such as "LLC".

- At least one member must be designated as a registered agent with a physical address in New Hampshire.

- Annual reports must be filed to maintain the LLC's good standing with the state.

Form Submission Methods (Online / Mail / In-Person)

The How To Form An LLC In New HampshireNolo can be submitted through various methods:

- Online submission via the New Hampshire Secretary of State's website.

- Mailing the completed form to the Secretary of State's office.

- In-person submission at the Secretary of State's office during business hours.

Quick guide on how to complete how to form an llc in new hampshirenolo

Effortlessly prepare How To Form An LLC In New HampshireNolo on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without holdups. Manage How To Form An LLC In New HampshireNolo on any device using the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

The easiest way to modify and electronically sign How To Form An LLC In New HampshireNolo effortlessly

- Obtain How To Form An LLC In New HampshireNolo and click on Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Alter and electronically sign How To Form An LLC In New HampshireNolo to ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the steps on how to form an LLC in New HampshireNolo?

To form an LLC in New HampshireNolo, you need to start by choosing a unique name for your LLC that complies with state regulations. Next, file your Certificate of Formation with the Secretary of State, and create an operating agreement to outline your LLC's structure. Lastly, obtain any necessary licenses and permits to legally operate your business.

-

What is the cost associated with how to form an LLC in New HampshireNolo?

The cost to form an LLC in New HampshireNolo includes a filing fee for the Certificate of Formation, which is typically around $100. Additionally, you may incur costs for business licenses and permits, as well as potential legal or consulting fees to ensure compliance. Overall, the process remains cost-effective when using reliable resources.

-

How can airSlate SignNow help in the process of how to form an LLC in New HampshireNolo?

airSlate SignNow streamlines the process of how to form an LLC in New HampshireNolo by enabling users to eSign important documents quickly and securely. Our platform simplifies document management, allowing you to focus on completing your LLC formation efficiently. You can easily store and share essential paperwork directly within the app.

-

Are there specific features of airSlate SignNow for forming an LLC?

Yes, airSlate SignNow offers specific features that are beneficial for anyone learning how to form an LLC in New HampshireNolo. Key features include customizable templates for legal forms, secure signing capabilities, and easy integration with other business tools to enhance your workflow. These features make document management hassle-free and efficient.

-

What are the benefits of forming an LLC in New HampshireNolo?

Forming an LLC in New HampshireNolo provides multiple benefits including limited liability protection, tax flexibility, and enhanced credibility with clients. It also allows for easier management and compliance with state regulations compared to other business structures. Overall, it lays a strong foundation for your business growth and legal protection.

-

How does airSlate SignNow integrate with business operations while forming an LLC?

airSlate SignNow integrates seamlessly with various business operations to facilitate the process of how to form an LLC in New HampshireNolo. You can sync with software like Google Drive or Dropbox, enabling easy access to your documents. This integration supports efficient document sharing and contributes to a streamlined business workflow.

-

What types of documents do I need when learning how to form an LLC in New HampshireNolo?

When learning how to form an LLC in New HampshireNolo, you'll need several essential documents including the Certificate of Formation, operating agreement, and any necessary licenses or permits. Additionally, maintaining an ongoing record of your business activities can be crucial for compliance. Ensure you have all documentation ready prior to filing.

Get more for How To Form An LLC In New HampshireNolo

Find out other How To Form An LLC In New HampshireNolo

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple