of Form Employment Certification 2011

What is the Of Form Employment Certification

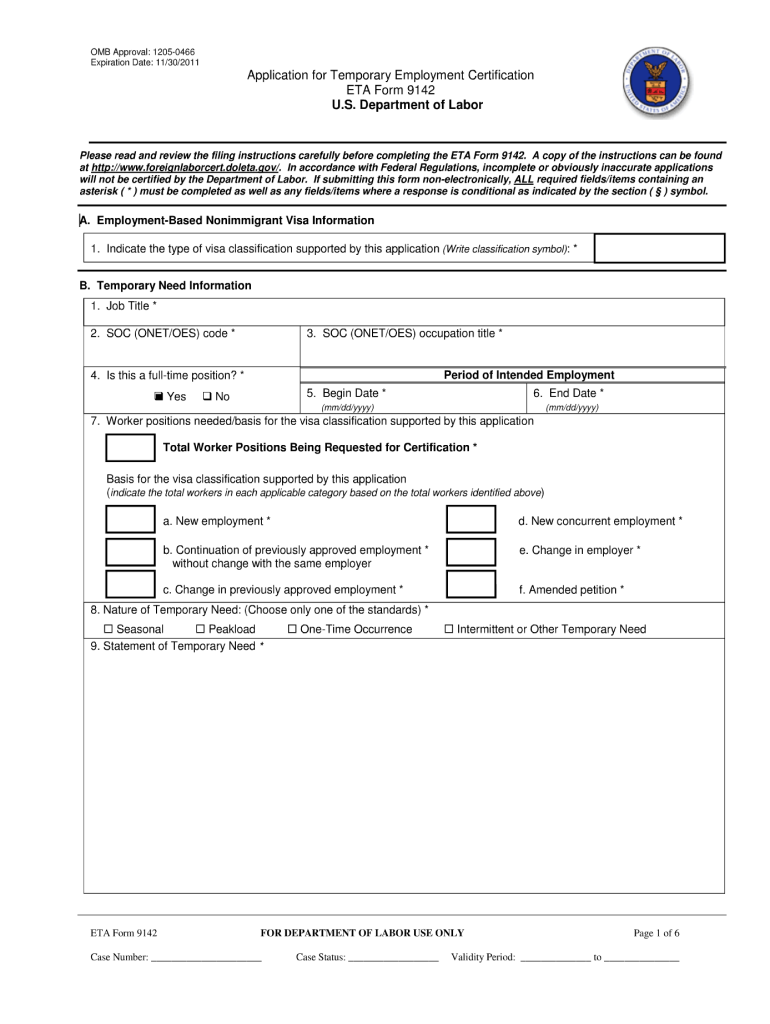

The Of Form Employment Certification is a crucial document that verifies an individual's employment status and details. This form is often required by employers, government agencies, and financial institutions to confirm that a person is employed and to provide information regarding their job title, duration of employment, and income. The certification serves as an official record that can be used for various purposes, including loan applications, rental agreements, and immigration processes. It is essential for the form to be accurate and up-to-date to ensure its validity.

Steps to complete the Of Form Employment Certification

Completing the Of Form Employment Certification involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including the employee's full name, job title, employment dates, and salary details. Next, fill out the form carefully, ensuring that all required fields are completed. It is also important to review the form for any errors or omissions before submission. Once completed, the form should be signed by an authorized representative of the organization to validate the information provided.

How to obtain the Of Form Employment Certification

To obtain the Of Form Employment Certification, individuals typically need to request it from their employer or human resources department. Employers may have a standard procedure for issuing this certification, which could involve filling out a specific request form or providing a written request. In some cases, employers may also offer digital versions of the certification that can be accessed through their internal systems. If the employment has ended, individuals may still request a certification from their previous employer, as it is important for future job applications or financial transactions.

Key elements of the Of Form Employment Certification

The Of Form Employment Certification should include several key elements to be considered valid. These include:

- Employee's Full Name: The complete name of the individual for whom the certification is being issued.

- Job Title: The official title of the employee's position within the organization.

- Employment Dates: The start and end dates of employment, or a statement indicating current employment.

- Salary Information: Details regarding the employee's salary, including any bonuses or commissions.

- Employer's Information: The name and contact information of the employer or organization issuing the certification.

- Authorized Signature: The signature of an authorized representative, confirming the authenticity of the document.

Legal use of the Of Form Employment Certification

The Of Form Employment Certification holds legal significance and can be used in various contexts. It is often required for financial transactions, such as applying for loans or mortgages, where proof of income and employment is necessary. Additionally, it may be requested during background checks for new job opportunities or for rental agreements. To ensure legal compliance, it is important that the information provided is accurate and that the form is completed according to the relevant regulations and guidelines.

Form Submission Methods (Online / Mail / In-Person)

The Of Form Employment Certification can typically be submitted through various methods, depending on the requirements of the organization requesting it. Common submission methods include:

- Online Submission: Many employers and institutions allow for digital submission of the certification through secure online portals.

- Mail: The form can be printed and mailed to the requesting party, ensuring that it is sent via a reliable postal service.

- In-Person Delivery: Individuals may also choose to deliver the certification in person, which can be beneficial for immediate processing.

Quick guide on how to complete form employment certification

Uncover the most efficient method to complete and endorse your Of Form Employment Certification

Are you still spending time preparing your official documents on physical copies instead of doing it online? airSlate SignNow presents a superior approach to finalize and endorse your Of Form Employment Certification and associated forms for public services. Our intelligent electronic signature solution provides you with all the necessary tools to handle documents swiftly and in compliance with official regulations - robust PDF editing, management, protection, signing, and sharing functionalities are all available within a user-friendly interface.

Only a few steps are required to fill out and endorse your Of Form Employment Certification:

- Upload the editable template to the editor using the Get Form button.

- Assess what information you need to supply in your Of Form Employment Certification.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is truly important or Blackout fields that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and finish your task with the Done button.

Store your finalized Of Form Employment Certification in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our service also offers flexible file sharing. There’s no need to print your templates when you need to send them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct form employment certification

FAQs

-

Are specifications documents required for ISO 9001 certification?

Yes, they are required. I shall explain this from the perspective of both ISO 9001 - 2008, the old standard and ISO 9001-2015, the new standard since the ISO 9001-2008 still has co-existence with ISO 9001-2015 till the dead line of transition to new standard which is 15 September, 2018.ISO 9001–2008ISO 9001 - 2008 under clause 4.2.1 expects organization to have :a) documented statements of a quality policy and quality objectivesb) a quality manualc) documents and records, required by the international standardd) documents including records, determined by the organization to be necessary to ensure effective planning, operation and control of processes.There are six mandatory procedures required by international standard against following clauses, namely, :4.2.3 Control of Documents4.2.4 Control of Records8.2.2 Internal Audits8.3 Control of Non Conforming Product8.5.1 Corrective Action &8.5.2 Preventive ActionAgainst the above clauses, the statement of requirement “ A documented procedure shall be maintained ” can be seen.The mandatory records required by the international standard can be identified by the statement “ records of….. Shall be maintained ‘ under respective clauses. Also in the brackets, 4.2.4 will be indicated which is the clause number for Control of Records.ISO 9001- 2015In ISO 9001- 2015 both documents and records are integrated together and bought under clause 7.5 documented information, which has sub clauses as follows, namely :7.5.1 General7.5.2 Creating and Updating7.5.3 Control of documented Information.Clause 7.5.1 of ISO 9001-2015 states that “ The organization ‘s quality management system shall include :a) documented information required by the international standardb) documented information determined by the organization as being necessary for the effectiveness of quality management system.The relevant clauses in the standard, where required, also indicate regarding maintaining the documented information.The question also refers to specifications, which, I believe, is pertinent to design and development specifications. Hence please note the following :The mandatory records required under clause 7.3 Design and Development of ISO 9001- 2008 are :Design & Development Input recordsDesign & Development Review recordsDesign & Development Verification recordsDesign & Development Validation records &Record of review of design changes & actionsThe documented information required by the clause 8.3, Design and Development of products and services of ISO 9001- 2015 are those relevant to :Design & Development PlanningDesign & Development InputsDesign & Development ControlsDesign & Development Outputs &Design & Development changes & its reviewsRef. ISO 9001-2008 & ISO 9001-2015 Standards

-

Is it legal to have an unregistered off-the-grid (no birth certificate) baby in the USA?

I was actually roommates with someone in College whose parents decided to have him “off-grid”. Let me just say this: Stop even entertaining the idea of having a baby off-grid. It really makes your child’s life unnecessarily hard and your kid will forever resent you for putting that pain on them.I’ll get into the details in a moment, but first let me address the question proposed above. Yes, technically speaking it is not a crime to have your baby off-the-grid in the U.S.A. However, a lot of details surrounding the event would be illegal. First of all, any licensed midwife or doctor is required by law to file a birth certificate or they actually risk losing their license and getting a misdemeanor. If you forced them or threatened them to not file the birth certificate that would make you a likely accomplice and would not go over well with the authorities.But let’s ignore that for a moment and just assume you know how to birth a child on your own and can do it in your basement without any professional medical physician there to oversee you (which would be the only way you could pull this off). In this case you wouldn’t get thrown in jail for failing to get a birth certificate and no crime would have been committed. However you just set up a very difficult life for your child.These are some of the things I was told from by my roommate who didn’t have a social security number until he was 20 years old.No, he could not get a (legal) jobQuite literally he didn’t qualify to get even a job at McDonalds. If you remember the last job you got no matter how prestigious or demeaning it was, you had to fill out a bunch of paperwork. Most of these forms require you to have a SSN (social security number) to properly fill them out. However the important one is the form labeled I-9. This form is required to be submitted by every employer after hiring a new employee. This form serves only one purpose, to determine that you are eligible to work in the United States. Your child (and my roommate) would not be able to complete this form which every employer must get filled out before starting employment with a new employee. Your child will not be able to get a job because of this.Yes, he can evade paying taxes.Okay, so this sounds like a perk I guess. But my roommate did not have to pay taxes. The government basically didn’t know he existed, so they never knew he was not paying. But then again he didn’t have a job. So would you rather have a job and pay some taxes or not ever be able to work except under the table for below minimum wage? Given that choice, taxes sound pretty awesome! Keep in mind that this also means your child is not eligible for any tax benefits or credits such as those that students get while going to college.No, You as the parent can not claim him as a dependent on your taxesYou’re already dealing with a child, wouldn’t it be great to get that child tax credit? Every year you'll basically be paying out of pocket for deciding not to get them a SSN.Yes, he can attend public school through 12th gradeHe would be able to attend school through high school without a social security number.No, he can not attend collegeWhile high school and lower education is okay, your child will never be able to attend collegeYes, he can go to the doctorThe doctor will still see your child and provide him his shots. However…No, he will not be covered under your family insurance (or qualify for Medicare/Medicaid)So you’ll need to plan on paying for all doctor appointments out of pocket.No, he can not travel abroad (even to Canada)You’d best hope none of your child’s friends decide to go to Cancun for spring break. Your child will not be eligible to leave the country or return to the US if he manages to leave (unless he plans to climb Trump’s wall)No, he will not be able to drive a carOkay, well nothing is stopping him from physically driving a car, but he would not be able to get a driver’s license and thus, can not LEGALLY drive. Hope he doesn’t get pulled over.No, he will not be able to voteOnce old enough he will not be able to register to vote.Yes, he can avoid the draftWell the good news is that like taxes, he can skirt the requirement to join the draft when he turns 18.No, he can’t get a loanThis means no credit cards, no car loan, no home, nothing. I’m sure plenty of people will claim these are all evil anyway, but these have powerful impacts on someone’s life. There might be times he needs it. (and when used properly none of these are bad things).No, he will not have a credit scoreThis goes with the above one, but he will not be able to work on this which affects your entire life/future. This also will disqualify him from renting most homes or apartments he is looking at.Basically your child will be treated as an illegal immigrant. Why put them through this when they are entitled to the benefits that the United States provides its citizens? There are people in other countries dying to get what your child is entitled to and you are (considering) denying your child those abilities? It just doesn’t make sense.Get them a SSN and if your child decides at 20 that he wants to live off-the-grid than he can burn his Social Security Card and go in the woods and hide from the government. But don’t be selfish enough to make that decision for them.My roommate resents his parents for not giving him a SSN. While all his friends in high school were driving, he couldn’t. While his friends go to Cancun for spring break, he had golden handcuffs in the U.S. and can’t leave. And worst of all he said was that while all his friends were earning money from jobs in high school, he couldn’t get a job.The job part was the hardest for him. He couldn’t leave the house or move out when he turned 18. He was stuck at home.Him working on getting a social security number was difficult and took him two years. He started when he turned 18 to get one once he realized he couldn’t go to college, he couldn’t get a job, he couldn’t rent an apartment, and thus will never really be able to be independent from his parents. It took two years and then at 20 he was able to get one and start working and going to school.He forever resented his parents. Don’t be those parents…

-

Does it pay off to get welding certifications?

Certification is one way to advance in the field after you complete your welding training. The type of certification a welder seeks usually depends on the industry he or she works in. Most welding certifications must be renewed after a certain length of time. Find out how long some of the most common certifications are good for in this article.When Do Welding Certifications Expire?Welding certifications are usually good for anywhere from six months to three years.Employer Certifications6 MonthsEmployers often test job applicants on the specific welding process they’ll be using in that line of work. Once a welder has proven his or her ability in a certain welding process, metal, position, and thickness range, he or she is considered qualified for the job. If the welder’s test results were documented, then he or she is certified to work in that welding process for six months.American Welding Society – industry standard6 monthsLearn More About Attending TWSIt’s easy – just fill out the form below and we will signNow out with more info!Full NameEmail AddressPhone NumberZip CodeGET STARTEDThe American Welding Society (AWS) offers eight certifications for welders. One of the tests is for the Certified Welder. This certification could prove helpful to welders working in the chemical refinery, structural steel, sheet metal, and petroleum pipeline welding industries.Every six months after you receive this certification you must submit a maintenance form to AWS verifying that you’re still performing the same welding you were initially tested on. Welders who do not submit their maintenance forms within this timeframe must be tested on the procedures again to reinstate their certification in them.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How can I obtain Japanese citizenship?

Great answers by Dick Karp and David LaSpina.I can only add my two cents of knowledge to their insights.The first thing: citizenship and naturalization are two different matters.You can only get citizenship if you were born from Japanese parents, AND being registered within 3 months with your local Japanese consulate.AND when you signNow 20 years old, it's mandatory you choose whether lose your local citizenship or your Japanese citizenship.Should you not make a move, you lose your Japanese one by default.On the other hand, you might be naturalised Japanese (i.e.: become a non-born Japanese with a permanent visa) if all these criteria are met:- you're living for at least 5 years in Japan- you're at least 20 years old- you can read, write and speak Japanese fluently- you are willing to go through writing exams and interview processes- you have professional skills and $ to support yourselfEvery case is examined and weighed individually. Say, if one of your parents is Japanese (Japanese-born), the Ministry of Justice may wave the age and residence requirements. But again: it is a case-by-case process.Sources:Japanese nationality lawI want to become a Japanese nationalMany angles to acquiring Japanese citizenship | The Japan TimesAlso, I went myself to my local Japan consulate and talked with them.

-

How can h1b visa holder can get green card and time line?

The typical scenario for obtaining a green card from an H1B status involves a series of steps. It’s not really easy to pinpoint an exact timeline, but if you follow the steps then you’ll certainly simplify the process for yourself and ensure that your application is completed correctly.Keep in mind, only a sponsoring employer can apply for a green card on your behalf. As an employee, you will usually fall under the EB1, EB2, or EB3 categories. You should know which category you are in so that you can better understand which steps pertain to you.Step 1: PERM Labor CertificationIf you are an EB2 or EB3 employee then this is the first step in the process. The PERM labor certification includes prevailing wage determination, recruitment, and ETA From 9089.Step 2: Form I-40Once you have filed the ETA and that has been approved, then you must file the Form I-40. This form basically indicates that you are eligible for employment and that your employer has necessary funds and assets to pay necessary wages.Step 3: Form I-485This is the final form that the employer must fill out and is the process for filing for permanent residency and is referred to as the Adjustment of Status.Each step in the process is incredibly important. To ensure that your green card is processed as quickly as possible, it would be best to consult an immigration attorney.LawTrades would be happy to connect you with a skilled and affordable immigration attorney. We work with a variety of clients whose needs range considerably. Allow our attorneys to counsel you on the best options for your situation. We offer set rates and flexible scheduling to accommodate your needs. Feel free to take a look at our website to learn more.

-

When do I have to file for an exam center in NISM certification?

I assume your question is “When should I ideally make online enrollment for an NISM Certification Examination?”As per NISM website, more than 200 NISM Test Centres are available across India. Each exam centre has specific dates for exam depending on the demand at that particular Test Centre.For example, NISM Test Centre in Delhi (CP) has 150 seats every Saturday and Sunday, whereas NSEiT - Agra Centre has limited exam seats 3 to 4 times in a month.Generally, you will find that sufficient seats are available if you are planning to take NISM Exam after 15–20 days. It may be possible that seats may get filled up as you approach closer to the exam date. This is similar to a seat booking for Indian Railways except the fact that there is no waiting list :)Therefore, once you have prepared yourself for the exam, you can make online enrollment 15–20 days in advance and utilize the time for revision and taking mock tests.You can take NISM Mock Tests and Download NISM Study Material freely online.

Create this form in 5 minutes!

How to create an eSignature for the form employment certification

How to generate an eSignature for the Form Employment Certification in the online mode

How to create an eSignature for the Form Employment Certification in Google Chrome

How to make an eSignature for putting it on the Form Employment Certification in Gmail

How to generate an eSignature for the Form Employment Certification from your mobile device

How to create an electronic signature for the Form Employment Certification on iOS

How to create an electronic signature for the Form Employment Certification on Android devices

People also ask

-

What is the Of Form Employment Certification and why is it important?

The Of Form Employment Certification is a crucial document used to verify an individual's employment status and eligibility for various benefits. It serves as proof of employment, which can be required for loan applications, government assistance, and more. Using airSlate SignNow, businesses can efficiently manage and eSign these certifications, ensuring compliance and accuracy.

-

How does airSlate SignNow help with the Of Form Employment Certification process?

airSlate SignNow streamlines the process of creating, sending, and eSigning the Of Form Employment Certification. With its user-friendly platform, you can quickly generate templates, customize them for specific needs, and send them out for electronic signature. This not only saves time but also enhances security and reduces paper waste.

-

What are the pricing plans for using airSlate SignNow for the Of Form Employment Certification?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, which include features for managing the Of Form Employment Certification and other documents. Additionally, you can try a free trial to explore the platform before committing.

-

Can I integrate airSlate SignNow with other software for handling the Of Form Employment Certification?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRM systems and project management tools. This allows you to streamline your workflow when managing the Of Form Employment Certification alongside other important documents. Integration ensures that data flows smoothly between systems, enhancing efficiency.

-

What security measures does airSlate SignNow implement for the Of Form Employment Certification?

airSlate SignNow prioritizes security with advanced measures such as encryption, secure cloud storage, and user authentication. These features ensure that your Of Form Employment Certification and other sensitive documents are protected from unauthorized access. You can confidently manage eSignatures knowing your data is secure.

-

Is it easy to customize the Of Form Employment Certification templates in airSlate SignNow?

Absolutely! airSlate SignNow provides a simple interface for customizing your Of Form Employment Certification templates. You can add your branding, modify fields, and tailor the content to meet specific requirements, making it easy to create professional and compliant documents.

-

How does using airSlate SignNow benefit my business for handling the Of Form Employment Certification?

Using airSlate SignNow for the Of Form Employment Certification can enhance efficiency and reduce turnaround times signNowly. The platform allows for quick document preparation and faster eSigning, which helps your business maintain productivity. Additionally, the electronic nature of the process reduces costs associated with printing and mailing.

Get more for Of Form Employment Certification

Find out other Of Form Employment Certification

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document