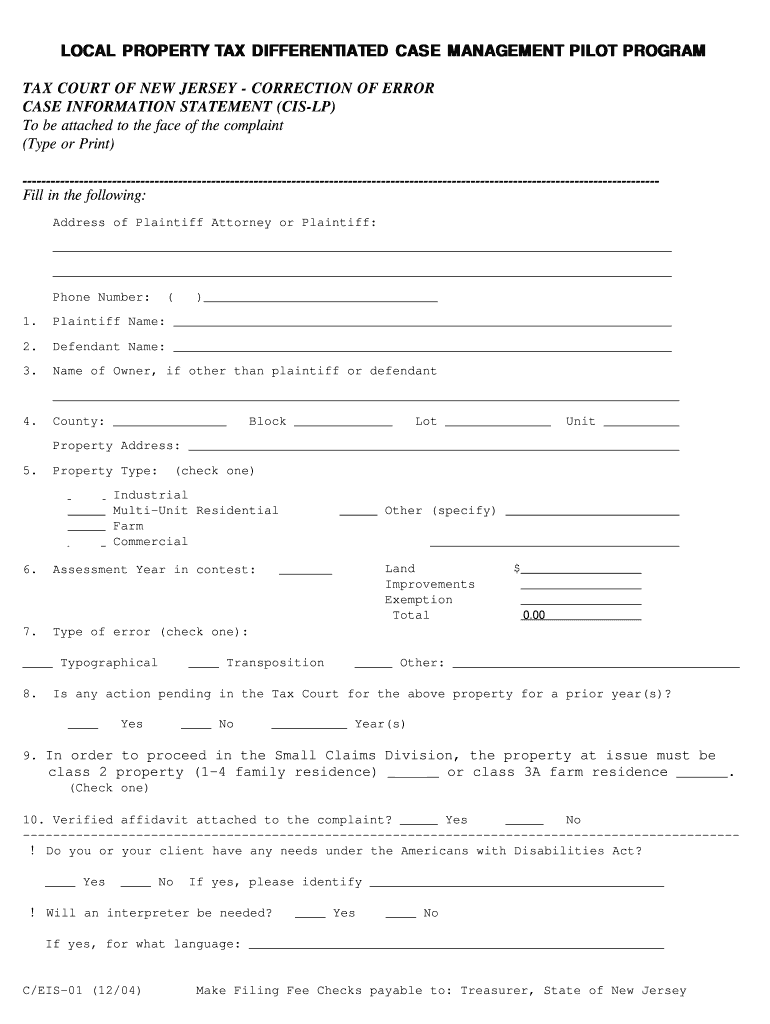

LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM Form

What is the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM

The LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM is an initiative designed to streamline the management of property tax cases. This program focuses on providing tailored approaches to handling various property tax issues, ensuring that each case is addressed based on its unique circumstances. By differentiating case management, the program aims to improve efficiency and outcomes for taxpayers and local governments alike.

Steps to complete the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM

Completing the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM involves several key steps:

- Identify eligibility criteria specific to your situation.

- Gather all necessary documentation related to your property tax case.

- Complete the required forms accurately, ensuring all information is current and correct.

- Submit your forms through the designated channels, which may include online submission, mail, or in-person delivery.

- Monitor the status of your submission and respond promptly to any requests for additional information.

Legal use of the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM

The legal use of the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM is governed by specific regulations that ensure compliance with state and federal laws. To be considered valid, the program must adhere to legal frameworks that protect taxpayer rights and ensure fair treatment. This includes following proper procedures for documentation, submission, and case management.

Eligibility Criteria

Eligibility for the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM typically includes homeowners and property owners who are facing unique challenges with their property tax assessments. Criteria may vary by state or locality, but generally, applicants must demonstrate a legitimate need for differentiated case management based on their specific circumstances, such as financial hardship or complex property issues.

Form Submission Methods

Submitting the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM form can be done through various methods to accommodate different preferences:

- Online Submission: Many jurisdictions offer online portals for easy and efficient submission.

- Mail: Forms can often be printed and mailed to the appropriate local tax authority.

- In-Person: Some individuals may prefer to submit their forms in person at designated offices for immediate assistance.

Key elements of the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM

Understanding the key elements of the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM is essential for effective participation. These elements may include:

- Case Assessment: A thorough evaluation of each case to determine the appropriate management approach.

- Communication: Clear and ongoing communication between taxpayers and tax authorities throughout the process.

- Resolution Strategies: Development of tailored strategies to resolve property tax issues effectively.

Quick guide on how to complete local property tax differentiated case management pilot program

Complete LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM seamlessly

- Obtain LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

The LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM is an initiative designed to streamline the management of property tax cases. This program allows for tailored approaches based on case complexity, ensuring timely resolutions and reducing administrative burdens.

-

How does the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM benefit my organization?

By utilizing the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM, organizations can improve efficiency and accuracy in property tax processes. This program helps in prioritizing cases, ultimately leading to faster responses and enhanced customer satisfaction, which are crucial for effective tax administration.

-

Is there a cost associated with the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

The pricing for the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM can vary based on the scale and specific needs of your organization. It is recommended to contact our sales team for a detailed quote based on your requirements and desired features.

-

What features does the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM offer?

The LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM includes features such as case prioritization, automated communications, and tracking capabilities. These tools are designed to enhance the overall management of property tax cases and ensure compliance with regulations.

-

Can the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM be integrated with existing systems?

Yes, the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM is designed to easily integrate with your current systems, ensuring a seamless transition. This integration helps maintain data integrity and improves overall workflow efficiency.

-

How can we ensure the security of data in the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

The LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM employs robust security measures, including encryption and access controls, to protect your data. We follow industry best practices to ensure that sensitive information remains confidential and secure.

-

What support is available for users of the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

Users of the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM can access our comprehensive support team, which offers assistance via email, chat, and phone. Additionally, we provide training resources and documentation to help you get the most out of the program.

Get more for LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM

- One month blood sugar log 10 tests a day optumrx form

- Optumrx residency form

- Prior authorization request form member optumrx

- Film 125 the textbook copyright lynne lerych pdf form

- March 18 2014 non legislative minutesdoc form

- Warranty parts amp service claim report delfield form

- Plumbing contractor registration grand blanc township twp grand blanc mi form

- Mbtajoblotterycom form

Find out other LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online