New Jersey Fixed Rate Note, Installment Payments Secured by Personal Property Form

What is the New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property

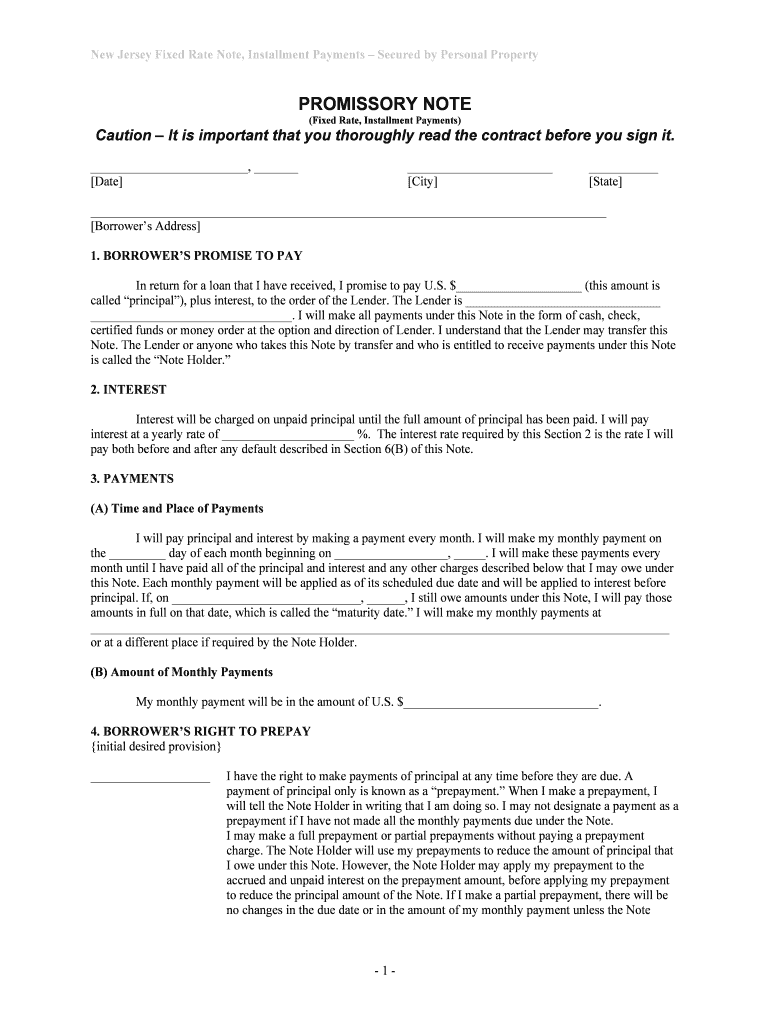

The New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property is a legal document used in financial transactions where a borrower agrees to repay a loan through fixed installment payments. This note is secured by personal property, meaning that if the borrower defaults, the lender has the right to claim the specified personal property as collateral. This type of note is commonly utilized in various lending scenarios, including personal loans, auto loans, and business financing, providing a clear framework for repayment terms and conditions.

How to use the New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property

Using the New Jersey Fixed Rate Note involves several steps to ensure that both parties understand their rights and obligations. First, the borrower and lender should agree on the loan amount, interest rate, and repayment schedule. Once these terms are established, the note must be filled out with accurate information, including the names of both parties, the description of the collateral, and the payment details. After completing the document, both parties should sign it, ideally in the presence of a witness or notary to enhance its legal validity.

Steps to complete the New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property

Completing the New Jersey Fixed Rate Note requires careful attention to detail. Follow these steps:

- Begin by entering the date of the agreement at the top of the note.

- Clearly state the names and addresses of both the borrower and lender.

- Specify the loan amount and the interest rate applicable to the loan.

- Outline the repayment schedule, including the frequency of payments and the total number of installments.

- Detail the personal property being used as collateral, including any identifying information.

- Include any additional terms or conditions that both parties have agreed upon.

- Ensure both parties sign the document, and consider having it notarized for additional legal protection.

Key elements of the New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property

Several key elements must be included in the New Jersey Fixed Rate Note to ensure its effectiveness and legality. These elements include:

- The names and contact information of both the borrower and lender.

- The principal amount of the loan and the interest rate.

- The payment schedule, including due dates and amounts.

- A description of the personal property securing the loan.

- Terms regarding default, including the lender's rights to the collateral.

- Signatures of both parties, indicating their agreement to the terms.

Legal use of the New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property

The legal use of the New Jersey Fixed Rate Note is governed by state laws that dictate how such documents must be executed and enforced. For the note to be legally binding, it must meet specific requirements, such as being signed by both parties and containing clear terms regarding the loan and collateral. Compliance with state regulations ensures that the lender has the right to enforce the terms of the note in case of default, making it a crucial document in protecting both parties' interests.

State-specific rules for the New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property

In New Jersey, specific rules apply to the execution and enforcement of the Fixed Rate Note. These rules include:

- All parties must be of legal age and have the capacity to enter into a contract.

- The note must be in writing and signed by both the borrower and lender.

- Proper identification of the collateral is required to ensure clarity and enforceability.

- Compliance with the New Jersey Uniform Commercial Code (UCC) is necessary for the security interest to be valid.

Quick guide on how to complete new jersey fixed rate note installment payments secured by personal property

Prepare New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property effortlessly on any device

Web-based document management has become increasingly popular among enterprises and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property with ease

- Find New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as an old-fashioned ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Modify and eSign New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property?

A New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property is a legal financial agreement where the borrower agrees to repay the borrowed amount at a fixed interest rate over time, using personal property as collateral. This note outlines the terms of the loan and the payment schedule, ensuring clarity for both parties involved.

-

What are the benefits of using a New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property?

The major benefits of a New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property include predictable monthly payments and protection for the lender through collateral. This structure helps borrowers manage their finances with stability and gives lenders confidence in repayment.

-

How is the pricing structured for the New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property?

Pricing for a New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property typically includes the principal amount, interest rates, and potential fees for processing. It's essential to discuss these details with a lender to understand the total cost and payment structure.

-

Can I customize the terms of a New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property?

Yes, the terms of a New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property can often be customized to fit the needs of both the borrower and lender. This can include adjustments to interest rates, payment schedules, and the specific collateral used.

-

How do I ensure the security of my New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property?

To ensure the security of your New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property, it is crucial to have a formal agreement drafted and signed by both parties. Additionally, you may wish to involve legal counsel to review the document and ensure all terms are clearly stated and enforceable.

-

What is the process for signing a New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property?

The process involves drafting the New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property, reviewing it, and then signing it in the presence of witnesses or a notary, if required. Using e-signature solutions like airSlate SignNow can streamline this process and ensure that all parties can easily sign digitally.

-

Are there any digital tools to assist with New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property?

Yes, there are digital tools available, including airSlate SignNow, that facilitate the creation and signing of a New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property. These tools enable easy collaboration, secure storage, and quick access to documents, enhancing efficiency for both borrowers and lenders.

Get more for New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property

- Nassau county civil service form csx 1

- Florida junior grade cattle identity program youth dairy form

- Statement of legal residence clayton county public schools clayton k12 ga form

- Glynn county public records form

- Request for academic transcript edith cowan university form

- Employee resignation form webcp union county public schools

- Abeukcom form

- Conservatoramp39s reportjdf 885 colorado bar association cobar form

Find out other New Jersey Fixed Rate Note, Installment Payments Secured By Personal Property

- How Do I Integrate eSignature in WorkDay

- Help Me With Integrate eSignature in WorkDay

- How Can I Integrate eSignature in WorkDay

- Help Me With Integrate eSignature in ServiceNow

- How Can I Integrate eSignature in ServiceNow

- Can I Integrate eSignature in ServiceNow

- Help Me With Use eSignature in SalesForce

- How To Use eSignature in DropBox

- How Do I Use eSignature in DropBox

- How Can I Use eSignature in SalesForce

- How To Integrate eSignature in NetSuite

- How To Install eSignature in DropBox

- Help Me With Integrate eSignature in NetSuite

- How Do I Install eSignature in DropBox

- Help Me With Install eSignature in DropBox

- How To Install eSignature in SalesForce

- How Can I Install eSignature in DropBox

- Help Me With Install eSignature in SalesForce

- Can I Install eSignature in DropBox

- How Can I Install eSignature in SalesForce