Heath Individual Return 13 City of Heath 2013

Understanding the Heath Individual Return 13 City of Heath

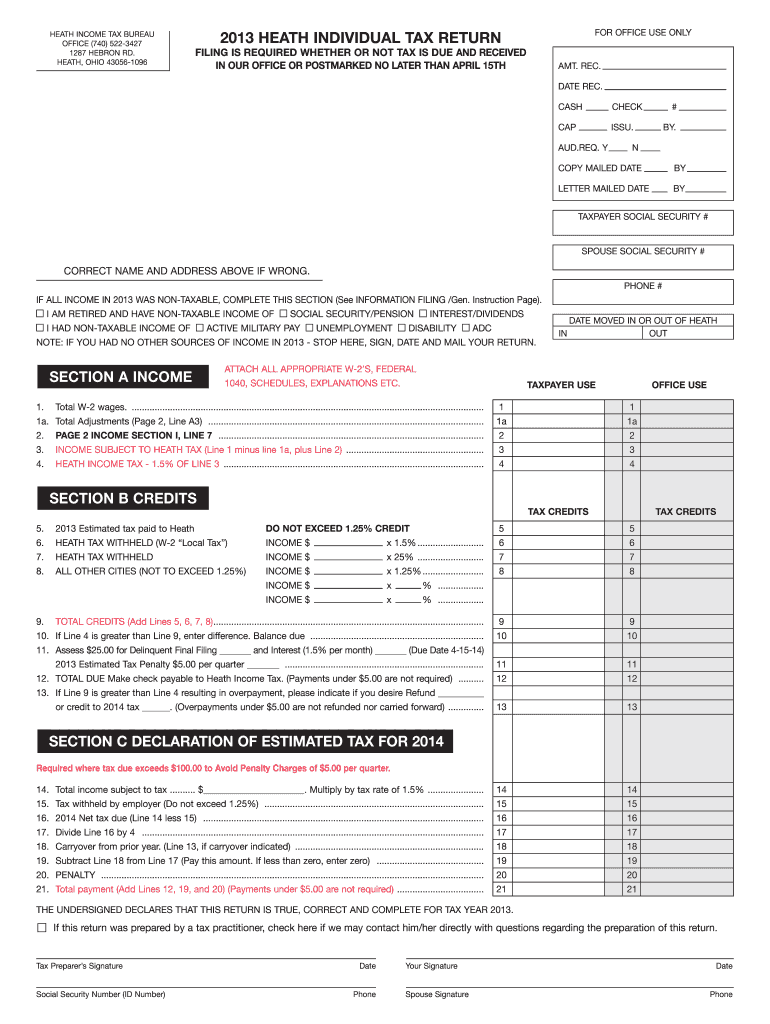

The Heath Individual Return 13 is a crucial form for residents of the City of Heath, Ohio, who need to report their income for local tax purposes. This form is specifically designed for individuals to declare their earnings and calculate their city income tax obligations. The information provided on this form helps the Heath Ohio Tax Department assess the appropriate tax rate and ensures compliance with local tax regulations.

Steps to Complete the Heath Individual Return 13 City of Heath

Completing the Heath Individual Return 13 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section, ensuring accuracy in your name, address, and Social Security number.

- Report your total income, including wages, salaries, and any additional earnings.

- Calculate your taxable income by applying any deductions or exemptions you qualify for.

- Determine your tax liability based on the city tax rate and complete the payment section if applicable.

- Review the form for accuracy before submitting it to avoid penalties or delays.

How to Obtain the Heath Individual Return 13 City of Heath

The Heath Individual Return 13 can be obtained through several methods:

- Visit the official website of the Heath Ohio Tax Department to download a digital copy.

- Request a physical copy by contacting the tax office directly via phone or email.

- Access the form at local government offices or community centers that provide tax assistance.

Legal Use of the Heath Individual Return 13 City of Heath

To ensure the legal validity of the Heath Individual Return 13, it is essential to comply with all local regulations. The form must be filled out accurately and submitted within the designated filing period. Electronic submissions are accepted, provided they meet the requirements set forth by the Heath Ohio Tax Department. Utilizing a reliable eSignature platform can enhance the security and legality of your submission.

Filing Deadlines and Important Dates

Filing deadlines for the Heath Individual Return 13 are crucial for compliance. Typically, the form must be submitted by April fifteenth each year for the previous tax year. It is important to stay informed about any changes to deadlines, especially if they are affected by holidays or local regulations. Late submissions may incur penalties, so timely filing is essential.

Required Documents for the Heath Individual Return 13 City of Heath

When preparing to file the Heath Individual Return 13, ensure you have the following documents ready:

- W-2 forms from employers detailing your earnings.

- 1099 forms for any freelance or contract work.

- Records of any additional income, such as rental or investment income.

- Documentation for any deductions or credits you plan to claim.

Quick guide on how to complete heath individual return 13 city of heath

Complete Heath Individual Return 13 City Of Heath seamlessly on any device

Web-based document administration has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to craft, modify, and electronically sign your documents quickly and without delays. Handle Heath Individual Return 13 City Of Heath on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest method to alter and electronically sign Heath Individual Return 13 City Of Heath with ease

- Obtain Heath Individual Return 13 City Of Heath and then click Get Form to begin.

- Leverage the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you would like to deliver your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Heath Individual Return 13 City Of Heath, and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct heath individual return 13 city of heath

FAQs

-

Did President Trump’s Executive Order directing the IRS to process individual income tax returns, where the heath insurance coverage box is left unchecked, mean you can leave blank the line on healthcare coverage on the tax form?

Absolutely not.This is very old news from early 2017 when filing 2016 tax returns, when IRS decided to delay the start of rejecting tax returns for not checking the full-year healthcare box and not having filed Form 8965.Some people were misinterpreting that as IRS doing something differently that year compared to previous years — but it’s the exact opposite — IRS was originally planning to do something different, and changed to do the same thing as previous years. For filing 2014 and 2015 tax returns, before Trump became president, IRS also did not reject tax returns that did not check the full-year healthcare box and not having filed Form 8965. They were originally planning to start rejecting such tax returns for the 2016 tax year, but they decided to delay that. All this commotion was about them doing the same thing as they did before, so it was completely unwarranted.And this delay did not mean they were “not enforcing” the individual mandate or that you could avoid paying the penalty if you didn’t have insurance. It just meant that they were not rejecting tax returns for failing to check that box. The IRS will continue to investigate and audit people who they believe failed to pay the penalty when they needed to. I forgot to check that box on my 2014 tax returns, and IRS sent me a notice in 2017 asking me to amend my 2014 tax returns to either check the box or file Form 8965 (I had full-year healthcare so I amended it to check the box). They will do so with 2015 and 2016 tax returns for people who forgot to check the box too.And the delay was just a delay for one year. For 2017 tax returns, filed in early 2018, they are rejecting e-filed tax returns if they did not check the full-year healthcare box and did not file Form 8965. (And next year, for 2018 tax returns filed in early 2019, they will continue to reject tax returns if they did not check the full-year healthcare box and did not file Form 8965.)

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the heath individual return 13 city of heath

How to generate an eSignature for your Heath Individual Return 13 City Of Heath online

How to make an electronic signature for your Heath Individual Return 13 City Of Heath in Chrome

How to make an eSignature for putting it on the Heath Individual Return 13 City Of Heath in Gmail

How to create an eSignature for the Heath Individual Return 13 City Of Heath straight from your smartphone

How to create an electronic signature for the Heath Individual Return 13 City Of Heath on iOS devices

How to generate an electronic signature for the Heath Individual Return 13 City Of Heath on Android

People also ask

-

What are heath city taxes and how can they affect my business?

Heath city taxes are local taxes imposed on businesses and property owners in Heath, Ohio. Understanding these taxes is crucial for compliance and budgeting. Proper management of heath city taxes can prevent legal issues and enhance your cash flow.

-

How can airSlate SignNow help manage heath city taxes?

AirSlate SignNow simplifies the document signing process, making it easier to manage any forms related to heath city taxes. With electronic signatures, businesses can quickly submit tax documents, ensuring timely compliance with local tax regulations. Our platform streamlines operations, allowing you to focus on growing your business instead.

-

What is the pricing for using airSlate SignNow for heath city taxes documentation?

AirSlate SignNow offers a range of pricing plans tailored to fit different business needs, including those handling heath city taxes. With flexible monthly or annual subscriptions, you can choose the option that best suits your budget. Explore our pricing page for detailed information on costs and features.

-

Are there specific features in airSlate SignNow that assist with heath city taxes?

Yes, airSlate SignNow includes features such as customizable templates and automated workflows specifically useful for managing heath city taxes documentation. These tools help ensure accuracy and efficiency in your tax processes. Additionally, real-time tracking allows you to monitor document status effortlessly.

-

What benefits can I expect from using airSlate SignNow for heath city taxes?

By utilizing airSlate SignNow for heath city taxes, you benefit from increased efficiency and reduced paperwork. Our platform also promotes better compliance through secure and fast document exchanges. Additionally, the mobile-friendly interface allows you to manage taxes on-the-go.

-

Does airSlate SignNow integrate with other software for handling heath city taxes?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software solutions, making it easier to manage heath city taxes. By connecting your workflow tools, you can automate document signing and filing processes, signNowly reducing administrative burdens.

-

Can I securely store documents related to heath city taxes in airSlate SignNow?

Yes, airSlate SignNow offers secure cloud storage for all your documents, including those related to heath city taxes. Our platform uses high-level encryption to protect sensitive information. This ensures that your important tax documents are safe and easily accessible whenever you need them.

Get more for Heath Individual Return 13 City Of Heath

- Liability of owner dealer for misrepresentation form

- Release adult 497427208 form

- Waiver and release from liability for minor child for deep sea fishing vessel form

- Waiver release liability agreement 497427210 form

- Release participation form

- Waiver and release from liability for adult for rally participation form

- Waiver release participation form

- Liability paragliding form

Find out other Heath Individual Return 13 City Of Heath

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement