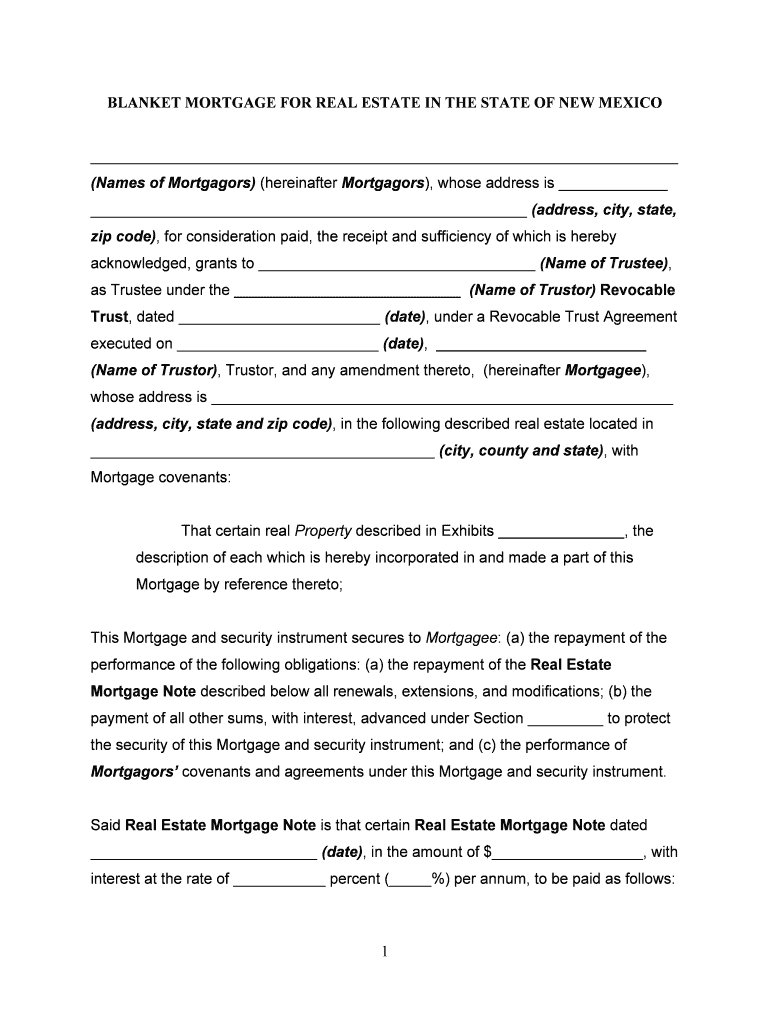

BLANKET MORTGAGE for REAL ESTATE in the STATE of NEW MEXICO Form

What is the blanket mortgage for real estate in the state of New Mexico?

A blanket mortgage is a type of loan that covers multiple properties under a single mortgage agreement. In the context of real estate in New Mexico, this financial tool is commonly used by developers and investors to finance multiple properties simultaneously. It allows the borrower to leverage the equity in one property to secure financing for additional properties, streamlining the borrowing process. This can be particularly beneficial for real estate investors looking to expand their portfolios without the need for separate loans for each property.

Key elements of the blanket mortgage for real estate in the state of New Mexico

Understanding the key elements of a blanket mortgage is essential for anyone considering this financing option. Key components include:

- Collateral: The properties being financed serve as collateral for the loan.

- Loan Amount: The total loan amount is based on the combined value of all properties included in the mortgage.

- Interest Rates: Interest rates may vary based on the lender and the overall risk associated with the properties.

- Terms: The repayment terms can differ significantly from standard mortgages, often allowing for more flexibility.

- Release Clause: This clause allows for the release of individual properties from the mortgage as they are sold or refinanced.

Steps to complete the blanket mortgage for real estate in the state of New Mexico

Completing a blanket mortgage involves several steps to ensure all requirements are met. Here is a general outline of the process:

- Assess Property Values: Determine the value of each property to be included in the mortgage.

- Choose a Lender: Research and select a lender that offers blanket mortgages.

- Gather Documentation: Prepare necessary documents, including property titles, financial statements, and tax information.

- Complete the Application: Fill out the mortgage application with accurate information regarding all properties.

- Review Terms: Carefully review the terms and conditions of the mortgage agreement before signing.

- Sign the Agreement: Once all parties agree, sign the mortgage documents, ensuring compliance with state laws.

Legal use of the blanket mortgage for real estate in the state of New Mexico

The legal use of a blanket mortgage in New Mexico requires adherence to state regulations and compliance with federal laws. It is important to ensure that all properties included in the mortgage are properly titled and that the mortgage agreement is executed in accordance with New Mexico law. Additionally, the lender must follow all applicable lending regulations, including those related to disclosure and borrower rights. This legal framework ensures that both lenders and borrowers are protected throughout the mortgage process.

How to obtain the blanket mortgage for real estate in the state of New Mexico

Obtaining a blanket mortgage in New Mexico involves a few key steps:

- Research Lenders: Look for lenders experienced in blanket mortgages and compare their offerings.

- Prepare Financial Information: Gather financial documents, including income statements and credit history.

- Submit an Application: Complete and submit the mortgage application along with required documentation.

- Negotiate Terms: Discuss and negotiate terms with the lender to find a suitable agreement.

- Finalize the Mortgage: Once approved, sign the mortgage agreement and complete any necessary legal formalities.

Examples of using the blanket mortgage for real estate in the state of New Mexico

Examples of how a blanket mortgage can be utilized include:

- Real Estate Development: Developers may use a blanket mortgage to finance multiple properties in a new housing project.

- Investment Portfolios: Real estate investors can leverage a blanket mortgage to acquire several rental properties, simplifying financing and management.

- Refinancing Options: Property owners may use a blanket mortgage to refinance existing loans on multiple properties, potentially lowering interest rates and consolidating debt.

Quick guide on how to complete blanket mortgage for real estate in the state of new mexico

Complete BLANKET MORTGAGE FOR REAL ESTATE IN THE STATE OF NEW MEXICO effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle BLANKET MORTGAGE FOR REAL ESTATE IN THE STATE OF NEW MEXICO on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign BLANKET MORTGAGE FOR REAL ESTATE IN THE STATE OF NEW MEXICO with ease

- Find BLANKET MORTGAGE FOR REAL ESTATE IN THE STATE OF NEW MEXICO and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign BLANKET MORTGAGE FOR REAL ESTATE IN THE STATE OF NEW MEXICO and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a blanket mortgage?

A blanket mortgage is a single loan that covers multiple properties or pieces of real estate. This financial tool allows investors to purchase or refinance several properties at once, providing flexibility and ease of management. With a blanket mortgage, you can streamline your financing process and keep your portfolio organized.

-

How does a blanket mortgage work?

A blanket mortgage allows you to finance multiple properties under one loan agreement, which can simplify payments and reduce closing costs. The loan is secured by the properties listed in the agreement, making it easier to manage multiple investments. This makes blanket mortgages particularly beneficial for real estate investors.

-

What are the benefits of using a blanket mortgage?

The primary benefits of a blanket mortgage include the ability to finance multiple properties in one loan, lower closing costs, and greater flexibility in cash flow management. Investors can sell individual properties without needing to refinance the entire mortgage. Additionally, blanket mortgages may provide better interest rates compared to traditional loans.

-

How can I apply for a blanket mortgage?

To apply for a blanket mortgage, you typically need to work with a lender that specializes in this type of financing. The application process involves submitting financial documents and information about the properties you wish to include in the mortgage. Working with a knowledgeable broker can help navigate this process efficiently.

-

What properties can be included in a blanket mortgage?

A blanket mortgage can include various types of properties, such as residential homes, commercial buildings, and land. However, eligibility can vary depending on the lender and the intended use of the properties. Generally, properties within the same geographical area or similar value range may be grouped together.

-

Are there specific risks associated with a blanket mortgage?

Yes, while a blanket mortgage has its advantages, there are risks involved, such as the potential for losing all properties if payments are not maintained. Additionally, securing a blanket mortgage can be more complex due to the valuation of multiple properties. It’s essential to assess your financial situation and seek professional advice.

-

Can I integrate airSlate SignNow with my blanket mortgage processes?

Absolutely! airSlate SignNow can enhance your blanket mortgage processes by allowing you to easily send, sign, and manage documents electronically. This can streamline communications and enhance workflows, especially when dealing with multiple properties simultaneously. Integrating e-signature capabilities can save time and improve efficiency.

Get more for BLANKET MORTGAGE FOR REAL ESTATE IN THE STATE OF NEW MEXICO

- Environmental health inpection form

- Ky inheritance tax 2015 form

- Loan estimate form

- Vs166 form

- California id fee waiver form

- Advisement regarding a penalty assessment summons and colorado form

- On contractors contractors state license board state of california cslb ca form

- Microchip registration form dayandeveningpetcliniccom

Find out other BLANKET MORTGAGE FOR REAL ESTATE IN THE STATE OF NEW MEXICO

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer