Interest Calculation for Compensation Due D 27Pdf Form

What is the Interest Calculation For Compensation Due D 27Pdf

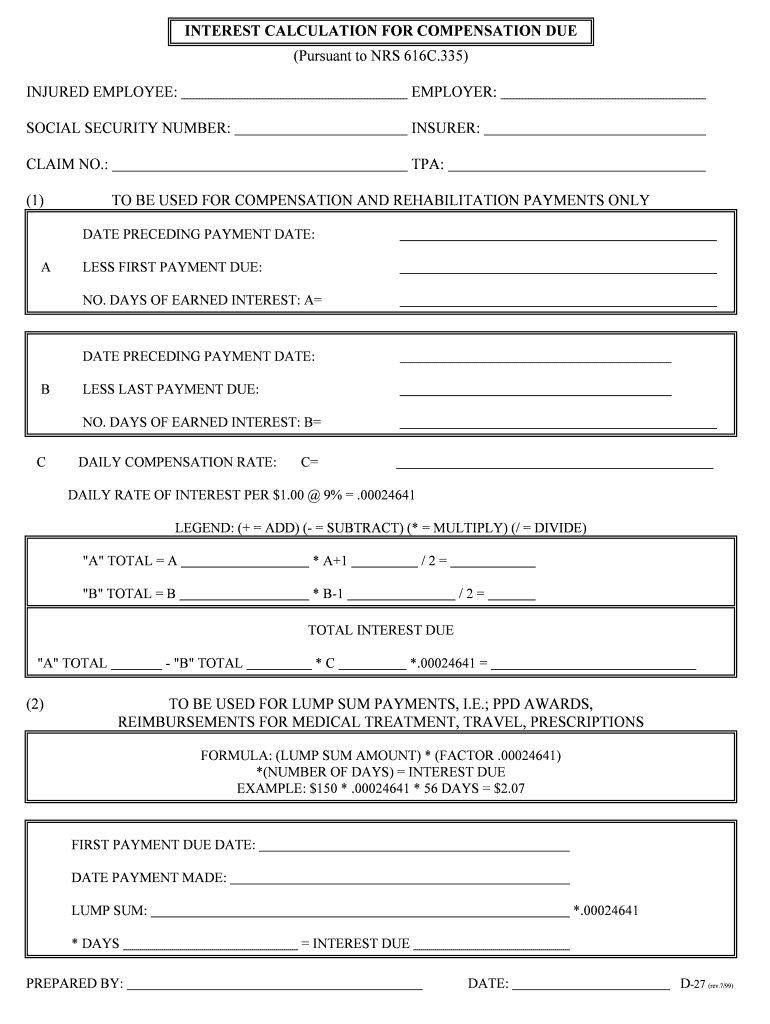

The Interest Calculation For Compensation Due D 27Pdf is a specific form used to determine the interest owed on compensation amounts. This form is typically utilized in legal and financial contexts where compensation is due, and it aims to provide a clear and accurate calculation of interest based on the principal amount. Understanding this form is essential for ensuring compliance with financial obligations and legal requirements when compensation is delayed or disputed.

How to use the Interest Calculation For Compensation Due D 27Pdf

Using the Interest Calculation For Compensation Due D 27Pdf involves several straightforward steps. First, gather all necessary information, including the principal amount owed and the applicable interest rate. Next, input this data into the form accurately. The form may include sections for entering the start date of the compensation period and the end date, which are crucial for calculating the total interest. Once completed, review the entries for accuracy before proceeding to submit the form as required.

Steps to complete the Interest Calculation For Compensation Due D 27Pdf

Completing the Interest Calculation For Compensation Due D 27Pdf requires careful attention to detail. Follow these steps:

- Gather relevant financial documents and details about the compensation due.

- Enter the principal amount in the designated field on the form.

- Input the interest rate applicable to the compensation.

- Specify the start and end dates for the interest calculation period.

- Double-check all entries to ensure accuracy.

- Save or print the completed form for submission.

Legal use of the Interest Calculation For Compensation Due D 27Pdf

The Interest Calculation For Compensation Due D 27Pdf serves a significant legal purpose. It is often used in disputes regarding compensation to establish a clear record of what is owed, including interest. For the form to be legally binding, it must be filled out correctly and submitted in accordance with relevant laws. This ensures that both parties are aware of their financial obligations and can avoid potential legal issues stemming from unpaid compensation.

Key elements of the Interest Calculation For Compensation Due D 27Pdf

Several key elements are essential to the Interest Calculation For Compensation Due D 27Pdf. These include:

- Principal Amount: The original sum of money owed.

- Interest Rate: The percentage used to calculate interest on the principal.

- Time Period: The duration for which interest is calculated, defined by start and end dates.

- Total Interest: The final amount of interest calculated based on the above factors.

Examples of using the Interest Calculation For Compensation Due D 27Pdf

Understanding practical applications of the Interest Calculation For Compensation Due D 27Pdf can enhance its utility. For example, if an employee is owed back wages, this form can calculate the interest on the unpaid amount from the date it was due until the current date. Similarly, businesses may use this form to determine interest on late payments from clients, ensuring they receive fair compensation for delays.

Quick guide on how to complete interest calculation for compensation due d 27pdf

Prepare Interest Calculation For Compensation Due D 27Pdf effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Interest Calculation For Compensation Due D 27Pdf on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Interest Calculation For Compensation Due D 27Pdf with ease

- Locate Interest Calculation For Compensation Due D 27Pdf and then click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, either by email, SMS, invite link, or download it to your computer.

Forget about losing or misplacing documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Interest Calculation For Compensation Due D 27Pdf and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Interest Calculation For Compensation Due D 27Pdf?

The Interest Calculation For Compensation Due D 27Pdf is a comprehensive tool that helps users accurately assess and calculate interest on various compensation amounts. This feature ensures that all calculations are precise and compliant with applicable regulations, making it essential for businesses handling financial compensation.

-

How can airSlate SignNow help with the Interest Calculation For Compensation Due D 27Pdf?

airSlate SignNow simplifies the process of managing the Interest Calculation For Compensation Due D 27Pdf by providing efficient document management and eSigning capabilities. Users can easily upload their compensation documents, perform calculations, and have them electronically signed, streamlining their workflow.

-

What features are included in the Interest Calculation For Compensation Due D 27Pdf tool?

Our Interest Calculation For Compensation Due D 27Pdf tool includes customizable templates, real-time calculation features, and reporting functionalities. These features help ensure that users can quickly and accurately prepare compensation documents while maintaining compliance.

-

Is there a cost associated with using the Interest Calculation For Compensation Due D 27Pdf feature?

While airSlate SignNow offers various pricing plans, the cost associated with utilizing the Interest Calculation For Compensation Due D 27Pdf feature depends on the chosen subscription. We provide multiple tiers that cater to different business sizes and needs, ensuring you can find a plan that fits your budget.

-

Can I integrate the Interest Calculation For Compensation Due D 27Pdf with other applications?

Yes, airSlate SignNow allows for seamless integration with various applications and platforms. Whether you use accounting software, CRM systems, or other business tools, you can easily connect them with the Interest Calculation For Compensation Due D 27Pdf to enhance your workflow.

-

What are the benefits of using the Interest Calculation For Compensation Due D 27Pdf with airSlate SignNow?

Using the Interest Calculation For Compensation Due D 27Pdf with airSlate SignNow offers benefits such as increased accuracy, enhanced efficiency, and better compliance for your compensation documents. The streamlined process saves time while ensuring all necessary calculations are performed correctly.

-

Who can benefit from the Interest Calculation For Compensation Due D 27Pdf feature?

The Interest Calculation For Compensation Due D 27Pdf feature can benefit a wide range of users, including HR departments, accountants, and business owners. Anyone involved in managing financial compensations can rely on this tool to ensure accuracy and compliance in their calculations.

Get more for Interest Calculation For Compensation Due D 27Pdf

- Change of address form owner relations hess corporation

- Printable office discipline referral form

- Consent for emergency dental and medical form pope county co pope mn

- Family systems license application minnesota statutes dhs state mn form

- Documentation template for physical therapist patientclient scranton form

- Half fare metrocard application form

- Charlotte metro fcu charlotte nc form

- Doterra product order form

Find out other Interest Calculation For Compensation Due D 27Pdf

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe