Name Control Rules for Trusts and Fiduciaries Tax Pro Form

What is the Name Control Rules For Trusts And Fiduciaries Tax Pro

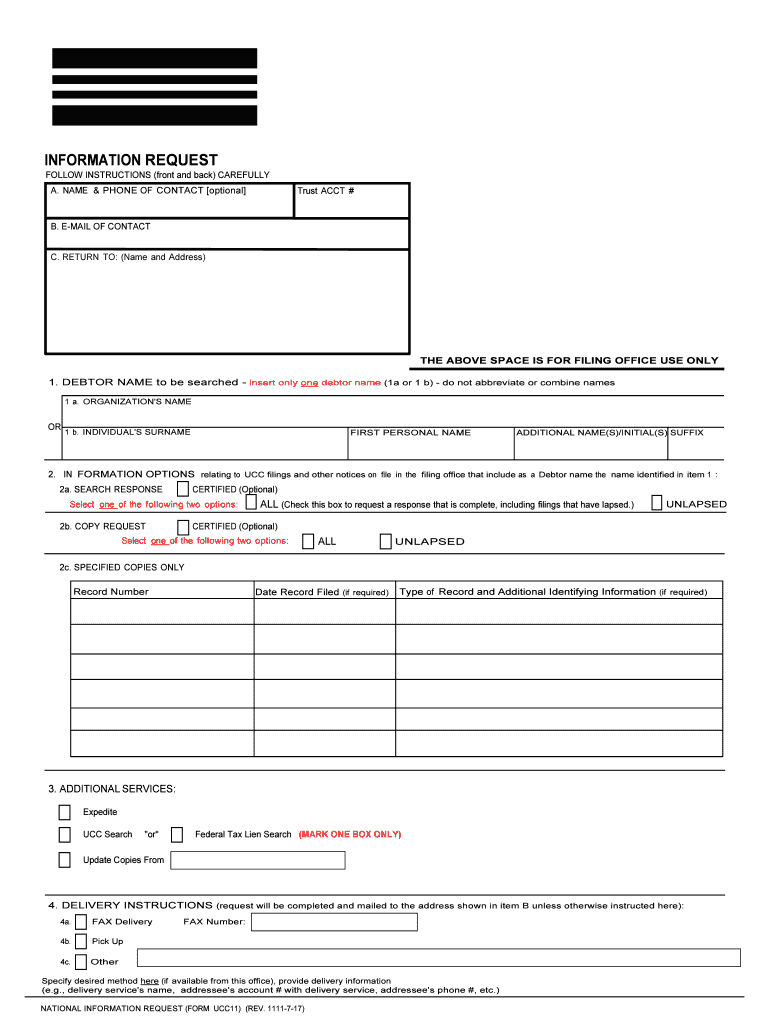

The Name Control Rules for Trusts and Fiduciaries Tax Pro form is a crucial document used by tax professionals when managing trusts and fiduciary accounts. This form helps ensure that the names of trusts and fiduciaries are correctly reported to the Internal Revenue Service (IRS). The rules dictate how names should be formatted and presented to avoid discrepancies that could lead to tax complications. Understanding these rules is essential for compliance and accurate tax reporting.

How to use the Name Control Rules For Trusts And Fiduciaries Tax Pro

Using the Name Control Rules for Trusts and Fiduciaries Tax Pro involves a clear understanding of the specific requirements outlined by the IRS. Tax professionals should carefully follow the formatting guidelines, ensuring that the name control is consistent with the legal documents of the trust or fiduciary. This includes using the correct entity type, such as a revocable trust or irrevocable trust, and ensuring that the name control matches the official documentation to facilitate proper processing by the IRS.

Steps to complete the Name Control Rules For Trusts And Fiduciaries Tax Pro

Completing the Name Control Rules for Trusts and Fiduciaries Tax Pro requires several key steps:

- Gather necessary documentation, including the trust agreement and any related legal documents.

- Identify the correct name control based on the trust's legal name and the type of fiduciary.

- Fill out the form accurately, ensuring all information aligns with the gathered documents.

- Review the completed form for any errors or discrepancies before submission.

- Submit the form through the appropriate channels, whether electronically or via mail.

Legal use of the Name Control Rules For Trusts And Fiduciaries Tax Pro

The legal use of the Name Control Rules for Trusts and Fiduciaries Tax Pro is governed by IRS regulations. Proper adherence to these rules is essential for the legitimacy of the tax filings associated with trusts and fiduciaries. Failure to comply can result in penalties or delays in processing. Therefore, tax professionals must ensure that all information is accurate and complete to maintain compliance with federal tax laws.

Key elements of the Name Control Rules For Trusts And Fiduciaries Tax Pro

Key elements of the Name Control Rules for Trusts and Fiduciaries Tax Pro include:

- Correct identification of the trust or fiduciary's legal name.

- Accurate representation of the type of entity, such as a trust or estate.

- Adherence to the formatting requirements specified by the IRS.

- Consistency with the information provided in other tax documents.

IRS Guidelines

The IRS provides specific guidelines regarding the Name Control Rules for Trusts and Fiduciaries Tax Pro. These guidelines outline how to determine the name control based on the type of entity and its legal documentation. Following these guidelines ensures that tax professionals can accurately report the necessary information to the IRS, reducing the risk of errors that could lead to audits or penalties.

Quick guide on how to complete name control rules for trusts and fiduciaries tax pro

Complete Name Control Rules For Trusts And Fiduciaries Tax Pro effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Name Control Rules For Trusts And Fiduciaries Tax Pro on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

The easiest way to edit and eSign Name Control Rules For Trusts And Fiduciaries Tax Pro without hassle

- Locate Name Control Rules For Trusts And Fiduciaries Tax Pro and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your desired device. Edit and eSign Name Control Rules For Trusts And Fiduciaries Tax Pro and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the Name Control Rules For Trusts And Fiduciaries Tax Pro?

The Name Control Rules For Trusts And Fiduciaries Tax Pro are guidelines that determine how names are formatted for tax purposes. These rules ensure that trusts and fiduciaries comply with IRS regulations, preventing issues with tax filings. Proper adherence to these rules is essential for maintaining legal and financial clarity.

-

How does airSlate SignNow assist with Name Control Rules For Trusts And Fiduciaries Tax Pro?

airSlate SignNow provides tools that facilitate the creation and management of documents in accordance with the Name Control Rules For Trusts And Fiduciaries Tax Pro. Our platform allows users to easily eSign and share necessary documents, ensuring compliance and reducing the likelihood of errors. This streamlining helps save time and improve accuracy.

-

What features does airSlate SignNow offer for managing trusts and fiduciaries?

Our platform includes features like customizable templates, secure eSigning, and document storage that cater specifically to trusts and fiduciaries. With airSlate SignNow, you can create documents that adhere to Name Control Rules For Trusts And Fiduciaries Tax Pro more efficiently. Additionally, collaborative tools allow multiple stakeholders to participate in the signing process seamlessly.

-

Is airSlate SignNow cost-effective for businesses managing trusts and fiduciaries?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage trusts and fiduciaries. Our pricing plans are designed to accommodate various business sizes and needs, making it affordable to comply with Name Control Rules For Trusts And Fiduciaries Tax Pro. You can choose a plan that best suits your organization's requirements.

-

Can airSlate SignNow integrate with existing systems for managing trust documents?

Absolutely! airSlate SignNow offers extensive integrations with popular business applications and software. By integrating with your existing systems, you can ensure that your handling of documents related to Name Control Rules For Trusts And Fiduciaries Tax Pro remains efficient and organized. This flexibility makes it easy to centralize your document management.

-

What are the benefits of using airSlate SignNow for fiduciaries?

Using airSlate SignNow streamlines the eSigning process for fiduciaries, saving valuable time and minimizing errors connected to Name Control Rules For Trusts And Fiduciaries Tax Pro. It enhances document security, ensuring sensitive information is protected, while facilitating easy collaboration among stakeholders. This combination of benefits results in improved overall productivity.

-

How secure is airSlate SignNow when handling documents for trusts?

airSlate SignNow prioritizes security and compliance, ensuring that all documents related to Name Control Rules For Trusts And Fiduciaries Tax Pro are handled with the utmost care. We employ state-of-the-art encryption and access controls to protect sensitive information. Our platform complies with industry standards, giving users peace of mind while managing important documents.

Get more for Name Control Rules For Trusts And Fiduciaries Tax Pro

- Guarantor form 204137528

- Confidential financial statement central state bank form

- Headquarters application for employment monrocom form

- Sole proprietorship resolution form

- Chessie federal credit union chessiefcu form

- Family court coversheet horry county horrycounty form

- Medical records release ivinson memorial hospital ivinsonhospital form

- My mercy birth plan expectant mother namebirth form

Find out other Name Control Rules For Trusts And Fiduciaries Tax Pro

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed