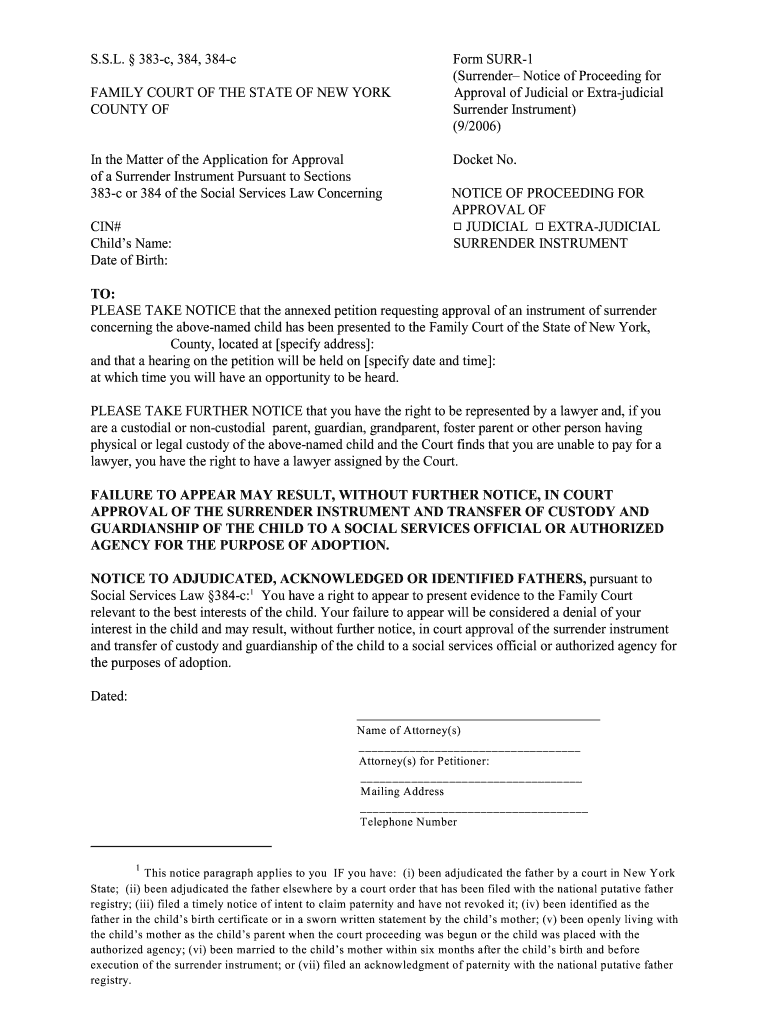

383 C, 384, 384 C Form

What is the 383 c, 384, 384 c

The 383 c, 384, and 384 c forms are essential documents used primarily for tax-related purposes in the United States. These forms are utilized by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Each form serves a unique function, catering to different aspects of tax reporting and compliance. Understanding the distinctions among these forms is crucial for accurate filing and adherence to tax regulations.

How to use the 383 c, 384, 384 c

Using the 383 c, 384, and 384 c forms involves a systematic approach to ensure proper completion and submission. Begin by gathering all necessary financial documents and information that pertain to your tax situation. Carefully read the instructions provided with each form to understand the specific requirements. Fill out the forms accurately, ensuring that all information is complete and truthful. Once filled, you can submit the forms either electronically or via mail, depending on your preference and the IRS guidelines.

Steps to complete the 383 c, 384, 384 c

Completing the 383 c, 384, and 384 c forms requires attention to detail. Follow these steps for successful completion:

- Gather relevant financial documents, including previous tax returns and income statements.

- Review the instructions for each form to understand the required information.

- Fill out the forms, ensuring accuracy in all entries.

- Double-check your information to avoid errors that could lead to penalties.

- Submit the forms electronically through a secure platform or mail them to the appropriate IRS address.

Legal use of the 383 c, 384, 384 c

The legal use of the 383 c, 384, and 384 c forms is governed by IRS regulations. These forms must be filled out truthfully and submitted within the designated deadlines to avoid legal repercussions. Proper use ensures compliance with federal tax laws and protects individuals and businesses from potential audits or penalties. It is important to stay informed about any changes in regulations that may affect the use of these forms.

Key elements of the 383 c, 384, 384 c

Each of the 383 c, 384, and 384 c forms contains key elements that are vital for proper tax reporting:

- Identification Information: Includes taxpayer identification numbers and personal details.

- Income Reporting: Sections dedicated to reporting various types of income.

- Deductions and Credits: Areas to claim eligible deductions and credits that can reduce taxable income.

- Signature Line: A section where the taxpayer must sign to certify the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 383 c, 384, and 384 c forms can be done through various methods. The IRS allows for electronic submission via approved e-filing software, which is often the fastest and most efficient method. Alternatively, forms can be mailed to the appropriate IRS address, ensuring that they are sent well before the deadline. In-person submission is generally not available for these forms, making electronic and mail options the primary methods for filing.

Quick guide on how to complete 383 c 384 384 c

Effortlessly prepare 383 c, 384, 384 c on any device

Digital document management has become a favorite among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle 383 c, 384, 384 c on any platform using airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

How to edit and eSign 383 c, 384, 384 c with ease

- Find 383 c, 384, 384 c and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important parts of the document or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming document searches, and errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign 383 c, 384, 384 c while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow related to 383 c, 384, 384 c?

airSlate SignNow offers a variety of features that simplify document handling, emphasizing the processes for 383 c, 384, and 384 c. These include customizable templates, secure eSigning, and efficient document sharing options. By using these features, businesses can streamline their workflows while ensuring compliance with relevant regulations.

-

How does airSlate SignNow support businesses needing 383 c, 384, 384 c documentation?

airSlate SignNow is designed to assist businesses in managing their 383 c, 384, and 384 c documentation effectively. The platform enables users to create, manage, and send documents easily, allowing them to focus on their core tasks. This support ensures that all legal requirements are met without sacrificing time or effort.

-

What is the pricing structure for airSlate SignNow focusing on 383 c, 384, 384 c?

The pricing for airSlate SignNow is competitive and offers various plans suitable for businesses needing 383 c, 384, and 384 c compliance. Each plan includes access to essential features tailored for document signing and management. For detailed information on specific pricing tiers, it’s best to check the pricing page on our website.

-

Can airSlate SignNow integrate with other tools for managing 383 c, 384, 384 c tasks?

Yes, airSlate SignNow seamlessly integrates with numerous software applications that businesses use for managing 383 c, 384, and 384 c tasks. These integrations allow for combined workflows and enhance productivity by automating various parts of the document process. Notable integrations include CRM systems, cloud storage, and productivity tools.

-

What are the benefits of using airSlate SignNow for 383 c, 384, 384 c documentation?

Using airSlate SignNow provides several benefits for managing 383 c, 384, and 384 c documentation. It ensures quicker document turnaround, improved accuracy, and enhanced security for sensitive data. Businesses can also save on operational costs by reducing the need for paper-based processes.

-

Is airSlate SignNow suitable for small businesses dealing with 383 c, 384, 384 c documentation?

Absolutely! airSlate SignNow is tailored to meet the needs of small businesses that require efficient management of 383 c, 384, and 384 c documentation. Its user-friendly interface and cost-effective pricing plans make it an ideal choice for small companies looking to enhance their document workflows without overwhelming complexity.

-

How can airSlate SignNow enhance the security of 383 c, 384, 384 c documents?

airSlate SignNow enhances the security of 383 c, 384, and 384 c documents through advanced encryption and secure access protocols. This ensures that only authorized individuals can view or modify sensitive information. Moreover, the platform offers audit trails that help track document actions for compliance and accountability.

Get more for 383 c, 384, 384 c

- Skinpen patient consent form nurse jenell

- Pre purchase questionnaire form ppq produced by nhs

- Confirmation of reasonable accommodation request form

- Teacher education bsupplementary formb faculty of education bb

- Format b tinggal lebih masa

- Fomema doctor form

- Renewal procedure of singapore gmdss license form

- 6059b 2016 form

Find out other 383 c, 384, 384 c

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now