413, 424 A, 426, 427, 433, Art Form

What is the 413, 424 a, 426, 427, 433, Art

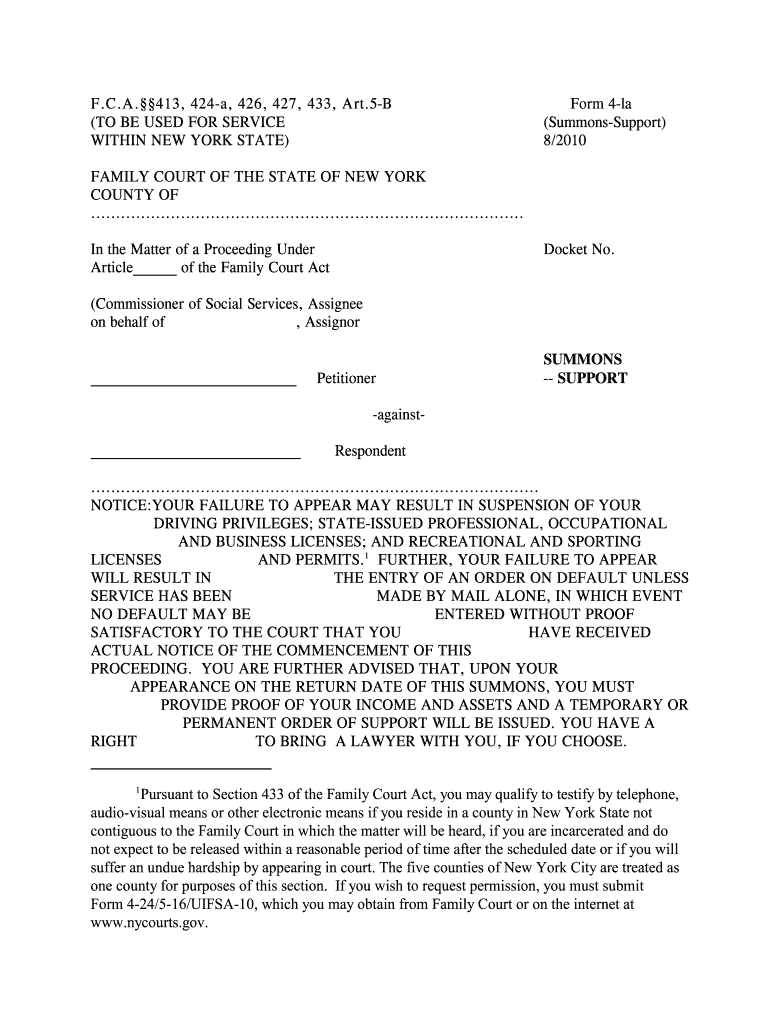

The 413, 424 a, 426, 427, 433, Art is a specific set of forms used primarily for tax and legal purposes in the United States. These forms facilitate various transactions, including reporting income, claiming deductions, and fulfilling regulatory requirements. Understanding the nuances of each form is essential for compliance and effective management of tax obligations.

How to use the 413, 424 a, 426, 427, 433, Art

Using the 413, 424 a, 426, 427, 433, Art involves a series of steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification and financial records. Next, fill out the forms meticulously, ensuring that all required fields are completed. After filling out the forms, review them carefully for accuracy before submitting them to the appropriate agency, either electronically or by mail.

Steps to complete the 413, 424 a, 426, 427, 433, Art

Completing the 413, 424 a, 426, 427, 433, Art requires careful attention to detail. Follow these steps:

- Gather relevant documents, such as income statements and previous tax returns.

- Access the forms online or obtain physical copies as needed.

- Fill in personal information accurately, including your name, address, and Social Security number.

- Complete the financial sections, ensuring all figures are correct and match your records.

- Review the form for any errors or omissions before submission.

- Submit the form via the chosen method, ensuring it is sent to the correct address or uploaded to the appropriate platform.

Legal use of the 413, 424 a, 426, 427, 433, Art

The legal use of the 413, 424 a, 426, 427, 433, Art is governed by federal and state regulations. These forms must be completed accurately to ensure they are legally binding. Compliance with the relevant laws, including the Internal Revenue Code and state-specific guidelines, is crucial. Failure to adhere to these regulations can result in penalties or legal issues.

Examples of using the 413, 424 a, 426, 427, 433, Art

Examples of using the 413, 424 a, 426, 427, 433, Art include:

- Submitting a 413 form for reporting income from self-employment.

- Using the 424 a form for claiming deductions related to business expenses.

- Filing the 426 form to report capital gains or losses.

- Utilizing the 427 form for tax credits associated with education expenses.

- Completing the 433 form to provide financial information for loan applications.

Required Documents

When preparing to complete the 413, 424 a, 426, 427, 433, Art, it is essential to have the following documents on hand:

- Current tax returns for reference.

- W-2 or 1099 forms to report income.

- Receipts for deductible expenses.

- Bank statements and investment records.

- Any prior correspondence with tax authorities.

Quick guide on how to complete 413 424 a 426 427 433 art

Manage 413, 424 a, 426, 427, 433, Art seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Handle 413, 424 a, 426, 427, 433, Art on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

Steps to edit and electronically sign 413, 424 a, 426, 427, 433, Art effortlessly

- Obtain 413, 424 a, 426, 427, 433, Art and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign 413, 424 a, 426, 427, 433, Art and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for managing 413, 424 a, 426, 427, 433, Art. agreements?

airSlate SignNow provides a comprehensive suite of features tailored for handling 413, 424 a, 426, 427, 433, Art. documents. This includes customizable templates, real-time collaboration, and a secure eSignature process. Users can streamline the entire agreement workflow, ensuring compliance with relevant regulations.

-

How does airSlate SignNow ensure the security of 413, 424 a, 426, 427, 433, Art. documents?

Security is a top priority for airSlate SignNow when it comes to managing 413, 424 a, 426, 427, 433, Art. documents. The platform uses advanced encryption and complies with leading industry standards. Additionally, users can set access permissions to control who can view or edit their documents.

-

What integrations does airSlate SignNow offer for handling 413, 424 a, 426, 427, 433, Art. forms?

airSlate SignNow seamlessly integrates with numerous applications to streamline the handling of 413, 424 a, 426, 427, 433, Art. forms. It connects with CRM platforms, cloud storage services, and productivity tools, enhancing collaboration and efficiency. These integrations simplify data management and improve overall workflow.

-

Is airSlate SignNow a cost-effective solution for managing 413, 424 a, 426, 427, 433, Art. documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses dealing with 413, 424 a, 426, 427, 433, Art. documents. With flexible pricing plans, users can select an option that best fits their budget without compromising on essential features. The platform's efficiency also helps reduce costs associated with paper and manual processes.

-

Can I customize templates for 413, 424 a, 426, 427, 433, Art. agreements using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize templates specifically for 413, 424 a, 426, 427, 433, Art. agreements. You can add specific fields, branding elements, and workflows that align with your business needs. This level of customization enhances the user experience and ensures compliance with industry requirements.

-

What are the benefits of using airSlate SignNow for 413, 424 a, 426, 427, 433, Art. agreements?

Using airSlate SignNow for 413, 424 a, 426, 427, 433, Art. agreements offers numerous benefits. Users experience faster turnaround times due to streamlined processes, improved accuracy with fewer errors, and enhanced document tracking capabilities. Overall, it boosts productivity and helps maintain compliance.

-

How does airSlate SignNow support mobile access for 413, 424 a, 426, 427, 433, Art. documents?

airSlate SignNow provides excellent mobile access, allowing users to manage 413, 424 a, 426, 427, 433, Art. documents on the go. The mobile app is user-friendly, making it easy to send, sign, and track documents from any device. This flexibility ensures that you stay productive, even when away from your desk.

Get more for 413, 424 a, 426, 427, 433, Art

- Form g 02pdffillercom

- 13l 50 2011 2019 form

- Indianaveba 2012 form

- Past medical history form

- Dog medical record paperwork showing spayed form

- Patient medical history form bw farese physical therapy

- New patient medical history questionnaire comprehensive pain form

- 2012 mortgage credit certificate program broward county broward form

Find out other 413, 424 a, 426, 427, 433, Art

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney