111 K; Form

What is the 111 k

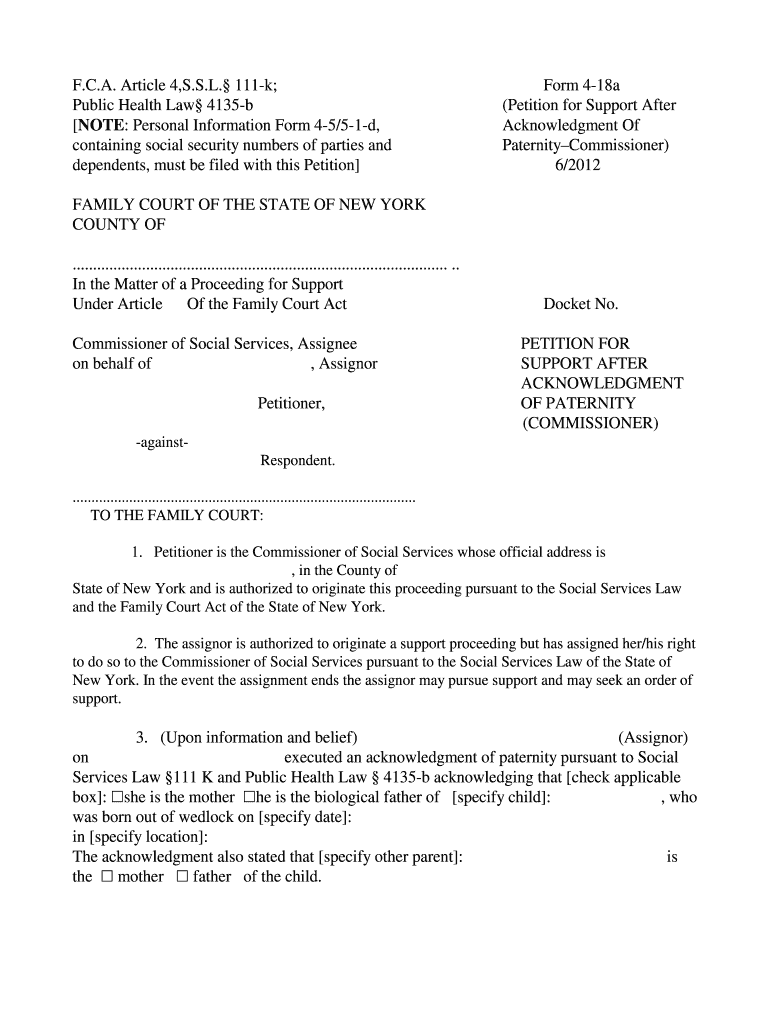

The 111 k form is a specific document used in various legal and administrative contexts, particularly in the United States. It serves as a formal request or declaration that may be required for compliance with certain regulations or procedures. Understanding the purpose and requirements of the 111 k is essential for individuals and businesses to ensure proper handling and submission.

How to use the 111 k

Using the 111 k form involves several steps to ensure that it is completed accurately and submitted correctly. First, gather all necessary information and documentation required to fill out the form. Next, carefully follow the instructions provided with the form, ensuring that all sections are filled out completely. Once completed, review the form for accuracy before submission, as errors can lead to delays or complications.

Steps to complete the 111 k

Completing the 111 k form involves a systematic approach to ensure compliance and accuracy. Begin by obtaining the latest version of the form from a reliable source. Fill in your personal or business information as required. Each section may have specific instructions, so pay close attention to details, such as dates and signatures. After filling out the form, double-check for any errors or omissions. Finally, submit the form through the appropriate channels, whether online or via mail.

Legal use of the 111 k

The legal use of the 111 k form is defined by its compliance with relevant laws and regulations. It is crucial to ensure that the form is filled out in accordance with federal and state guidelines. Additionally, the form may need to be notarized or accompanied by supporting documentation to be considered valid. Understanding these legal requirements helps prevent issues that could arise from improper use.

Key elements of the 111 k

Several key elements are essential to the 111 k form. These include the identification of the individual or entity submitting the form, the purpose of the submission, and any required signatures. Additionally, the form may include sections for additional documentation or information that supports the request being made. Ensuring that all key elements are present and correctly filled out is vital for the form's acceptance.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use and submission of the 111 k form. It is important to refer to these guidelines to understand any tax implications or requirements associated with the form. The IRS may outline deadlines for submission, eligibility criteria, and any penalties for non-compliance, which are crucial for maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 111 k form are critical for compliance. These dates can vary based on the specific use of the form, such as tax-related submissions or other legal requirements. It is advisable to keep track of these important dates to avoid penalties or complications that may arise from late submissions. Regularly consulting official resources can help ensure that you remain informed about any changes to deadlines.

Quick guide on how to complete 111 k

Effortlessly prepare 111 k; on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 111 k; on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to alter and eSign 111 k; without stress

- Locate 111 k; and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to deliver your form, be it via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign 111 k; to facilitate excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. For those looking for comprehensive solutions, the '111 k;' plan provides advanced features at a competitive rate. Businesses can compare plans to find the one that best suits their requirements.

-

What features does the '111 k;' plan include?

The '111 k;' plan includes essential features like unlimited document signing, templates, and advanced security options. Users also gain access to enhanced collaboration tools that streamline the signing process. This plan is ideal for businesses looking to maximize their efficiency.

-

How can airSlate SignNow benefit my business?

airSlate SignNow benefits businesses by simplifying the document signing process and reducing turnaround time. The '111 k;' solution allows teams to handle documents digitally, improving workflow and productivity. By utilizing this platform, businesses can become more agile and responsive.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with a variety of third-party applications. Whether you're using CRMs, cloud storage, or other productivity tools, the '111 k;' plan supports integration to enhance your workflows. This allows for a cohesive and streamlined document management system.

-

Is airSlate SignNow secure for handling sensitive information?

Absolutely, airSlate SignNow prioritizes security with high-level encryption and compliance with industry standards. The '111 k;' plan includes advanced security features to ensure that your documents and data remain protected. Businesses can trust airSlate SignNow with their sensitive information.

-

What kind of customer support does airSlate SignNow offer?

airSlate SignNow provides comprehensive customer support, including chat and email assistance. Users of the '111 k;' plan benefit from priority support, ensuring quick resolutions to any issues. Their knowledgeable team is ready to help users maximize their experience.

-

How can I start using airSlate SignNow?

Getting started with airSlate SignNow is easy and straightforward. Simply sign up for a free trial or choose one of the pricing plans, including the '111 k;' option. Once registered, users can begin creating and sending documents for eSignature immediately.

Get more for 111 k;

- Life care planning kaiser permanente mydoctor kaiserpermanente form

- Application for lewis mcchord communities wwwjblmc form

- Indiana university plagiarism test certificate answers form

- Tokyo gardens catering llc tgcsushicom form

- Application for employment rhapsodielle form

- A55 lease 2017 nyc form

- Navmc 2795 counseling worksheet form

- How to file nbi complaint online form

Find out other 111 k;

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile