New York State Department of Taxation and Finance TP 584 I Form

What is the New York State Department Of Taxation And Finance TP 584 I

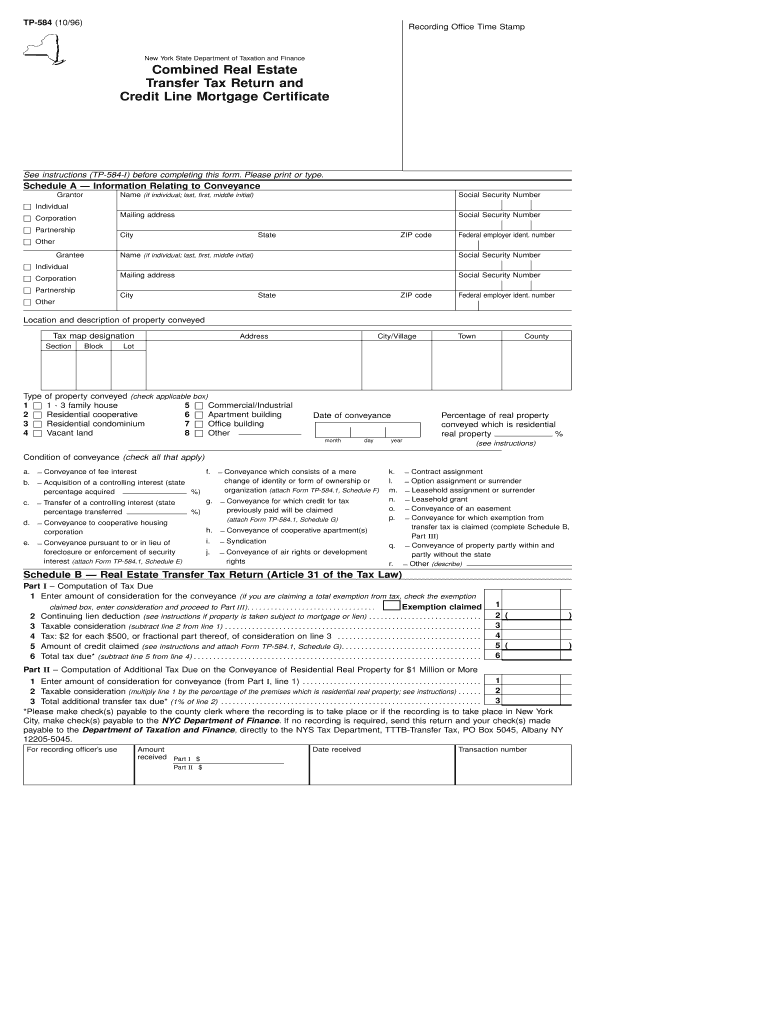

The New York State Department of Taxation and Finance TP 584 I form is a crucial document used for the transfer of real property in New York State. This form is specifically designed to facilitate the reporting of the sale or transfer of real estate, ensuring compliance with state tax laws. It captures essential information about the transaction, including the parties involved, the property details, and the sale price. Proper completion of this form is vital for both buyers and sellers as it helps in determining any applicable taxes and ensures that the transfer is legally recognized.

How to use the New York State Department Of Taxation And Finance TP 584 I

Using the New York State Department of Taxation and Finance TP 584 I form involves several key steps. First, gather all necessary information related to the property and the transaction. This includes details about the buyer, seller, and property description. Next, fill out the form accurately, ensuring that all fields are completed to avoid delays. After completing the form, it must be signed by the appropriate parties. Finally, submit the form to the New York State Department of Taxation and Finance, either electronically or by mail, depending on your preference.

Steps to complete the New York State Department Of Taxation And Finance TP 584 I

Completing the TP 584 I form requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by entering the date of the transfer.

- Provide the names and addresses of both the seller and buyer.

- Include a complete description of the property, including its address and any relevant tax identification numbers.

- Indicate the sale price and any other financial considerations.

- Sign and date the form, ensuring all required signatures are obtained.

Once completed, review the form for any errors or omissions before submission.

Legal use of the New York State Department Of Taxation And Finance TP 584 I

The TP 584 I form is legally binding once properly completed and submitted. It serves as an official record of the property transfer and is essential for tax assessment purposes. To ensure its legal standing, the form must be filled out in compliance with New York State regulations. This includes adhering to any specific requirements regarding signatures and additional documentation that may be needed. Failure to comply with these legal standards could result in penalties or complications in the property transfer process.

Key elements of the New York State Department Of Taxation And Finance TP 584 I

Several key elements must be included in the TP 584 I form to ensure its validity:

- Transaction date: The date when the property transfer occurs.

- Parties involved: Names and addresses of both the buyer and seller.

- Property description: Detailed information about the property being transferred.

- Sale price: The agreed-upon amount for the property.

- Signatures: Required signatures from both parties to validate the form.

Each of these elements plays a critical role in the processing and acceptance of the form by the state.

Form Submission Methods (Online / Mail / In-Person)

The TP 584 I form can be submitted through various methods, providing flexibility for users. The options include:

- Online submission: Many users prefer to submit the form electronically through the New York State Department of Taxation and Finance website, which offers a streamlined process.

- Mail: Users can print the completed form and send it via postal service to the appropriate department address.

- In-person: For those who prefer direct interaction, submitting the form in person at designated offices is also an option.

Choosing the right submission method depends on individual preferences and circumstances.

Quick guide on how to complete new york state department of taxation and finance tp 584 i

Effortlessly Prepare New York State Department Of Taxation And Finance TP 584 I on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow offers all the tools required to create, edit, and eSign your documents swiftly and without interruptions. Manage New York State Department Of Taxation And Finance TP 584 I on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign New York State Department Of Taxation And Finance TP 584 I with Ease

- Find New York State Department Of Taxation And Finance TP 584 I and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method to share your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign New York State Department Of Taxation And Finance TP 584 I and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the New York State Department Of Taxation And Finance TP 584 I?

The New York State Department Of Taxation And Finance TP 584 I is a tax form used for reporting and handling the transfer of real property in New York. This form is essential for ensuring compliance with state tax laws regarding property transactions. By using airSlate SignNow, you can easily eSign and manage this important document securely.

-

How does airSlate SignNow help with the New York State Department Of Taxation And Finance TP 584 I?

airSlate SignNow simplifies the process of completing the New York State Department Of Taxation And Finance TP 584 I by allowing users to fill out, sign, and send documents electronically. This ensures that all required signatures and information are accurately captured. Our platform streamlines document management, making property transactions more efficient.

-

Are there any costs associated with using airSlate SignNow for the New York State Department Of Taxation And Finance TP 584 I?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. These plans provide access to features specifically designed for managing documents like the New York State Department Of Taxation And Finance TP 584 I. Users can choose a plan that best fits their volume of transactions and required functionalities.

-

What features does airSlate SignNow offer for the New York State Department Of Taxation And Finance TP 584 I?

airSlate SignNow provides features such as document templates, eSignature capabilities, and workflow automation, specifically beneficial for forms like the New York State Department Of Taxation And Finance TP 584 I. These features help reduce processing time and increase accuracy in document handling, making real estate transactions smooth and straightforward.

-

Can I integrate airSlate SignNow with other software for handling the New York State Department Of Taxation And Finance TP 584 I?

Yes, airSlate SignNow offers various integrations with popular software applications that can enhance your experience with the New York State Department Of Taxation And Finance TP 584 I. This allows users to connect their existing workflows seamlessly, saving time and improving efficiency in document processing.

-

What are the benefits of using airSlate SignNow for eSigning the New York State Department Of Taxation And Finance TP 584 I?

Using airSlate SignNow for eSigning the New York State Department Of Taxation And Finance TP 584 I ensures faster completion of paperwork and enhances the security of sensitive information. Our platform is user-friendly, making it easy for all parties involved to sign documents electronically without the need for printing or mailing.

-

Is airSlate SignNow compliant with legal requirements for the New York State Department Of Taxation And Finance TP 584 I?

Absolutely, airSlate SignNow complies with all legal requirements for electronic signatures in the United States, including those relevant to the New York State Department Of Taxation And Finance TP 584 I. This ensures that your electronically signed documents are legally valid and can be used without concerns during property transactions.

Get more for New York State Department Of Taxation And Finance TP 584 I

- Accommodation third party form

- Six month temporary guardianship form

- Grievance from english fl 3 13 07 insurance company form

- For minor children to travel form

- Allen scholarship application lakewood k12 mi form

- Pl739 a driver statement of applicant rev121916xls cpuc ca form

- Ct 5 4 2016 2019 form

- Form 74 12 courts of justice act consent to applicant39s ontariocourtforms on

Find out other New York State Department Of Taxation And Finance TP 584 I

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template