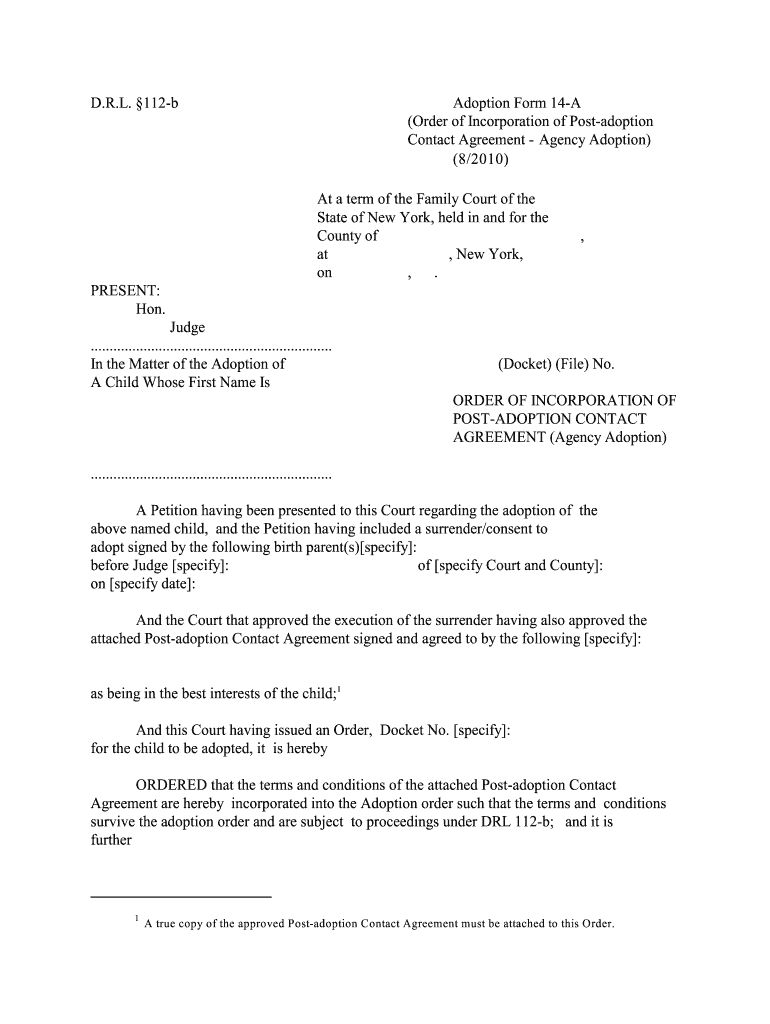

112 B Form

What is the 112 b

The 112 b form, often referred to in the context of business tax filings, is a crucial document used by certain entities to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is specifically designed for organizations that are classified as partnerships or S corporations. The information provided on the 112 b helps the IRS assess the tax obligations of these entities, ensuring compliance with federal tax laws.

How to use the 112 b

Using the 112 b form involves several steps that ensure accurate reporting of financial information. Initially, businesses must gather all necessary financial records, including income statements and expense reports. Once the data is compiled, it can be entered into the appropriate sections of the form. It's essential to follow IRS guidelines closely to avoid errors that could lead to penalties. After completing the form, businesses should review it for accuracy before submission.

Steps to complete the 112 b

Completing the 112 b form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income and expense records.

- Fill out the entity's identifying information at the top of the form.

- Report total income and allowable deductions in the respective sections.

- Calculate the taxable income based on the reported figures.

- Sign and date the form to certify its accuracy.

Legal use of the 112 b

The legal use of the 112 b form is governed by IRS regulations. It is essential for entities to file this form accurately to maintain compliance with federal tax laws. Failure to do so can result in penalties, including fines and interest on unpaid taxes. The form must be submitted by the designated deadline to avoid complications with the IRS.

Key elements of the 112 b

Several key elements are critical when filling out the 112 b form. These include:

- Entity identification: Accurate reporting of the business name and Employer Identification Number (EIN).

- Income reporting: Detailed documentation of all sources of income.

- Deductions: A clear outline of allowable deductions that reduce taxable income.

- Signature: The form must be signed by an authorized individual to validate its contents.

Filing Deadlines / Important Dates

Timely filing of the 112 b form is crucial to avoid penalties. Typically, the deadline for submission is the fifteenth day of the third month following the end of the entity's tax year. For entities operating on a calendar year, this means the form is due by March 15. Extensions may be available, but they must be requested appropriately to ensure compliance.

Quick guide on how to complete 112 b

Complete 112 b effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage 112 b on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The most effective way to modify and electronically sign 112 b with ease

- Locate 112 b and select Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, either by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign 112 b to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's 112 b feature?

The 112 b feature within airSlate SignNow allows for seamless electronic signing of documents, making the process quick and efficient. This feature integrates user-friendly workflows to help businesses streamline their document management. With the 112 b functionality, you can expect improved turnaround times for critical business agreements.

-

How does airSlate SignNow ensure compliance with the 112 b signing process?

airSlate SignNow adheres to industry standards for electronic signatures, ensuring that the 112 b signing process is secure and compliant with regulations. Each signed document is legally binding and can be tracked for verification. This compliance gives businesses peace of mind while using the 112 b feature.

-

What are the pricing options for using the 112 b feature?

The pricing for airSlate SignNow’s 112 b feature is designed to be cost-effective for businesses of all sizes. We offer tiered subscription plans to suit various needs, including pay-as-you-go options. By choosing the right plan, businesses can maximize their use of the 112 b feature while managing costs effectively.

-

What benefits does the 112 b feature provide for businesses?

The 112 b feature of airSlate SignNow provides numerous benefits, including increased efficiency, reduced turnaround times, and lower operational costs. It simplifies the document signing process, making it easier for teams to collaborate and finalize agreements swiftly. Adopting the 112 b feature can lead to enhanced productivity across your organization.

-

Can airSlate SignNow integrate with other software while using the 112 b feature?

Yes, airSlate SignNow offers robust integrations with various software applications, which complements the 112 b feature perfectly. You can integrate with CRM systems, cloud storage, and productivity tools, allowing for a seamless workflow. These integrations enhance the overall functionality of the 112 b feature, helping businesses work more effectively.

-

Is it easy for clients to sign documents using the 112 b feature?

Clients find it straightforward to sign documents using the 112 b feature of airSlate SignNow. The interface is user-friendly, enabling signers to complete their tasks quickly, even on mobile devices. This ease of use in the 112 b signing process ensures a positive experience for both senders and recipients.

-

What types of documents can be signed with the 112 b feature?

With the 112 b feature, users can sign a wide range of documents, including contracts, agreements, and forms. airSlate SignNow supports various document formats, ensuring versatility and convenience. Businesses can use the 112 b feature to handle all types of essential paperwork effortlessly.

Get more for 112 b

- Marriage license application joseph e smith st lucie county form

- National center for ptsd clinician administered ptsd scale for dsm 5 caps ca 5 assessment instrument caps ca 5 ptsd va form

- Deliberate practice growth target form fm 7575

- Ctprp eligibility policy 12jan16 final shared assessments form

- Stanley c panther appearance request form

- Curepsp brain tissue donation program s3amazonawscom form

- Atlx dispatch services limited power of attorney home atlx inc atlx form

- Hartford board of assessment appeals applications may be sent to pursuant to p hartfordassessor hartford form

Find out other 112 b

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer